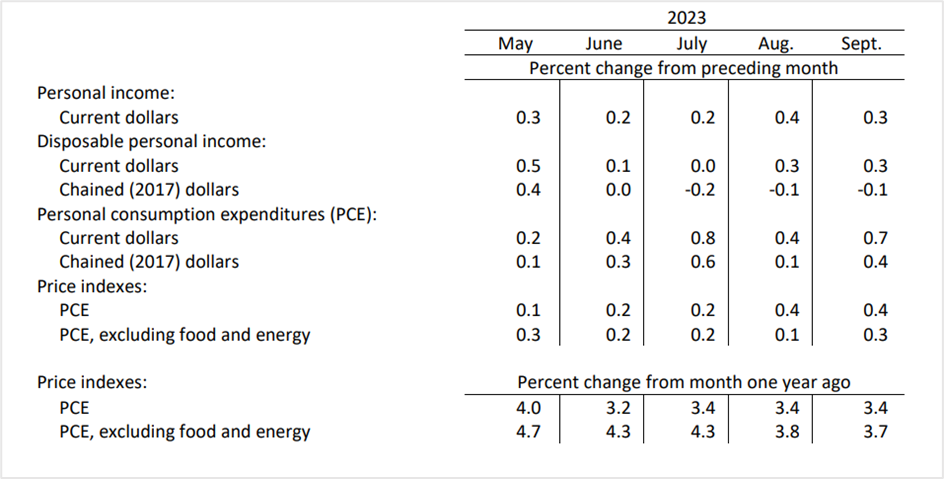

Headline PCE price index surged 0.4% month-on-month, while core inflation climbed 0.3%

US personal consumption expenditures (PCE) price index increased 0.4% in September, unchanged from the previous month but higher than the 0.3% rise expected by analysts, data released by the Bureau of Economic Analysis (BEA) showed. On the other hand, the core PCE price index, which excludes the volatile food and energy prices, increased by a smaller 0.3% from 0.1% in August. Meanwhile, the headline index surged 3.4% over the last 12-months, unchanged from September 2022, and well above the Fed’s inflation target of 2%. On the contrary, the core PCE price index dipped to 3.7% from 3.8% year-on-year, the lowest in over two years and in line with Street forecasts.

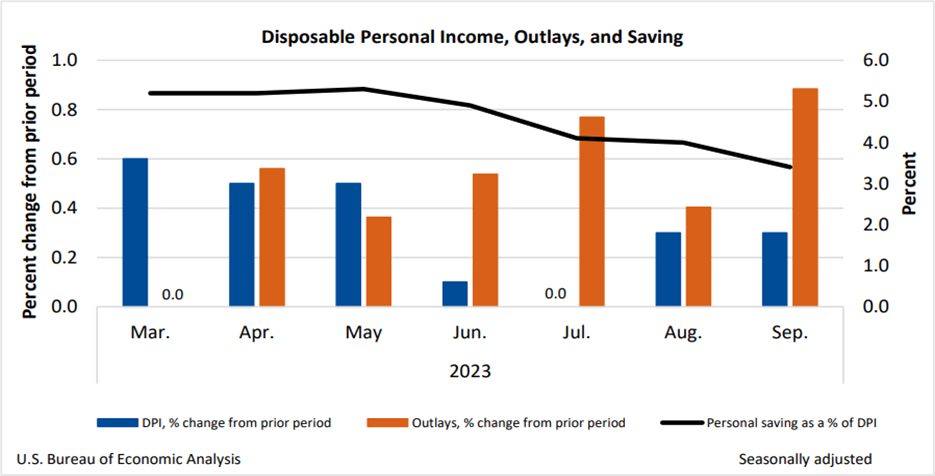

The PCE price index rose on the back of strong consumer spending as households purchased motor vehicles and spent on traveling, ahead of a challenging fourth quarter, according to economists. Consumer spending, which accounts for more than two-thirds of the economic activity in the US, rose 0.7% in September from 0.4% the previous month, beating a Reuters poll of economists who forecast spending to increase by 0.5%.

Housing costs primarily drove the price increase, but most economists predict spending to cool off in early 2024 as consumers run out of the excess savings accumulated during the pandemic. However, while the September PCE price index didn’t show a marked improvement in inflation, it wasn’t rising sharply either, and although the risks of a rate hike remain, most economists believe that the Fed is done lifting interest rates.

PCE price index- Source: Bureau of Economic Analysis

Personal consumption expenditures (PCE) is the Fed’s preferred inflation measure since it includes changing consumer behavior, while the core PCE price index is believed to predict future inflation trends better. The Fed focuses on core inflation to better assess where prices could be headed over the longer term.

Key highlights of the Personal consumption expenditures report

Personal income grew $77.8 billion, or 0.3% month-on-month in September, while disposable personal income (DPI), which deducts personal current taxes from personal income, also increased by 0.3%. However, real DPI, which accounts for inflation, dropped 0.1% in September. The nominal personal consumption expenditures (PCE) increased by $138.7 billion, or 0.7%, in September, with prices of goods rising by 0.5% and services by 0.3%.

