Analysis & Forecast

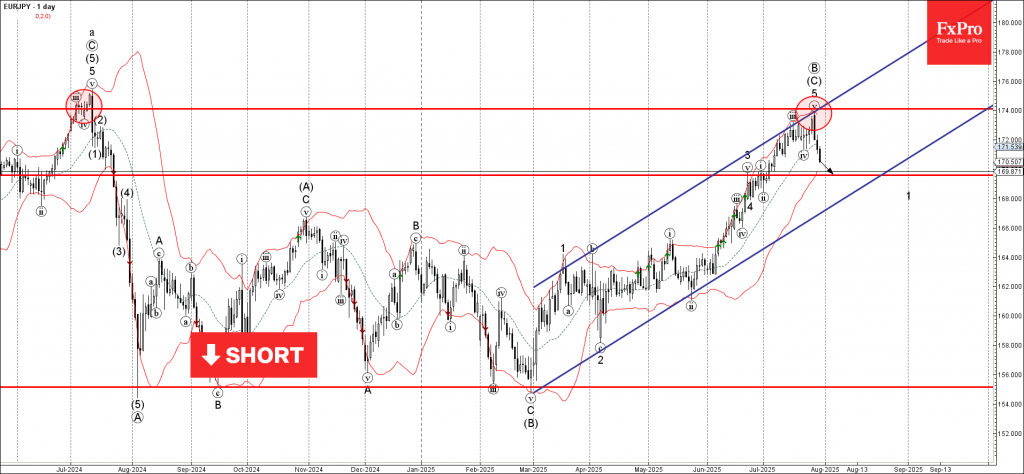

EURJPY: ⬇️ Sell– EURJPY reversed from the resistance zone– Likely fall to support level 169.60EURJPY currency pair recently reversed down from the resistance zone between the resistance level 174.00, the upper daily Bollinger Band and...

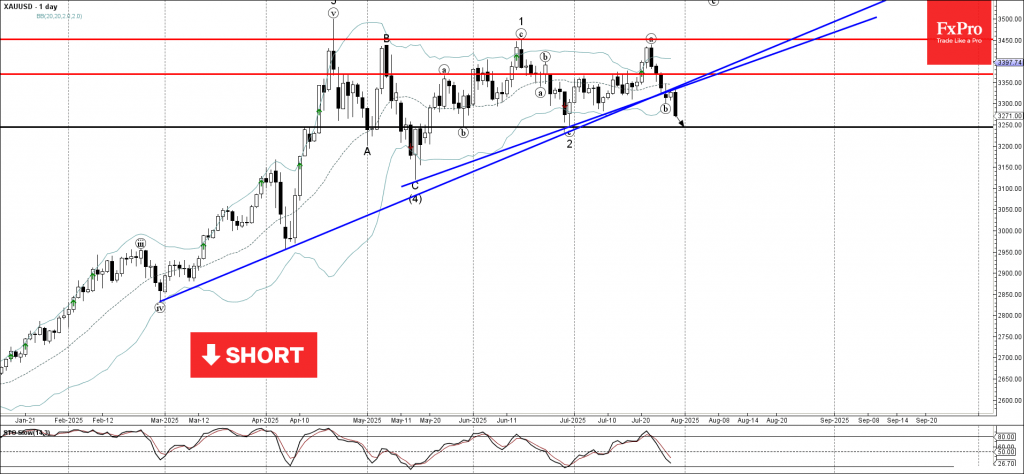

Gold: ⬇️ Sell– Gold falling inside wave b– Likely fall to support level 3250.00Gold is under bearish pressure after the price broke the two upward-sloping support trendlines from May and February.The breakout of these support trendlin...

