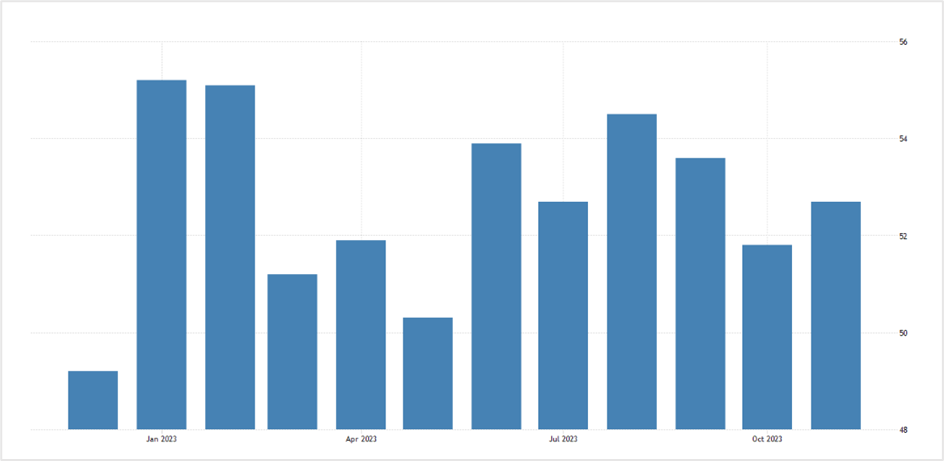

Non-manufacturing PMI climbs from 5-month lows as business activity gains momentum

The US services sector expanded to 52.7% in November from a 5-month low of 51.8% the previous month amid heightened business activity, the Institute for Supply Management (ISM) reported on Tuesday. The November Purchasing Managers Index figures showed that the services sector continued its robust growth story for the eleventh successive month and 41 months out of 42, with the only contraction coming in December 2022. A poll of economists by The Wall Street Journal predicted the services PMI to increase to 52.4%.

Also, a separate reading from S&P Global showed that the Purchasing Managers Index in the services sector rose to 50.8 in November from 50.6 the month earlier, in line with the November flash report.

ISM Services PMI

SOURCE: TRADINGECONOMICS.COM

According to the Institute for Supply Management Services Business Survey Committee Chair Anthony Nieves, the uptick in the services sector index in November was primarily from the rise in business activity and moderate employment growth. However, respondents were concerned about inflation, interest rates, and geopolitical events, while employers faced challenges from rising labor costs and labor constraints.

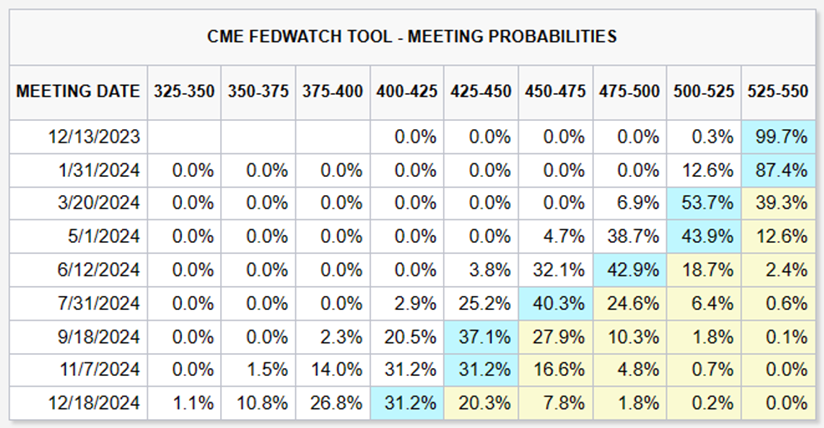

Many economists believe the better-than-expected US services PMI in November might push the economy toward a soft landing. In addition, markets are raising bets that the Fed's tightening cycle has ended, and the US central bank might start cutting interest rates from March 2024.

The latest reading from the CME's FedWatch Tool showed traders anticipating a 56.7% chance that the Fed will cut interest rates in March. The Federal Reserve holds its last monetary policy meeting for 2023 next week, with markets pricing in a no-policy change.

SOURCE: CME FedWatch Tool – CME Group

Meanwhile, in other economic data on Tuesday, the US Bureau for Labor Statistics announced the outcome of October's job openings and labor turnover survey. The report showed job openings in the US fell to 8.7 million in October from a revised 9.4 million the month earlier, reinforcing the view that the aggressive Fed tightening is cooling the labor market. Also, the ratio of job openings to the number of unemployed people dropped to 1.3, the lowest since mid-2021, from nearly 2 in 2022.

Key highlights of the Purchasing Managers Index report

The increase in the US services PMI in November was led by the business activity index, which climbed by one percentage point to 55.1% from 54.1 in October. Meanwhile, the inventories index jumped 5.9 percentage points to 55.4%, the inventories sentiment index surged 7.8 percentage points to 62.2%, and the supplier deliveries index rose by 2.1 percentage points to 49.6%, registering the second successive monthly contraction. Also, the new orders index was at 55.5%, unchanged from the previous month.

On the other hand, the prices index slipped 0.3 percentage points to 58.3%, and the backlog of orders index contracted 1.8 percentage points to 49.1%.

To summarize, fifteen industries in the services sector reported growth, while three industries declined.

Economists' review of the services PMI data

Kathy Bostjancic, the chief economist at Nationwide, thinks the economy is slowing down and expects a mild recession next year. She also thinks traders pricing in rate cuts in March is a little bit premature.

