Founded in 2008, Exness is a well-established and reputable multi-asset CFD and Forex broker offering a wide range of trading services and a user-friendly trading platform. During its operations in the Forex market, Exness has achieved significant milestones and experienced substantial growth with worldwide clients from over 130 countries.

We will explore its timeline of operations, milestones, growth scale, Exness statistics about traders, money earned, money lost, and other interesting facts. Here are the key statistics and insights about Exness and its growth scale:

-

15 years of experience providing online trading services.

-

Exness achieved a new record in trading volume on its retail brokerage platform in March 2023, reaching $3.88 trillion.

-

Exness has consistently maintained a trading volume above $2 trillion for 14 consecutive months.

-

Active traders on the Exness platform reached a new all-time high of 491,064 in March 2023.

-

Exness has received several prestigious industry awards – being awarded as the best Global Broker of the Year at Traders Summit 2022.

-

The trading firm offers 44 account base currencies.

-

The broker's market dominance is attributed to its expansion efforts, particularly in Asia, and now Africa. In total, Exness holds 8 different regulatory licenses (Tier-1, Tier-2, and Tier-3) solidifying its foothold worldwide.

-

Exness has obtained licenses in South Africa and Kenya, solidifying its foothold in these regions.

-

+2,000 employees work at Exness Group from +90 countries.

-

Exness clients withdrew $1.35 billion in profits during the first quarter of 2023.

-

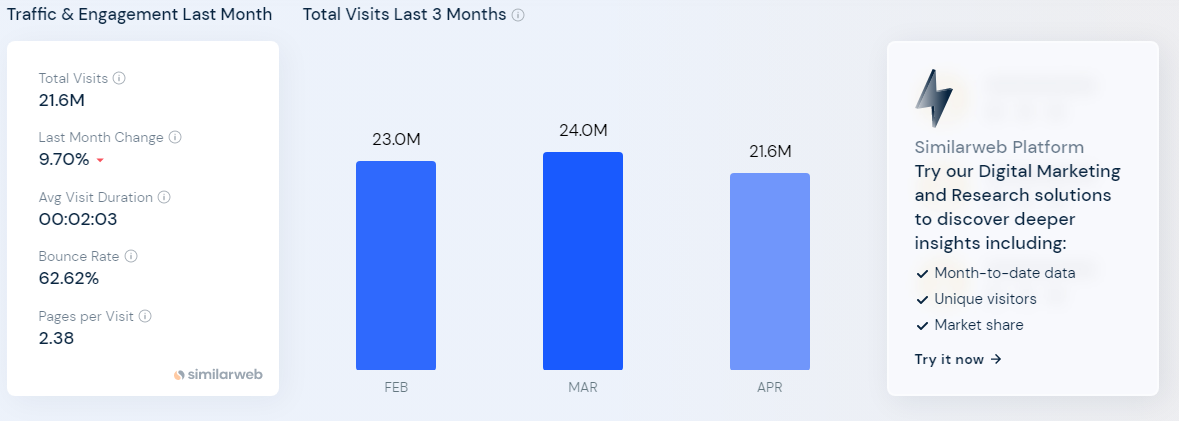

Exness witnessed a total of 21.6 million visits in the last month, signifying a significant user base.

-

The total funds held by the Exness Group in its corporate accounts as of December 31, 2021, amounted to US$316.3 million.

Exness Timeline of Operations

Here's a breakdown of the Exness Group's milestones, achievements, history, and key features by year:

2008:

-

Exness Group is founded by a group of professionals in the financial industry.

-

The company obtains its regulatory licenses from the Financial Services Authority (FSA) of Saint Vincent and the Grenadines.

2009:

-

Exness launches its online trading platform, providing access to the foreign exchange (forex) market.

-

The company expands its presence by opening representative offices in Russia and China.

-

Exness became one of the first companies to introduce the MetaTrader 5 platform.

2010:

-

Exness became a member of the Financial Commission, an international organization that resolves disputes in the financial services industry.

