The US dollar has been the world's reserve currency since World War II, with its status akin to that of a heavyweight champion in the world of currencies. But the greenback status was unchallenged for decades, up until now as escalating global power struggles have intensified, posing a significant threat to the dollar's status as the world’s reserve currency.

Like many champions before it, the dollar is now showing signs of vulnerability, with a decline in its value and growing concerns about its prospects. It's as if the currency has taken a few too many blows, its once-unstoppable momentum is now slowed to a crawl.

Can the dollar rise to the occasion and reclaim its former glory, or is its time in the spotlight finally coming to an end?

In this article, we'll take a deep dive into the rise and fall of the US dollar, examining the factors that have led to its success and its current decline. We will also draw on lessons from history to help us understand what the future may hold for the almighty US dollar, and whether it can recover from its current slump and reclaim its status as the reigning champion of the currency world.

The Dollar Dynasty: How the US Currency Conquered the World of Money

The dollar's reign as the world's dominant currency is no accident as it has been a result of deliberate policies, military might, and economic influence that the US has wielded for decades. Today, more than half of global trade is conducted in dollars, giving the US unparalleled power.

This power is further cemented by the fact that the US can pay its foreign debt in its currency, a luxury no other country enjoys. Even if the US government were to accrue astronomical levels of debt to foreign investors, it can simply print more dollars to pay them back.

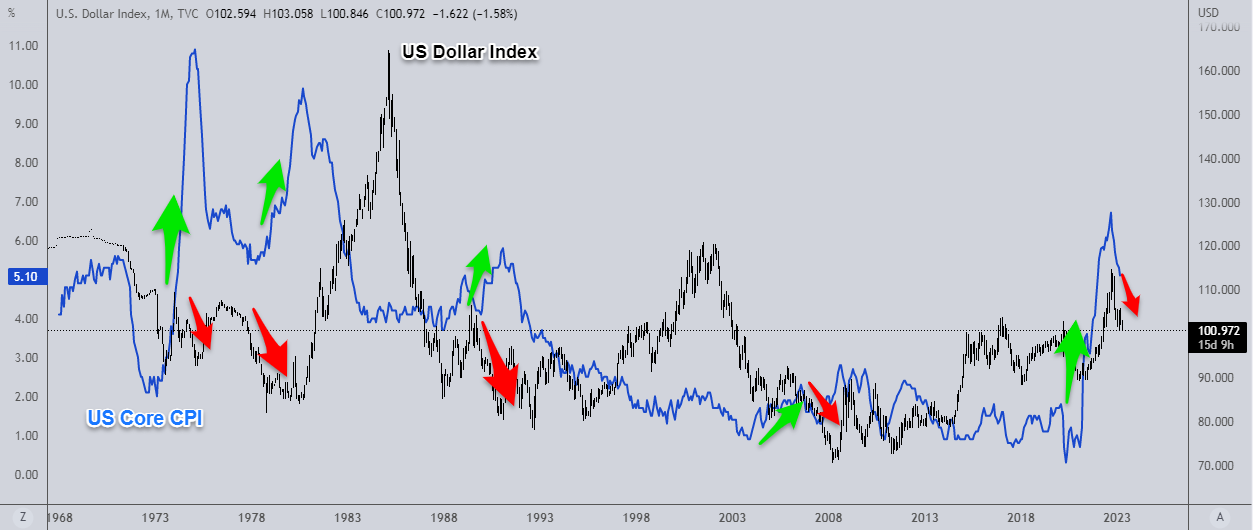

Nevertheless, this ability to turn on the printing press comes with a price since it could result in inflation, which can devalue the greenback and create a ripple effect on the global economy.

Breaking Free from the Dollar: The Rise of De-Dollarization across the World

For decades the greenback has been hailed as the go-to currency for international trade and transactions. But, with the advent of digital currencies and the emergence of new economic superpowers, the US dollar's status quo is being challenged.

While the US government has been quick to defend the greenback's exorbitant privilege, the reality is that countries such as China and Russia continue to increase their economic power and influence, and it is clear that the dollar's status as the world's reserve currency is facing unprecedented challenges, and the US must adapt if it wishes to remain a major player on the global stage.

The once-fanciful notion of de-dollarization is now quickly becoming a reality, with countries and regions around the world breaking free from the dollar's grasp.

In the 1970s, global banking became synonymous with the dollar, and the fall of the Soviet Union paved the way for the US dollar's domination. However, this is now changing. China and Russia are leading the way in building an alternative block of currency, marking a return to a Cold War-like era where different economic blocks operate with their currencies.

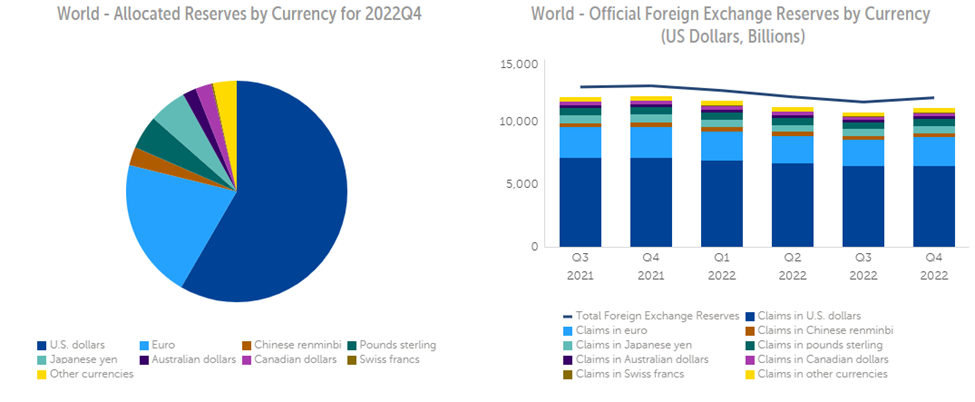

According to the International Monetary Fund (IMF), the US dollar has lost 12% of its market share over the last two decades, falling from 71% to 58.36%. This decline is not limited to one region or country, but rather a global trend.

