Social trading is an area of the forex trading world that is growing at breakneck speed. As an industry that reached $2.3 billion a couple of years ago, it’s expected to reach $3.7 billion by 2028. We’re not surprised by these numbers. Forex social trading is popular among beginning and advanced traders alike. Here, we’re taking the opportunity to dive into the ins and outs of forex social trading. By the end, anyone will be able to master the art of social trading with confidence.

Understanding Forex Social Trading

For many, social trading is a game changer. Becoming profitable with traditional forex trading requires a relatively steep learning curve. Forex social trading is a strategy where traditional forex trading partners with social networking. In the end, investors take advantage of an environment that encourages sharing and learning from each other. Let’s begin by taking a look at the main concepts of social forex trading.

Core Concepts of Social Trading

At the very core of social trading is a platform of shared knowledge. Forex social trading programs are built on platforms that allow individual traders to interact with each other. The communities tend to lean heavily toward beginning traders. However, there is usually a broad range of experience levels interacting with each other. This includes experts who are there to offer guidance and advice.

The end result is a highly collaborative environment that helps to flatten the learning curve for those who are new to forex trading. Along with this, more experienced traders gain confidence and learn from the strategies of other traders.

Copy Trading

The most basic component of social trading is copy trading. The terms social trading and copy trading are frequently used interchangeably. However, they are not exactly the same. Copy trading is a strategy that allows investors to copy the transactions of more experienced traders. This is usually done automatically. An investor chooses the portfolio they want to copy, click a button, and it’s done.

Most copy-trading brokers offer only the most successful traders in their copy-trading program. Because of this, copy trading is widely successful and profitable. However, it’s not foolproof. Even the most experienced, successful forex traders have bad days. There is still a risk of loss when copy trading forex.

Social trading includes this copy-trading element, in addition to social interaction. Before going all in on a copy trading platform, we recommend doing some research. For example, our guide on how to master reading forex charts is a good place to begin.

Social Interaction

The second component of social trading is social interaction. When a forex broker offers social trading, this means they are equipped with a platform for social interaction. A well-designed social trading program will feature forums, chat features, and comment sections. It’s easy to spot a social trading platform that has been well-nurtured. The environment is collaborative, allowing participants to learn from each other’s successes and losses.

Benefits of Social Trading

On the surface, the most obvious benefit of social trading is the opportunity for new traders to profit from successful strategies. However, looking at the big picture, we see that the benefits extend much further than this. In addition to more profitable trades, there are learning opportunities and chances to diversify portfolios.

Learning Opportunities

Social trading offers learning opportunities for novices and experts in forex trading alike. Even traders who have been active in the forex market successfully for years can learn by observing others. Insights help traders better analyze the forex markets and manage their own positions. Watching expert traders in real-time is one of the most effective learning strategies.

Diversification

Next up on our list of benefits of forex social trading is diversification. In our experience, those who are new to trading find a strategy they are successful with and stick with it. This isn’t a bad thing. However, diversity is essential for the long-term success of any portfolio.

Social trading opens up opportunities for trying new strategies with minimized risk. Following multiple traders and testing their strategies enables investors to spread their risks across multiple strategies. A portfolio that offers both short and long-term profitability is a good goal for balancing overall returns.

Choosing a Social Trading Platform

It’s important to know that not every forex broker offers a social trading platform. Some only offer copy trading, and others steer clear from social and copy trading altogether. The obvious first step in choosing a forex broker is finding one that offers a social and copy trading platform.