The rise in personal income in current dollar terms was primarily a reflection of a surge in personal income receipts on assets, compensation, nonfarm proprietors’ income, and rental income. Of the $138.7 billion increase in the PCE in current dollars, consumer spending on the services industry accounted for an increase of $96.2 billion, while consumer spending on goods rose by $42.5 billion. Within services, the most significant contributors to the increased spending were other services, such as international travel, housing and utilities, health care, and transportation. Within goods, the foremost sectors where consumer spending was seen were other nondurable goods and motor vehicles and parts- primarily led by new motor vehicles.

Economists’ view of the PCE price index report

Jeffrey Roach, the chief economist at LPL Financial, believes that although headline inflation rose faster than expected, core inflation declined, which is good from the Federal Reserve’s point of view. He expects policymakers not to change their view about cooling inflation in the coming months amid slowing demand. Going forward, he expects consumer spending to moderate as people curtail spending to less than what they earn.

Stephen Stanley, the chief economist at Santander Capital Markets, estimates inflation to continue rising around the 0.3% mark for some time and said that we should get used to this number. According to him, the US economy is robust despite interest rates increasing rapidly, although the unemployment rate has remained low.

Sal Guatieri, a senior economist at BMO Capital Markets, said consumers still have some gas left in the tank, which might be carried into the fourth quarter. While he expects consumer spending and economic activity to decrease substantially in the fourth quarter, he thinks there’s still a risk that they will be hotter than the Fed needs to curb inflation.

Market reaction to the US PCE price report

The US equities markets ended mixed on Friday, with the Dow Jones Industrial Average and the S&P 500 closing in negative territory, while the Nasdaq Composite Index ended with gains.

The Dow Jones Industrials fell 1.12% to end the week at 32,417.59, led by a 3.6% decline in JP Morgan Chase after the CEO Jamie Dimon said he plans to sell 1 million shares next year. Meanwhile, the S&P 500 settled at 4,117.37 on Friday, falling into correction territory for the 103rd time in history, data from FactSet showed. However, the large-cap index is still up 7.2% year-to-date.

Also, last Wednesday, the Nasdaq Composite Index was the first among the major stock indices to enter correction territory, its 70th in history, as rising long-term treasury yields weighed on growth stocks from the technology sector. The index closed at 12,643.01 on Friday, up 0.38% for the day. But, despite falling into correction territory, the composite index has gained 20.8% year to date.

The US Treasury markets were mixed on Friday, with the 2-year and 10-year notes falling slightly while the 30-year bond yield rose as investors assessed the PCE inflation report that offered a mix of good and bad news. The rate-sensitive 2-year note closed lower by 4 basis points at 5.004%, while the benchmark 10-year note slipped 0.8 basis points to settle at 4.839%, and the 30-year rose 2.9 basis points to end Friday’s session at 5.019%. This follows a sharp drop in the treasury yields on Thursday after data showed the US economy growing at a solid annual pace of 4.9% in the third quarter. The slump in yields comes as traders expect the Federal Reserve to hold off raising interest rates on November 1st despite the US economy continuing to show strength on the back of solid employment gains and consumer spending. In the meantime, markets brace for around $1.5 trillion in Treasury borrowing before next week’s quarterly refunding statement.

The US dollar index futures (DXY) ended flat for the successive day on Friday but managed to register weekly gains against its six rivals in the currency index as traders await the outcome of the monetary policy meetings of three central banks next week. The Bank of Japan will be the first to announce its interest rate decision late on Monday evening, followed by the Federal Reserve on Wednesday and the Bank of England on Thursday. Although the central banks are expected to maintain the status quo on interest rates, market participants will eagerly seek information on the monetary policy path, which will likely drive these currencies over the next few weeks.

Last week, the European Central Bank maintained its main refinancing operations rate at 4.5% and the deposit facility rate at an all-time high of 4.0%, holding off lifting rates for the first time after ten successive rate hikes before the October meeting.

Technical View

S&P 500 December futures

The S&P 500 December futures ended Friday’s session at 4137.75 to register the lowest close since May 24th. The index derivative is in a long-term downtrend and closed below key supports at 4180 earlier last week. Unless the benchmark index futures climbs above this level over the next couple of trading sessions, the decline could extend to the next support at 4080. On the upside, the short-term resistance zone is in the 4180-4240 range, and a close above will push the index toward 4350-4440, the base of the long-term uptrend. On the other hand, if the bearish trend continues beyond 4080, the S&P 500 futures could slump to 3400-3410.

The short-term strategy is to go long on the index futures at 4080, with a stop loss at 4050 for a profit target of 4170. But, if the index futures closes below 4080, exit all long trades and short the index for a 3-6 month target of 3400.

S&P 500 December futures- Daily chart

Advanced Micro Devices Inc (AMD)

Shares of AMD jumped 2.95% on Friday to settle at $96.43, reversing some of the massive losses in the previous two sessions. Although the stock rebounded somewhat on Friday after sinking below the September 25th lows of $94.46 during the previous session, a drop toward $89.00 cannot be ruled out if it drops below the support again. But if the stock holds above $94.00 until mid-week, the gains could extend to the top end of the long-term bearish channel at $108.00.

Traders willing to take additional risk can buy AMD at $95.00 with a stop loss of $84.00 for a profit target of $107.00. Low-risk traders can buy the stock when it dips to $89.00-$90.00, have a stop loss at $84.00, and exit as prices approach $107.00.

Advanced Micro Devices Inc (AMD)- Daily chart

ThailandUS

ThailandUS