In recent years, bots have gained popularity, and they can be incredibly powerful. Essentially, a bot is a software program or an algorithm that performs automated tasks. One of the primary benefits of bots is their ability to complete tasks quickly and efficiently, far more so than manual trading.

When it comes to trading, every second counts and efficiency can make or break your profits. With ChatGPT's trading bot builder, you can use advanced algorithms and machine learning techniques to execute trades at lightning-fast speeds and maximize your profits.

But it's not just about speed – bots also provide various customization options to tailor your trading strategies to your unique goals and preferences.

Whether you prefer to execute trades based on technical indicators, market trends, or other criteria, ChatGPT's trading bot builder can help you create a bot perfectly suited to your needs.

So, if you're ready to revolutionize your trading game, give ChatGPT's trading bot builder a try today!

What Exactly Is ChatGPT All About?

This open-source framework is perfect for building your customized bots, whether you're an experienced developer or just starting. With ChatGPT, you can create your AI-powered trading bot with just a few simple commands.

And the best part?

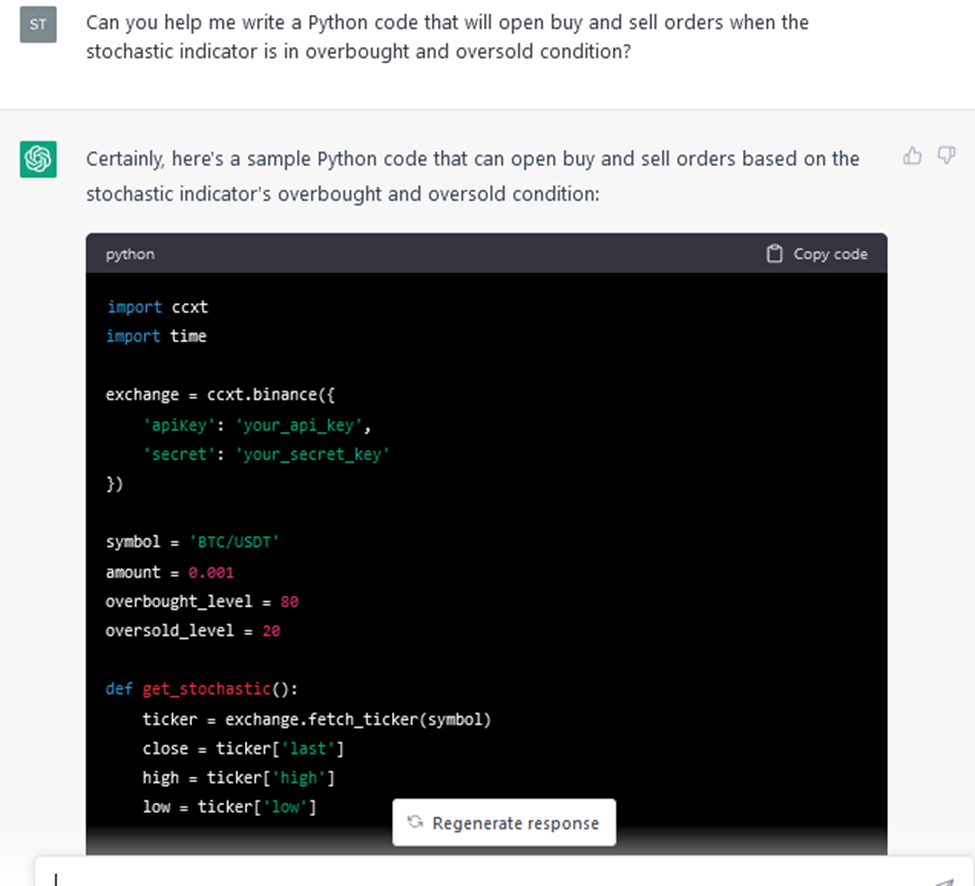

You don't need any programming experience or knowledge of machine learning algorithms to start building a trading bot with chatGPT using simple commands that anyone can understand.