We’ll go into a few of the best social trading forex brokers in just a minute. But first, let’s take a look at the most important features to consider. We also offer comprehensive reviews of forex brokers, and here are some of the main factors we assess.

| Factor to Consider | Description |

| User Interface | Intuitive, easy-to-navigate design |

| Trader Quality | Verified track records, transparent performance metrics |

| Regulatory Compliance | Licensed and regulated by reputable financial authorities |

| Fees and Commissions | Competitive and transparent fee structure |

| Asset Range | Wide variety of tradable forex pairs and other assets |

| Copy Trading Features | Flexible allocation and risk management settings |

| Educational Resources | Comprehensive learning materials and market analysis |

Top Social Trading Platforms in 2024

When considering all of the social trading platforms we have reviewed, there are six that stand out to us. Each of these platforms offers something a bit different, catering to the diversity we’re seeing among forex traders. This includes catering to different trading styles, preferences, and goals. Here’s a look at the six best social trading platforms available today.

eToro

If we were to highlight only one forex broker with social trading capabilities, it would be eToro. eToro has a global community of more than 35 million users. Its copy trading platform is user-friendly and automatic. There are also no additional charges or fees for using eToro’s copy trading platform. This is a popular choice among both new and advanced traders. Our comprehensive eToro review goes into all of the details.

RoboForex

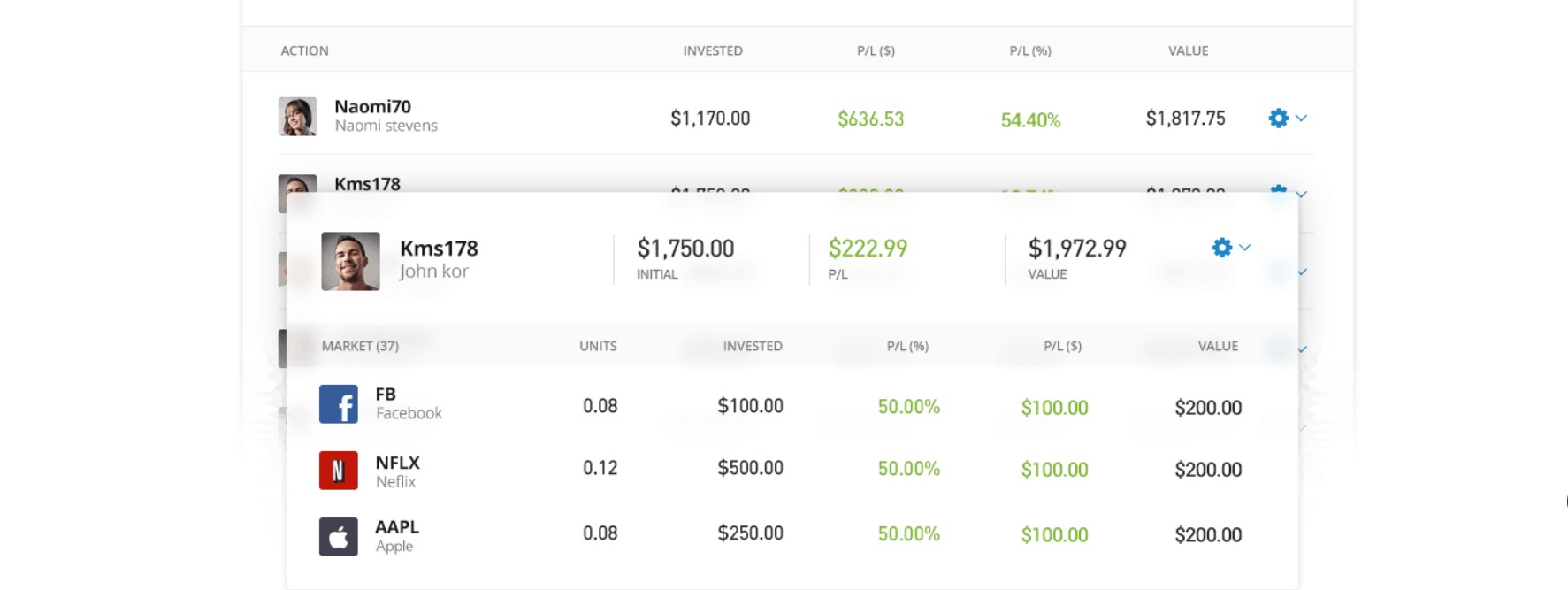

RoboForex offers a robust copy trading platform, with an active social community. One way that RoboForex stands out in this industry is with the flexibility its copy trading offers. Copying strategies can be stopped or paused at any time. Additionally, flexible copy ratios are offered, providing options for minimizing risks or optimizing profitability.

