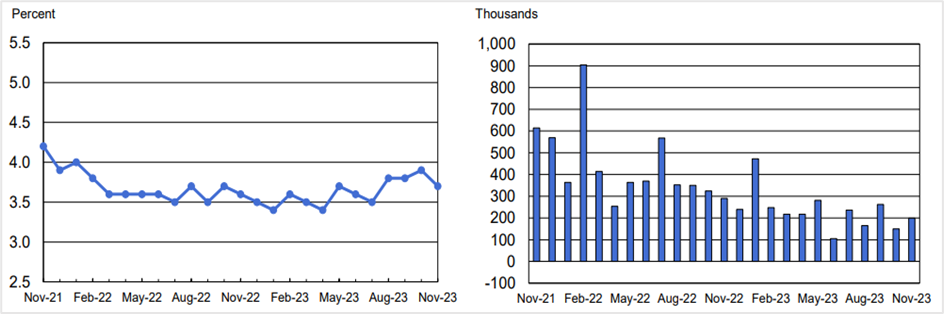

Unemployment rate dipped to four-month lows while wages increased

The US economy gained 199,000 jobs in November, up sharply from the 150,000 the previous month and above economists' expectations of 190,000, the US Bureau of Labor Statistics said on Tuesday. The surge in the seasonally-adjusted nonfarm payrolls was primarily led by job growth in the healthcare sector, government, manufacturing, and leisure and hospitality. In addition, the 47,000-odd labor force returning from strikes organized by UAW and SAG contributed to the increase in payroll employment.

Meanwhile, the unemployment rate improved to 3.7% from October's 3.9%, in line with Street estimates. However, a broader measure of the unemployment rate that comprises individuals who are marginally attached to the labor force, such as discouraged employees and those working part-time, fell by 0.2% to 7.0%, the lowest since February 2020.

On the other hand, average earnings, a key inflation indicator, rose 0.4% month-on-month, slightly above estimates of a 0.3% monthly increase and 4% over the last 12 months.

Source: Bureau of Labor Statistics website

Friday's nonfarm payrolls and the unemployment rate report are the last major data ahead of the Fed's monetary policy meeting on December 12th-13th, and according to analysts, the outcome should be enough for policymakers to maintain the status quo on interest rates.

However, the November CPI data is due on December 11th. Fed officials will keep an eye on how the report pans out, hoping that demand moderates sufficiently and inflation dwindles progressively without pushing the economy into a recession.

Key highlights of the Bureau of Labor Statistics report

The job gains occurred in healthcare, government, and the manufacturing sector, while those in the retail trade dropped. The Bureau of Labor Statistics data broadly comprises two surveys- the household and the establishment surveys. The former includes the labor force statistics, and the latter measures the nonfarm employment, hours worked, and industry-wise earnings.

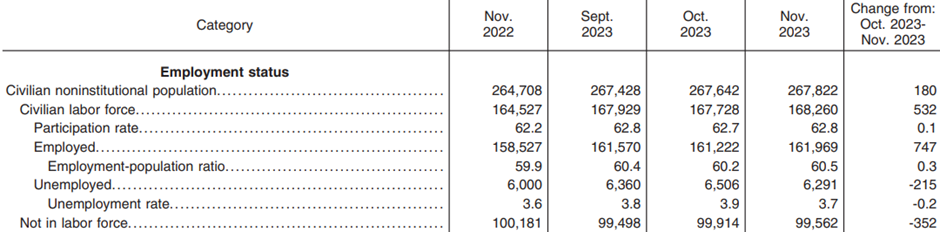

The November household report disclosed that the number of unemployed people was at 6.3 million, almost unchanged month-on-month, with the long-term number of unemployed people at 1.2 million, slightly below the previous month. Likewise, the number of employed part-time fell by 295,000 to 4.0 million, while those not in the labor force but looking for a job were at 5.3 million. However, these people were not included in the unemployed list since they were either not actively looking for a job over the previous four weeks before the survey or were unavailable to start a new job. Lastly, the employment-population ratio rose 0.3 percentage points to 60.5% in November, while the labor force participation rate was almost unchanged at 62.8%.

Data from the establishment survey showed employment growth was below the monthly average of 240,000 over the past 12 months. Job gains in the labor market were primarily seen in the healthcare sector (77,000), government ((49,000), manufacturing (28,000), leisure & hospitality (40,000), and social assistance (60,000). On the contrary, job losses were seen in retail trade (38,000), and transportation & warehousing (5,000), with minor changes in mining, oil & gas extraction, construction, professional activities, wholesale trade, business, and other services.