Kurt Rankin, the senior economist at PNC Financial Services, said that the employment growth in the US has cooled over the last year, but despite this, it remains solid. He believes the industry's need to hire more people will cause interest rates to stay higher for longer.

Market reaction to the Purchasing Managers Index report

The US stock markets swung between gains and losses to end mixed on Tuesday. The Dow Jones Industrial Average slid 0.22% to close at 36,124.56, the S&P 500 was a tad lower at 4,567.18, while the Nasdaq 100 reversed some of the previous session's losses to settle 0.24% higher at 15,877.71.

The three major US stock benchmarks are down this week after a solid rally saw markets notch up five consecutive weekly gains. While the broader trend remains bullish, some analysts believe equities have run up too quickly and are in overbought territory.

John Stoltzfus, the chief investment strategist and the managing director at Oppenheimer Asset Management, thinks that while the equities rally from the October lows is constructive, the gains have been hastily realized. He believes the five-week rally has pushed equities into overbought territory and estimates some gains will likely be offloaded early next year.

The US dollar index (DXY) rose for the second consecutive day on Tuesday to close at nearly three-week highs of 104.05, up 0.33% for the session. The trade-weighted currency index has recently been bolstered by a series of positive economic data from the US and amid a broader strength in the greenback. While Tuesday's economic indicators were mixed, with the services PMI rising for the eleventh straight month in November, the JOLTS report signaled a cooling labor market in October.

The US currency also gained ahead of November's ADP and employment reports on Wednesday and Friday, respectively, and next week's CPI data.

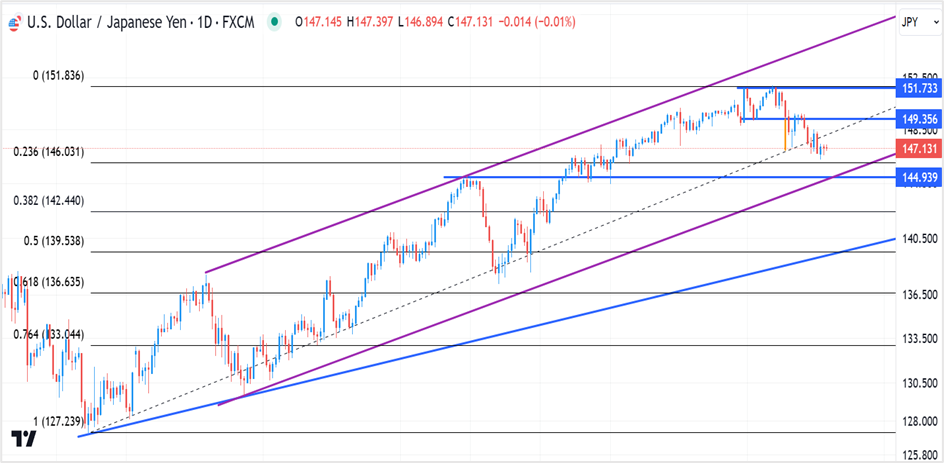

Among the major pairs, the EURUSD fell 0.37% to 1.0796, GBPUSD slid 0.33% to 1.2590, and the USDJPY ended flat at 147.14.

Click the link to view the chart- TradingView — Track All Markets

US Treasuries surged on Tuesday, and long-term yields fell, signaling market concerns of a possible economic slowdown. The yield on the rate-sensitive 2-year TNote slid 5.6 basis points to 4.579%, while the yield on the 10-year note fell 9 basis points to 4.167%, and the 30-year bond yield dropped 11.4 basis points to 4.297%.

Economists believe that there were multiple reasons for Treasury yields falling. The first was investors jumping into Treasurys on expectations of a rate cut early next year. The second factor was investors taking off some risk premium from holding longer-term debt, and the third stemmed from markets partly weighing a US economic slowdown.

Technical View

USDJPY

The USDJPY pair closed at ¥147.14 on Tuesday, unchanged for the day. The US currency has declined against its Japanese counterpart after surging to the highest since July 1990 in October and November, forming a double-top reversal pattern in the process. The target for the breakout of the chart pattern was ¥147.00, which was achieved in the second half of November. However, continued dollar weakness against most currencies drove the yen higher.

The pair will likely find support at ¥144.90-145.00 in the near term, which could be good levels to go long. Place a stop loss at ¥144.40 for a profit target of ¥149.00. However, if the pair closes below ¥144.90 or drops to ¥144.40, short the dollar with a stop at ¥145.50 and exit as prices approach ¥142.50.

USDJPY- Daily chart

Click the link to view the chart- TradingView — Track All Markets

Apple Inc.

Apple closed at $193.42 on Tuesday, registering the highest settlement since August 1st this year and hitting the $3 trillion milestone again for the first time since August. The stock is up 49% year-to-date and is on track to register the best annual performance since 2020.

On charts, Apple shares have been consolidating around the September highs of $190.00 for almost three weeks. However, the tech giant closed with authority above the crucial level, and if the gains hold over the subsequent few sessions, the stock can rally to $230.00 over the medium term. On the downside, a close below $190.00 for a few sessions could push the stock toward $180.00-$182.00, which will likely hold for now.

The strategy is to buy the stock at $190.00 with a stop loss at $186.00 for a profit target of $229.00. If the stops are hit, initiate fresh long positions again at $183.00 with a stop loss at $177.00 and exit as prices approach $229.00.

Apple Inc- Daily chart

Click the link to view the chart- TradingView — Track All Markets

IranUS

IranUS