Each expert trader sets the commission rate for copying their trades. This may be a flat fee but is more often in the form of a percentage of profits. Learn more by reading our RoboForex review.

XM

With XM, those interacting with the social trading platform have access to more than 4,000 strategies. XM claims that more than 150,000 trades are executed daily, with options for forex, indices, algorithmic trades, and commodities. This is also a successful platform for expert traders who want to share strategies and profit at the same time. Currently, XM strategy managers have earned more than $1 million in shared profits. We encourage anyone interested in this broker to check out our XM review.

LiteFinance

LiteFinance offers what we consider to be a solid social trading platform. We appreciate this broker’s commitment to providing new traders with the information and tools needed to become successful. By subscribing to chosen trader’s news feeds, investors can keep up with what’s happening in real-time. Copy traders can utilize a number of filters to choose the experts they want to follow. These filters include lifespan, profitability, equity, and the number of copying traders they have.

InstaForex

InstaForex offers copy trading with a low minimum deposit of only $10. This is great for beginners who want to dip their toes into copy trading with minimum investment. It’s possible to copy multiple traders at the same time, and trades are automatically copied. This is also a good platform for traders who are interested in their strategies being copied. InstaForex offers a profit boost for traders who attract their own followers. We go further into the benefits of InstaForex with our comprehensive InstaForex review.

FXOpen

FXOpen offers copy trading through PAMM accounts. This is a different type of copy trading service that enables expert traders the ability to trade with larger amounts of capital. Through the PAMM system, copy traders place a certain amount of money into an expert’s account when they follow a trader. This enhances the overall potential profitability for both the expert and followers. Learn more with our FXOpen review.