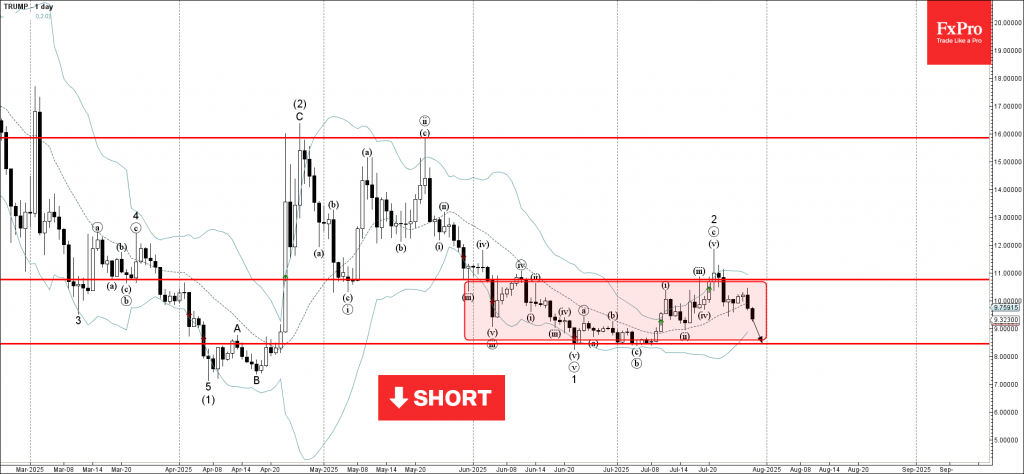

Trump: ⬇️ Sell– Trump falling inside the sideways price range– Likely fall to support level 8.4380Trump cryptocurrency continues to fall inside the sideways price range, which has contained price action from the start of June.The...

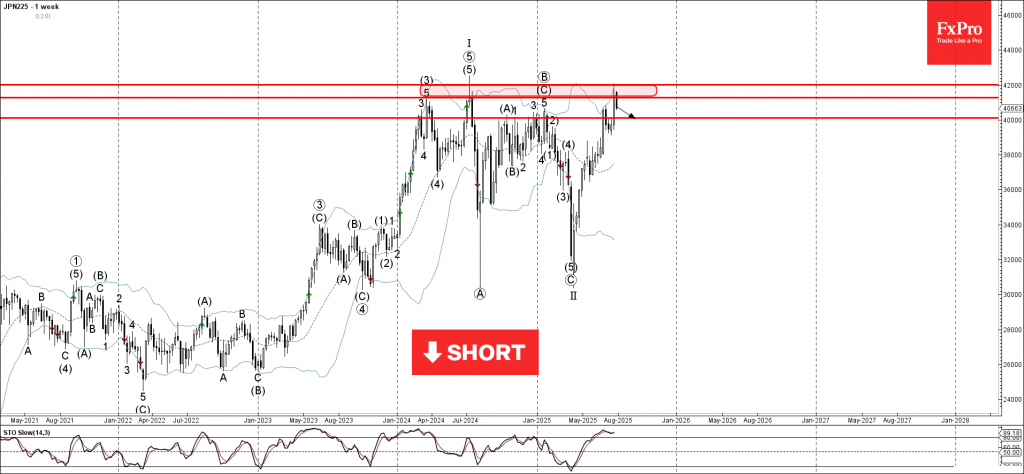

Nikkei 225: ⬇️ Sell– Nikkei 225 reversed from the resistance zone– Likely fall to support level 40000.00Nikkei 225 index recently reversed from the resistance zone between the resistance levels 42000.00 (which started the sharp s...

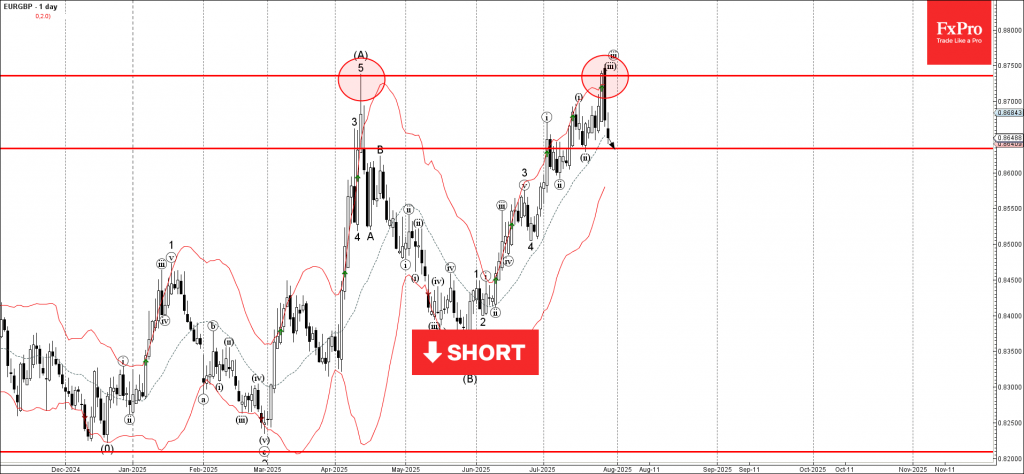

EURGBP: ⬇️ Sell– EURGBP reversed from the resistance zone– Likely fall to support level 0.8635EURGBP currency pair recently reversed down from the resistance zone between the multi-month resistance level 0.8735 (which stopped sha...

