Analysis & Forecast

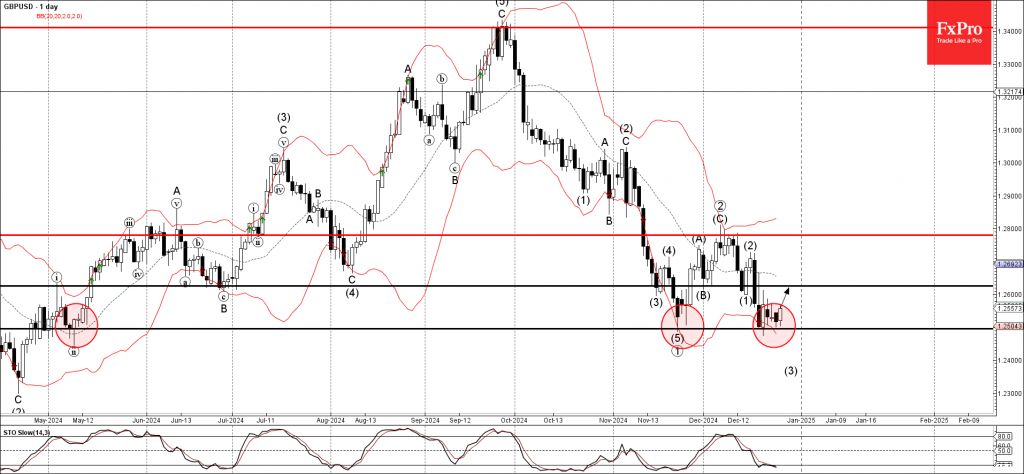

– GBPUSD reversed from support level 1.2495– Likely to rise to resistance level 1.2625GBPUSD currency pair recently reversed up from the pivotal support level 1.2495 (which has been steadily reversing the pair from May) intersecting with ...

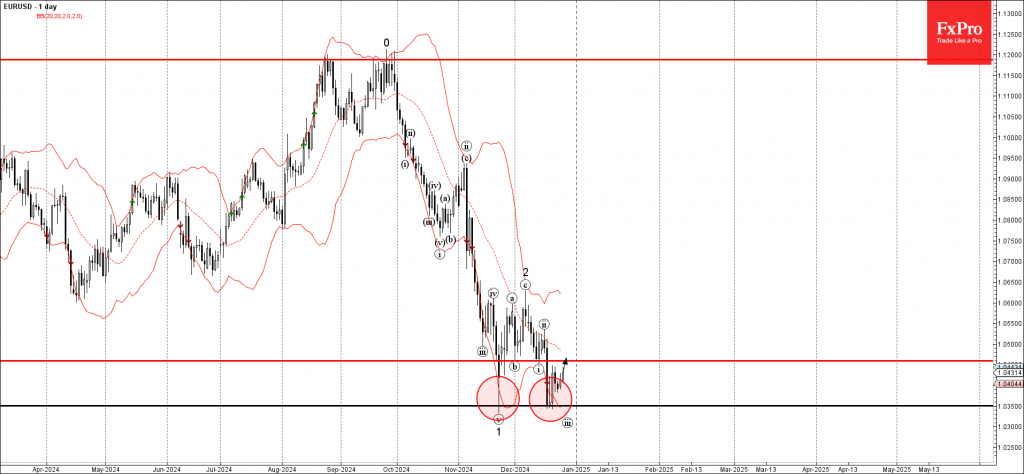

– EURUSD reversed from powerful support level 1.0350– Likely to rise to resistance level 1.0460EURUSD currency pair recently reversed up with the daily Morning Star from the powerful support level 1.0350 (which stopped the previous sharp ...

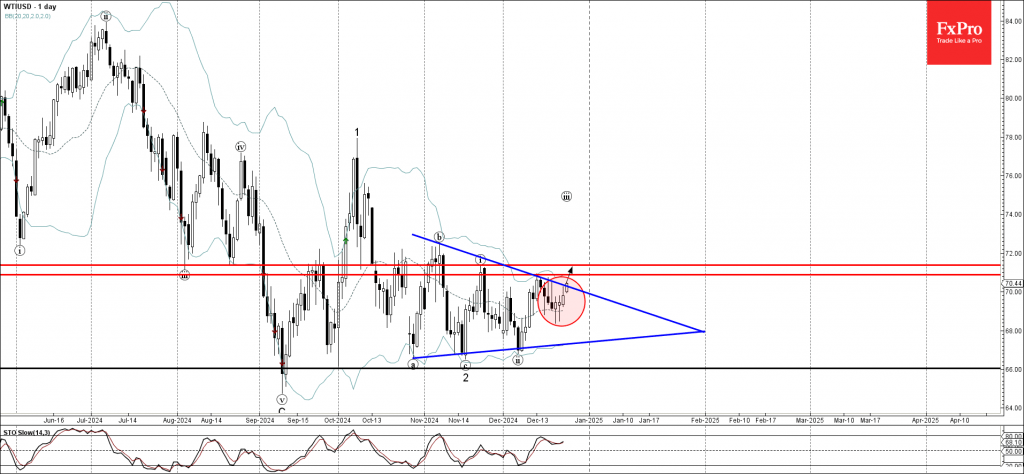

– WTI broke daily Triangle– Likely to rise to resistance level 70.90WTI crude oil today broke the resistance trendline of the daily Triangle from the end of October, inside which the price has been moving from October.The breakout of this...