So, how does it work?

The first step in creating a new bot with ChatGPT is deciding which instrument (forex, stocks, cryptocurrencies, etc.) you want to use for trading. From there, you can use ChatGPT's simple interface to create custom rules and strategies for your bot to follow.

You can specify conditions for entering and exiting trades, set stop-loss and take-profit levels, and much more. And thanks to ChatGPT's powerful machine learning algorithms, your bot can even learn and adapt to changing market conditions over time, helping you stay ahead of the curve and maximize your profits.

How To Build An AI Trading Bot

So, what's the first step in creating your bot? Choosing what type of algorithm to use:

-

Trend following,

-

Momentum trading,

-

Mean reversion,

-

Arbitrage trading,

-

Support/resistance trading,

-

RSI indicator-based entry signals?

Whatever strategy you choose, it's important to remember that success largely depends on market conditions at any given moment.

However, creating a successful trading bot is about more than just choosing the right strategy and setting up the right rules. You also need to ensure that your bot is stable and performs well over long periods. That's why we'll also discuss some best practices for creating bots that can run smoothly without any issues affecting performance or stability.

So whether you're a seasoned trader or just starting, ChatGPT is the perfect tool for making your trading bot strategy.

10 prompts To Help You Make A Trading Bot With ChatGPT:

-

Can you help me create a trading bot that works based on support and resistance levels?

-

I need assistance in building a Forex bot that opens buy and sell orders on specific technical indicators. Can you help?

-

What steps can I take to integrate machine learning algorithms into my trading bot strategy?

-

Write a Pine Script code for the TradingView platform that executes trades based on the time of day and volume trends.

-

Can you guide how to build a forex trading bot that employs both fundamental and technical analysis?

-

How can I modify my trading bot's code to ensure that it only enters a position if there is not already an open position, and only allows one open position at a time?

-

Can you explain how to implement a stop loss in my trading bot's code to minimize losses in case of a sudden market downturn?

-

Build me a trading bot around the 200-day moving average that never risks more than 2% per trade.

-

Can you help me write a Python code that will open buy and sell orders when the stochastic indicator is in overbought and oversold condition?

-

How can I modify my trading bot's code to ensure that it only enters a position if there is not already an open position, and only allows one open position at a time?

What Are The Components Of A Trading Bot?

When it comes to building a successful trading bot, there are three core components that you should focus on algorithm architecture, data modeling, and backtesting/forward testing.

Algorithm architecture is the foundation of your bot's decision-making process. It defines how your bot will react to different market scenarios. For instance:

-

If the EURUSD exchange rate falls below 1.20, then buy 1 standard lot at the market price.

-

If the EURUSD exchange rate rises above 1.30, then sell 1 standard lot at the market price.

Data Modeling

Data modeling is the next core component of a trading bot. It involves gathering data from various sources, analyzing that data, and developing models and algorithms that can accurately predict market trends. Some popular models include Bollinger Bands, Moving Averages, and Relative Strength Index (RSI).

Backtesting

The final core component of a trading bot is the backtesting part. This involves testing your trading bot's performance under different market conditions and tweaking its algorithms and strategies based on the results.

Testing and validation can help you optimize your bot's performance and ensure that it operates smoothly over long periods.

Overall, the key to building a successful trading bot is to focus on these three core components. By developing a strong algorithm architecture, accurate data modeling, and rigorous testing and validation strategies, you can create a bot that can make profitable trades on your behalf without requiring constant supervision.

Check out our guide to the best forex brokers in 2023 and find the perfect partner for your trading journey. From fees and platforms to customer support and regulation, we've got you covered.

