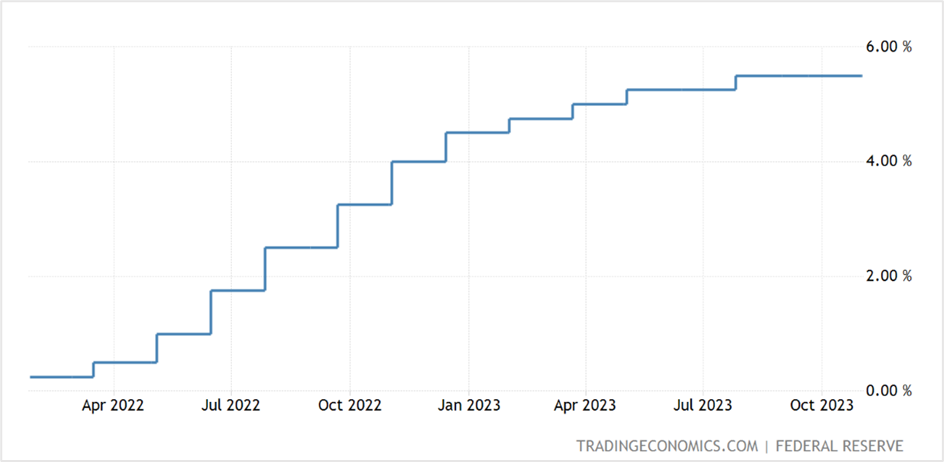

Policymakers leave the door open for another rate hike, but markets skeptical

The Federal Open Market Committee (FOMC) left interest rates unchanged at 5.25%-5.50% at the end of their two-day monetary policy meeting on Wednesday, November 1st, in line with market expectations. The decision to maintain the rates at current levels was unanimous as officials weighed tight financial and credit conditions in the backdrop of a strong economy. The interest rate decision left the benchmark rate at the highest in 22 years after the Federal Reserve launched one of its most aggressive rate hikes in over four decades, starting in March 2022. The Fed last raised interest rates in July this year, the eleventh hike since it began its rate hiking campaign in March 2022 to fight inflation soaring at multi-decade highs.

Fed Funds rate

At the post-meeting press conference, Fed Chair Jerome Powell said that although the US economy expanded swiftly in the third quarter, the massive interest rate hikes since March last year are fueling downward pressure on inflation and economic growth. In addition, Powell forecasts the recent surge in Treasury bond yields, home mortgage rates, and other financing costs to impact the economy as long as they persist, with policymakers closely monitoring their economic impact while considering further rate hikes.

Powell further said as the past interest rate hikes take effect, the economy will cool down, although it would not result in a recession. He, however, emphasized that Fed officials will monitor the payroll and inflation data between now and the December meeting to determine whether to raise interest rates again.

The US economy expanded at an annual pace of 4.9% in the third quarter, led by a surge in consumer spending. In the meantime, the annual inflation rate in the US based on the PCE price index was at 3.4% in September, unchanged since July, while core inflation that excludes the volatile food and energy prices ticked lower to 3.7% from 3.8% the previous month. However, despite inflation cooling from multi-decade highs last year, it remains above the US central bank's 2% target.

Key highlights of the Federal Reserve's monetary policy statement

The Federal Open Market Committee (FOMC) statement released by the US central bank disclosed that economic activity in the US expanded at a robust pace in the third quarter, while inflation remained elevated on the back of solid job gains and a low unemployment rate. But, policymakers believe that job growth has moderated.

The policy statement also showed that Fed officials are optimistic about the resilience of the US banking system, even as they anticipate tighter financial and credit conditions to impact households and businesses. Although they are unsure of the scope of these effects, they predict the tight financial and credit conditions will likely weigh on economic activity, hiring, and inflation.

The Committee reiterated that it aims to achieve maximum employment and inflation of 2% over the longer term but will remain patient and continue monitoring incoming information on the economic outlook. If risks emerge that could hamper its goals, it will appropriately adjust its monetary policy stance. In the meantime, policymakers will continue reducing holdings of Treasury securities, agency mortgage-backed securities, and agency debt based on their earlier commitment.

Economists' review of the Federal Reserve's interest rate decision

Peter Cardillo, the chief market economist at Spartan Capital, believes the FOMC statement is dovish. According to him, the Fed left interest rates unchanged for the second time in a row, and if they do the same in December, they are done raising rates.

Lon Erickson, a portfolio manager at Thornburg Investment Management, thinks Fed officials are trying to thread the eye of a needle in attempting to lower consumer and aggregate demand without causing a recession that will lead to high unemployment.

According to Whitney Watson, the CIO of fixed income and liquidity solutions at Goldman Sachs, interest rates will persist at these levels for a while. He trusts the resilience of the US economy has not rebalanced the labor market nor lowered wage and price pressures. He expects disinflation eventually and says the Fed will keep its policy unchanged going into next year.