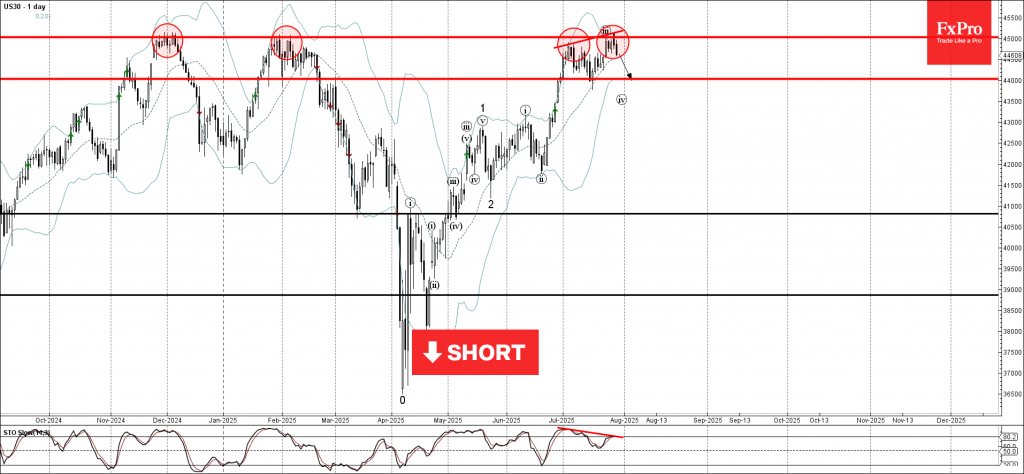

Dow Jones: ⬇️ Sell– Dow Jones reversed from the long-term resistance level 45000.00– Likely fall to support level 44000.00Dow Jones index recently reversed down from the resistance zone between the long-term resistance level 4500...

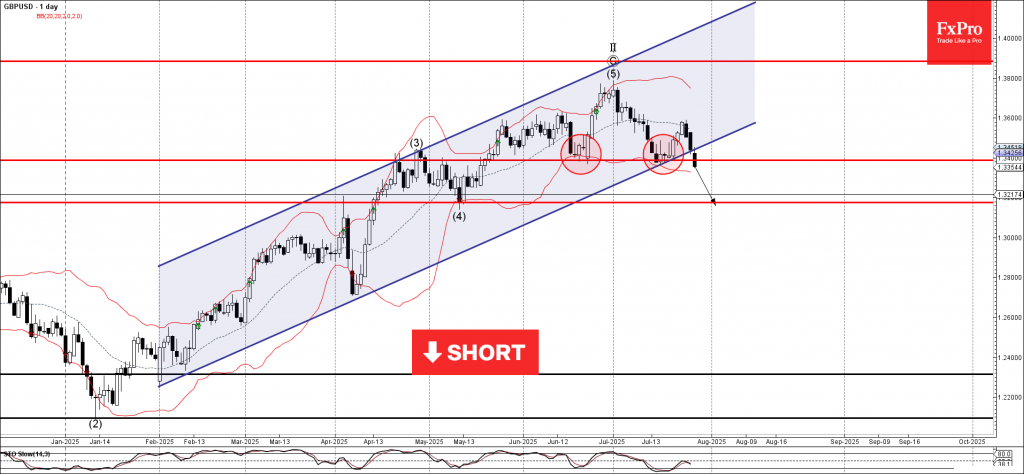

GBPUSD: ⬇️ Sell– GBPUSD broke support zone– Likely fall to support level 1.3175GBPUSD currency pair recently broke the support zone between the support level 1.3385 (which has been reversing the price from June) and the support trendl...

