"Revenge trading" – it's a term that's been around for ages, yet it still catches traders off guard. It's when you trade impulsively, fueled by emotions like anger, frustration, or disappointment, in an attempt to make up for past losses. But this type of behavior can quickly spiral out of control and lead to even more financial losses.

So, what's behind this destructive cycle?

It's often a lack of discipline. Traders, eager to make amends, abandon their trading plan and make hasty decisions.

Have you ever found yourself wanting to "teach the market a lesson" after a losing trade? That's a classic example of revenge trading. It's easy to get caught up in the heat of the moment and let emotions guide your decisions.

But hold on a minute!

The dangers of revenge trading are real and shouldn't be taken lightly. It can sabotage your performance, shake your confidence, and before you know it, you've lost your trading discipline. But fear not, in this article, we'll cover the revenge trading definition, what triggers it, and most importantly, how to stay disciplined in the heat of the moment.

Ready to take control of your emotions and learn how to trade with discipline?

Let's dive into the nitty-gritty of what is revenge trading and how it operates.

What Is Revenge Trading and How Does It Work?

Revenge trading is a term used to describe a trader's emotional response to a losing trade. Simply put, it's when a trader makes a trade to get even, rather than following a trading plan.

It often happens when a trader has suffered a loss and feels the urge to immediately jump back in and recoup those losses. They're not taking a step back and evaluating the market, but rather acting on raw emotions like anger, frustration, or even greed.

But how does revenge trading work?

Well, the trader will usually take on larger positions or make multiple trades than they normally would. This leads to overtrading and even bigger losses, creating a vicious cycle of seeking revenge where your account slowly bleeds trade after trade.

It's like the old saying goes, "When you're in a hole, stop digging". But with revenge trading, the trader keeps digging, trying to recover from a drawdown, forcing trades without a solid trading plan in place.

The bottom line is that revenge trading is a dangerous game, and it's one that rarely has a happy ending. But now that we understand what it is, let's talk about how to avoid it.

What Risks Does Revenge Trading Pose?

Revenge trading may seem like a quick fix for losses, but it’s a bad habit that poses serious risks to traders. Let's take a closer look:

-

Capital depletion: Jumping into a trade to make up for losses can lead to wiping out your entire trading account.

-

Confidence crisis: A string of losses can shake your confidence in your trading skills and your trading system, causing long-term emotional turmoil.

-

Throwing caution to the wind: When emotions run high, traders tend to ignore best practices such as entry and exit strategies and risk management.

So, it's never wise to let emotions drive your trades.

The result?

A confidence crisis, depleted capital, and a tough road to recovery.

What Causes Revenge Trading?

Despite knowing the negative consequences, why do traders resort to revenge trading?

The answer lies in our humanity. Our emotions and instincts guide us, especially when it comes to decision-making. Anger, fear, shame, and greed are natural reactions to market losses. Even though these feelings may be irrational, they still play a role in our trading decisions.

-

Anger and Greed

When a trader experiences a big loss, anger, and greed can take over and drive their next decision. The trader may blindly enter a trade without proper analysis, hoping to recoup their losses. Unfortunately, this bad habit leads to an even bigger drawdown.

-

Fear and Shame

Some traders find it easier to place a revenge trade right away than to acknowledge and accept a significant loss. The drive to move on from a setback could also stem from a fear to avoid recognizing defeat or the potential shame that might accompany it.

Saving face can be a strong incentive for traders who have a “never lose a trade” mindset to participate in revenge trading.

The urge to make up for a loss is real, but it's important to resist the temptation to trade based on emotions and instead stick to a strategy and manage risk.

How Do I Get Rid Of Revenge Trading?

