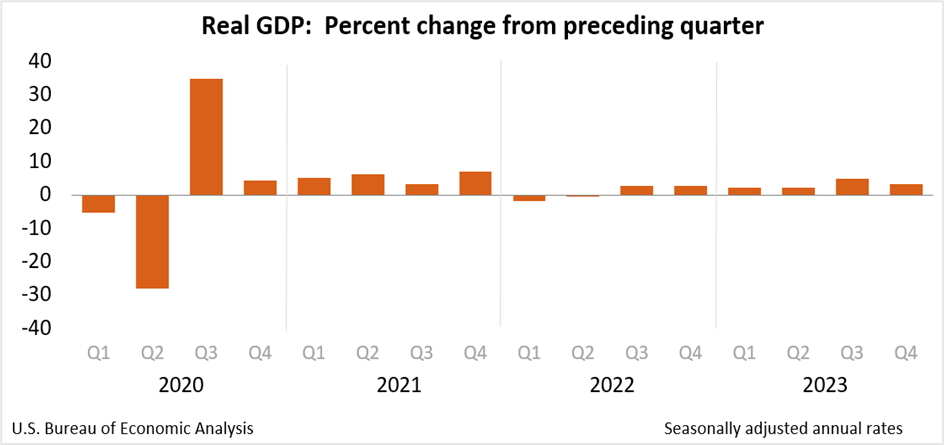

Gross domestic product slowed from the previous three months but rose more than expected

US economic growth advanced at an annual pace of 3.3% in the fourth quarter of 2023, the US Commerce Department's Bureau of Economic Analysis' advance report showed on Thursday. Real gross domestic product, a measure of all the goods and services produced in the US, rose more than the 2.0% anticipated by Wall Street economists amid solid consumer spending, putting to rest the dreadful prospects of a recession many analysts projected since mid-2022.

The higher-than-expected GDP report comes against the backdrop of inflation slowing meaningfully in the fourth quarter. The core prices reflecting personal consumption expenditures (PCE) climbed 2.0% in the final quarter, while the headline inflation rose 1.8%. Annually, the PCE price index advanced by 2.7%, sharply below the 5.9% reported in the last quarter of 2022, while core inflation stood at 3.2% from 5.1% during the same period.

The US economy advanced by 4.9% in the third quarter, surging rapidly even as inflation cooled considerably. The strong GDP growth is primarily attributed to the labor market resilience on the back of low layoffs and decent wage gains, which has supported consumer spending. In addition, robust government spending, near-zero interest rates, and cash dole-outs to households during the COVID pandemic drove retail savings, while businesses locked low rates, all of which helped stave off an almost certain recession.

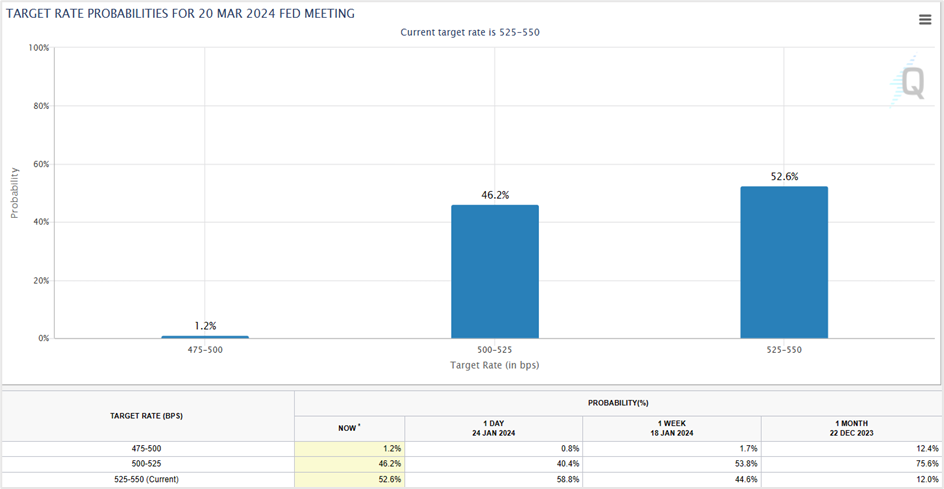

The fourth quarter GDP report comes less than a week before policymakers from the Federal Reserve gather for their first monetary policy meeting this year. While markets overwhelmingly expect the Fed officials to maintain the interest rate at multi-decade highs of 5.25%-5.50%, the strong GDP report could prompt the US central bank to hold on to the high rates for some more time.

Meanwhile, Fed Funds futures traders have gradually sunk their expectations of the Fed pivoting to lower interest rates anytime soon. According to the CME FedWatch Tool, markets are now pricing a 46.2% chance that the Fed will lower rates from the current level in March. That number is sharply down from a month back when the rate cut probability was as high as 75.6%.

Source: cmegroup website

Key highlights of the fourth quarter gross domestic product report

The rise in real GDP was led by consumer spending on goods and services, federal government, state and local government spending, exports, residential and nonresidential fixed investment, and private inventory investment. Consumers primarily spent on services such as food, accommodation, and health care while spending on goods included other nondurables, recreational goods, and vehicles.

On the contrary, the slowdown in real fourth-quarter GDP was primarily due to lower private inventory investment, consumer spending, residential fixed investment, and federal government spending, while imports decelerated. The current‑dollar GDP increased at an annual rate of 4.8%, or $328.7 billion, to $27.94 trillion from 8.3%, or $547.1 billion, in the third quarter.