Making a Profitable Trading Bot With 6 ChatGPT Prompts

Making a profitable trading bot can be as easy as following these chatGPT prompts:

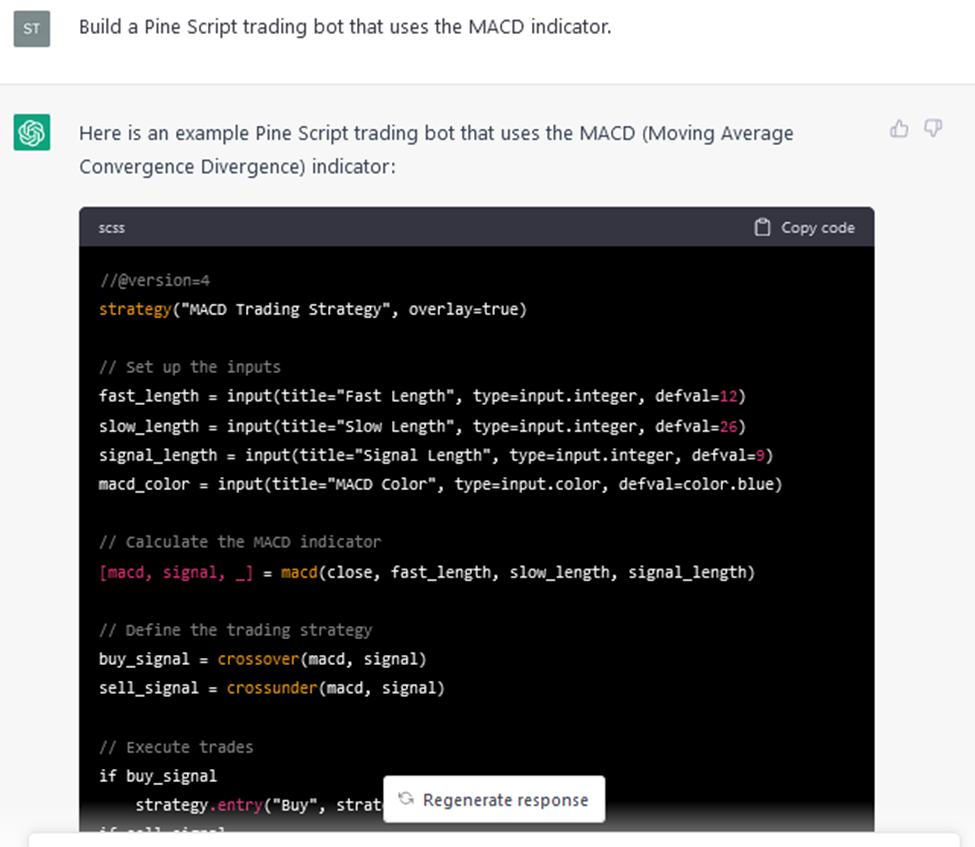

chatGPT Prompt #1: Build a Pine Script trading bot that uses the MACD indicator.

“This Pine Script code defines a trading strategy that buys when the MACD line crosses above the signal line and sells when the MACD line crosses below the signal line. The bot also sets stop-loss and take-profit orders based on 2% and 2% above and below the entry price, respectively. The code displays the MACD indicator on the chart and highlights the buy and sell signals.”