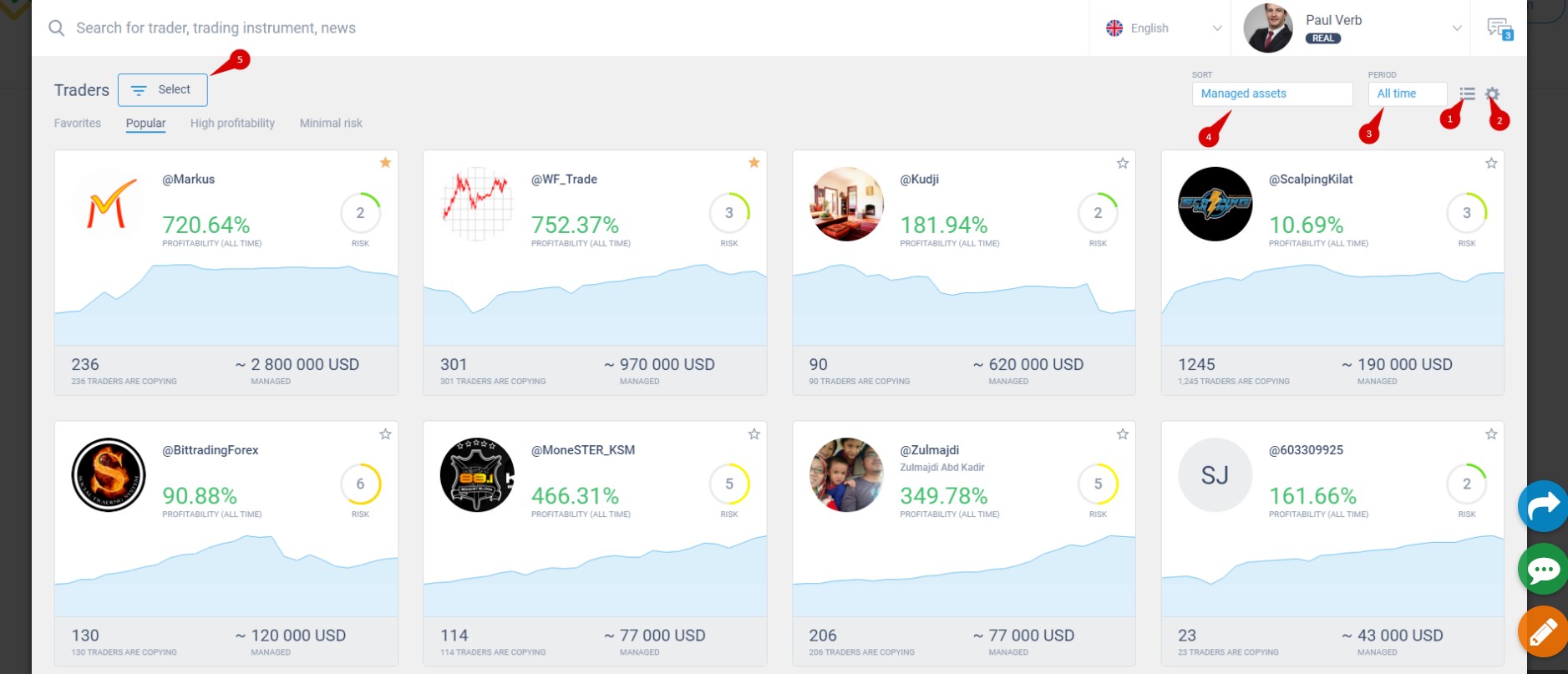

Evaluating Traders to Follow

Choosing a forex broker that offers social trading is step one. The next important step is evaluating which traders to follow. A common beginner mistake is to look only at the experts with the highest returns. Yes, there is good potential for profitability here, but there are other factors to consider. For example, we should be asking if the trader has consistent results with their strategy and looking at it from a risk management perspective.

Performance Metrics

When evaluating traders, you’ll want to look at a range of performance metrics. These include their win rate, average profit per trade, and maximum drawdown. Don’t just focus on short-term gains – look for consistent performance over time. Remember, past performance doesn’t guarantee future results, but it can give you valuable insights into a trader’s capabilities.

Risk Management

A trader’s approach to risk management is just as important as their profit potential. Look for traders who demonstrate prudent risk management through appropriate position sizing, consistent use of stop-losses, and overall portfolio management. A trader who can preserve capital during downturns is often more valuable than one who makes big gains but takes excessive risks.

Risks and Challenges of Social Trading

We feel it would be remiss of us to mention the benefits of social trading without giving equal attention to the risks and challenges. We feel it’s important to be aware of the potential risks before investing any amount of money or time in social trading.

Over-reliance on Others

In our opinion, the over-reliance on others is one of the most significant risks of copy trading. These platforms are great tools for beginning traders, and those who have some experience but are still looking for guidance. It’s not completely out of the question for an advanced trader to spot a great strategy and copy it. Although, advanced traders would do better for themselves by offering their own strategies on the platform.

However, simply copying trades without an understanding of the strategy behind them is financially risky. Taking advantage of educational resources and learning tools while social trading can help new traders identify strategies and risks. At the end of the day, social trading should be used as a tool but not replace the development of personal strategy.

Lack of Personal Strategy Development

Successful forex traders can confidently move within the market using their own strategies. Even though not every transaction will be profitable, there is a baseline knowledge of the market and various strategies.

This is extremely important for new traders to develop. Unfortunately, it becomes all too easy to simply copy others but not put in the work of understanding the market. Not relying solely on copy trading is a smart move to build resilience and personal adaptability in the market.

Market Volatility and Crowd Behavior

The forex market can be volatile sometimes, and social trading can play a role in this. For example, social trading can amplify certain market movements, sparking increased volatility. It’s important to be aware of this potential because in some cases, it can lead to higher risks and loss.

