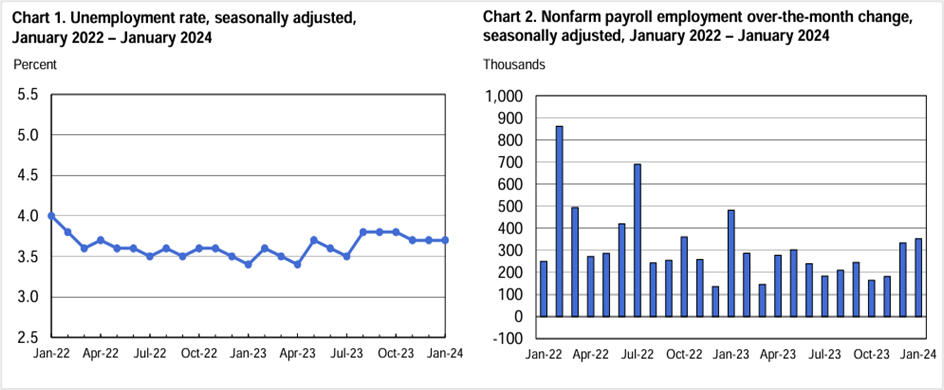

December figures revised higher; unemployment rate unchanged for the third straight month

Nonfarm payroll employment accelerated in January, signaling the continued resilience of the labor market, which will likely shield the US economy from a recession this year even as it allows the Federal Reserve more time to keep interest rates elevated at multi-decade highs.

Nonfarm payrolls jumped 353,000 in January from an upwardly revised 333,000 the previous month, leaving the unemployment rate unchanged at 3.7%, data published by the US Bureau of Labor Statistics showed. The solid labor market report surprised economists who predicted the economy would create about 180,000-185,000 new jobs. Meanwhile, December’s payroll numbers were revised sharply higher from 216,000.

Source: US Bureau of Labor Statistics website

The job growth in January was widespread across sectors, which bodes well for a healthy US economy after earlier reports showed employment primarily concentrated in only three sectors – government, healthcare, and education. In addition, nonfarm payroll employment in January has topped 250,000 for six straight years, a significant milestone for the US labor market. However, some analysts believe that new additions to the labor force in January are challenging to interpret due to a big shift in the labor market at the start of the year, where temporary workers hired during the holiday season are released, even as many companies announce job cuts during this period. Although the government tries to provide an accurate picture using seasonal adjustments, economists believe these adjustments have shown inflated job growth in January. All said and done, the jobs report points to a robust labor market, and although layoffs are rising, people can still find jobs.

Key highlights of the US nonfarm payroll report

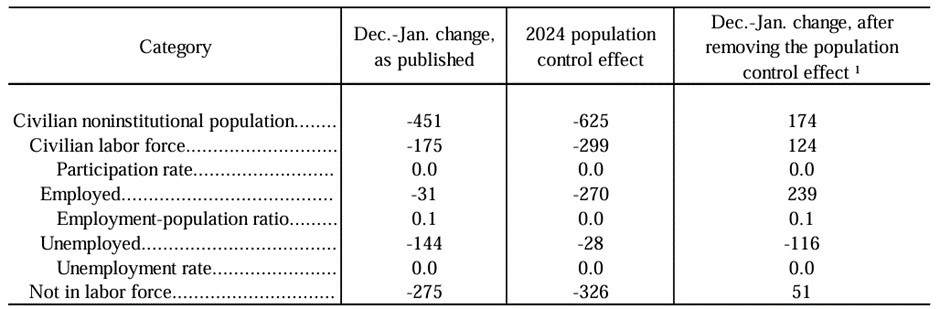

The US nonfarm payroll and the unemployment rate report are derived from two monthly surveys- the household and establishment surveys. The former measures the labor force status, such as unemployment, based on demographic characteristics, while the establishment survey gauges nonfarm employment, hours, and earnings by industry.

The household survey showed that the unemployment rate was at 3.7% in January, unchanged for the third consecutive month, while the number of unemployed individuals changed little, at 6.1 million. Meanwhile, the number of people without jobs over the long term, or those without a job for 27 weeks or more, stood at 1.3 million, accounting for 20.8% of the total unemployed. The labor force participation rate was unchanged at 62.5%, with the employment-population ratio at 60.2%, barely changing over the year.