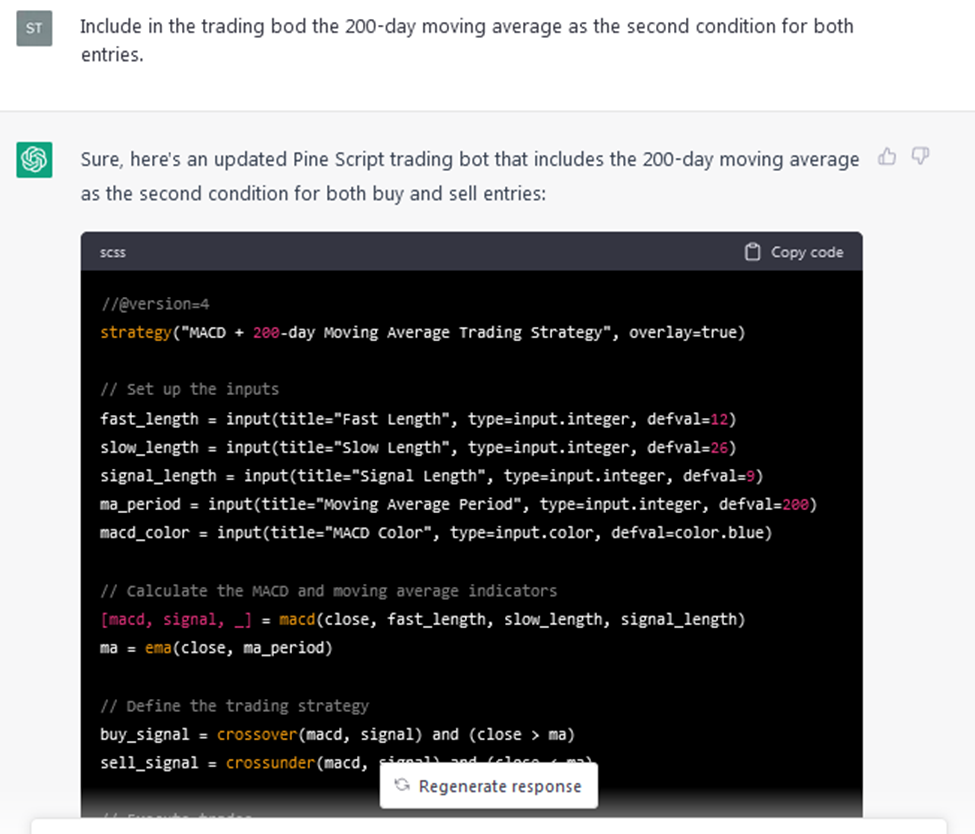

chatGPT Prompt #2: Include in the trading bot the 200-day moving average as the second condition for both entries.

“This Pine Script code defines a trading strategy that buys when the MACD line crosses above the signal line and the price is above the 200-day moving average and sells when the MACD line crosses below the signal line and the price is below the 200-day moving average.”