-

The company introduces an automated withdrawal system, allowing clients to quickly and easily withdraw funds from their trading accounts.

2011:

-

Exness achieves a significant milestone by exceeding $30 billion in monthly trading volume.

-

The company introduces new trading instruments, including commodities, and stock indices.

-

Exness introduced the ECN system.

2012:

-

Exness establishes its headquarters in Limassol, Cyprus.

-

The company's trading volume reaches $80 billion per month, solidifying its position as a major player in the forex industry.

2013:

-

Exness introduces social trading capabilities, allowing clients to copy the trades of successful traders.

-

The company's monthly trading volume surpasses $145 billion.

2014:

-

Exness launches its proprietary trading platform, known as Exness Trader.

-

The company expands its global presence by opening offices in the United Kingdom and China.

2015:

-

Exness reaches a monthly trading volume of $230 billion.

-

The company's client base grows to over 36,500 traders from more than 120 countries.

-

The company became a member of the Financial Commission, an independent self-regulatory organization for the forex industry.

2016:

-

Exness introduces a mobile trading application, enabling clients to trade on the go.

-

The company's trading volume exceeds $250 billion per month consistently.

-

Exness was named Best MT4 Broker by the UK Forex Awards.

2017:

-

Exness became a regulated broker under the Cyprus Securities and Exchange Commission (CySEC), providing clients with increased investor protection.

-

The company's monthly trading volume reaches $320 billion.

2018:

-

Exness launches an innovative feature called "One Click Trading," allowing clients to execute trades with a single click.

-

The company's monthly trading volume surpasses $395 billion.

-

Exness introduced cryptocurrency trading and launched its cryptocurrency wallet.

-

The same year, the company was awarded the Best Global Forex Trading Education Provider by Global Brands Magazine.

2019:

-

Exness expands its range of trading instruments by adding exchange-traded funds (ETFs).

-

The company's monthly trading volume reaches $400 billion.

-

Exness Affiliates, established in 2019, has emerged as one of the top-performing affiliate programs in the finance industry.

2020:

-

Exness enhances its trading conditions by offering ultra-low spreads and leverages up to 1:2000.

-

The company's monthly trading volume exceeds $785 billion.

-

The Exness client base surpassed 100k for the first time reaching 145,400 Forex traders.

-

Exness also launched its mobile app, Exness Trader, and introduced negative balance protection for clients.

-

Was named Most Transparent Forex Broker and Best Forex Broker Middle East by Global Banking and Finance Review.

2021:

-

Exness introduces a new account type, Raw Spread, providing traders with even tighter spreads starting from 0.0 pips.

-

The company's monthly trading volume reaches $1.26 trillion.

-

Exness continued to expand its product offerings, adding new asset classes such as stocks and indices.

-

The company also received multiple awards, including the Best Forex Broker Middle East and Best Forex Broker Europe from Global Banking and Finance Review

2022:

-

Exness expands its educational resources, providing clients with comprehensive trading tutorials and webinars.

-

The company's monthly trading volume surpasses $2.81 trillion.

-

The Exness client base surpassed 200k for the first time reaching 246,561 Forex traders.

-

Exness donated over €300,000 to support firefighting efforts in preventing wildfires.

-

Exness launched the Exness Academic Excellence Program, providing scholarships to exceptional students.

-

Exness obtained a license from the Capital Markets Authority of Kenya (CMA) in 2022, authorizing them to operate as a non-dealing online broker in Kenya, expanding their presence in Africa.

2023:

-

Exness announced the opening of its first physical office in Latin America, located in Uruguay, which marks a milestone in its global presence.

-

Plans to hire over 100 employees by the end of the year.

-

Hits record trading volume, record number of forex traders, and record affiliate payouts.

-

Exness made a charitable donation of $10,000 to the Rotary Club of Abuja Wuse II in January 2023, aimed to support communities affected by the 2022 floods of the River Niger.

These milestones, achievements, and features showcase the growth and development of the Exness Group over the years, cementing its position as a leading global Forex broker.

Check out an in-depth Exness review!