Data from the establishment survey showed that payroll employment surged by a monthly average of 255,000 in 2023, with job gains in January seen in health care, retail trade, professional and business services, and social assistance. On the other hand, the number of employed declined in the mining, quarrying, and oil and gas extraction industries. Employment in professional and business services jumped by 74,000 jobs in January, 70,000 in health care, 45,000 in retail trade, 30,000 in social assistance, 36,000 in the government, and 23,000 in manufacturing. Contrarily, employment in the mining, quarrying, and oil and gas extraction industries fell by 5,000.

Lastly, the average hourly earnings for all employees rose by 19 cents, or 0.6%, to $34.55 in January and by 4.5% over the year, even as the average workweek slid by 0.2 hours to 34.1 hours in January and by 0.5 hours year-on-year.

Source: US Bureau of Labor Statistics website

Economists review of the jobs report

Kevin Gordon, a senior investment strategist at Charles Schwab, said the labor statistics report clarified the March rate cut debate. He thinks the market was wrong for most of last year about the near-term trajectory of the Fed’s policy. He believes the market is correct to assess that lower inflation will drive central bank policymakers to lower interest rates. But, he thinks that the pace and the size of the interest rate cuts will depend on the labor market.

George Mateyo, the chief investment officer at Key Private Bank, believes that the blowout jobs report will vindicate Fed policymakers who ruled out an interest rate cut in March. He forecasts that the solid labor market and higher-than-expected wage growth will delay rate cuts this year, even as some market participants reexamine their thinking.

Eric Merlis, the managing director and co-head of global markets at Citizens Bank, said that while job growth increasing at a rapid pace quashes fears of an upcoming recession, it is also pushing the timing of a Fed rate cut farther into 2024. He further said that the increase in hourly wages might revive inflation worries.

Market reaction to the US nonfarm payrolls report

The US equity markets rose on Friday, with the major stock indices scaling to new peaks, led by the tech-heavy Nasdaq, as the AI-powered boom and a solid quarterly performance in the last quarter by some of the biggies in the IT space more than offset the negative impact of a hotter-than-expected January jobs report. The benchmark S&P 500 surged 1.07% to settle at 4958.61, the 30-share Dow Jones Industrial Average rose 0.35% to 38654.42, and the Nasdaq 100 jumped 1.72% to end Friday’s session at 17642.73.

The biggest gainer was Meta, which rallied more than 20%, while Amazon Inc., which reported upbeat quarterly results after market hours on Thursday, jumped 7.87%, adding to the positive momentum.

However, while the S&P 500 closed more than a percent higher on Friday, the advance-decline ratio (ADR), which measures the number of stocks advancing to the number declining, showed two stocks declining for every stock rising. This has happened only twice in 62 years and brings back memories of October 19th, 1987, or Black Monday, when the Dow Jones Industrial Average plunged around 22% in 24 hours.

Treasury yields rose on Friday after the January nonfarm payrolls report surprised investors and dashed hopes that the US central bank would pivot to rate cuts anytime soon. The yield on the rate-sensitive 2-year Note spiked 16.1 basis points to 4.37%, the yield on the benchmark 10-year TNote climbed 14.2 basis points to 4.024%, marking its biggest one-day surge since September 2022, while the 30-year bond yield rose 10.3 basis points to 4.223%.

