Service sector output slips 0.1% while manufacturing output ticks 0.1% higher

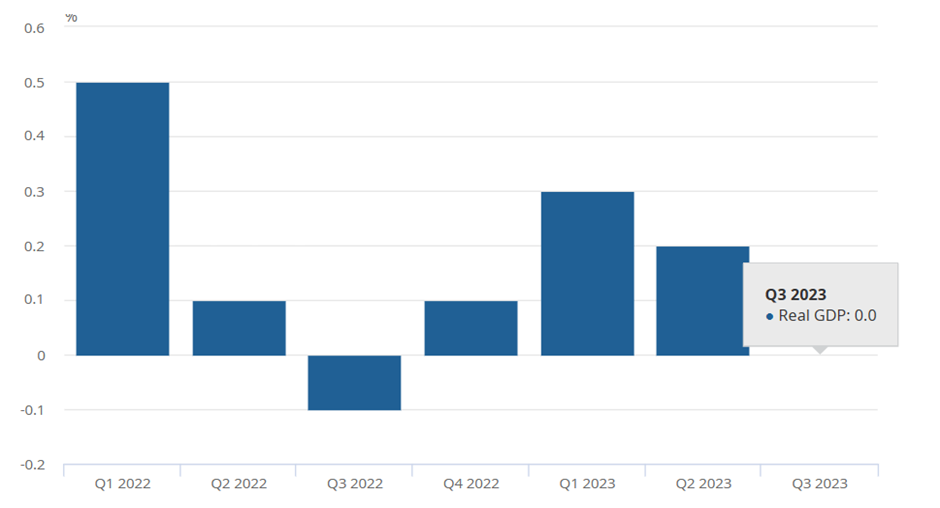

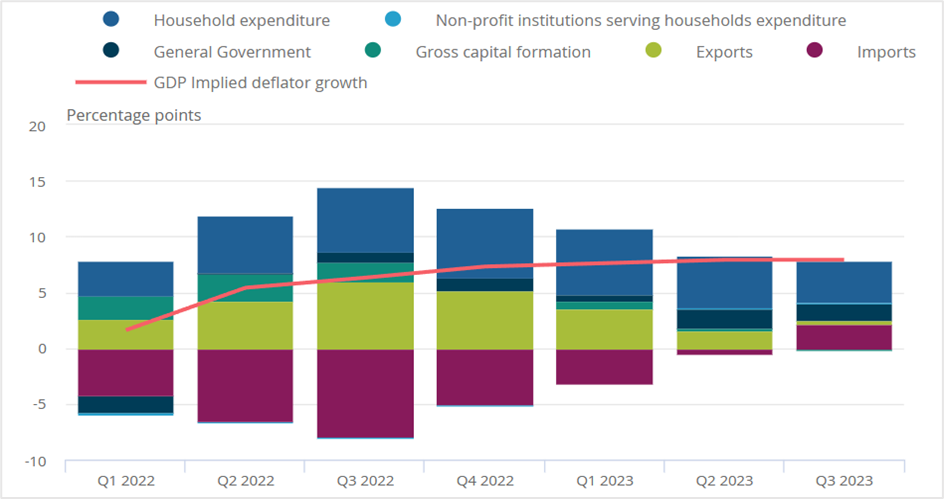

Economic growth in the UK stagnated in the September 2023 quarter after expanding at a 0.2% pace in the three months to June 2023, partly from the sharp increase in the interest rates. Year-on-year, the economy grew 0.6% in the third quarter, unchanged from the previous quarter. The data announced by the Office for National Statistics showed the UK economy registered its weakest performance in the last four quarters but beat economists' expectations of a 0.1% contraction. Meanwhile, the implied GDP deflator, a measure of inflation in the economy, rose 7.9%, mainly reflecting a drop in the implied price of imports, the ONS said.

Source: Office for National Statistics

Speaking on Friday, the UK Chancellor of the Exchequer, Jeremy Hunt, said high inflation is the biggest threat to economic growth and the best way forward for the economy was to bring prices under control. He also said the Autumn Statement will focus on investments to help people return to work, reform public services, and ensure a healthy UK economy.

Key highlights of the UK GDP growth numbers

UK gross domestic product (GDP) was flat in the third quarter, while nominal GDP grew 1.4% in Q3 from 2.5% in the previous quarter. The flat Q3 GDP comes from a 0.1% drop in the services sector output, following zero growth in the second quarter. 8 out of the 14 subsectors in the services industry reported a drop, while 6 increased. Overall, consumer-facing services weakened by 0.7% in the third quarter from growth in Q2, 2023. The largest contributions to the fall were a 0.4% decline in real estate activities and a 1.2% drop in the transportation and storage subsector. On the other hand, the biggest positive growth influencer was from the professional, scientific, and technical activities subsector, which expanded by 0.6%.

Manufacturing output increased by 0.1% in the third quarter, following a 1.9% growth in the previous quarter. 7 of the 13 subsectors expanded, with the most significant contribution from the manufacturers of transport equipment, who reported positive growth for the fourth straight quarter. Meanwhile, construction output increased 0.1% in Q3 from 0.3% in the second quarter, primarily driven by a 0.7% growth in repair and maintenance, which partially offset a 0.3% drop in new work.

