Scams in the Forex market have been run since the industry became decentralized, and even though the regulators try to reduce the occurrence, it still goes on. To avoid falling for one, here are some notable scams which were uncovered. Try to see what they all have in common so you can spot the next scam. (Know the: Lessons on self-defense: Forex scams)

Keith Simmons and Deanne Salazar

These 2 individuals were responsible for the elaborate Black Diamond forex scam that ran from 2007 to 2010. The pair operated several hedge funds, together with other partners in crime, which solicited clients to invest in the Forex market. From 2007 to 2010, more than 240 clients invested a total of $35 million.

Toward the end of the scam, they were unable to pay their investors because they were running a pyramid scheme and had never actually invested any money. After the CFTC investigations ended in 2011, Simmons was imprisoned for 40 years while Salazar got 4.5 years after confessing.

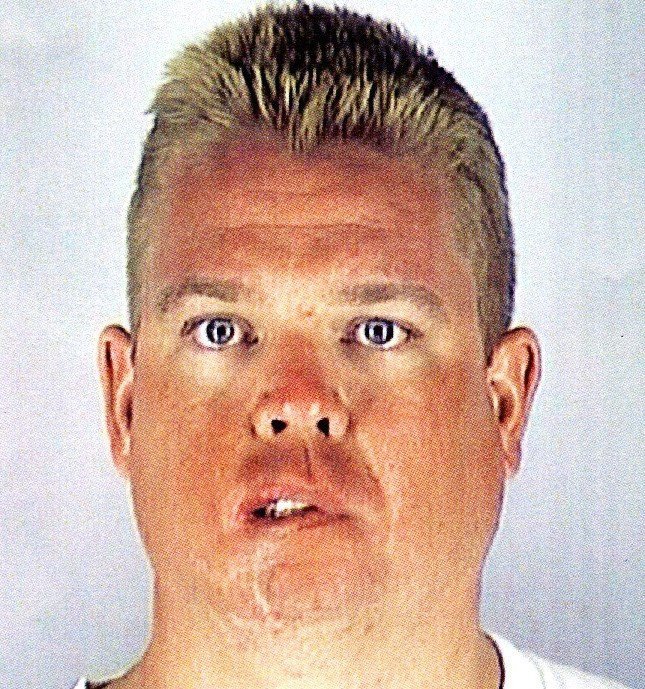

Trevor Cook

Cook founded Universal Brokerage Services, a forex trading company, in 2003 and started advertising his services through radio. He was arrested and imprisoned in 2010 when investors were unable to get their money back during the 2008 financial crisis. It turns out that Cook had invested the clients’ money through Crown Forex SA, but the company had trouble with the Swiss regulator. In the end, over 1,000 investors lost more than $190 million in one of the largest Forex scams. (Learn more: Benefits of Trading with Admiral Markets)

Adrian Shiroma

This was a scammer whose scheme was uncovered by the Forex forum Trading Heroes last year. The writer investigates how a trader called Adrian Shiroma created a website to promote his Forex investment business. On the website, he claimed to have had success in the industry since 2009, urging investors to trust him with their money. The same scammer later started promoting a Forex brokerage by the name MitsuiFX, which was also found not to be regulated or even have a permanent address. What are the: 10 steps of successful traders)

We cannot know how much Adrian Shiroma took from people, but there is a high chance he managed to trick more than a few unsuspecting investors.

Colin Davids

This guy ran Platinum Forex in 2013 out of South Africa claiming to provide returns of 48% and 84%. Investors had put in more than R100 million before the Financial Services Board (FSB) learned that the company was not licensed as a financial services provider. It turns out they were running a Ponzi scheme, and worse, using the money for personal expenses. (What are the intricacies of Forex trading in South Africa)

Luis Alonso Serna

He was a pastor in Los Angeles, California, but on the side was running a Ponzi scheme based on the Forex market. He had marketed the platform to members of his congregation, getting them to invest more than $4 million. The members had taken out loans from their homes to achieve 20% monthly returns, which not even the best world’s forex broker for trading can promise.

Timothy Coughlin

He claimed to be a former naval pilot for the army, a line that he used to lure more than 5,000 unsuspecting investors to part with $12.8 million. Forex regulators have not found any record of him being in the army, but that was enough to make him seem trustworthy. The investment funds had mostly come from US residents, but some were from outside the country.

David Hawkins

This deputy sheriff also ran a modest Ponzi scheme within his town of Colorado, managing to get $1.2 million from investors after promising 20% monthly returns. After running the scheme for a short while, he discovered that the scheme would collapse and chose to willingly refund his investors a total of $1 million. His investors were mainly friends and co-workers, so the remorse he felt was understandable. The courts also gave him a light sentence of 30 months for a crime that should have earned him up to 20 years in prison.

Gerald Rogers

After running Premium Income Corp. right about when the Forex market got decentralized, he cooked up this company promising enormous returns from the Forex market. The scam was spread through 3 companies that had, by 2005, collected more than $100 million. After complaints to the SEC, the company has restituted $36 million to investors, but Rogers is now in prison. (What are the: Laws and limits of forex trading in the US)

Orion International Inc.

This is another one of the earliest Forex market schemes, which gained $40 million from investors by 2003. When it was discovered, the president of the company was fined $150 million and imprisoned.

National Investments Consultants Inc.

By the year 2005, investors had handed over $2 million to the company for investment in the Forex market, but it was just a Ponzi scheme all along. The company executives received fines amounting to $3.4 million.

Final Thoughts

Simple advice: Never trust your money to someone you are not 100% sure about.