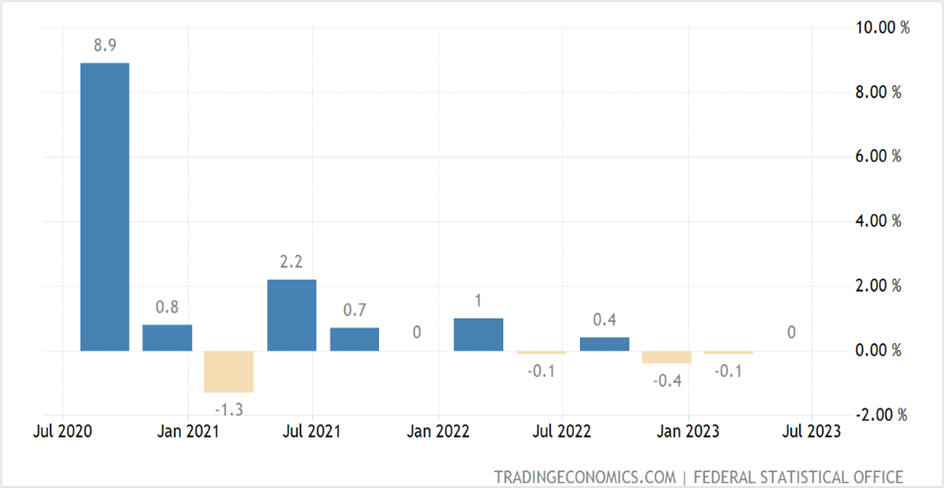

GDP unchanged in Q2, 2023, after contracting in the previous two quarters

Second-quarter GDP growth (second estimate) in Europe's largest economy was flat in the April-June quarter, unchanged from the first estimate published by Germany's Federal Statistical Office (Destatis) in July and line with analysts' expectations. Year-on-year, the German economy contracted by 0.2%. At constant prices, gross domestic product rose to €815.40 billion in the April-June quarter from €815.25 billion in the first quarter of 2023, data from Destatis showed on Friday.

Economic activity in Europe's largest economy contracted in the previous two quarters, falling by 0.4% in the fourth quarter of 2022 and by 0.1% in Q1 2023. Economists believe a country is in a technical recession if gross domestic product shrinks for two successive quarters.

Germany Q2 GDP

Highlights of the second quarter GDP data

German Q2 GDP numbers saw an uptick in government spending by 0.1%, while household consumption was flat after declining in the previous quarter. Meanwhile, inventory changes contributed 0.4 percentage points to the GDP figures.

Among the negatives, gross fixed capital formation fell to 0.4% from 1.7% in the previous quarter as investments in construction slumped to 0.2% from 2.7%, while investments in machinery plunged from 2.1% to 0.7%. Also, a drop in external demand from a 1.1% drop in exports took away 0.6 percentage points from the GDP growth figures.

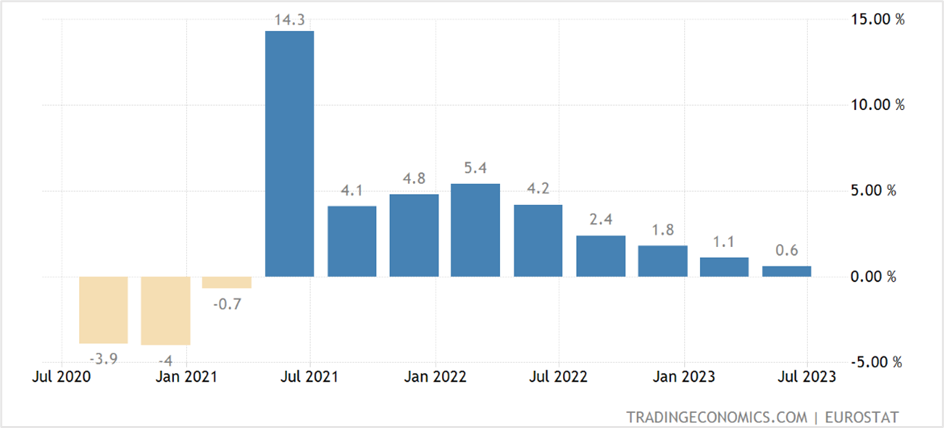

The German economy is the fifth-largest economy in the world and the biggest in Europe. While the economy stagnated in Q2 following a weak winter half year, data from the eurozone earlier this month showed the combined gross domestic product in the 19 countries adopting the euro expanded by 0.3% in Q2, 2023, from flat growth in the first quarter as energy and food prices cooled. The economic rebound was led by France, which recorded a 0.5% GDP growth, while Spain's economy advanced by 0.4%. On the contrary, GDP growth in Italy contracted unexpectedly by 0.3%. Year-on-year, the eurozone economy expanded by a sluggish 0.6%, the slowest pace since the 2020-21 recession.