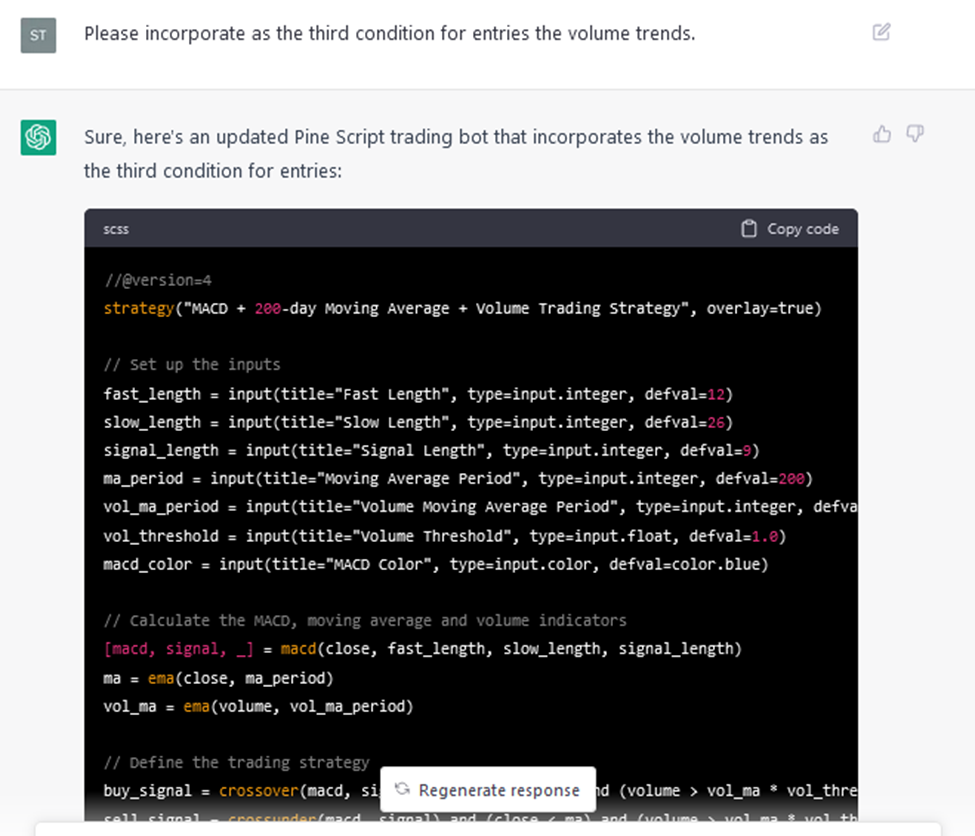

chatGPT Prompt #3: Please incorporate as the third condition for entries the volume trends.

“This Pine Script code defines a trading strategy that buys when the MACD line crosses above the signal line, the price is above the 200-day moving average, and the volume is above the volume moving average multiplied by a threshold value, and sells when the MACD line crosses below the signal line, the price is below the 200-day moving average, and the volume is above the volume moving average multiplied by a threshold value.”

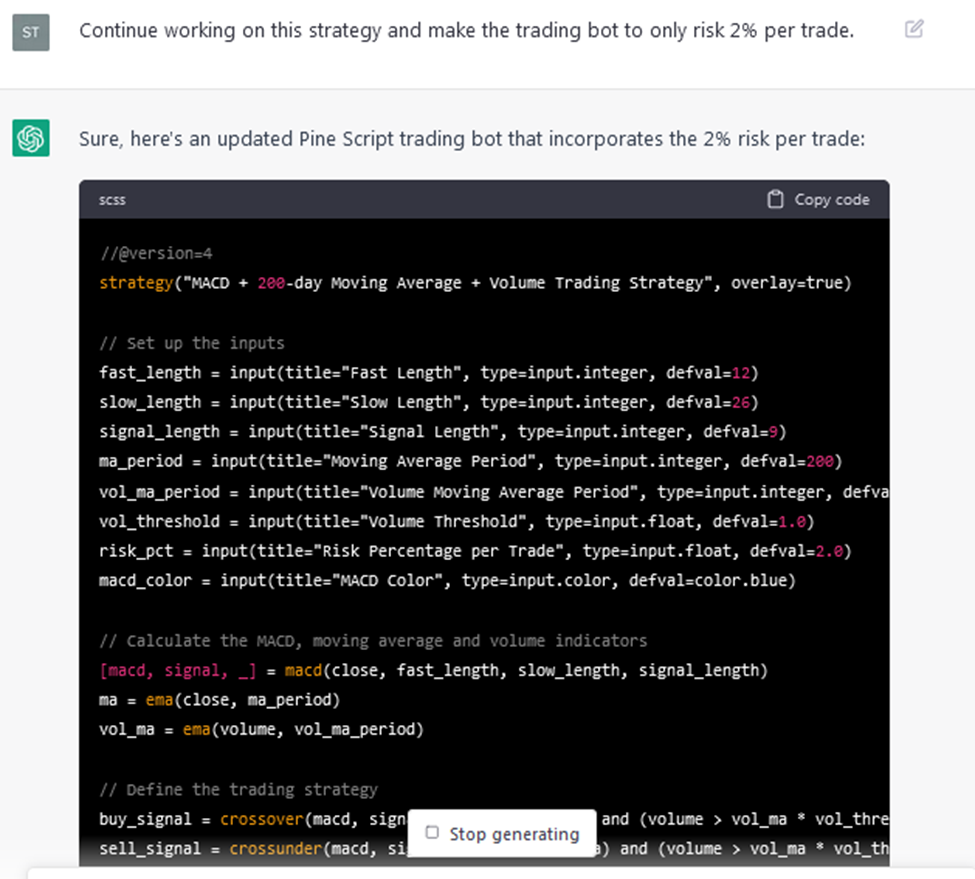

chatGPT Prompt #4: Continue working on this strategy and make the trading bot only risk 2% per trade.

