In the world of trading, having a well-defined trading strategy is key to success. It is essential to have a system that can help you identify entry and exit points, manage risk, and optimize your profit potential while at the same time limiting losses.

Nowadays it’s easier than ever to develop a trading strategy with the help of artificial intelligence (AI) tools such as ChatGPT.

In this article, we'll go through the step-by-step process of creating a full-day trading strategy with ChatGPT that you can use in any market, including Forex, crypto, or the stock market.

An Introduction To chatGPT

It is essential to understand that ChatGPT is an AI language model trained to help answer questions and provide information on a wide range of topics. To make a trading strategy with ChatGPT, you need to specify your requirements and parameters.

You can ask ChatGPT to create a strategy code based on specific indicators or filters, such as Bollinger Bands, moving averages, and volume oscillators.

To get started, you'll need to provide ChatGPT with information about your investment goals, risk tolerance, trading style, entry and exit rules, etc. From there, ChatGPT will analyze the data and generate a custom trading strategy tailored to your needs.

What Are Trading Strategies? How To Develop One?

Trading strategies are the backbone of every successful trader, and coding them is an important step toward automating the trading process.

These strategies are not just sets of rules and instructions, but rather complex algorithms that take into account a wide range of factors such as market trends, technical indicators, and risk management techniques.

The benefits of coding trading strategies are manifold. By using algo trading to execute trades based on specific conditions, traders can ensure that their decisions are made quickly and accurately.

How Do You Plan A Trading Strategy?

So you're ready to start developing your first trading strategy.

Well, first things first – have you considered which trading platform and forex broker you want to use?

If not, check out our list of the best forex brokers in 2023 – these brokers have got you covered with competitive spreads, reliable trading platforms, and all sorts of useful tools and resources to help you develop a trading strategy that fits your goals and preferences.

Some of the most popular trading platforms are:

-

TradingView,

-

cTrader 4.

-

Trader Workstation (TWS)

-

TradeStation

All of these offer a range of features such as charting tools, backtesting capabilities, and the ability to execute trades automatically.

However, different platforms support different programming languages, so it is important to choose a platform that supports the language you are most comfortable with.

For example, Python, Java, and C++ are among the most popular programming languages for trading. Nonetheless, Pine Script and MetaQuotes Language 4 (MQL4) are two platforms widely used in forex trading.

Using Chat GPT To Make A Trading Strategy

To start developing a trading strategy, we're going to use TradingView, a free online charting platform, and Pine Script, their proprietary programming language.

Don't worry if you have zero coding knowledge, anyone can figure it out with a little help from ChatGPT.

Pine Script is a scripting language developed specifically for TradingView designed to be easy to learn and use, making it an excellent choice for traders who are new to coding. With Pine Script, traders can create custom indicators, backtest their trading strategies, and even automate their trading using TradingView's alerts system.

To get things started we asked chatGPT to:

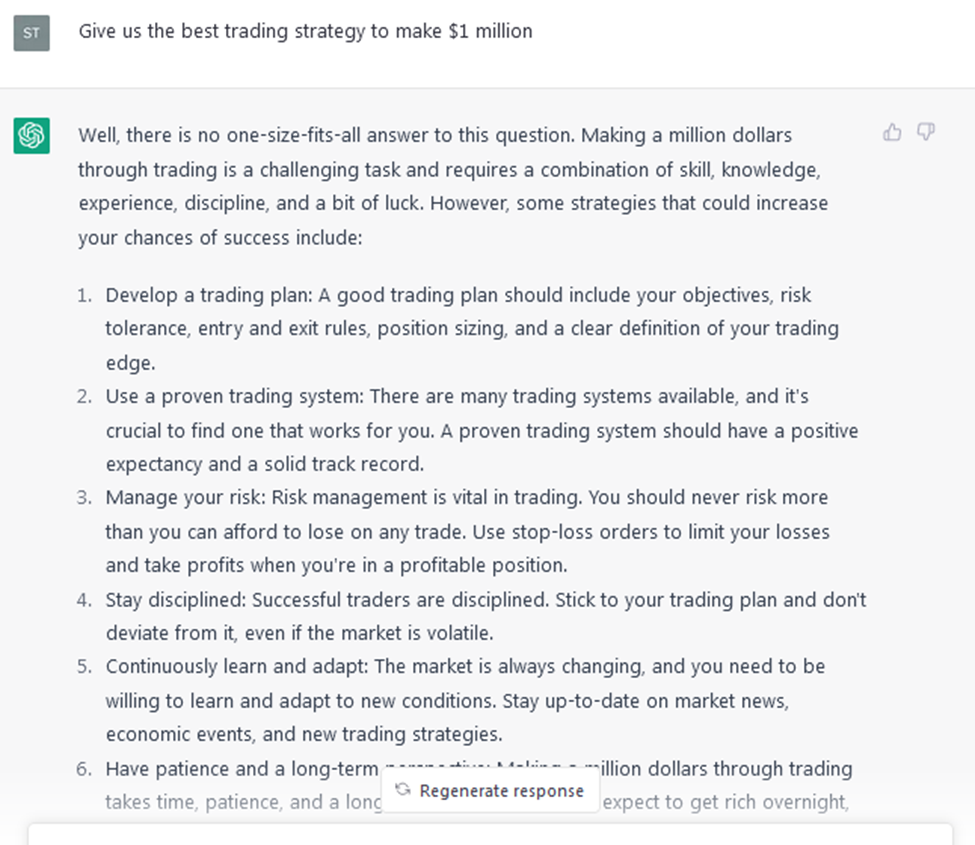

“Give us the best trading strategy to make $1 million.”

ChatGPT gives us the following response:

It wasn’t the response we were looking for, but it’s a great starting point from where we can start building our trading strategy.

Through this experiment, we’re going to let chatGPT build from scratch a trading strategy that can make us money.

10 Steps To Build Trading Strategy With ChatGPT

-

Choose A Trading Style

Decide which type of trader you want to be, such as:

-

Day trader,

-

Swing trader,

-

Or position trader.

Each style requires a different approach, so it's important to choose the one that aligns with your trading goals.

We started by asking chatGPT:

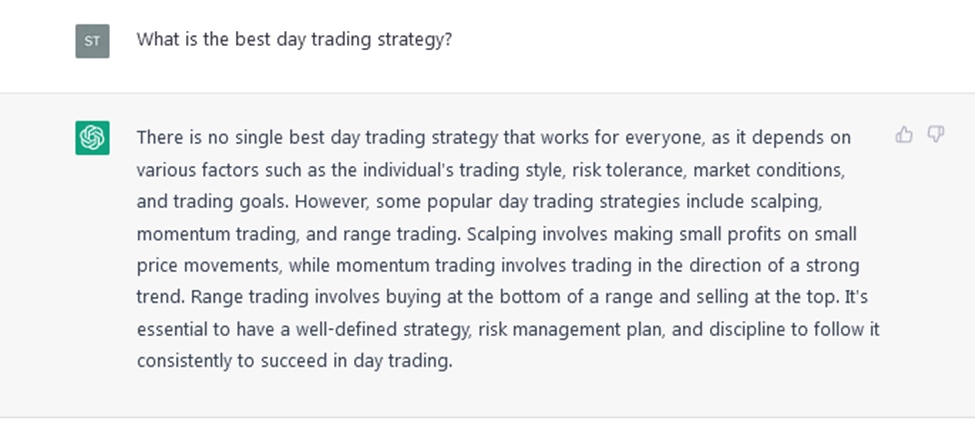

“What is the best day trading strategy?”

Unfortunately, chatGPT only advised with some generic information about scalping, momentum trading, and range trading:

To receive the best answers from chatGPT, traders need to feed the AI platform with more details, so we followed up with a second prompt:

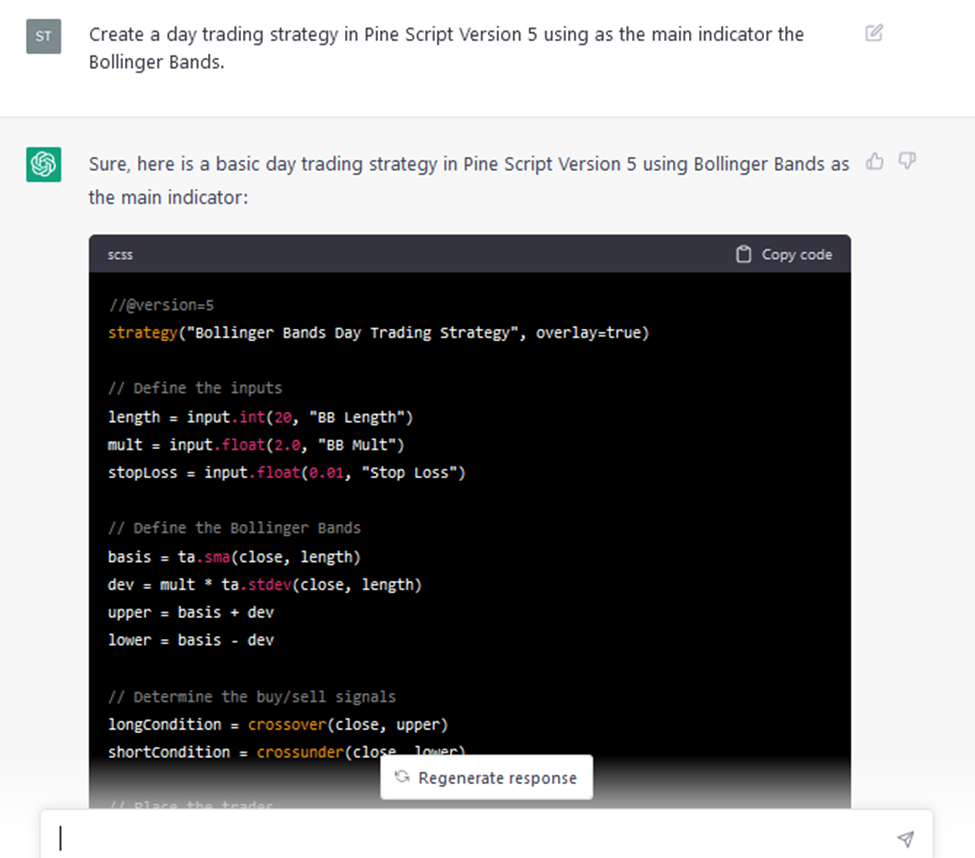

“Create a day trading strategy in Pine Script version 5 using as the main indicator the Bollinger Bands.”

Traders can choose any indicator they need, like the RSI, Stochastic, MACD, CCI, etc. but for this demonstration, we’ve picked up the Bollinger Bands.

The Pine Script code generated by chat GPT buys and sells when the close price crosses above the upper Bollinger Band respectively when the close price crosses below the lower BB.

-

Define When To Buy And Sell

While the chatGPT trading strategy has its own buy and sell rules, in this part we need to filter out some of the bad trade signals. To accomplish this we can use another technical indicator or price action signal or another condition.