Herd Mentality

The main contributor to social trading influencing market movements is herd mentality. If large amounts of investors are flocking toward the same movements, this causes an unexpected shift in the market.

This is especially risky with experienced traders who have a very large following. New traders might enter a social trading platform and automatically gravitate toward an expert with the most followers. However, herd mentality shows us why this isn’t always the best strategy and why other factors should be considered.

Best Practices for Forex Social Trading in 2024

Just like traditional trading, forex social trading requires strategy and best practices to be successful. Here, we share a few of the best practices for social trading in today’s market.

Diversify Your Copied Traders

Even with the best copy trading platform, it’s important to have some diversity in copied traders. There’s an old saying about not putting all of one’s eggs into a single basket. We feel this applies perfectly to those who copy-trade forex. Even for traders who are not yet confident in investing on their own, we strongly encourage diversification in copy trading. This could look like copying the strategies of multiple traders and also diversified specialties.

Regular Performance Review

Going in and frequently reviewing the performance of followed traders is always a smart strategy. Things change in the world of forex trading, and strategies need to be refined and adapted. It’s important to review one’s own portfolio and the traders followed to ensure the current strategy is still working.

Combine Social Trading with Personal Analysis

When a new investor is starting out, social trading can serve an important role as a guide and instill confidence. However, social trading should not stand alone as the only approach to forex trading. Online brokers offer analysis tools, and educational resources to teach investors how to use them.

These tools can be used to gain insights into what is currently happening in the market and to identify trends. We recommend using these tools to your advantage. Personal analysis can be a great complementary tool to social trading. They can help investors make more informed decisions and develop their own strategies.

Educate Yourself

On the topic of analysis and educational materials, we encourage every trader to take full advantage of the resources offered by their broker. For example, some brokers offer a very thorough academy-type platform, with full lessons. Others offer videos, webinars, and articles. We’ve interacted with a few forex brokers who also offer personal coaching services. The more time invested in self-education, the easier it is to understand the motivation behind each expert’s strategy.

Automated Copy Trading Software

We’ve seen the popularity of social trading really surge in recent years. Part of this is due to the advancement of sophisticated copy-trading software that automates the process. Machine learning integration and customizable software have changed the landscape of automated copy trading.

Machine Learning Integration

Artificial intelligence is influencing many industries, including copy trading. Machine learning can be an excellent tool for identifying risk management and fine-tuning strategies to maximize profitability. These systems are capable of adapting to rapidly shifting market conditions faster than a human can. These quick, accurate insights can be used in social trading to optimize outcomes.

Predictive Analytics

A major component of machine learning integration is the forecasting of market trends. AI’s capabilities for analyzing almost unimaginable amounts of data are impressive. This technology can simultaneously analyze decades of historical data, combine it with current market conditions, and make accurate predictions.

Customizable Copy Settings

In the past, copying a portfolio or transaction with the click of a button was the simplest approach to copy trading. This can still be an effective strategy. However, technology has caught up with the fact that most investors need or want more flexibility. Today, investors can customize their trading strategies, even within the social trading landscape.

Partial Copying

Partial copy-trading allows investors to allocate a certain portion of their portfolios to copy-trading, without sacrificing total control. The remainder of the portfolio can be controlled in whichever way the investor prefers. We see partial copying as a stepping stone between copy trading and individually managed investments.

Regulatory Landscape for Social Trading

The forex trading industry as a whole is tightly regulated, and for good reason. This protects investor funds and provides a secure, transparent environment. As social trading gains more traction, the need for more specific regulations has emerged.

Transparency Requirements

Transparency is essential in protecting the integrity of the financial world. With social trading, issues such as conflicts of interest can exist. We’re seeing an increase in jurisdictions that require transparency disclosures, benefiting both the broker and the client.

Cross-Border Regulations

Forex trading is global by nature, which presents some challenges in the regulatory landscape. In social trading environments, especially those that operate across borders, understanding global regulations has been a challenge.

