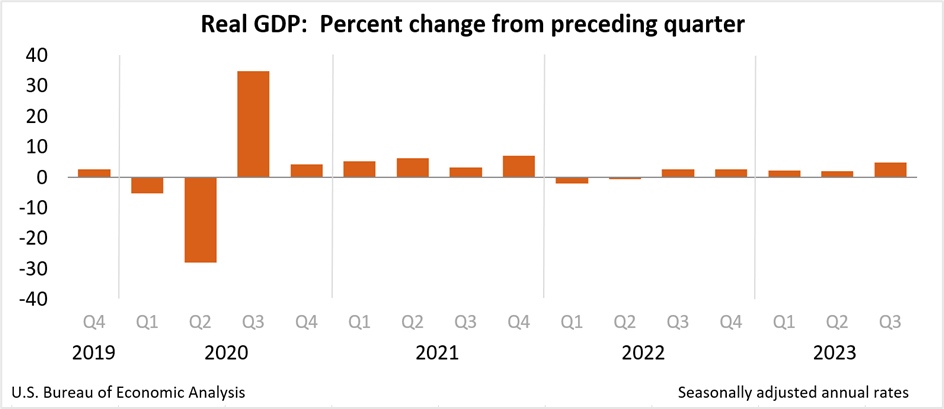

GDP growth jumped to 4.9% in the September quarter from 2.1% in the second quarter

The US real gross domestic product (GDP) expanded at an annual pace of 4.9% in the three months to the end of September 2023 as a shrinking trade deficit and solid consumer spending lifted economic growth, the advance estimate released by the Bureau of Economic Analysis showed on Thursday. The robust third-quarter figures, the highest since 2014, more than doubled the GDP growth rate of the previous two quarters, excluding the pandemic years of 2020-2021. A poll of Wall Street economists forecast economic growth to expand at an annual pace of 4.7% in the third quarter.

According to Reuters, the advance estimate of the third quarter gross domestic product somewhat inflated the country's economic health as the Federal Reserve's aggressive interest rate hikes led to the weakest domestic demand in two years. In addition, residential fixed investment fell for the sixth successive quarter, the most since the 2006 housing market collapse, as soaring mortgage rates drove investors away. However, the news agency said that the rebound in the gross domestic product after two successive quarterly declines provided evidence that the US economy is not in a recession. But, it believes that the risk of a downturn has increased with Fed officials keen on lifting interest rates as they look to tame inflation that has sped to multi-decade highs.

Key highlights of the US third-quarter gross domestic product (GDP) report

According to the Bureau of Economic Analysis, real gross domestic product (GDP) advanced from 2.1% in the April-June quarter amid a surge in consumer spending, residential fixed investment exports, private inventory investment, and federal, state, and local government spending. On the other hand, nonresidential fixed investment registered a decline.

In current dollar terms, third quarter GDP jumped at an annual rate of 8.5%, or $560.5 billion, to $27.62 trillion compared to a 3.8%, or $249.4 billion increase in the second quarter. The price index for gross domestic purchases climbed 3.0% in the third quarter, compared with a 1.4% increase in Q2, 2023.

Meanwhile, the personal consumption expenditures (PCE) price index surged 2.9% in Q3 from a 2.5% rise in the second quarter. Excluding food and energy prices, the PCE price index amplified by 2.4% against a 3.7% increase in the previous quarter.

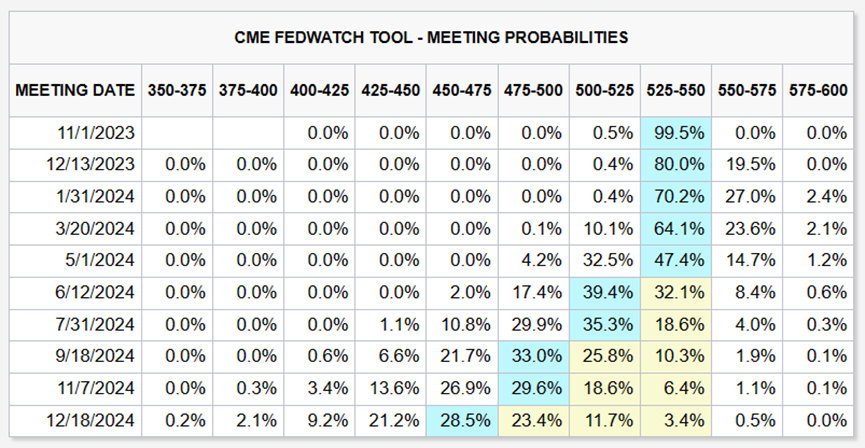

The solid Q3 GDP report has not changed traders' views of the Federal Reserve's monetary policy path for the rest of the year. According to the CME FedWatch Tool, Fed Funds futures traders see a less than 1% chance of policymakers lifting interest rates on November 1st and about a 20% probability of rates going higher in mid-December.