Exness Statistics Review about Employers

Exness Group, a leading marketplace built on ethics and integrity, boasts a team of over 2,000 tech professionals (70% of the total staff engaging in office work and 30% engaging in remote working) and thought leaders dedicated to driving innovation in the financial industry and employees hailing from more than 90 countries.

Here are some key Exness stats about its employees:

-

Headquarters: Exness Global Ltd, located at HE 326879, Siafi 1, Porto Bello, Office 401, 3042, Limassol, Cyprus.

-

Team: Over 2,000 tech professionals and thought leaders from 90+ countries.

-

Office Work:

-

1,450+ employees across 6 offices worldwide.

-

Representing 70 nationalities, fostering diversity and inclusion.

-

Remote Employees:

-

500+ employees working remotely.

-

Representing 65 nationalities, spanning 254 cities and 60 countries.

Exness takes its responsibility towards society seriously, utilizing Corporate Social Responsibility (CSR) initiatives as a platform to drive positive change. The company focuses on three key areas:

o Education: Conducting 20+ activities across 5 countries.

o Environment: Collecting 700+ kg of garbage and planting 450 trees.

o Emergency Support: Delivering 1,000+ meals.

Interesting Facts: Exness' Impact on the Fight against COVID-19 In response to the global pandemic, Exness demonstrated its dedication to corporate philanthropy. The company pledged an impressive €1 million to the fight against COVID-19.

Exness Statistics about Traders, Money Earned, Trading Volume

With record-breaking figures in trading volume, a surge in active clients, substantial client withdrawals, and increasing partner rewards, Exness Group continues to demonstrate its prowess in the market.

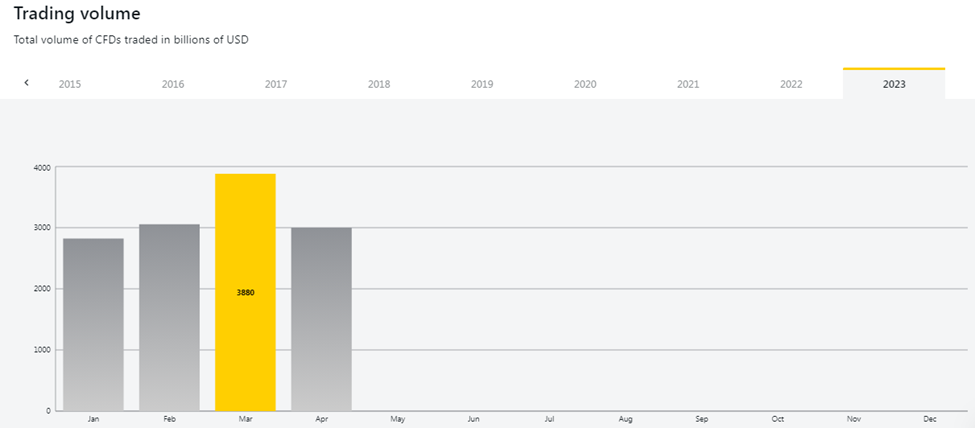

Trading Volume Soars to New Heights:

Exness Group's trading volume has witnessed an incredible surge, reflecting the platform's popularity and increased trading activity:

-

In March 2023, the trading volume reached a record of $3.88 trillion

-

That’s a substantial increase of 26.2% compared to the previous month's volume of $3.05 trillion.

-

Compared to March 2022, there has been an impressive growth of 56.5%, with trading volume soaring from $2.48 trillion to $3.88 trillion.

-

Exness executes an average of 6 million trades daily, highlighting the high trading volume and activity on their trading platforms.