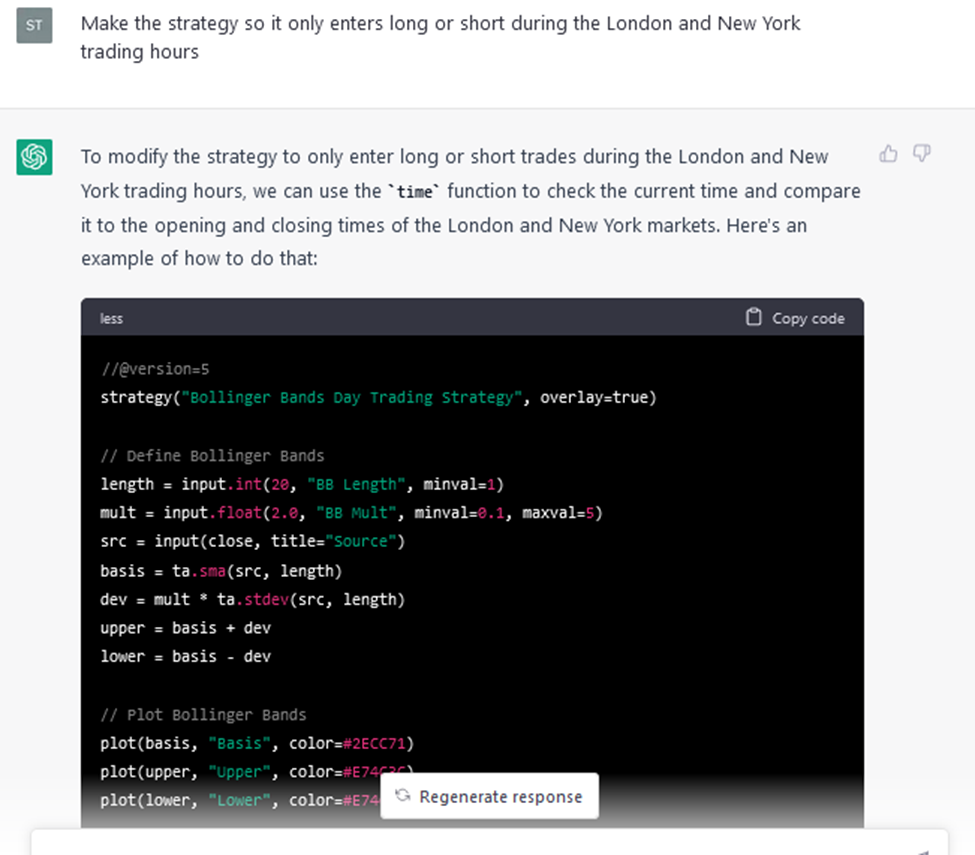

For this demonstration, we asked chatGPT to update the forex trading strategy and “only take into account the signals during the London and New York trading sessions.”

The AI platform updated the algo trading to this:

-

Select A Trading Instrument For Your Strategy

This day trading strategy is suitable for forex, stocks, or cryptocurrencies but for this example, we have opted to test the algo bot on the EURUSD currency pair.

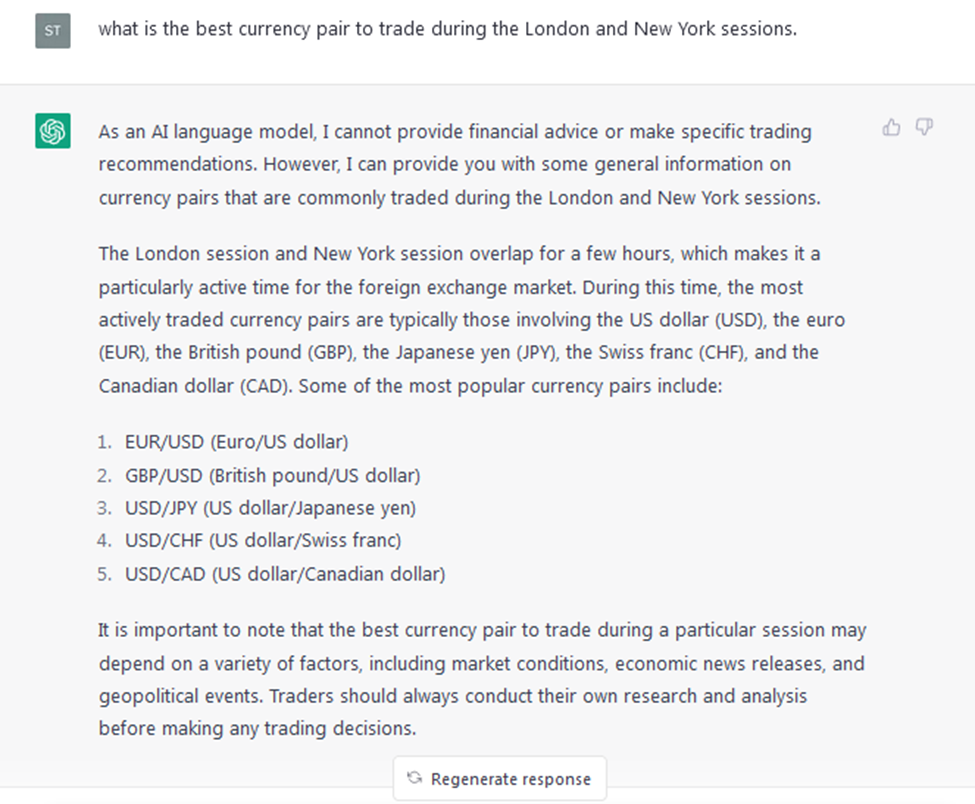

But we can also ask chatGPT for his opinion about “the best currency pair to trade during the London and New York sessions.”

Here is the chatGPT reply:

-

Choose to Take Profit And Stop Loss Levels

Instead of using fixed take profit and stop loss orders, traders can opt for using dynamic SL and TPs that follow the market volatility.

For this purpose, traders can use the Average True Range (ATR) indicator to set exit rules.