Economists' take on the US Q3 GDP report

Sal Guatieri, a senior economist at BMO Capital Markets in Canada, believes the US economy paints a grim picture below the glossy headline gross domestic product number. He is sure economic growth is slowing down, and once the full effect of the past and future Fed rate hikes kick in, the economy could post a modest downturn in the first half of next year.

Sam Bullard, the senior economist at Wells Fargo, said the US economy posted a strong third-quarter gross domestic product number, which will not be sustained in the future. His fourth-quarter GDP estimate is much below these levels.

Michael Arone from State Street Global Advisors said GDP growth aligned with market expectations as consumers went on a shopping spree in July-September. He believes the GDP report won't change the outlook for monetary policy, so markets are not overreacting to the data.

Market reaction to the third quarter GDP growth numbers

US equities markets trimmed losses in the final hour of trading on Thursday, with the Nasdaq 100 down 1.89% or 272 points to close at 14,109.57, registering the lowest settlement since May 23rd. Earlier in the day, the tech-heavy index slumped more than 2% to 14058.33 before reversing some of the earlier session's declines. While poor quarterly earnings by some tech giants contributed to the drop, semiconductor stocks dropped for the second straight day, extending the previous week's losses after the US government announced export curbs of advanced computer chips to China last week, targeting Nvidia's A800 and H800 chips, designed specifically for the Chinese markets.

Meanwhile, the Dow Jones Industrial Average fell 0.76% to end Thursday's session at 32,784.30, and the S&P 500 closed at 4,137.23, down 1.18% for the day.

In the US Treasury markets, yields fell across maturities as traders in the government debt markets looked beyond the strong third-quarter gross domestic product numbers, focusing instead on the economy losing strength.

Yields on the benchmark 10-year note and the 30-year government bond registered the sharpest one-day drop in two weeks on Thursday, closing at 4.847% and 4.990%, respectively, while the policy-sensitive 2-year note closed at 5.044%, the lowest in two weeks.

In the currencies markets, the US dollar index rose for the fourth straight day on Friday, as the solid third quarter GDP data bolstered the case for the higher-for-longer interest rates in the US, even as traders raised hopes that the Federal Reserve might be tempted to lift interest rates again in December.

The US dollar index futures (DXY) traded at 106.62 in the Asian markets on Friday, slightly above the previous session's close as it headed for the third successive weekly gain against a basket of six currencies. The US currency ticked higher against the euro and was last seen trading at 1.0555, up 0.06%. Earlier Thursday, the European Central Bank (ECB) left the main refinancing operations rate unchanged at 4.5% and the deposit facility rate at an all-time high of 4.0%, pausing after a record streak of 10 successive rate hikes.

Meanwhile, the GBPUSD pair was at 1.2114, down 0.1%, and the USDJPY edged 0.11% higher to 150.20, holding slightly below the 12-month highs of the previous session ahead of next week's monetary policy meetings in the US, UK, and Japan.

Technical View

GBP-USD

The pound sterling is in a long-term downtrend against the US dollar. The pair is holding near crucial support at 1.2125 ahead of the FOMC and the Bank of England's monetary policy decisions next week.

A close below the support could push the sterling toward the October low of 1.2040. On the upside, the near-term resistance is around 1.2240, followed by 1.2310.

Short the pair if it closes below 1.2125, with a stop loss at 1.2155 for a profit target of 1.2050. You can also initiate short positions if the British pound surges toward the resistance at 1.2240, with a stop loss at 1.2280 and a profit target of 1.2150.

GBP-USD- Daily chart

Click the link to view the chart- TradingView — Track All Markets

Broadcom Inc (AVGO)

Broadcom broke out the primary uptrend on Thursday to settle below the long-term bullish support at $835.00. If the semiconductor company fails to reverse the decline and head back into the primary bullish channel over the subsequent few trading sessions, it could plunge to $770.00-$776.00. On the upside, a close above $835.00-840.00 is bullish for Broadcom, with the gains likely to extend to the all-time highs of $925.00.

Short the stock at $835.00 with a stop and reverse at $850.00 for a profit target of $775.00. If the buy stops are hit, continue holding long positions with a fresh stop at $820.00 and exit as prices approach $920.00.

Broadcom Inc- Daily chart

Click the link to view the chart- TradingView — Track All Markets

GermanyUS

GermanyUS