Bankruptcy is nothing new, and we have seen some big names in art and sports file for personal bankruptcy. Companies, too, can file for bankruptcy when they can’t sustain their operations. For a regular company, financial operations involve paying the suppliers and employees while maintaining a profit for the company.

Why companies file for bankruptcy

The primary reason why a company would file for bankruptcy would be to protect its assets and those of its shareholders. In the case of a Forex brokerage, the clients have the right to withdraw their money at will, despite the state of the company. This would force the broker to liquidate all its assets to fulfill this requirement. Bankruptcy protects the broker from this and essentially overrides the initial agreement.

A more personal, and perhaps sinister, motive behind filing for bankruptcy, was for the shareholders and owners of the brokerage firm to protect their assets. As a shareholder in a company, you enjoy the profits and suffer the losses, so the chairman of a Forex brokerage firm would be forced to sell their sports car to settle the client’s money. They don’t want to let go of their toys, though, so they just file for bankruptcy and are untouchable.

Knowing this, it’s important to learn how this could happen to help you while choosing a Forex broker. 2 reasons can lead to the bankruptcy of a broker:

1. Rapid loss of the company’s required capital

Before a broker can begin offering their services to new clients, they must be approved by the Forex regulators of the region. Among the requirements before being licensed by the regulators is that the brokerage company has a substantial amount of capital. The required capital will vary from one region to another, but it’s usually a lot of money that is meant to prove the company can sustain its operations.

The purpose of this capital is to safeguard against significant losses and, ironically, to prevent a case where the broker has to file for bankruptcy. This capital requirement is usually quite substantial, perhaps tens of millions of dollars, especially in well-regulated areas like the US and UK, but even in fringe nations like Cyprus, the capital requirement is still substantial.

However, there are certain situations that neither the Forex regulators nor the Forex broker themselves imagined. Such a situation may be so serious as to wipe out the broker’s capital and force them to file for bankruptcy.

2. Extreme market volatility

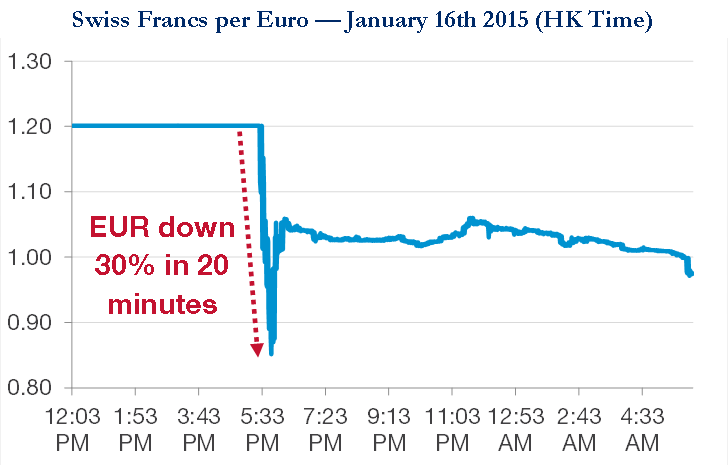

Traders love it when there is a lot of movement in the Forex market, after all, there wouldn’t be any money to be made if there wasn’t any movement. Despite this desire for action, it can turn into a disaster if the volatility is much higher than was anticipated. A good example of such unprecedented market volatility happened early last year when the Swiss National Bank (SNB) de-pegged the Swiss Franc from the Euro.

Since the global recession of 2007 – 2008, investors and asset holders sought a secure place to keep their money. The recession has sunk several major investment banks like Lehman Brothers and Blackrock, so people have lost faith in such banks. Switzerland has always been a haven for money, and people transferred their money there for security.

This caused the Swiss Franc to soar in value, but the SNB didn’t like that. Switzerland depended upon exports to and tourism from other European nations, but a strong Franc would make their exports expensive and discourage trading, so they pegged the Franc to the Euro to keep it from rising too high.

How did they do that, by printing lots of Swiss Francs and devaluing the currency? On the downside, inflation in Switzerland rose due to the flooding of Francs, but the SNB felt the trade-off was reasonable. However, the European economy was worsening, and to keep the Swiss Franc’s value pegged to the Euro, would require more printing of Swiss Francs, further raising inflation in the country. The SNB had had enough, it just wasn’t worth it anymore, so they de-pegged the Franc from the Euro.