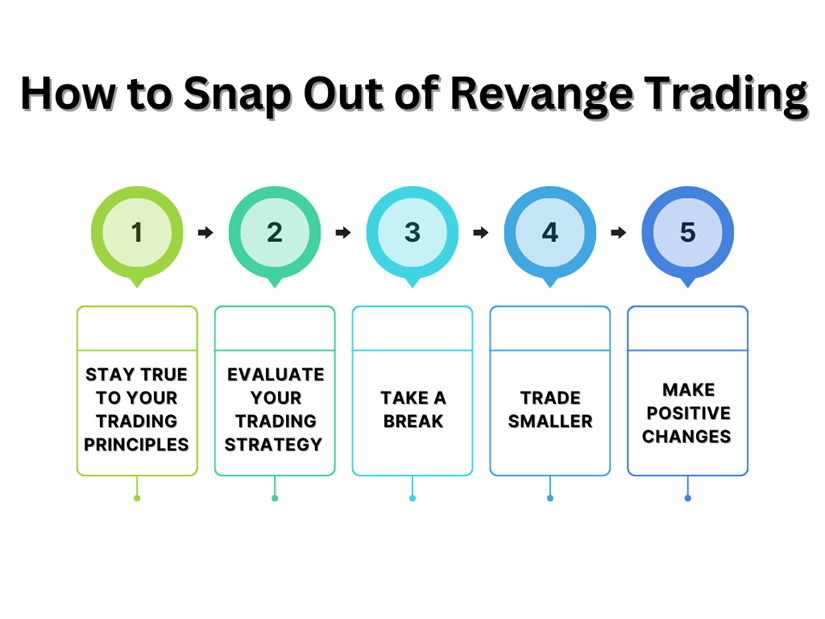

Revenge trading can be a challenging habit to break, but with determination and effort, it is possible. Here are five effective methods to help traders overcome the urge to trade in reaction to prior losses.

-

Stay True to Your Trading Principles

First, it is essential to remember your roots as a trader. If you have spent years developing your strategy and skills, don't let a single loss lead you astray from your proven methods. Refocus by reviewing your trading plan or re-checking the price charts to stay on track.

-

Evaluate your Trading Strategy

While you're at it, assess your trading strategy too. Is it still appropriate for current market conditions?

Do you need to make adjustments to the way you trade?

Also, review your entry and exit strategies.

Did you stick to your plan?

Did you have a valid signal or did you force a trade?

-

Take a break

After a loss, especially a significant one, it can be challenging to remain objective and control emotions. Take a day or two off, or even just a short break. Turning off your computer, and taking some time to clear your mind can provide much-needed perspective.

This time away can be used to reassess your plan so that when you come back, you're ready to make changes.

-

Trade Smaller

To reduce the impact of losses on your emotions, consider trading smaller position sizes. This way, you won't feel as emotionally invested in each trade and the impact of a loss will be less intense.

Resist the temptation to increase your lot size to make up for a loss. This is a classic example of revenge trading and can quickly spiral out of control.

-

Make changes

Lastly, it's time to make the necessary adjustments to your trading strategy or procedures. And don't forget about developing a post-loss ritual, like the one suggested by Steve Ward in his book "High-Performance Trading."

Acknowledge the loss, learn from it, throw it away, mentally rehearse what you wish had happened, and affirm to yourself, "That's how I'll do it next time."

How To Stay Disciplined In Trading?

Maintaining discipline is crucial for successful trading. While developing discipline is an ongoing process, there are several strategies you can implement to maintain it. But how can you maintain trading discipline in the face of potential losses or revenge trading forex?

Here are some helpful tips to help you develop and maintain trading discipline:

-

Stick to a consistent trading schedule. This will establish good habits and help you take good trades.

-

Don't deviate from proven trading strategies. It's okay to try new things, but don't risk large losses on untested chart patterns.

-

Learn how to identify market trends.

-

Accept that losses are inevitable.

-

Know when to cut your losses. Don't try to force trades when you know they're not working.

In addition to these tips, consider asking yourself the following questions to help you stay disciplined:

-

What is my risk tolerance, and how can I ensure I'm not taking on too much risk?

-

Am I sticking to my trading plan, or am I making emotional decisions based on short-term fluctuations in the market?

-

How can I improve my knowledge of the markets and refine my trading strategies?

-

Am I taking the time to analyze my past trades and learn from my mistakes?

Remember, successful trading isn't just about picking the right investments—it's about maintaining the discipline and patience necessary to stick to your trading plan.

Final Thoughts

Trading is already tough enough, why make it tougher by getting caught up in emotions? Revenge trading is a surefire way to put your capital in jeopardy. The key is to maintain a cool, level-headed approach.

Think about it, algorithms are great at trading because they don't get emotionally attached. Sure, you don't have to be a robot, but you do need to be aware of when emotions start to cloud your judgment.

Here's the good news: after a tough day in the markets, you get a fresh start tomorrow. Don't let your emotions ruin your chance to get back in the game and make up for past losses.

And remember, the best traders don't let a bad trade get the best of them. They step back, regroup, and come back stronger. That's the name of the game. So, stay disciplined and avoid revenge trading.

Discover the top Forex brokers – click here for a comprehensive comparison.

FranceUS

FranceUS