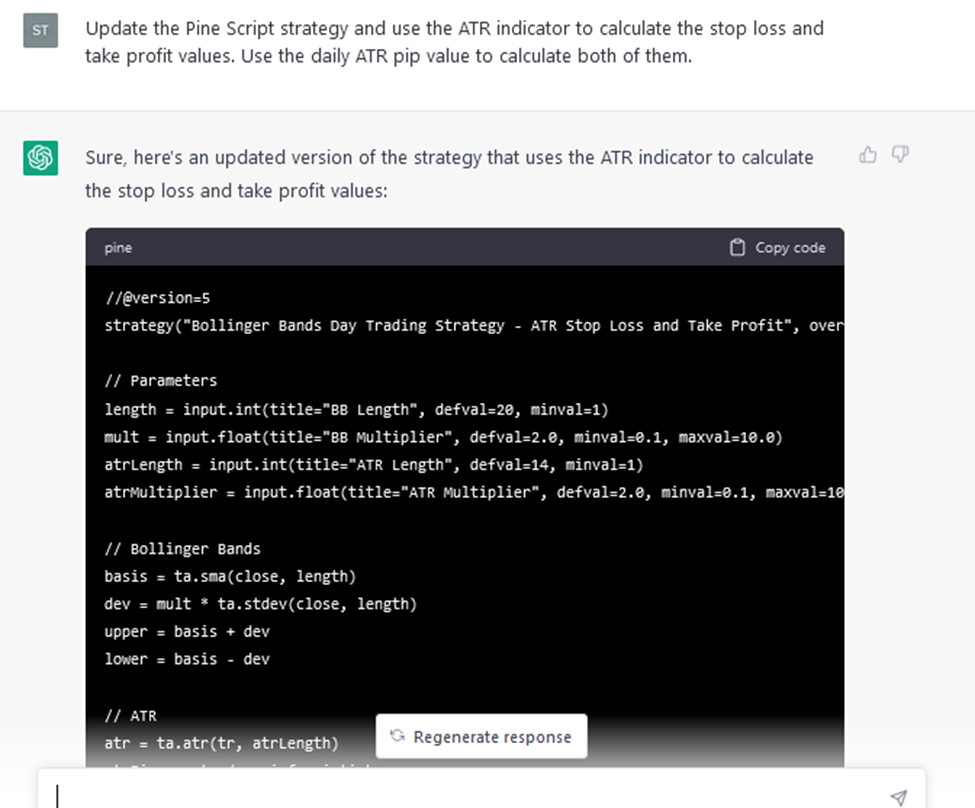

Here is our chatGPT prompt:

“Update the Pine Script strategy and use the ATR indicator to calculate the stop loss and take profit values. Use the daily ATR pip value to calculate both of them.”

As you can see below, the AI changed the Pine Script code just as we asked:

This means that the trading strategy made with chatGPT will have a risk-to-reward ratio of 1:1.