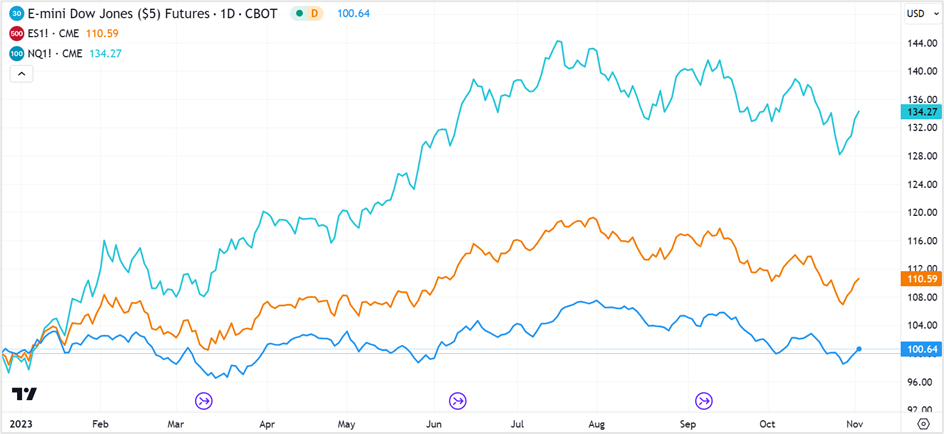

Market reaction to the US interest rate decision

US equities came off the day's highs during Fed Chair Powell's press conference on Wednesday but rebounded toward the session's close to end the third successive day with gains. The dovish tone of the Federal Reserve Chairman at the press meet raised optimism that policymakers might be done raising interest rates this cycle, drove treasury yields lower, and aided the stock market rally.

The Dow Jones Industrial Average closed 0.67% higher at 33274.58, the S&P 500 ended Wednesday's session at 4237.86, up 1.05%, and the Nasdaq 100 jumped 1.77% to settle at six-session highs of 14664.91.

Meanwhile, Fed Funds futures rallied as markets reversed the risk of interest rate hikes to about 20% in December and 25% in January. Markets have also priced in a 70% probability that the July rate hike was the last and expect the Fed to loosen by 85 basis points next year, beginning in June.

Treasurys jumped on Wednesday, with yields across maturities falling double digits after the Federal Reserve sounded dovish on future rate hikes, leading economists to believe that the US central bank is done lifting interest rates. The yield on the rate-sensitive 2-year note slumped 14.4 basis points to 4.952% on Wednesday, its lowest closing since October 10th, while the yield on the benchmark 10-year note tumbled 19.9 basis points to 4.734%, and the 30-year bond yield fell 16.6 basis points to 4.931%.

US treasury yields have been surging over the last few weeks, and Powell said he recognized the impact of high bond yields on the economy, especially the 30-year fixed-rate home mortgage rate, which is nearing 25-year highs of 8%. He believes higher Treasury yields bring about higher borrowing costs for households and businesses and will impact economic activity as long as it persists.

The US dollar rose after the Fed unanimously agreed to leave the benchmark interest rates unchanged on Wednesday. The US currency gained for the second straight day against a basket of six rival currencies as the Federal Reserve acknowledged the unexpected resilience of the US economy in the face of aggressive tightening over one and a half years. The dollar index futures (DXY) rose 0.21% to settle at 106.88 on Wednesday, its highest close since October 3rd. The greenback ended flat against the euro and pound sterling at 1.0569 and 1.2151, respectively, while it slid 0.47% to 150.95 versus the yen.

Technical View

E-mini Dow Jones December futures

The Dow Jones futures rose for the third successive day on Wednesday to close at 33351, up 0.65% for the session. The 30-stock benchmark is in a long-term downtrend, and despite the recent bounceback, it remains in a bearish trend with near-term resistance at 33630. The index has to settle above this level for the gains to extend to 34700. On the downside, the immediate support zone is around 32400-32450, the region from where the index futures rebounded recently.

The trading strategy is to go long on the index futures if it closes above 33630. Place a stop loss at 33550 and exit as the index approaches 34650.

E-mini Dow Jones December futures- Daily chart

Click the link to view the chart- TradingView — Track All Markets

WTI Crudeoil December futures

Crudeoil futures closed at $80.44 a barrel on Wednesday, down 0.72% day-on-day, extending losses for the third successive day to settle at the lowest since August 28th. The pullback comes as tensions in the Middle East eased somewhat, and the Federal Reserve chose a wait-and-watch approach in its monetary policy path.

WTI oil futures closed below key levels at $81.50 for the second straight day on Wednesday, and unless oil prices rebound to close above this resistance in the next couple of sessions, it could slide anywhere between $75.50 to the August lows of $77.60.

Go long on WTI crudeoil futures if it closes above $81.50, with a stop loss at $80.50, and exit as prices approach $86.00. However, if oil prices slide from current levels, initiate fresh long positions at $76.00, with a stop loss at $75.00 for a profit target of $81.00.

WTI December crudeoil futures- Daily chart

Click the link to view the chart- TradingView — Track All Markets

AustraliaUS

AustraliaUS