On the expenditure side, real household expenditure fell 0.4% in Q3 after increasing 0.5% in the second quarter. The most significant contributors to the decline were lower spending on miscellaneous goods and services, transport, net tourism, and food and non-alcoholic drinks. Likewise, real government consumption expenditure declined 0.5% in the third quarter from a 2.5% surge in the second quarter amid a slowdown in spending on health and education.

Gross fixed capital formation (GFCF) fell by 2.0%, following a 0.8% increase in the previous quarter, mainly from a 4.2% slump in business investment during the quarter, with declines seen in investment, transport equipment, other machinery and equipment, and dwellings.

Lastly, the UK's trade deficit for goods and services was 0.7% of nominal gross domestic product (GDP) in the third quarter, a good improvement from the 1.5% deficit in quarter 2. Export volumes rose by 0.5% in the recent quarter after sliding 0.9% in Q2. The volume increase was from a 2.8% rise in services exports, which offset a 2.0% drop in goods exports.

Source: Office for National Statistics

Economists and market experts' views of the UK Q3 GDP report

Professor Costas Milas from the Management School at the University of Liverpool said the UK economy has run out of steam as real money growth, which turned negative in mid-2022, has shrunk rapidly. He expects the UK to fall into a recession in early 2024, pushing Bank of England policymakers to cut interest rates earlier than expected.

According to Lindsay James, the investment strategist at Quilter Investors, Friday's GDP figures have confirmed a slowdown. Leading indicators have already signaled a softening economy over the past few months, with consumer spending and business activity showing cracks, leading to slowing labor demand. With the Bank of England stating that the impact of higher interest rates is yet to be seen on the economy, she expects economic growth in the UK to face growing headwinds going into 2024.

Henry Cook, a senior economist at MUFG, said that although the UK avoided a recession, growth has remained muted for the past six quarters. His base case is for UK GDP growth to remain flat or weak, with at least one contraction in 2024. He forecasts annual GDP growth of 0.5% in 2024.

Market reaction to the UK GDP report

The UK stock market fell on Friday, with the benchmark FTSE 100 down 1.35% at 7355.10 at 9.45 AM ET. The index looks to end with weekly losses, the third in four weeks, amid concerns that UK economic growth will likely be subdued over the next few quarters and could even head into a recession.

BAE Systems was the top performer on Friday, up 1.4%, while Diageo Plc tumbled 14% after the alcohol/beverage maker warned that sales in Latin America and the Caribbean could plunge by 20% year-on-year. The region accounts for 11% of its revenues.

FTSE 100- Daily chart

In the currency markets, the pound sterling fell against most of its counterparts on Friday as high interest rates curbed consumer spending and flattened economic growth in the third quarter. The pound was also under pressure as several economists anticipated the UK economy to slide into a recession next year, even as some predicted the Bank of England would lower interest rates much earlier than expected.

At 10.20 AM ET, the UK currency was at 1.2208 against the US dollar, down 0.12% on the day, while it fell 0.22% to 1.1430 versus the euro, extending the decline for the fifth successive day against both currencies and was almost flat at 184.88 against the Japanese yen.

Technical View

GBPEUR

The pound sterling settled at 1.1455 versus the euro on Thursday, down 0.13% for the day. The pair held near crucial support at 1.1440 at 10.35 AM ET on Friday, a close below which could see further declines in the UK currency toward the channel support at 1.1350. On the upside, the resistance zone is at 1.1490-1.1530. In the near term, the pair will likely oscillate in the 1.1350-1.1530 range, with a breakout leading to a 180-200 point move in either direction. For now, trade the range.

Go long on the sterling if the pair closes above 1.1440, with a stop loss at 1.1410 for a profit target of 1.1500. Long positions can also be initiated at 1.1350, with a stop loss at 1.1300, and exit as the pair approaches 1.1490-1.1500.

On the contrary, if the pair extends gains from current levels, short the sterling at 1.1530 with a stop at 1.1570 for a profit target of 1.1450.

GBPEUR- Daily chart

Click the link to view the chart- TradingView — Track All Markets

Diageo (DGE)

Diageo Plc (DGE) reversed a three successive winning streak to close at £28.50 on Friday, down 12.17% for the day. However, shares of the company recovered somewhat toward the close of the session after plunging as low as £27.19 earlier in the day. The UK-based alcoholic beverage company, which owns Johnie Walker and Tanqueray gin, registered the worst one-day slump in three years after it lowered its sales outlook for the first fiscal amid weak performance in Latin America and the Caribbean.

On charts, Diageo opened below the long-term bearish support at £30.10, and although the stock fell as low as £27.19, it rebounded to close slightly above the crucial 0.618 Fibonacci level at £28.48. If the stock closes above this level for the subsequent 2-3 trading sessions, we could see the gains extending toward £30.30. However, if the stock opens below the Fibonacci level on Monday, prices could retreat toward £26.90 before recovering.

If the stock opens with gains, buy at £28.50, with a stop and reverse at £28.20 for a profit target of £30.00. If the sell stop is triggered, hold on to the short positions, with a fresh stop loss at £28.80 for a profit target of £27.00

Diageo- Daily chart

Click the link to view the chart- TradingView — Track All Markets