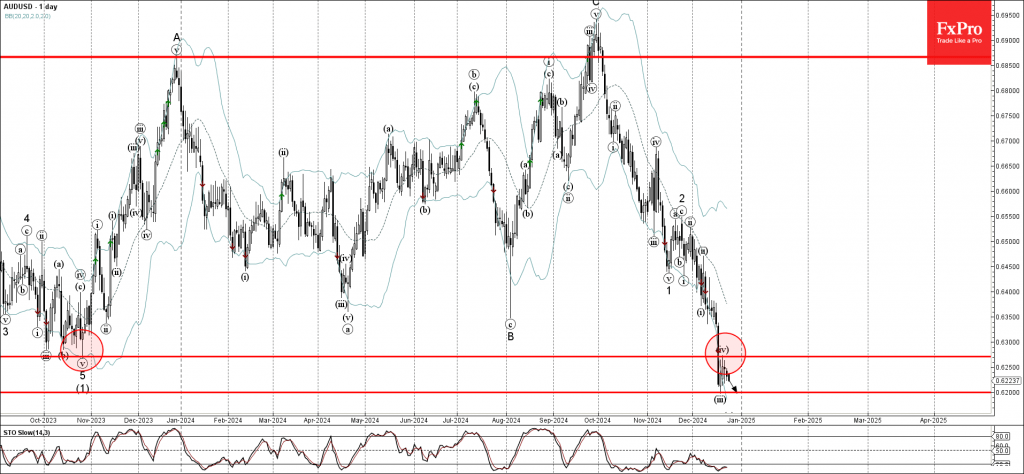

– AUDUSD reversed from resistance level 0.6270– Likely to fall to support level 0.6200AUDUSD currency pair recently reversed down from the resistance level 0.6270 (former multi-month support from the start October of 2023, acting as the r...

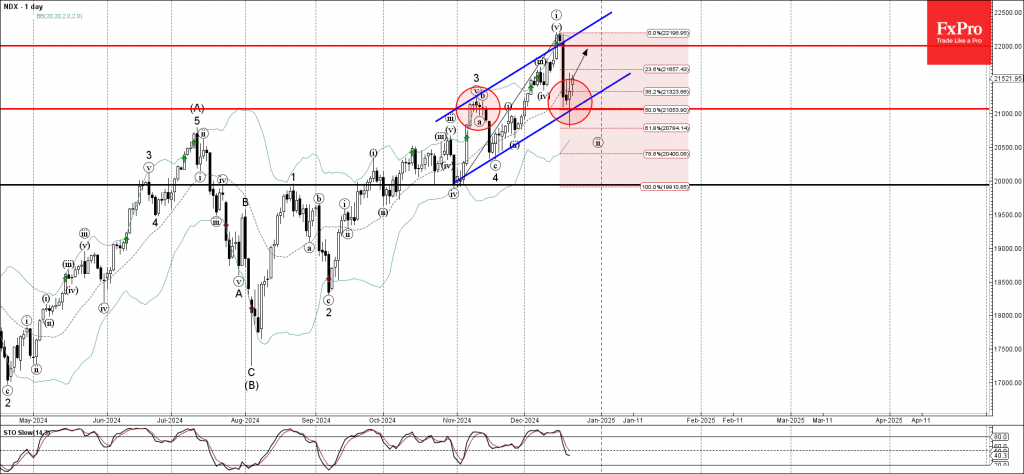

– Nasdaq 100 reversed from strong support level 21000.00– Likely to rise to resistance level 22000.00Nasdaq 100 index recently reversed up from the strong support level 21000.00 (former resistance from the start of November), intersecting...