-

Choose A Time Frame To Trade

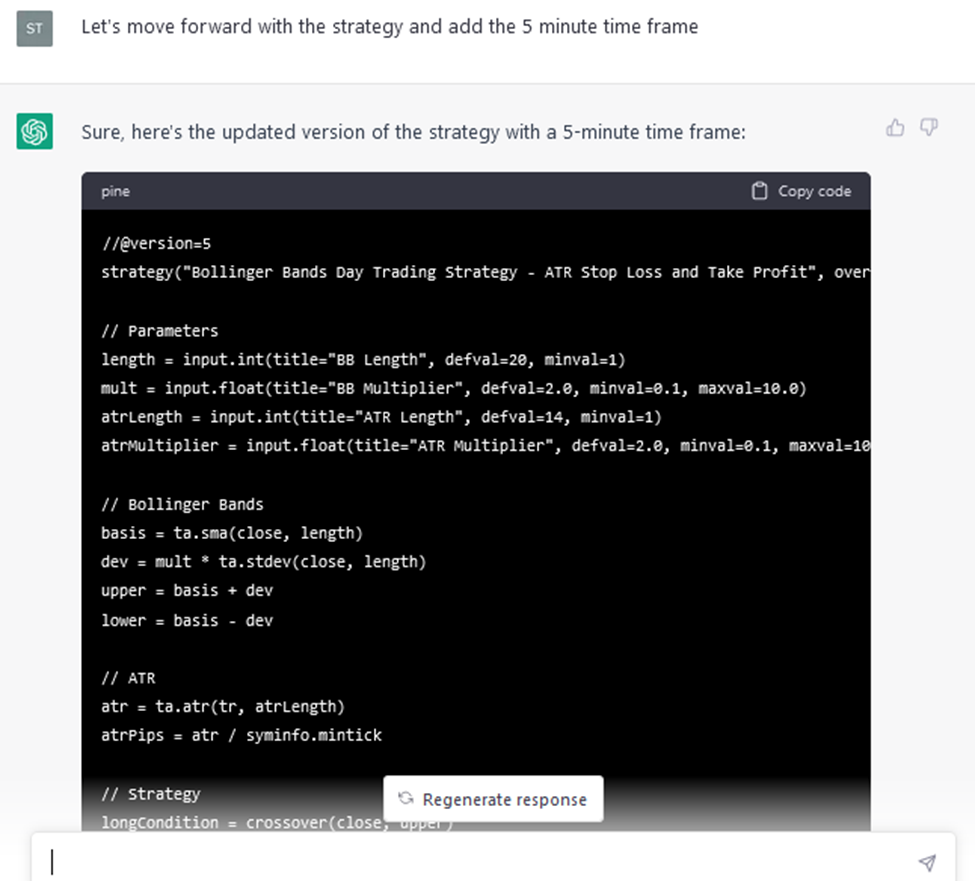

For day trading, a common time frame to use is the 5-minute chart.

However, it's important to note that the ideal time frame may vary based on the specific trading strategy being used, as well as market conditions and individual preferences.

-

Define Your Risk Level

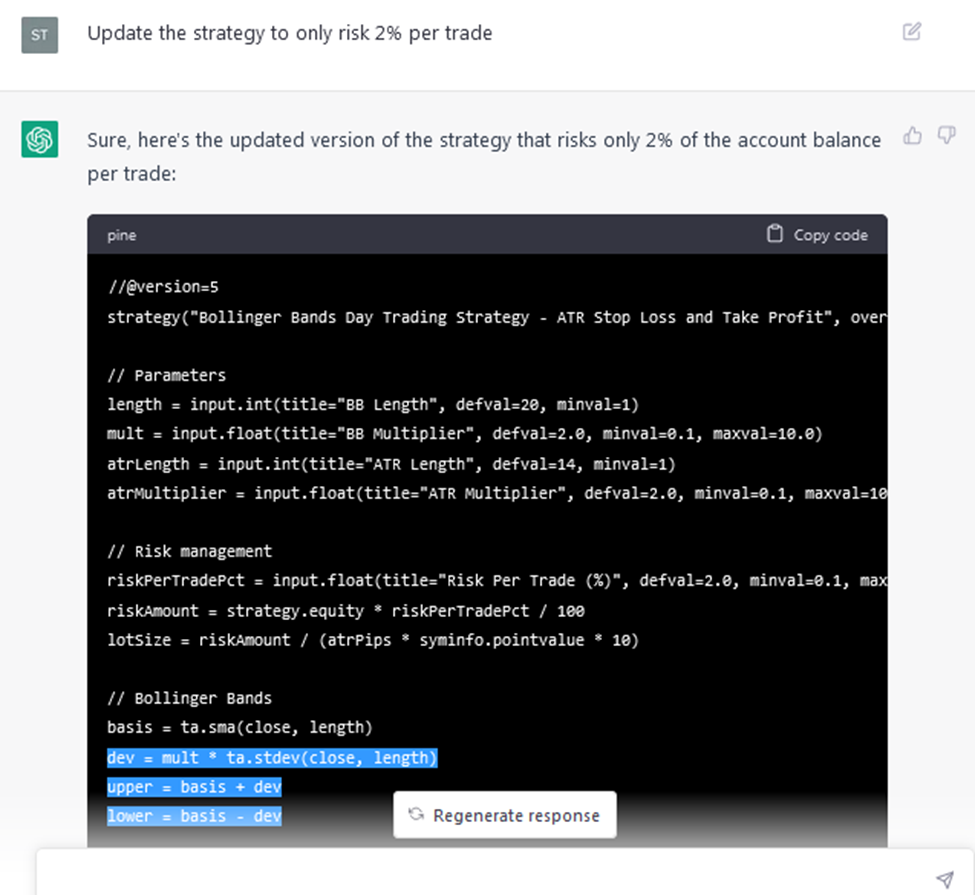

A commonly recommended risk per trade is 2% of your trading account balance, as this helps to limit potential losses and preserve capital over time. By keeping your risk consistent and avoiding emotional decision-making, you can stay disciplined and focused.

We used this chatGPT prompt:

“Update the strategy to only risk 2% per trade.”

This concludes the risk management part.

Now, here comes the tricky part, we want to test the chatGPT trading strategy to make sure it’s error-free and what is more importantly, to make sure that the algo strategy is profitable.