Licensing Requirements

In response to the need for clearer cross-border regulations in social trading, we’re seeing regions introduce new licensing requirements. Each copy trading broker is responsible for upholding these licensing requirements and ensuring standards are being met across the board.

Social Trading Analytics and Metrics

Today, we have advanced analytic tools that have transferred how traders are approaching their strategies. With sophisticated metrics, traders of all levels are able to access deeper insights into forex the market. Here are a few areas of social trading analytics to pay attention to.

Social Sentiment Analysis

Social sentiment analysis tools are helpful for measuring the mood, or temperature, of the market. These tools measure communications and actions in the market and then use this information to form predictive analysis. From this, investors can gain insights into the market sentiment and consider this when making investment decisions.

Crowd Wisdom Indicators

These are amazing tools in social trading software. Crowd wisdom indicators collect and analyze opinions and recent positions. They generate trading signals by tapping into these insights that are subtle enough that traders might otherwise miss.

Performance Attribution

These are important tools for investors who want more insights into the traders they’re following. Performance attribution tools look deep into why traders are performing the way they do. This includes looking at both successes and failures. Performance attribution is a good tool for new traders to use for a couple of reasons. First, it helps them understand the “why” behind an expert trader’s success. Secondly, it also can provide insights into their own trading strategies.

Risk-Adjusted Returns

This is a sophisticated analysis tool that measures not just the movements or results, but also how much risk was involved in achieving those results. From a risk management perspective, these tools are incredibly valuable. They can help investors spot expert traders who achieve profitability without taking significant risks.

Integration with Traditional Trading Platforms

In the past, social trading platforms existed in a separate space from traditional forex platforms. Social trading tools were designed to be used with traditional platforms but there wasn’t automatic integration. This is something that we have seen change significantly in recent years. Hybrid trading environments and cross-platform compatibility have made social trading a more seamless, intuitive experience.

Hybrid Trading Environments

Hybrid trading environments are becoming the new standard for social trading platforms. Hybrid trading combines manual trading, social trading, and algorithmic trading into one platform. The benefit of hybrid trading environments is that they allow for a more diverse approach to trading, This is ideal for new traders who want to slowly venture away from social trading as they gain experience. .

Cross-Platform Compatibility

We see that today’s forex trader demands flexibility. This includes social trading features that are accessible from desktop devices, web, and mobile platforms. The ability to manage positions from anywhere is a key feature that is quickly becoming non-negotiable. Cross-platform compatibility makes this possible.

API Integration

API is essential for integration and automated trading capabilities. Forex API brokers support these innovative apps and tools within their social trading platforms. The end result is a wider range of customization options and functionality for social trading.

Key Learnings Recap

Here, we’ve looked at what social trading in forex is and how to maximize results from social trading as a strategy. Before we say goodbye, let’s look at a few of the most important key takeaways.

- Social trading is a copy-trading approach with a social aspect added in.

- Through copy trading, investors can replicate the strategies of successful forex traders.

- Copy trading is not a set-it-and-forget-it strategy. It should be used as a complement to personal analysis and frequently revisited.

- Spend some time researching social trading platforms before committing.

- Diversification is important with copy trading.

- Automated copy trading software provides a more intuitive experience and can manage risk.

- Invest time in learning about forex trading and how to use analytical tools.

- Relying on copy trading as a sole long-term strategy is generally advised against.

Whether someone is new or experienced in forex trading, there’s a level of stress involved. We suggest tools to help learn how to manage forex trading stress for managing the psychological aspects of trading. At TopBrokers, we strive to provide the trading world with up-to-date resources and information. This includes insights into the world of forex social trading and many other areas of trading. We also take the time to do deep research into trading platforms, providing our audience with honest, unbiased reviews. We encourage you to check back with us often and to think of TopBrokers as your partner in a successful trading experience.

CanadaCA

CanadaCA United StatesUS

United StatesUS