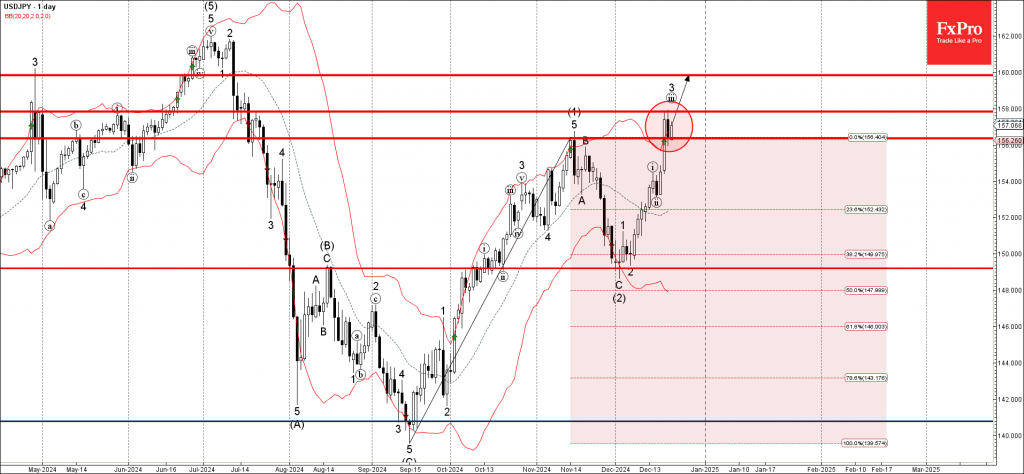

– USDJPY reversed from key support level 156.35– Likely to rise to resistance level 158.00USDJPY currency pair recently reversed up from the key support level 156.35 (former resistance from November, acting as she support after it was bro...

– EURCHF falling inside minor impulse wave 5– Likely to fall to support level 0.9250EURCHF currency pair continues to fall inside the minor impulse wave 5, which started earlier from the pivotal resistance level 0.9430 (standing wel...

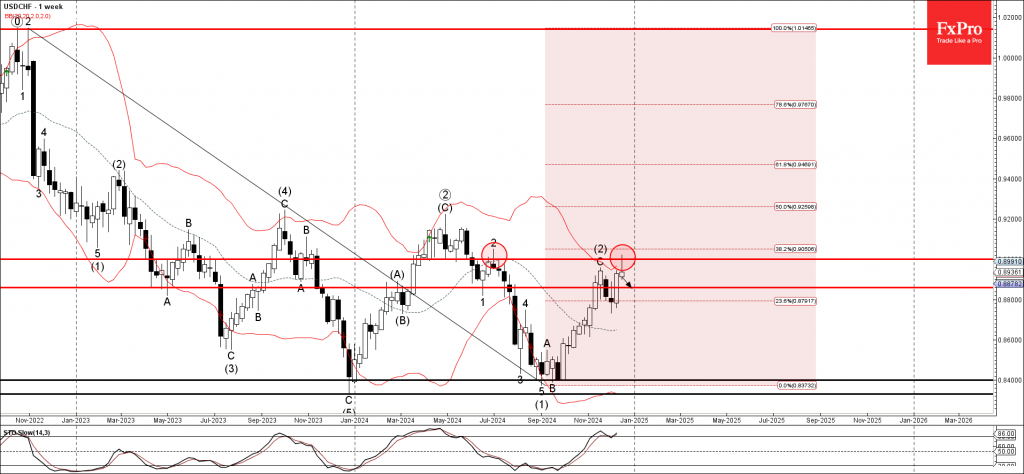

– USDCHF reversed from resistance zone– Likely to fall to support level 0.8860USDCHF currency pair recently reversed down from the strong resistance zone located between the round resistance level 0.90000 (which has been reversing the pai...

– EURGBP reversed from support zone– Likely to rise to resistance level 0.8300EURGBP currency pair recently reversed up from the support zone located between the key support level 0.8225 (which stopped the previous minor impulse wave i) a...

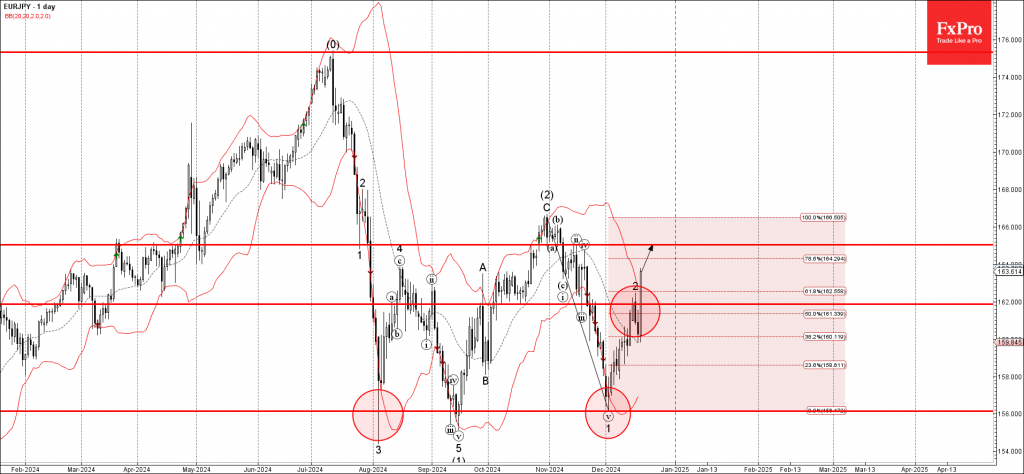

– EURJPY broke resistance zone– Likely to rise to resistance level 165.00EURJPY currency pair recently broke the resistance zone located between the key resistance level 162.00 (which stopped the previous minor wave 2) and the 50% Fibonac...