See below:

-

Backtest Chat GPT Trading Strategy

Once the day trading strategy is completed, the algorithm can be copied and pasted on TradingView to conduct backtesting and identify areas of improvement. For the backtesting process, we used the historical price data from the beginning of the year.

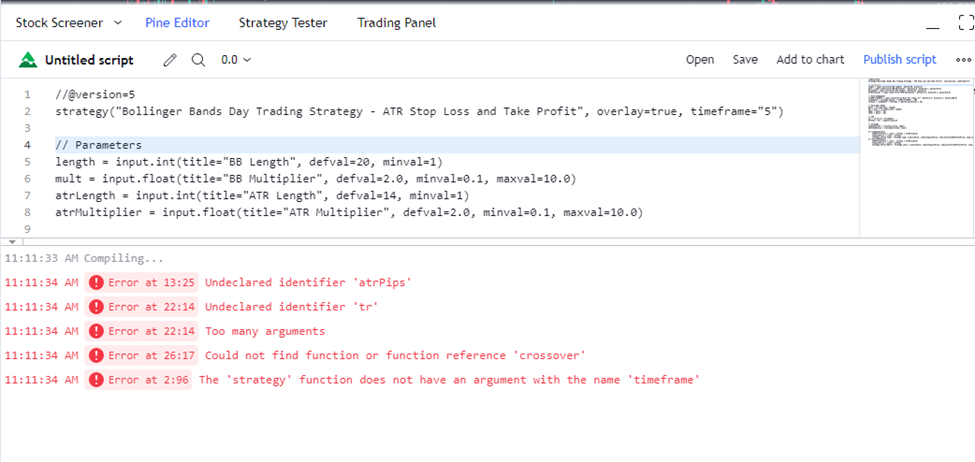

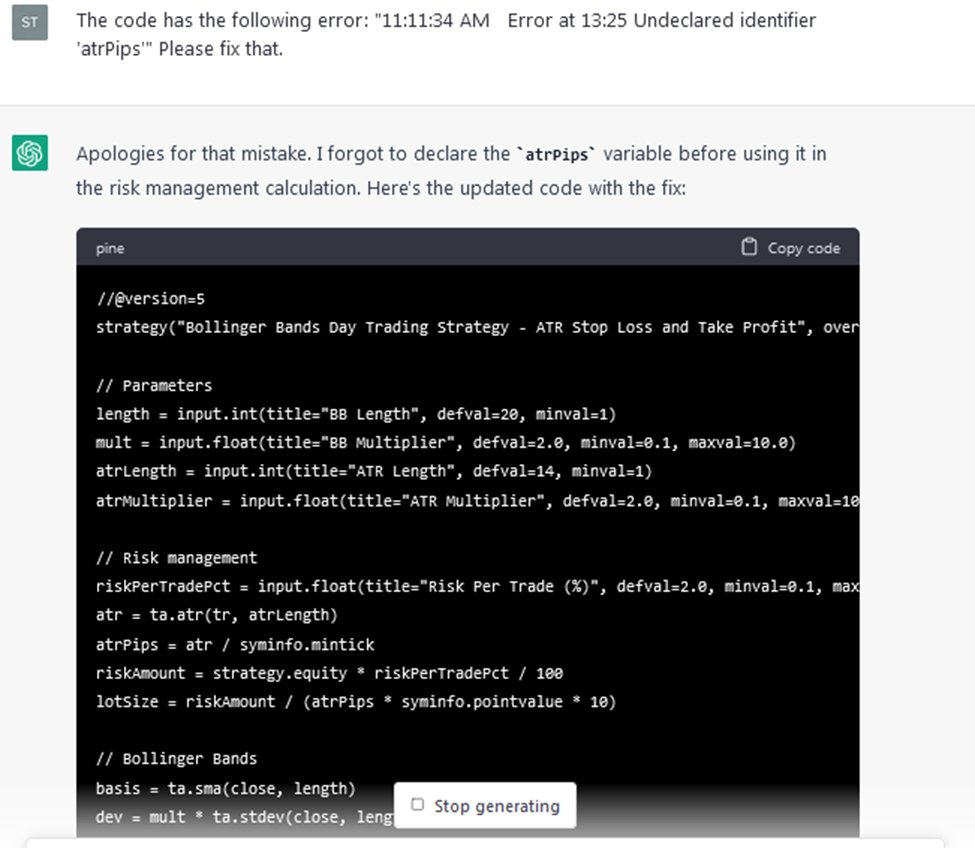

The algorithm generated by chatGPT comes with some technical errors (see figure below), which the AI platform could solve.