Source: IMF’s Currency Composition of Official Foreign Exchange Reserves

At the 14th BRICS summit in June, Russian President Vladimir Putin announced the association's intention to develop a new international reserve currency, a move that could shift the balance of power away from the US dollar. Similarly, Saudi Arabia's announcement that it was open to selling oil to China in Yuan marks a significant shift away from its longstanding commitment to the dollar denomination.

China and Brazil's decision to abandon the dollar in bilateral trade relations is yet another sign of the growing trend of de-dollarization.

The finance ministers of the ASEAN countries also recently met in Indonesia to discuss reducing dependence on the dollar and transitioning to local currencies for financial transactions. Even France, traditionally an ally of the US, has just concluded its first deal for "Chinese" liquid natural gas denominated in Yuan, marking a significant shift away from the dollar.

The rise of de-dollarization may seem like a distant threat to the US dollar, but the trend is undeniable.

As more countries and regions seek to break free from the dollar's grip, the question remains: can the US dollar adapt and remain relevant in a world where the balance of power is shifting?

Or will it succumb to the forces of de-dollarization and fade into obscurity?

The US Dollar's Endless Cycle: What Goes Up Must Come Down

Throughout financial history, we have seen numerous boom-bust cycles. The frequency of these cycles suggests that history tends to repeat itself. As the saying goes “History doesn't repeat itself, but it often rhymes,” and that’s even truer with the highs and lows of the US dollar's cycles.

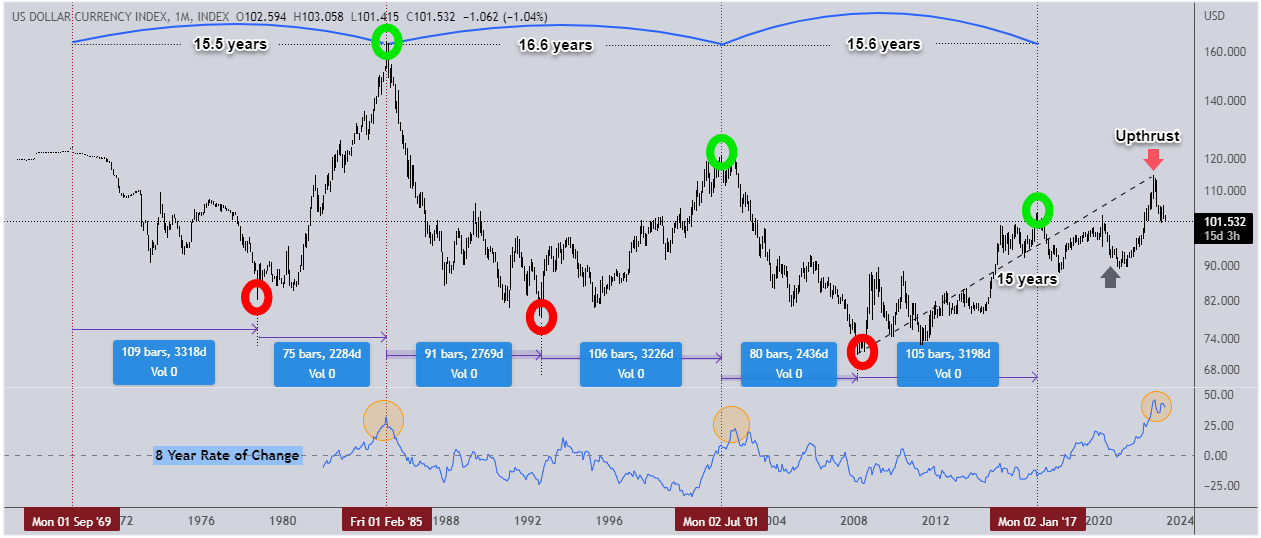

Since freely trading in the 1970s, the US dollar has followed a peak-to-peak cycle lasting roughly 16 years, which includes two sub-cycles (bullish and bearish) lasting around 8 years each. This 8-year cycle is similar to the more well-known 8-year cycle of gold in the trading community.

Initially, the US dollar was expected to complete its 16-year peak-to-peak cycle in January 2017. However, due to the unprecedented response of the Federal Reserve to save the economy during the COVID-19 pandemic, two things happened:

-

The circulation of the US dollar increased by 22% in 2020, a bearish signal for the currency.

-

The 16-year cycle was disrupted, with the symmetry shifting from a peak-to-peak cycle to a through-to-peak cycle that spanned from the 2008 low to the 2022 high.

If the 16-year cycle continues to repeat, then the US dollar is likely to continue weakening from its 2022 peak, with the downward trend projected to continue through 2030.

If you're interested in taking advantage of these forex market trends, consider working with the best forex brokers in the industry. Check out our best Forex brokers page to compare the top brokerage firms and find the one that's right for you.

RussiaUS

RussiaUS