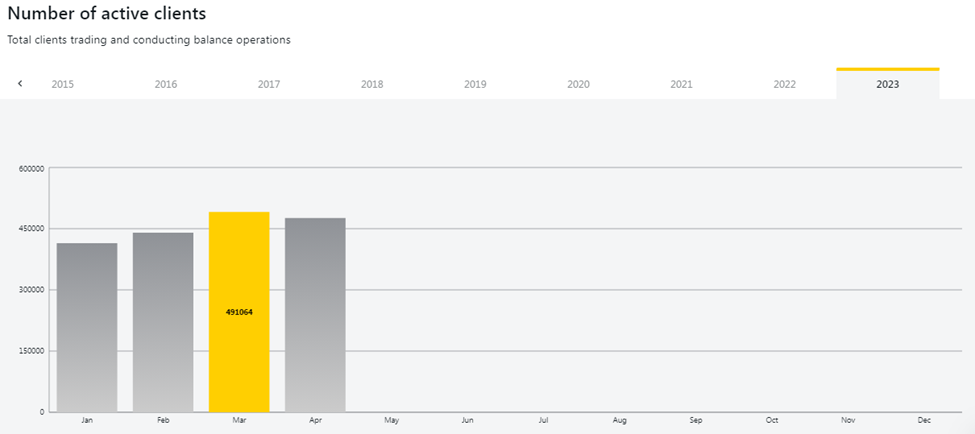

Active Clients Reach New Milestones:

Exness Group's ability to attract and retain clients is evident in the number of active clients on its platform. In March 2023, Exness stats shows the platform achieved a significant milestone, surpassing 491,000 active clients, representing an impressive year-over-year increase of 62.9% compared to the 301,575 clients recorded in the same period a year ago.

Although April 2023 witnessed a slight decrease, with total clients reaching 476,172, the numbers remained consistently above 450,000 for two consecutive months, reflecting the platform's sustained appeal.

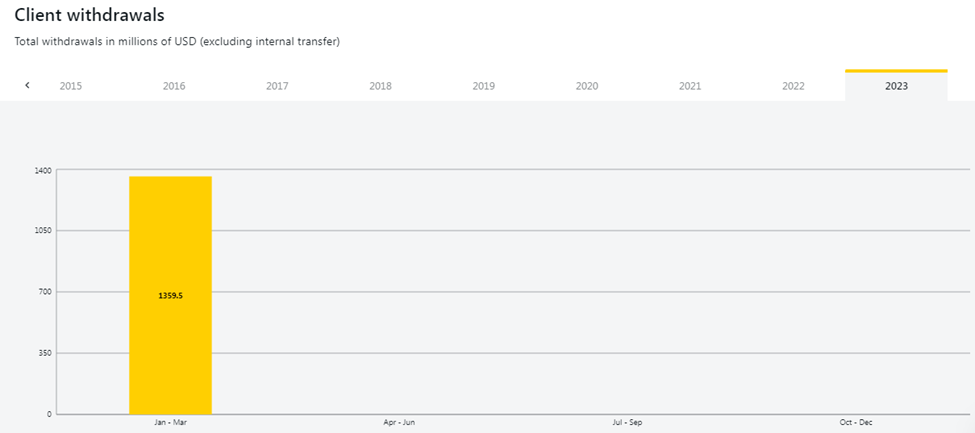

Client Withdrawals Surpass Expectations:

Client withdrawals indicate the level of trust and confidence that Exness Group's client's place in the platform:

-

Q1 of 2023, client withdrawals reached a record-breaking figure of $1.35 billion, reflecting a substantial increase of 55.2% compared to the previous year's first-quarter withdrawals of $870 million.

-

The last quarter of 2022 witnessed withdrawals amounting to $1.13 billion, showcasing a steady upward trend in clients accessing their funds. This marks the third consecutive quarter where client withdrawals have exceeded the $1 billion mark.