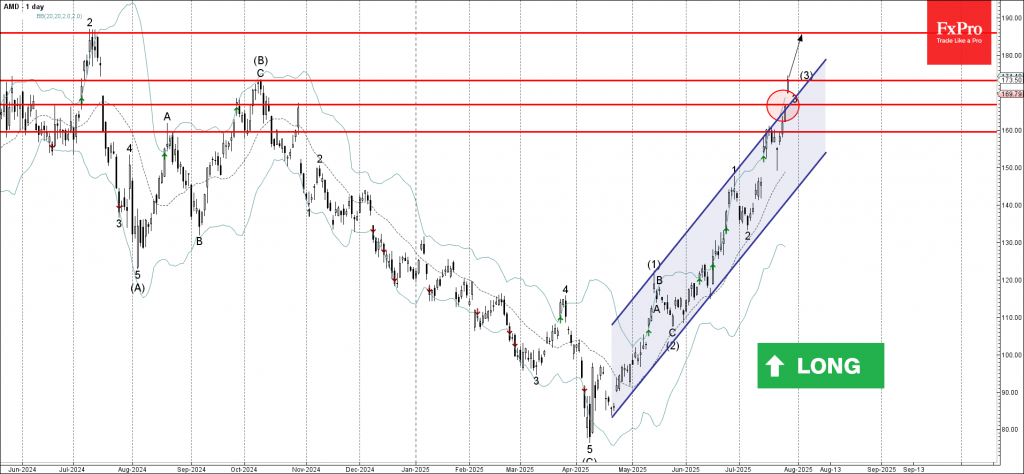

AMD: ⬆️ Buy– AMD broke resistance zone– Likely to rise to resistance level 185.95AMD recently broke the resistance zone between the resistance level 166.75 and the upper resistance trendline of the daily up channel from April.The brea...

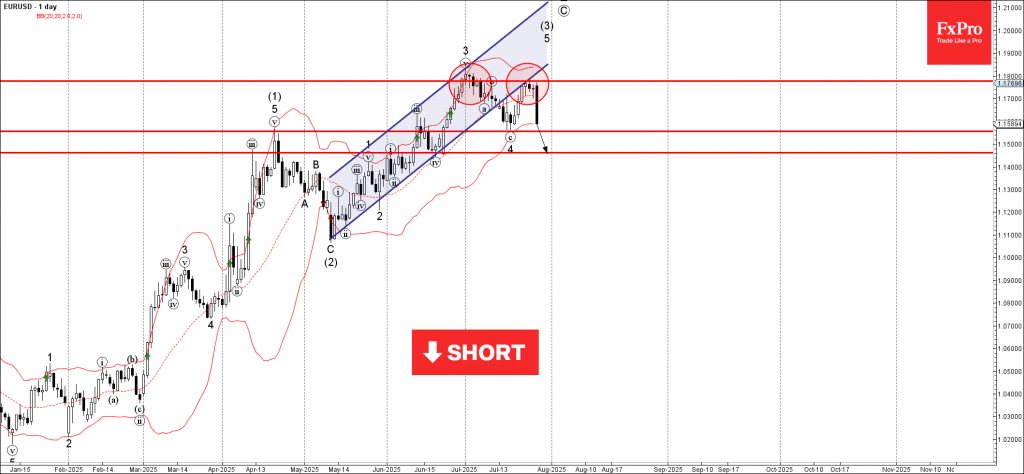

EURUSD: ⬇️ Sell– EURUSD reversed from the resistance level 1.1775– Likely to fall to support levels 1.1555 and 1.1460EURUSD recently reversed down from the resistance zone between the resistance level 1.1775 (which stopped the previou...

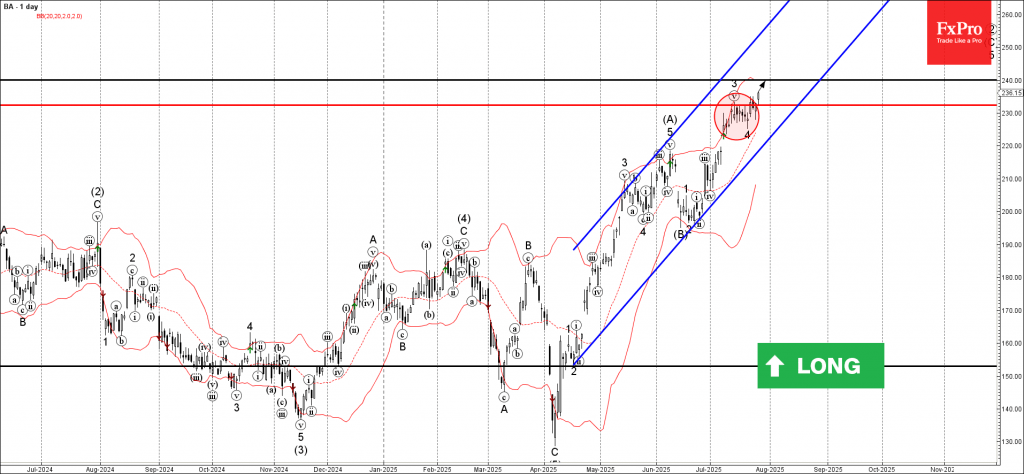

Boeing: ⬆️ Buy– Boeing broke the resistance level 232.50– Likely to rise to resistance level 240.00Boeing recently broke the resistance level 232.50 (which stopped the previous minor impulse wave 3 in the middle of July, as can be see...