Meanwhile, the average hourly earnings of all employees increased by 12 cents or 0.4% month-on-month to $34.10 and by 4.0% annually. Also, the average workweek ticked higher by 0.1 hours to 34.3 hours, with the workweek for employees in the manufacturing sector unchanged at 40 hours per week.

Employment status of the civilian population in the US (in thousands)

Source: Bureau of Labor Statistics website

Economists' reaction to the US unemployment report

Daniel Zhao, the lead economist at Glassdoor, believes the job market is resilient despite recession fears. According to him, one of the concerns before the release of the November report was the rise in the unemployment rate, and the better-than-expected outcome is a welcome relief.

Paul Ashworth, the chief North American economist for Capital Economics, said the labor statistics excluding the 47,000 workers returning from the twin strikes comes to an employment gain of 152,000 in November, about the same as the previous month. He believes the employment trend remains weak, especially in the cyclical sector, with some signs of labor market capitulation.

Daniel McCormack, the head of research at Macquarie Asset Management, said consumer spending was solid in 2023 due to household savings accumulated during the pandemic. However, he expects spending to slow down next year, although he believes it might not fall steeply.

Market reaction to the nonfarm payrolls and unemployment news

The US stock indices swung between gains and losses before closing the day in positive territory to record two successive winning sessions. The Dow Jones Industrial Average closed at 36,247.87, higher by 0.36%, while the S&P 500 ended at 4,604.37, gaining 0.41%, and the Nasdaq 100 rose 0.39% to 16,084.69. All three indices registered their sixth consecutive weekly gains.

After posting its highest yearly close for 2023 last week, the S&P 500 hit a new high on Friday following the stock market-friendly November payrolls and unemployment reports. In addition, the better-than-expected University of Michigan's Consumer Sentiment Survey added to the optimism.

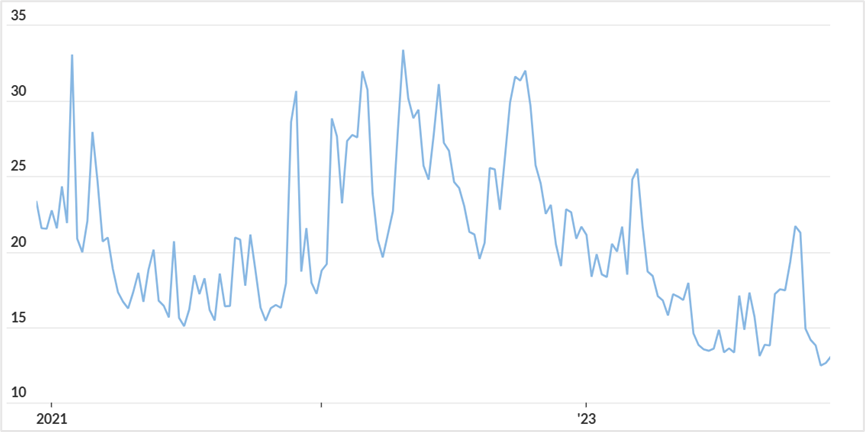

In good news for stock market enthusiasts, Nicholas Colas, the co-founder of DataTrek, believes the CBOE Volatility Index (VIX), also referred to as the stock market's 'fear gauge,' is flashing a positive sign for 2024. The index is below its 2023 lows after closing at 12.35 on Friday, marking its lowest close since January 2020.

According to Colas, the gauge follows a market cycle pattern, where stocks are considered bullish if the index trades below 20 for a long time and in a bear market if the VIX remains above 20.

CBOE Volatility Index (VIX)

Source: MarketWatch

The US dollar rose against its counterparts in the currency markets following the higher-than-expected November payroll numbers. The dollar index, a measure of the strength of the US currency against its major trading trading partners, climbed 0.45% to close at 104.01 on Friday. The greenback rose 0.32% against the euro and the pound sterling to settle at 1.0758 and 1.2546, respectively, while the USDJPY pair surged 0.61% to 144.96.

The index has rebounded about 1.7% after hitting three-and-a-half-month lows on November 29th amid a slew of positive economic data that signaled the US economy might avoid a recession, even as economic growth in Europe and the UK reel from the pressure of high-interest rates.