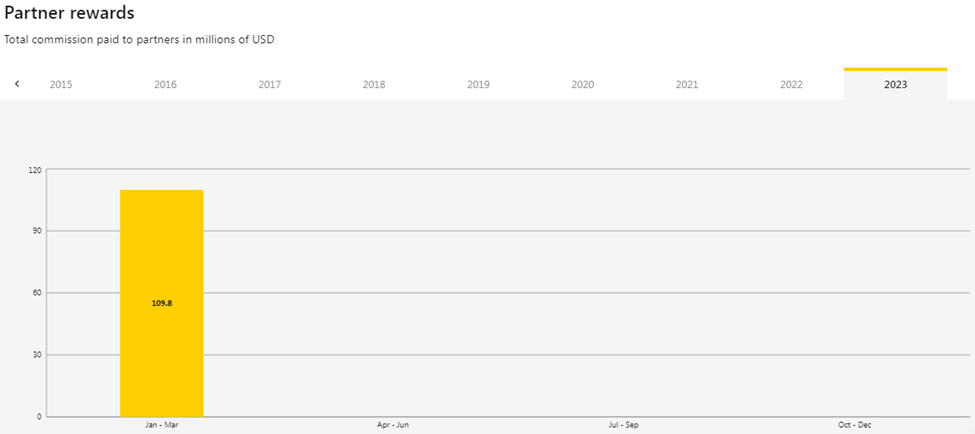

Partner Rewards Reflect Strong Partnerships:

Exness Group highly values its partnerships and rewards partners for their contributions to the platform's growth:

-

In the first quarter of 2023, total partner rewards reached a new record of $109.8 million, marking a noteworthy increase of 10.8% compared to the last quarter of 2022, which recorded rewards of $99.1 million.

-

Compared to the first quarter of 2022, where partner rewards were $83 million, there has been a remarkable growth of 32.3% in rewarding partners for their dedication and client acquisition efforts.

-

They offer competitive commissions, with affiliates having the potential to earn up to $1,850 for the CPA and up to $45 for the CPL, depending on the country and deposit amount.

Exness Statistics about Market Share and Traffic Analytics

According to SimilarWeb, Exness, a prominent online brokerage platform, holds a global rank of #3,362, highlighting its substantial reach and influence in the financial industry. Let's delve into some key statistics and draw relevant conclusions based on the data:

-

Traffic and Engagement Analysis

-

Exness witnessed a total of 21.6 million visits in the last month, signifying a significant user base.

-

The average visit duration on the platform is 2 minutes and 3 seconds, indicating user engagement with the content and services offered.

-

However, the bounce rate, which stands at 62.62%, suggests that a considerable portion of visitors left the website after viewing only one page.

-

Pages per visit were recorded at 2.38, indicating that users typically explore multiple pages during their visit.

-

The total visits over the last three months show some fluctuations, with February and March reaching 23 million and 24 million visits, respectively, and April saw a slight decline to 21.6 million visits.

-

Top Countries

-

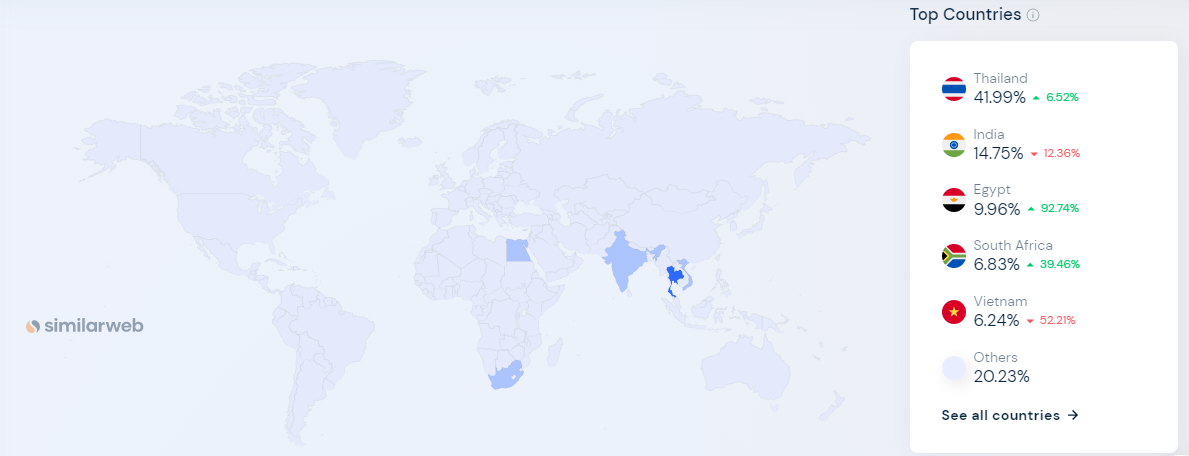

Thailand emerged as the leading country in terms of desktop traffic sent to Exness, accounting for 41.99% of visitors.