“The bot calculates the position size based on the 2% risk per trade.”

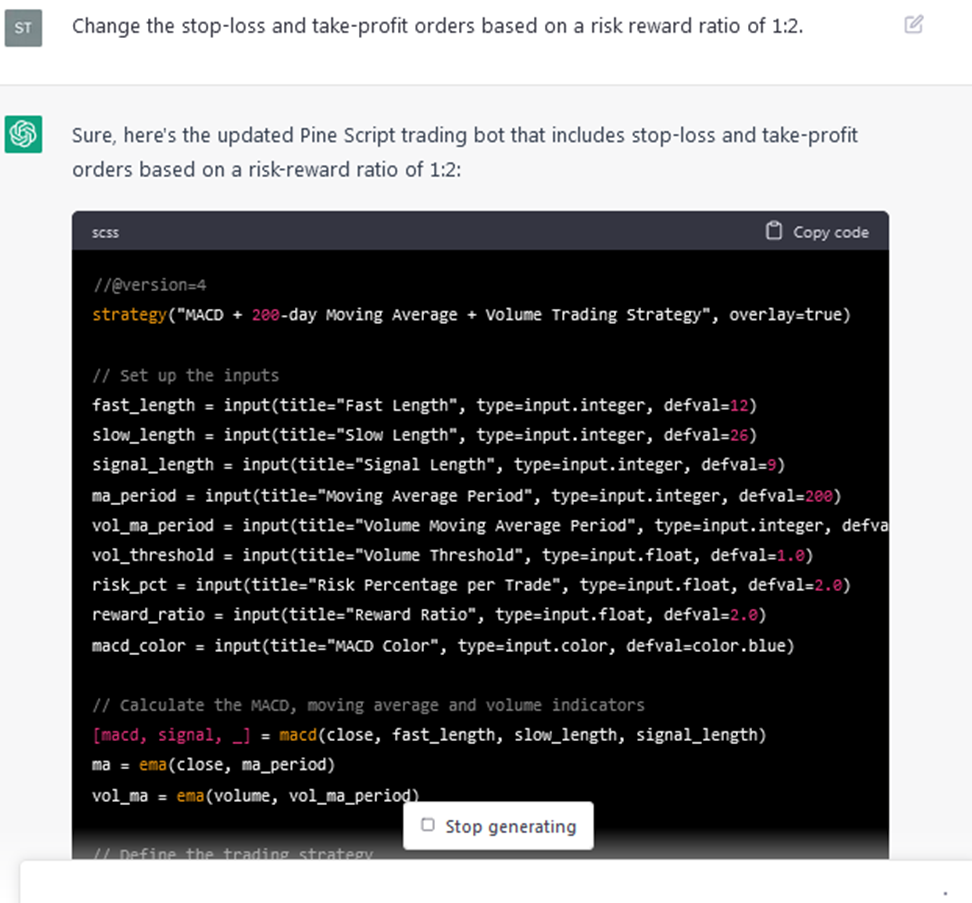

chatGPT Prompt #5: Change the stop-loss and take-profit orders based on a risk-reward ratio of 1:2.

“In this updated Pine Script code, we added a reward_ratio input to set the reward ratio for the take-profit and stop-loss orders. The code calculates the take-profit distance as reward_ratio * stop_distance and the stop-loss distance as stop_distance. The bot then sets the take-profit and stop-loss orders when entering a long or short position. Note that the strategy exit function has been renamed to "TP/SL" to differentiate it from the previous exit orders.”

