Sales at autos and retailers rose, while it fell at gas stations and health & personal care stores

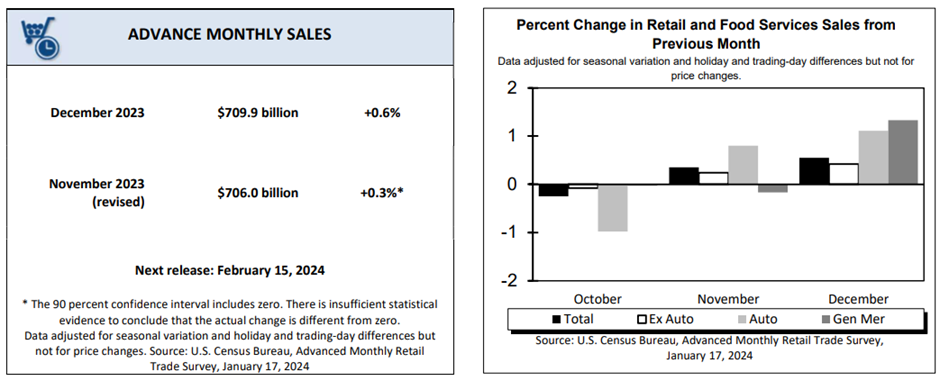

Sales at US retailers rose 0.6% in December, the most since September, amid solid consumer spending, to mark the end of a tumultuous year that underscored the strength of the US economy on the back of a robust labor market. Excluding autos, retail sales rose by a smaller 0.4%. A poll of economists by The Wall Street Journal predicted headline retail sales to surge by 0.4% and 0.2%, excluding autos.

Retail sales account for a third of the total consumer spending and provide clues to the resilience of the US economy. According to the US Census Bureau, which comes under the Department of Commerce, the advance estimates of retail sales, including food sales, surged by $709.9 billion in December, up 5.6% year-on-year and 3.2% in 2023. Meanwhile, total sales in the last quarter of 2023 were up 3.9% from the corresponding period in the previous year.

Higher sales were reported at nonstore retailers (1.5%), general merchandise stores (1.3%), clothing (1.5%), and other retail stores (0.7%). On the contrary, sales fell at health & personal care stores (-1.4%), gasoline stores (-1.3%), furniture shops (-1%), and stores selling electronics and appliances (0.3%). Core retail sales, which exclude autos, gas station sales, food services, and building materials, surged by a solid 0.8% in December, the highest since July.

The monthly retail trade data is not adjusted for inflation, signaling that sales are increasing faster than the annual inflation rate of 3.4%, as shown by the December consumer price index (CPI) numbers earlier this month. Even on a month-on-month basis, household sales rose 0.6% in December compared to a 0.3% rise in inflation, signifying solid consumer spending.

While the robust retail sales figure in December reinforces the view that the US economy might not slip into a recession that many analysts predicted last year, it also bolsters the Fed’s case to wait a little longer before cutting interest rates. However, economists from Bank of America are cautious about the strong December sales figures. They believe the numbers were driven by a substantial shift in seasonal factors, which will be offset in January.

Thomas Martin, a senior portfolio manager at Globalt Investments, believes the Federal Reserve will likely lower rates by the end of this year, although it might not happen at every monetary policy meeting. He believes traders positioned for aggressive rate cuts and primarily invested in stocks might diversify their portfolios into bonds.

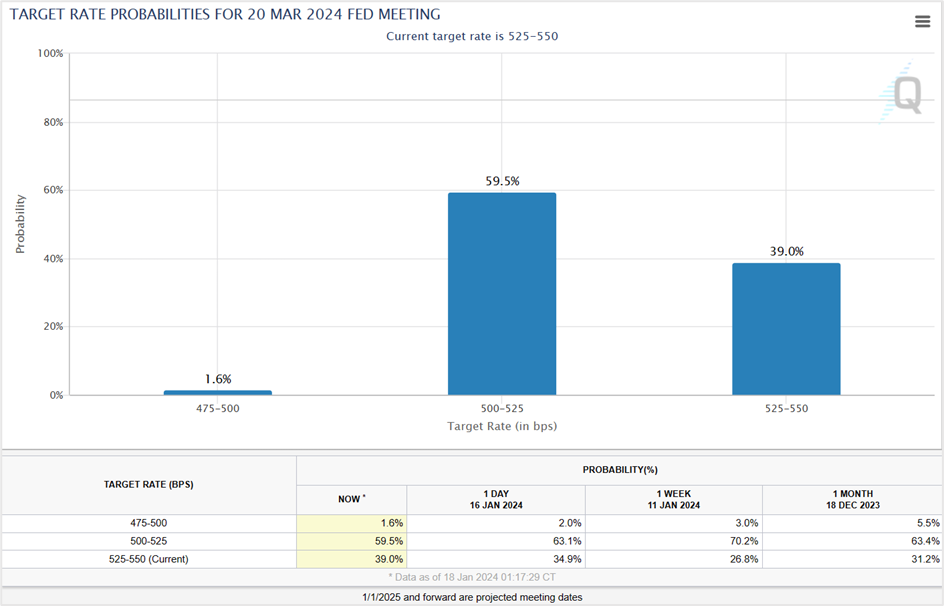

Meanwhile, Fed Funds futures traders have dropped their expectations of interest rates falling in March, although the percentage of traders still expecting the US central bank to lower rates is close to 60%. According to the latest CME Group’s FedWatch Tool, the probable target rate, the percentage of traders expecting the Fed to lower rates in March, stood at 59.5% on Wednesday, down from 63.1% the previous day and 70.2% on January 11th.