-

India followed with a share of 14.75%, Egypt with 9.96%, South Africa with 6.83%, and Vietnam with 6.24%.

-

These countries collectively contribute significantly to Exness's user base and indicate its popularity in various regions.

-

Audience Demographics

-

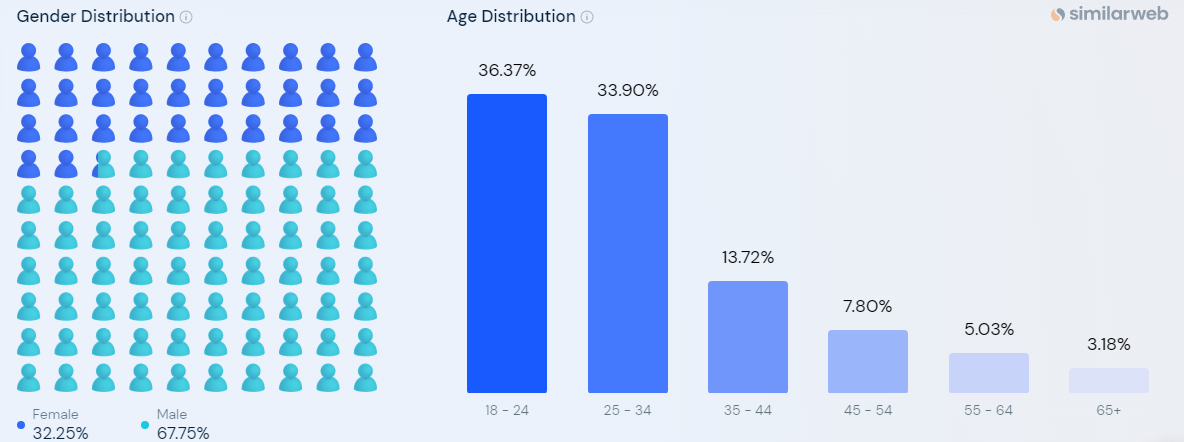

Exness's audience consists of 67.75% males and 32.25% females.

-

The largest age group among visitors falls in the 18-24 category (36.37%), highlighting the platform's appeal to younger individuals seeking financial and investing information.

-

Other age groups also show notable engagement, with visitors aged 25-34 accounting for 33.90% of the audience.

-

Similar Sites & Competitors

-

Exness faces competition from similar platforms, including XM, iqbroker, exnesspromo, mql5, and coinw.

-

These sites cater to similar audiences and operate in the finance and investing niche.

-

Furthermore, within the Finance-Investing category, Exness holds a commendable position, ranking 5th while it competes with established platforms like investing.com, tradingview.com, and settrade.com.