Government securities sold off, and yields rose across maturities after the nonfarm payroll and unemployment news showed that the US economy added more jobs than initially expected and the unemployment rate dipped from 3.9% to 3.7%. The yield on the rate-sensitive 2-year TNote rose 14.1 basis points to 4.727%, while the yields on the benchmark 10-year TNote and the 30-year bond climbed 7.4 basis points and 4.9 basis points to 4.23% and 4.306%, respectively.

The rebound in Treasury yields comes as traders scaled back the odds that the Fed would start cutting interest rates in March and now expect the first cut in May.

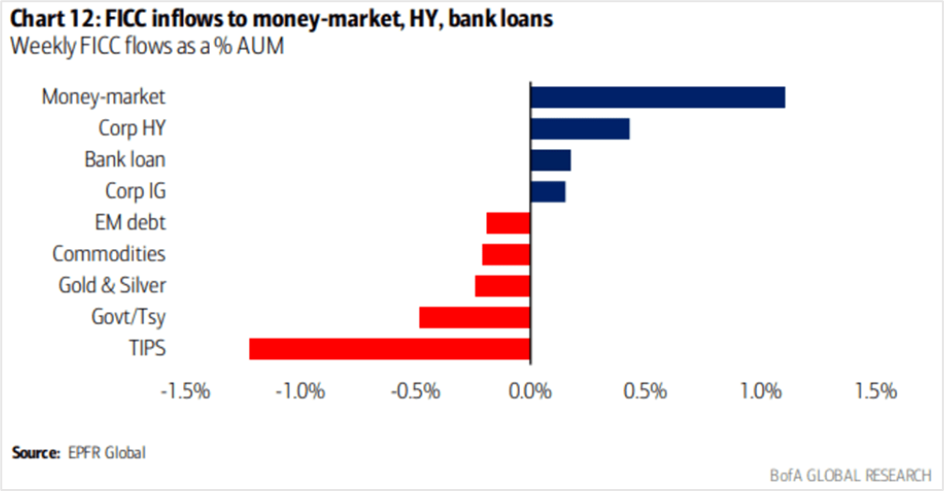

Meanwhile, optimism around rate cuts pushes investors into a range of risky assets, including junk bonds. According to MarketWatch, citing CreditSights, investors poured money into high-yield ETF funds, raising investments by $1.5 billion in the week to December 6th while adding exposure to high-yield corporate funds, even as they pulled assets from the inflation-linked TIPS funds and government securities.

Source: MarketWatch

Technical View

Dow Jones Industrial Average March futures (YMH24)

The most active DJIA futures March contract jumped into the primary bullish territory on Friday to settle at 36,643, up 1.32% for the day and a touch below the all-time highest close of 36,675 registered on January 4th, 2022. A close above this level is highly bullish, with medium-term targets of 39,550-39,600. The index futures also broke out of a bullish flag pattern, with the short-term target at 36,990-37,000. On the downside, the near-term support is at 36,550, and a close below could drive the index toward 35,800-36,150.

Go long at 36,550, with a stop loss at 36,450, and exit as prices approach 36,850. Long positions can also be initiated if the index futures settle above 36,675 or break 36,800. Place stops at 36,450 and exit at 39,800. Ensure trailing stops are placed for this medium-term trade.

On the contrary, if the DJIA futures drop below 36,450, reverse all long positions and go short, with a stop loss at 36,650 for a profit target of 35,850.

E-Mini Dow Jones futures (YMH24)- Daily chart

Click the link to view the chart- TradingView — Track All Markets

Spot GBPUSD

The pound sterling settled at 1.2547 versus the US dollar on Friday, down 0.36% for the session, and although the pair is in a primary uptrend after rebounding sharply from the all-time lows of 1.0356 on September 26th, 2022, it still faces a crucial breakout level at 1.2930.

The GBPUSD is forming a bullish flag pattern, with the flag support at 1.2500 and resistance at 1.2590. A breakout of the pattern could drive prices toward the long-term resistance at 1.2830-1.2900.

Initiate long positions at 1.2500, with a stop loss at 1.2460 and a profit target of 1.2590. Long sterling positions can also be taken if the pair closes above 1.2590 or breaks 1.2630. Place stops at 1.2540 and exit as prices approach 1.2900.

GBPUSD- Daily chart

Click the link to view the chart- TradingView — Track All Markets

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM IC Markets

IC Markets Forex.com

Forex.com AXITrader

AXITrader