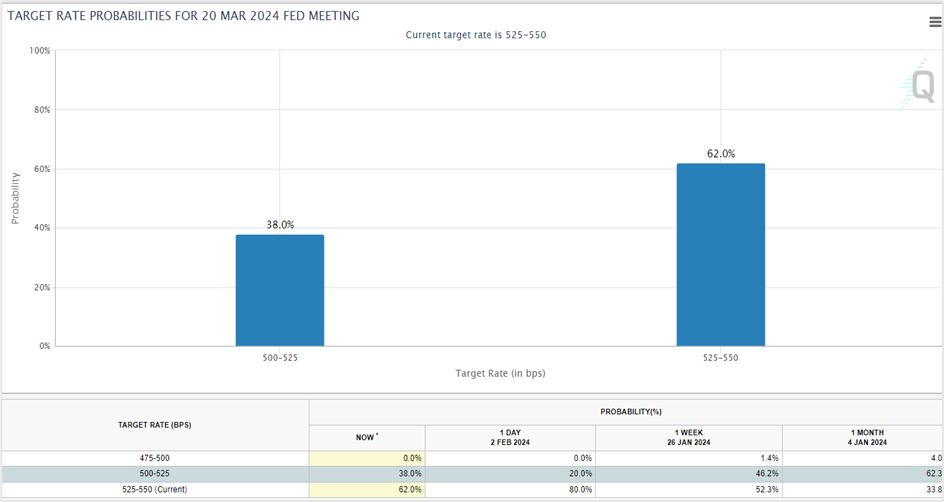

Following the robust nonfarm payrolls report, market participants have lowered their forecasts of how much the Federal Reserve will cut the benchmark Fed Funds rate in 2024. They now expect the US central bank to lower rates by around 127 basis points this year against the more than 160 basis points projected last month.

Market experts confident that the Federal Reserve would embark on its first rate cut in March have begun revising their forecasts following Friday’s labor statistics data. According to Lawrence Gillum, the chief fixed-income strategist at LPL Financial, the bond market is repricing the expected rate cuts in 2024 amid the upside surprise in the nonfarm payrolls report. That’s evident on the CME FedWatch Tool, where traders now project a 38% chance that the Fed would ease by 25 basis points on March 20th. That number is sharply down from 62% a month back.

Source: cmegroup website

The greenback rose to seven-week highs against its counterparts in the dollar index (DXY) after the US Labor Statistics report pointed to solid jobs growth in January, denting hopes of near-term rate cuts by the Federal Reserve. The currency index, a gauge of the strength of the US dollar against six currencies from developed nations, rose for the third successive week to settle at 103.922 on Friday, up 0.85% for the day. The EURUSD fell 0.78% to 1.0786, the GBPUSD slid 0.89% to 1.2630, and the USDJPY rose 1.30% to 148.31.

According to Marc Chandler, the chief market strategist at Bannockburn Global Forex, the January nonfarm payrolls report blew away market estimates of a March rate cut and toned down the number of rate cuts the Fed will deliver in 2024, leading to adjustments in the currencies market. He expects the dollar to remain firm going forward, although he didn’t specify the time frame.

Technical View:

S&P 500 March futures (ESH24)

S&P 500 futures rallied to a fresh all-time peak on Friday, backed by stocks from the Information Technology space, after a solid quarterly earnings report and the first-ever dividend payment from Meta drove the stock higher by 20%, pulling the rest of the stocks in the sector along. The benchmark stock index futures settled at 4980.25, up by 1.05% for the day.

The index futures are near the top end of the long-term bullish channel, where it will likely face near-term resistance in the 5010-5025 zone, pushing the index futures lower toward the 4840-4870 support zone. However, subsequent settlements above 5025 will ensure the bull run extends toward 5480-5500, which looks unlikely at the moment.

Trading Strategy

Short S&P 500 futures in the 5010-5020 zone, with a stop loss at 5060 and exit as the index futures approach 4870. Ensure to trail your profits.

S&P 500 March futures (ESH24)- Daily chart

Click the link to view the chart- TradingView — Track All Markets

Alphabet Inc. (GOOG)

Shares of Google tumbled more than 11% after hitting an all-time peak earlier this week after the company reported better-than-expected Q4 revenue and profit but trailed analysts’ projections on ad revenue, even as the company said it paid $2.1 billion in severance and other related charges in 2023. The company’s shares closed at $143.54 apiece on Friday, up 0.58% on the day, reversing the morning session losses after testing key support at $138.00 as the solid Q4 earnings report from Facebook’s parent Meta boosted shares of the Information Technology sector.

The stock ended slightly above the near-term support zone at $137.00-$138.00, a close below which prices could slide to $132.00. On the upside, the near-term resistance zone is at $153.00-$157.00.

Trading Strategy

Initiate long positions in Alphabet Inc. at $132.00, with a stop and reverse at $129.00 for a profit target of $138.00. However, if the SAR orders are triggered, hold on to the short trades with a stop loss at $135.00 and exit as prices approach $108.00. Ensure that you trail your profit on the short position.

Alphabet Inc. (GOOG)- Daily chart

Click the link to view the chart- TradingView — Track All Market

SpainUS

SpainUS