Within hours of this announcement, the value of the Swiss Franc rose by almost 40% against the Euro, Pound, and US Dollar. This was a move no one had seen coming, and it rocked the Forex market in a big way. Traders who had shorted the Franc saw their trades go south like a falling rock on their Forex charts. That such a move was unexpected made the situation even worse, because there were traders who had not placed stop losses to their trades. This meant that they were quickly hit with stop calls, and before they could react by adding funds, the account was wiped out because the drop was so fast.

Had the traders been trading their initial deposits alone, then the broker would not have suffered, but the leverage they offered is what hurt the brokers. Looking at a trusted Forex brokers list will show you the amazing leverages they offer that can be as high as 1:1000, meaning that a trader can place trades with a value 1,000x their initial deposit. In such a case, the client would lose just what they had deposited, but the broker would lose 1,000 that amount. Now imagine a certain broker has, say, 1,000 clients short on the Swiss Franc, and without a stop loss to their trades, tragic.

This is what happened to Alpari UK and FXCM, both of which are worldwide recognized Forex brokers with plenty of clients. It wasn’t just those two either, many Forex brokers filed for bankruptcy, including those 2 shortly after that day, because of the losses they had incurred.

ECN Forex brokers were most affected by this because they link the client’s trades directly to the liquidity provider, and have no control over the trades. In these cases, the leverage was still applied, but it was the broker who lost more money. On the other hand, STP Forex brokers have a system that places the client’s trades through to the liquidity provider, and although they won’t admit it, they can manipulate these trades to their benefit.

The role of the liquidity provider (LP)

Ever wondered why there is always someone willing to sell you or buy your commodity, whether it’s a stock, currency pair, commodity, binary option, or whatever? This is possible because of the liquidity provider, who acts as the market maker and is usually a big bank referred to as a Tier 1 liquidity provider.

Since the LP is a big bank, most retail traders don’t have the necessary capital to trade with them, but the FX broker provides leverage so that you can. ECN brokers deal with clients with huge capital and their trades can be handed off directly with minimal leverage, but the rest require substantial leverage. Therefore, the broker takes your little capital, raises it through leverage, and makes the trade with the LP. The LP offers a small spread to the broker, and the broker raises the spread some more, and both of them make money from your winning trades.

In case of a losing trade, it is the broker who loses and has to pay the LP. A good broker will have substantial capital enough to compensate the LP, but losses from extreme market volatility that cause losses by many traders can wipe off the broker’s capital. These Forex brokers who saw their money dry up quickly filed for bankruptcy to protect themselves from claims by the liquidity providers.

Lessons learned from this experience

This year, we also had a period of extreme market volatility, after the BREXIT vote passed. Despite causing a lot of movement, it was not unexpected since everyone knew the vote was coming. This allowed the brokers time to increase spreads, fill up their coffers, and prepare for the worst, and not a single FX broker went under due to the BREXIT vote.

Lawsuits against the broker

It is possible for a client of a Forex brokerage firm to sue the broker if they feel their rights have been infringed. These rights are provided by the financial regulator of the region and can be:

- Australia – Australian Securities and Investments Commission (ASIC)

- Cyprus – Cyprus Securities and Exchange Commission (CySEC)

- Russia – Federal Commission of Securities Market of Russia (FFMS)

- South Africa – Financial Services Board (FSB)

- Switzerland – Swiss Financial Market Supervisory Authority (FINMA)

- UK – Financial Conduct Authority (FCA)

- US – US Securities and Exchange Commission (SEC)

There are several reasons to sue your broker:

a) Fraudulent practices

Despite being regulated by the financial regulator in the company’s headquarters, sometimes the Forex brokerage can still do some fraudulent activities. It is important to realize that Forex regulators may not be aware of all the activities of a Forex brokerage, and this creates loopholes that the broker can take advantage of. Just because a certain broker is regulated by a reputable Forex regulator doesn’t mean they can’t hide a lot from them.

Consider the financial crisis of 2007 – 2008, when major banks that were thought to be closely regulated, collapsed and had to bail out. It was not that the regulators were incompetent, but they are just not as informed about the companies they regulate as you think.

So, what kinds of fraudulent activities can lead to the bankruptcy of a Forex brokerage? Well, the easiest is to simply trade with the client’s money as if it were theirs. It’s not a bad idea when you think about it. Imagine a major Forex broker with thousands of clients, some are small-time day traders and scalpers with a few dollars in their account and they quickly withdraw any profits they earn. Then other clients are ‘big players’. These clients have millions of dollars in their trading accounts, but they are not as aggressive as the day trader.