The price index representing gross domestic purchases climbed 1.9% in the fourth quarter from 2.9% in the third quarter, while the personal consumption expenditures (PCE) price index rose by 1.7% from 2.6%. Meanwhile, the core PCE price index, which excludes food and energy prices, advanced 2.0%, the same as in the third quarter.

You can view the full report HERE.

Economists' review of the Gross Domestic Product figures

Rob Haworth, the senior investment strategy director at US Bank Asset Management Group, believes the GDP report surprised the markets as inflation cooled despite solid consumer spending. He anticipates further support from corporate earnings and sales growth in the future.

Hargreaves Lansdown analyst Sophie Lund Yates said the US economy has remained resilient amid high interest rates and swelling inflation due to strong consumer spending. According to her, households are burning excessive savings, with many paying high rates on personal loans, thereby absorbing higher-than-expected shocks. She believes the storm will not blow over without implications but warns that market participants forecasting the Fed will cut rates soon will be highly disappointed.

Market reaction to the US fourth quarter GDP report

US equities rose on Thursday, with the S&P 500 and the Dow Jones Industrial Average closing at another record peak, while the Nasdaq 100 slipped from the session high to end with small gains after the better-than-expected Q4 GDP growth lifted investor optimism about the US economy. The benchmark S&P 500 surged 0.53% to close at 4894.16, the Dow settled 0.64% at 38,049.13, and the Nasdaq 100 rose 0.10% to 15,510.50.

The US economy advanced 3.3% in the fourth quarter, propelled by solid consumer spending, even as inflation remained steady, indicating that the Fed is winning the war against high prices while avoiding a recession. According to Dow Jones Newswires, the S&P 500 is trading at 20 times its estimated earnings over the next 12-months, the most since the Fed started lifting interest rates in 2022.

Yields on US Treasurys fell on Thursday despite the US economy putting up a strong show in the fourth quarter as investors focused on the inflation component of the GDP report, anticipating a further decline in prices, even as they stuck to their stand of six quarter-point rate cuts by the Fed this year.

The yield on the 2-year Note fell 8.5 basis points to 4.299%, the 10-year TNote slid 6 basis points to 4.12%, and the 30-year yield dropped 3.9 basis points to 4.372%

Meanwhile, the US Treasury successfully auctioned $41 billion in 7-year Notes with a small discount, with bids from non-dealers coming in at an above-average rate of 86.1%, a report from BMO Capital Markets stated.

The US dollar rose against its counterparts in the US dollar index (DXY) on Thursday, with the trade-weighted index gaining 0.33% to close at two-session highs of 103.57. The US currency surged 0.35% versus the euro to end Thursday's session at 1.0846, while it rose 0.15% against the pound sterling to 1.2706 and 0.11% to 147.66 vs the Japanese yen. Strong US economic growth in the fourth quarter lifted hopes that the Federal Reserve would keep interest rates higher for longer, raising demand for US currency. Meanwhile, the euro was under pressure after investors raised bets of a potential rate hike in April following Thursday's European Central Bank's (ECB) monetary policy meeting.

Technical View

Tesla Inc (TSLA)

Tesla shares tumbled more than 12% to close at $182.63 on Thursday after the company reported lower-than-expected earnings in the fourth quarter of last year and shared a tepid outlook for EVs in 2024. The weak earnings report, coupled with vague guidance from the management, led to a host of downgrades and target cuts, driving the stock to the lowest settlement since May 19th, 2023.

Tesla shares are currently in a primary downtrend, closing slightly below the medium-term bearish trendline at $183.00, with the losses likely to extend to $175.00-$176.00 before rebounding. On the upside, the immediate resistance is around the November lows of $195.00, followed by the $205.00-$208.00 zone. The RSI is in oversold territory, indicating a near-term rebound from the sharp losses.

Trading Strategy

Go long on Tesla if prices drop to $175.00-$176.00. Place a stop loss at $169.00 and exit as prices approach $190.00-$194.00. On the other hand, long positions should only be attempted if the stock closes above $208.00. Place stops at $201.00 for a profit target of $237.00-$240.00

Tesla Inc.- Daily chart

Click the link to view the chart- TradingView — Track All Markets

Shopify Inc. (SHOP)

SHOP closed 0.30% lower at $80.49 on Thursday, pulling back from the nearly two-year highs registered earlier in the week. While the stock reacted more or less in line with the broader market, Shopify continues to be in a primary uptrend, but the double top formation indicates a near-term drop in prices if it breaks below the neckline.

If prices close below $80.50 (the breakout level of the double-top reversal pattern), the decline could extend to $70.00-$70.60, the horizontal line connecting the December and January lows. On the other hand, if the stock rebounds to close above $83.50, the gains could extend all the way to $103.00-$116.00.

Trading Strategy

Short SHOP only if the stock closes below $80.50. Have a stop loss at $84.50 and exit as prices approach $71.00. Contrarily, initiate long positions if Shopify closes above $84.00 or surges above $86.00. Place a stop loss at $78.00 for a profit target of $103.00-$115.00. Ensure trailing stops are placed on the long positions.

Shopify Inc.- Daily chart

Click the link to view the chart- TradingView — Track All Markets

FranceUS

FranceUS