-

Top Marketing Channels

-

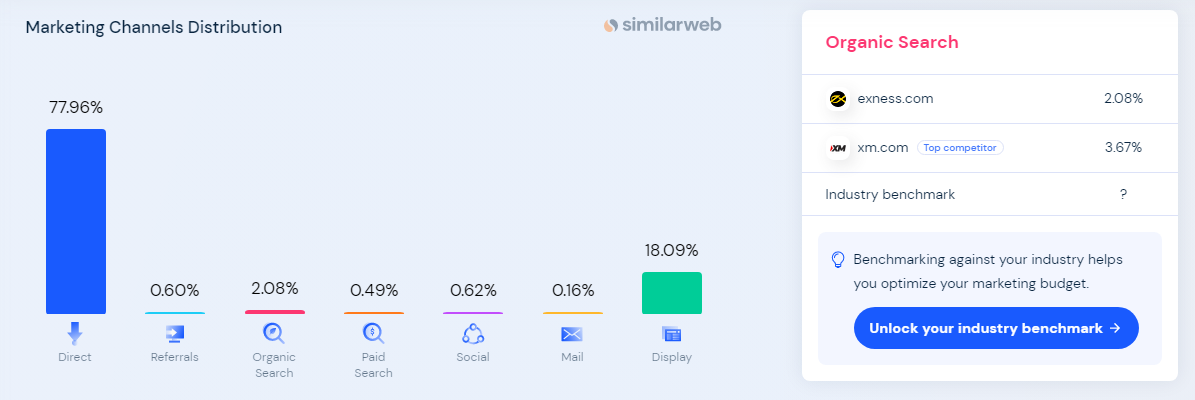

Direct traffic is the primary source of visits to Exness, driving 77.96% of desktop visits last month.

-

Display advertising ranks as the second most significant channel, accounting for 18.09% of traffic.

-

Other channels, such as referrals, organic search, paid search, social media, and email marketing, contribute to a lesser extent.

-

Technology Stack

-

Exness employs a diverse range of technologies from 17 different industries, totaling 80 technologies.

-

This technological prowess allows Exness to provide a seamless user experience and stay at the forefront of online brokerage services.

Exness Statistics about Online Trading App

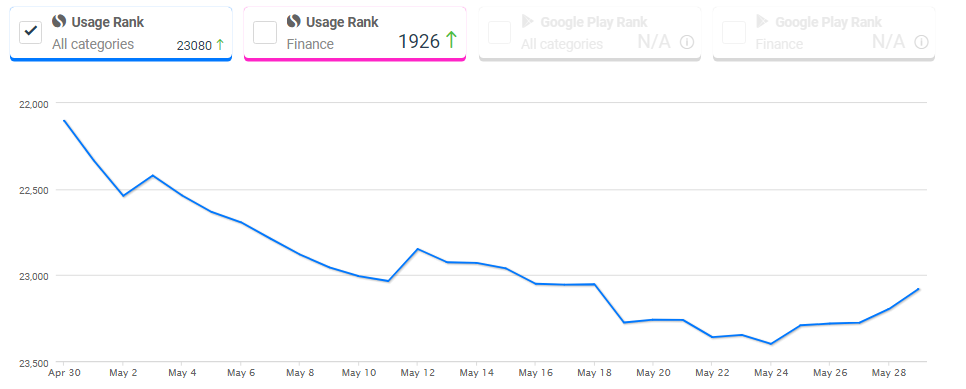

According to SimilarWeb, the Exness Trading App has achieved notable rankings across various countries. In the overall Google Play Store ranking, it holds a respectable position at 23,080 while in specific markets, the app ranks as follows:

-

France: 10,102

-

United Kingdom: 11,341

-

Germany: 15,843

-

Canada: 19,693

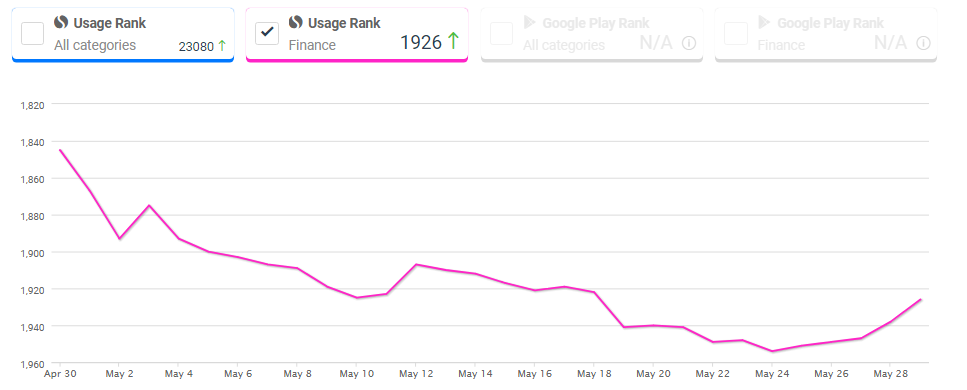

Finance Category Ranking

Within the Finance category, the Exness Trading App has achieved a commendable ranking of 1,926 globally. This highlights its growing popularity among users seeking financial and trading solutions. Additionally, its rankings in specific markets are as follows:

-

France: 593

-

United Kingdom: 637

-

Germany: 903

-

Canada: 992

User Audience Interests

The Exness Trading App attracts users from various backgrounds and interests. SimilarWeb's analysis reveals the top categories and apps that are popular among users of the "Exness Trade: Online Trading" app. The findings include:

-

Finance: 35.5% of users show a keen interest in finance-related apps and services.