Source: cmegroup website

Economists review the monthly sales report

Chris Larkin from Morgan Stanley said that before the retail sales figures were released, Fed officials were firm they wouldn’t rush to cut rates, and Wednesday’s stronger-than-expected sales report bolsters their view.

Christopher Rupkey, the chief economist at the New York office of FWDBONDS, believes economic growth in the US is solid, and economists who predicted a recession this year will have to take it down. He further said that according to Fed officials, the US economy might be appropriate for a few rate cuts this year.

Quincy Krosby, LPL Financial’s chief global strategist in Charlotte, said the December retail sales indicated a slowing economy boosted by household spending amid a strong labor market, a pullback in gasoline prices, and interest rates ticking lower.

Market reaction to the monthly retail trade news

US equities reversed early declines but ended with losses on Wednesday after the stronger-than-expected US retail sales damped hopes of the Federal Reserve launching interest rate cuts from March, driving the US dollar and Treasury yields higher, impacting equities. All the stock benchmarks ended in the red, with the Dow Jones Industrial Average registering three successive losing sessions. The 30-share index closed 0.25% lower at 37,266.67, led by a nearly 3% plunge in Walgreens (WBA) and Caterpillar (CAT), while Charles Schwab (SCHW) fell 1.3%. Among the winners, Boeing (BA) rebounded 1.3% on Wednesday from a more than 25% slump from the December peak. Meanwhile, the S&P 500 and the Nasdaq 100 slid by 0.56%, ending at 4,739.21 and 16,736.28, respectively.

According to Deutsche Bank strategist Jim Reid, the recent strong correlation between equities and bonds that began bearishly in August and turned bullish in October is once again signaling bearishness. While the tight correlation won’t last forever, the relationship is in lockstep for now, with both selling off on Wednesday as investors reexamined the prospects of near-term rate cuts.

Treasury yields rose on Wednesday, with the 10-year T-Note and 30-year bond hitting five-week highs after consumer inflation in December rose unexpectedly in the UK and retail sales rose to three-month highs in the US. The yield on the 2-year rose 12.6 basis points to 4.363%, the highest close since January 9th, while the yields on the 10-year T-Note and 30-year bond rose 4.2 and 2.0 basis points to 4.109% and 4.318%, respectively. Meanwhile, the yield inversion between the 2-year and 10-year steepened to -25 basis points on Wednesday from -16 basis points the previous day, the lowest since November last year after the retail sales report.

According to the fixed-income portfolio manager at Wellington Management, Brij Khurana, the robust short-term US economic data has pushed investors to dial back on Fed pricing. He thinks there’s too much priced into the front end of the yield curve in terms of rate cuts.

The US dollar rose against its counterparts for the fourth successive day in the USD index (DXY) to end Wednesday’s session at 103.45, the highest since December 12th after the solid US retail sales report damped expectations about the US central bank rushing to lower interest rates in March.

The US dollar rose 0.07% to settle at 1.0882 versus the euro on Wednesday, while against the pound sterling and the Japanese yen, the greenback climbed 0.32% and 0.65% to close at 1.2676 and 148.14, respectively.

Despite Fed policymakers, such as Governor Christopher Waller and Cleveland Fed President Loretta Mester, cautioning that central bank officials will not lower rates aggressively, markets are still pricing a 145 basis points rate cut this year. According to Niels Christensen, the chief analyst at Nordea, the risk-off sentiment and a drawdown in rate cut expectations are bullish for the US currency.

Technical View

Microsoft Corp. (MSFT)

Microsoft pulled back from its all-time peak to close at $389.47 on Wednesday, down 0.20% for the session. Following a subdued open, the tech giant extended losses in the morning session before rebounding from the day’s lows after failing to breach the near-term support and the previous all-time high at $384.30. A close below the level could push the stock toward the next support at $368.00 (the trendline connecting the recent lows). On the upside, a close above $391.00 or a break of $396.00 could drive the stock toward $416.00.

Strategy:

Go long on MSFT if the stock closes above $391.00 or breaks $396.00. Place a stop loss at $388.00 and exit as prices approach $416.00. Traders can also initiate long positions at $369.00-$370.00, with a stop loss at $364.00 and a profit target of $384.00.

Microsoft Corp- Daily chart

Click the link to view the chart- TradingView — Track All Market

Spot Gold

Spot gold closed at $2006.20 on Wednesday to end the second consecutive day with losses after the stronger-than-expected US retail sales figures drove the US dollar and Treasury yields higher while weighing on risky assets such as equities and commodities. The precious metal is in a primary uptrend, but in the near term, we could prices oscillate in the $1973.00- $2090.00 band.

If gold prices stay above Wednesday’s low, we could see a short-term rebound toward $2043.00. However, for the next leg of the bull rally to start, spot gold should close above $2090.00. On the downside, the near-term support is at $2002.00 (Wednesday’s low), a close below which the losses could extend to $1973.00-$1975.00 (December 2023 lows).

Strategy:

Go long on spot gold at $1973.00-$1975.00, with a stop loss at $1962.00, and exit as prices approach $2040.00. Long positions can also be initiated if the precious metal closes above $2043.00 or breaks $2050.00. Place your stop loss at $2035.00 for a profit target of $2085.00-$2090.00.

Spot Gold- Daily chart

Click the link to view the chart- TradingView — Track All Markets

AustraliaUS

AustraliaUS