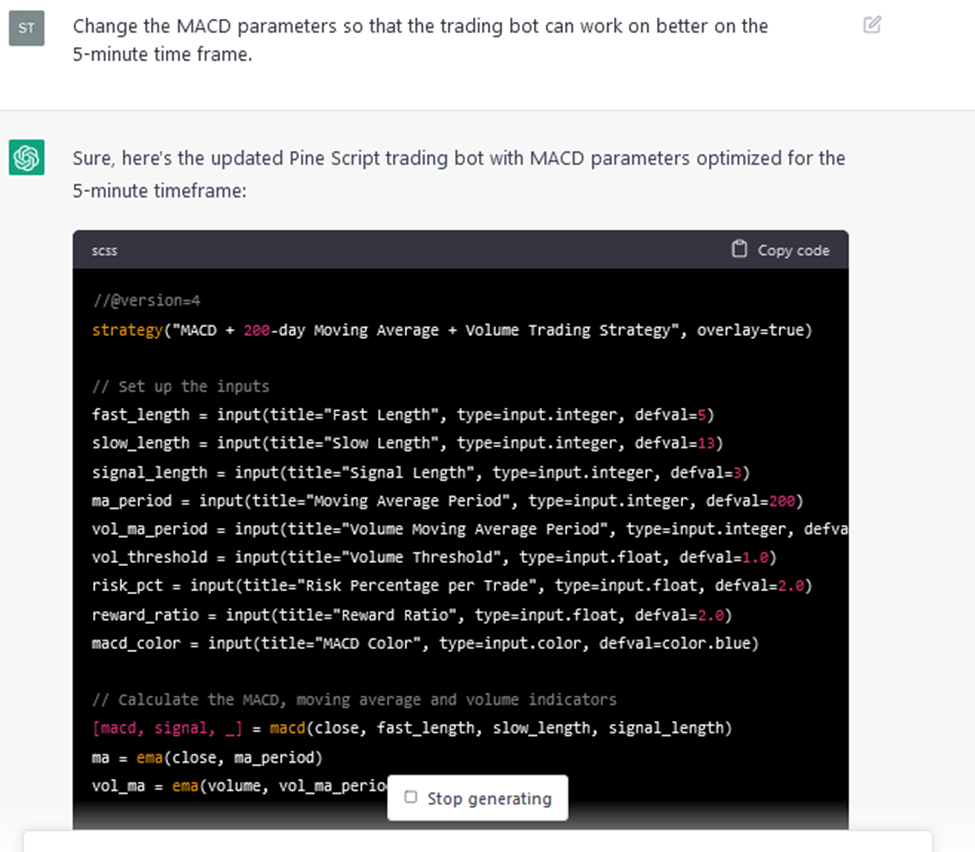

chatGPT Prompt #6: Change the MACD parameters so that the trading bot can work better in the 5-minute time frame.

“In this updated Pine Script code, we changed the MACD parameters to better suit the 5-minute timeframe. We reduced the fast_length to 5, the slow_length to 13, and the signal_length to 3. These values are commonly used in the 5-minute timeframe. Note that these parameters may need further optimization for specific markets or trading strategies.”

Final Thoughts

In this comprehensive tutorial, we have delved into the exciting world of building a trading bot with ChatGPT. The possibilities are endless, and you can use this approach to develop bots for various currency pairs and financial instruments, not just the forex market.

As the world of forex trading continues to evolve, there are countless opportunities available for those who are willing to put in the work. With ChatGPT, you can build your trading bot and potentially make money by trading on autopilot.

Whether you're a seasoned trader or just getting started, there's never been a better time to jump into the exciting world of algorithmic trading.

If you're ready to take your trading game to the next level and start using a trading bot, it's crucial to have a reliable and trustworthy forex broker by your side. To find the best forex brokers in 2023, head over to our comprehensive guide that covers everything you need to know to make an informed decision.

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM IC Markets

IC Markets Forex.com

Forex.com AXITrader

AXITrader