-

Tools: 18.6% of users explore various utility and productivity apps.

-

Communication: 12.9% of users engage with communication apps, showcasing the importance of staying connected with peers, experts, and news sources in the trading community.

-

Social: 6.3% of users are interested in social media platforms.

Exness Statistics about Financial Performance

The audit conducted by Deloitte, enhances the transparency and credibility of the Exness Group's operations, assuring traders of a reliable and trustworthy trading environment. Various aspects of trading volume, clients' withdrawals, and agents' commissions were examined. The report covered the period from January 1, 2021, to December 31, 2021, and followed the International Standards of Related Services (Revised) 4400 Agree-Upon Procedures engagement.

Here are some key findings from the report:

-

Trading Volume: The total trading volume during the period from January 1, 2021, to December 31, 2021, amounted to US$11.06 trillion.

-

Agents' Commissions (referral fees): The total agents' commissions paid by the Exness Group during the same period were US$176.76 million.

-

Clients' Withdrawals: The total amount of withdrawals made by clients of the Exness Group was US$1.85 billion.

Exness Statistics from the Clients Equity Report

Deloitte performed various procedures including obtaining data from the Exness Group's data warehouse, analyzing MT4 and MT5 trade data, calculating equity movements, reconciling trading reports, verifying deposits and withdrawals, and conducting GITC testing on relevant systems.

Here are some key findings from the report:

-

Exness Net Worth – Corporate Accounts:

The total funds held by the Exness Group in its corporate accounts as of December 31, 2021, amounted to US$316.3 million.

-

Clients' Segregated Accounts:

The total funds held by the Exness Group in clients' segregated accounts as of December 31, 2021, amounted to US$264.8 million.

-

Total Equity Clients Held:

The total equity held by clients with the Exness Group as of December 31, 2021, amounted to US$234.8 million.

By undergoing such audit procedures and reporting the findings, the Exness Group demonstrates its commitment to maintaining strong financial controls and safeguarding clients' funds. The transparency and accuracy of the reported figures enhance the trust and confidence of clients in the Exness platform, providing forex traders assurance that their funds are being managed responsibly.

Exness Statistics FAQ

How many users does Exness have?

A: Exness boasts a substantial user base, with over 491,000 active clients in March 2023. This number has seen significant growth compared to 301,575 clients a year ago. Follow this guide to open a live trading account with Exness.

What is the annual profit of Exness?

A: Exness is a profitable company, but specific details about its annual profit are not publicly disclosed. However, based on the audit conducted by Deloitte the total funds held by the Exness Group in its corporate accounts as of December 31, 2021, amounted to US$316.3 million.

How trustworthy is Exness?

A: Exness is a reputable online trading platform known for its commitment to ethics and integrity. With a strong focus on transparency and client satisfaction, Exness has gained the trust of many traders worldwide.

Q: Who is Exness' competitor?

A: Exness operates in a highly competitive market, and some of its notable competitors in the online trading industry include:

-

IQ Option

-

IG

-

IC Markets

-

Plus500

-

eToro

Please note that this list is not exhaustive and there may be other competitors in the industry as well – you can compare Exness with other top Forex brokers HERE.

Q: How long has Exness existed?

A: Exness was established in 2008, making it a well-established player in the online trading industry with over 15 years of experience. With over a decade of experience, Exness has gained a strong reputation and a significant client base.

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM IC Markets

IC Markets Forex.com

Forex.com AXITrader

AXITrader