To make the algo trading strategy error-free, traders need to feed the exact error to the AI platform and ask to fix them.

The primary objective of utilizing a backtest is to offer traders a distinct perspective on the profitability of their trading strategy. However, the trading strategy made with chatGPT showed negative historical results.

This raises the question:

How do you optimize a trading strategy?

See below:

-

Optimization

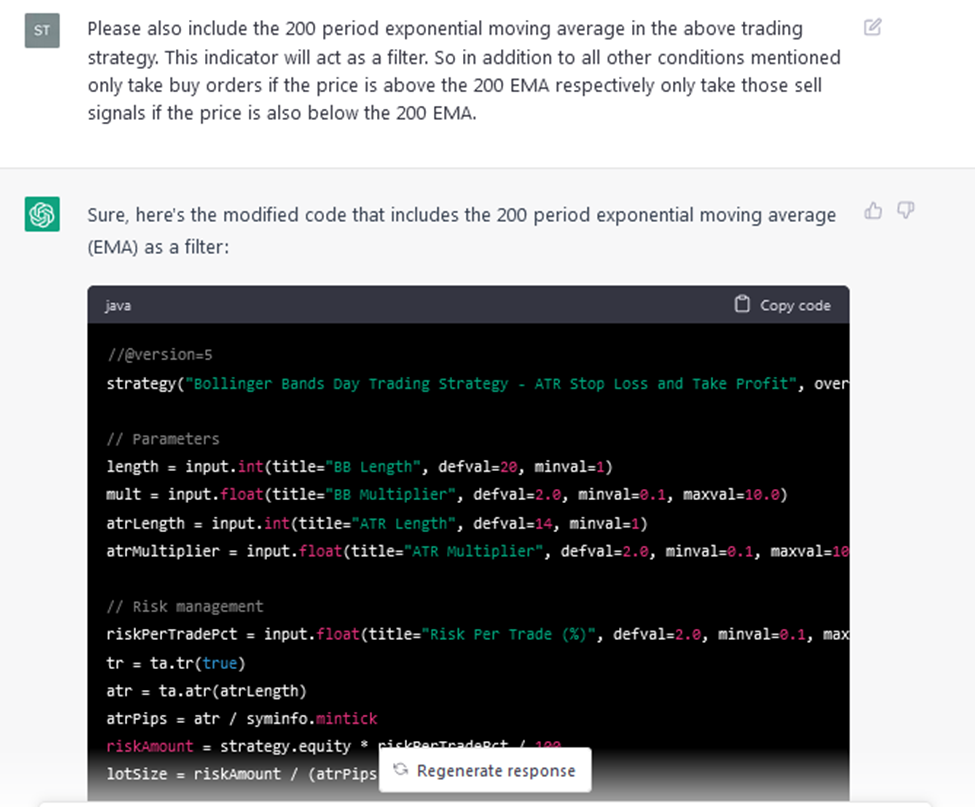

To improve the quality of the trading strategy we can add another technical indicator, to filter out more of the bad trade signals.

To do that, we used the following chatGPT prompt:

“Please also include the 200-period exponential moving average in the above trading strategy. This indicator will act as a filter. So in addition to all other conditions mentioned, only take buy orders if the price is above the 200 EMA respectively and only take those sell signals if the price is also below the 200 EMA.”

ChatGPT programmed everything we asked for:

-

Try The Trading Strategy On Different Markets

The day trading strategy developed by chatGPT can be tested for different currency pairs and on different markets to point out if certain instruments perform better than other instruments with this trading strategy.

For example, when tested on Bitcoin price, this chatGPT day trading strategy was more profitable. Since the beginning of the year, the strategy generated by chat GPT generated EUR 86,569.30 in profits.

-

Go Live

Once you have backtested a trading strategy and have found it to be profitable, the next step is to move on to a live account. It's also a good idea to continue testing the strategy on a demo account to gain more confidence in its performance.

Final Thoughts

After 39 trades, our chatGPT trading strategy had an average win rate of 39% and an impressive profit of about EUR 86,569.30. This day-trading strategy shows the power of developing a system with the help of AI.

If you're looking to take advantage of the power of AI in your forex trading, it's essential to partner with the best forex brokers available. To help you get started, we recommend checking out our Best Forex Brokers in 2023 comparison page.

JapanUS

JapanUS