They see the Forex market as a form of long-term investment and have kept their initial deposit and all the profits they have made over the years sitting in the account. The broker knows this, and one day he believes he has found a great opportunity to trade and is confident in his prediction. Normally, he would trade with the company’s money, but he thinks he could make so much more if he had more capital. So, he ‘borrows’ some more capital from some of his ‘big fish’ clients and makes the trade, but it goes wrong, losing both the company’s funds and the clients’.

This is fraudulent because the Forex broker is only supposed to act as a channel between the client and the interbank market. Unless the client agrees to have their funds managed by a money manager or by a trading signal, the broker is not supposed to touch these funds. Unfortunately, this kind of activity happens all the time, but the broker is usually smart enough not to lose money while trading. However, everyone has a bad day, and even the smartest broker can make a terrible mistake that sinks the entire company.

b) The churn and burn

Other fraudulent practices occur in PAMM accounts, which you can find out more about in the link there. Briefly, a PAMM account broker provides a platform similar to an investment bank where several clients deposit funds with a money manager who trades with the accumulated deposit and distributes the profits minus their commission.

The idea behind a PAMM account is very attractive, though, and it gives the investors a lot of confidence because the money manager also has some of their money in the account. If you’re the money manager, you wouldn’t want to lose money, right? So you would trade very carefully – but that’s the ethical money manager, some are just out to rip you off. Churn and burn is a strategy known in the financial world where the money manager overtrades a client’s account just for the commission without making any profit.

One such case that made the news recently was the case of Mr. George S. Bos against Avail Trading Corp (ATC). Mr. Bos deposited $445,000 on the 26th of January, 2012 with the broker ATC. By the 23rd of February that same year, Mr. Bos’ account only had $25,568 left, which was less than a month after the initial deposit. As it turned out, it was not that the money was lost during an investment gone wrong, but rather from the commission charged by ATC for each trade.

Normally, the money manager is supposed to make a profit, so that even after the commission is deducted, the initial deposit still grows. Instead, the money manager made trades amounting to $730 million, all of which were break-even, meaning that these trades didn’t make any profit or loss. Nevertheless, the commission was still deducted from the client’s account due to the amount of volume traded, causing the client to lose money just from the commissions.

A lot of people have suffered from this churn and burn strategy used by brokers, and it’s often the client who loses the case in court, but Mr. Bos’ case had 2 factors that made for a good case:

- At the time he opened the account and made the deposit, he specified that it was a long-term investment for money he had received from an inheritance. Therefore, he was not looking for an aggressive money manager, but someone who would gradually grow the account. This is always a choice whenever you’re selecting a money manager from a Forex PAMM brokers list, and the money manager is supposed to keep this in mind. Instead, the money manager invested too aggressively, effectively breaking the contract

- All the trades valued at $730 million were done within a week, between the 14th of February and the 23rd of February. Such a rapid hike of activity on an account was suspicious

.jpg)

Upon using the broker, ATC, the company filed for bankruptcy to avoid the various penalties it would have to incur. The penalties would probably be such that ATC could bear them, but they filed for bankruptcy nonetheless in fear that other clients would withdraw their funds. This case ended in a private settlement a few days after the court found it in favor of Mr. Bos, and ATC withdrew the bankruptcy claim.

What the bankruptcy of a broker means to its clients

The whole point of filing for bankruptcy is to protect the person filing for bankruptcy. In the case of a forex broker who files for bankruptcy, they become essentially untouchable because the bankruptcy protects them from claims by any party involved. Neither the liquidity provider nor the clients can claim their money, and the broker can remain protected by the law.

For the client whose account was already wiped out, they would have nothing to lose. There were still some clients who either didn’t trade that day, didn’t have any trades with a Swiss Franc pair, or who long on the Franc and made a killing. These traders would be stuck because they could not withdraw their money, but wait until the dust settled.

For some forex brokerages, this was the end of the line, and they closed up shop, such as:

- Excel Markets

- FX World

- LQD Markets

Most of these bankrupted Forex brokers managed to return their client’s funds, and although it took them some time to liquidate their assets, they eventually did.

However, most brokers survived by being bought out by major Forex brokerages who still saw potential in the bankrupted companies. In such a case, the company that buys the bankrupted forex brokerage will settle all claims, returning the clients’ funds and paying the LP, as was the case with Alpari UK and FXCM. Currently, both companies are fully operational, but Alpari UK now operates worldwide as Alpari, after coming out of bankruptcy.

This is how news of Black Thursday and the bankruptcy of forex brokerages was reported by news stations:

FranceUS

FranceUS