Eurozone- Quarterly GDP growth

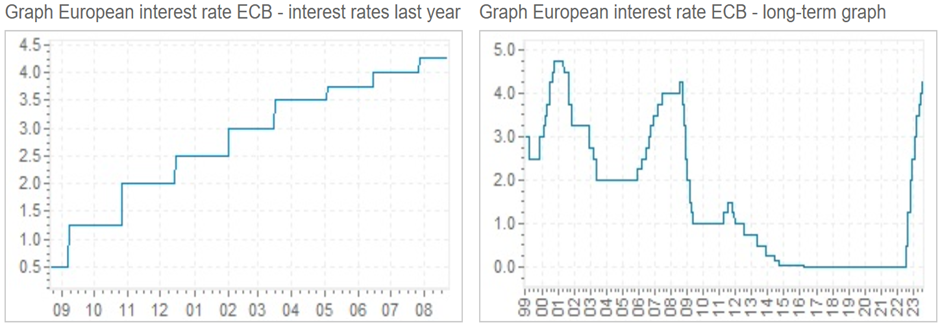

The recovery in demand in the eurozone is attributed to the inflation rate moderating from a series of interest rate hikes by the European Central Bank and despite waning consumer confidence. The ECB has raised interest rates at each of its nine meetings, with the latest on July 27th, driving the benchmark refi rates to 4.25%, the highest since July 2008.

Economists' Views & Forecasts

The global head of macro at ING, Carsten Brzeski, is pessimistic about Germany's short- and long-term economic outlook. He believes that weak purchasing power, thin industrial order books, an economic slowdown in China, and aggressive monetary policy tightening indicate economic activity to remain sluggish.

Melanie Debono, the senior economist at Pantheon Macroeconomics in Europe, also paints a gloomy picture of Germany's economic outlook. She forecasts the gross domestic product in Germany to contract by 0.3% in the third quarter before rebounding by 0.4% in the last quarter. Pantheon expects weak economic activity to shrink the German GDP by 0.2% in 2023.

Meanwhile, in its monthly report a few days back, the Federal Republic Bank of Germany (Deutsche Bundesbank) predicted gross domestic product to stagnate in the third quarter. The German Central Bank anticipates private consumption to be boosted by a robust labor market, solid wage growth, and lower inflation. However, it expects industrial production to remain weak from sluggish demand abroad.

Market reaction

European stocks were upbeat on Friday, shaking off the sharp drop in the US equities markets in the previous session amid talks that the European Central Bank might pause rate hikes in September as headline inflation softens. Around noon GMT, Germany's benchmark stock index, the DAX, was up 0.47% at 15,695.05, France's CAC 40 rose 0.66% to 7262.14, Italy's FTSE MIB jumped by 1.00% to 28,351,64, Spain's IBEX 35 surged higher by 0.70% to 9390.20, and the UK's FTSE 100 climbed 0.49% to 7369.90.

Overnight, the 30-shares Dow Jones Industrial Average dropped 1.08% to end Thursday's session at 340999.42, the S&P 500 fell 1.35% to 4376.31, and the Nasdaq 100 tumbled 2.19% to settle at 14816.44 as investors continued to sell US equities ahead of Jerome Powell's speech at Jackson Hole later today. The Dow, S&P 500, and the Nasdaq 100 futures are trading with gains of 0.25%-0.45% on Friday ahead of Powell's speech at 10.05 AM.

Among individual stocks, Nvidia opened at $502 on Thursday, a jump of more than 6.5% from solid quarterly earnings that beat Street forecasts before reversing all its gains to end flat. The AI chip giant is poised to open modestly lower at $469-$470 on Friday.

In currencies, the US dollar is mostly flat against its six foreign counterparts on Friday after climbing to the highest in two and a half months in the previous session. The US dollar index futures (DXY) rose by 0.54% to settle at 103.982 on Thursday, registering the highest close since June 7th as it attempts to end the sixth straight week with gains, the most since April-May 2022. At 12.25 PM GMT on Friday, the euro is flat against the greenback at 1.0809, the pound sterling is up 0.18% at 1.2621, and the Japanese yen is a tad higher at 145.89.

US dollar index futures- Daily chart

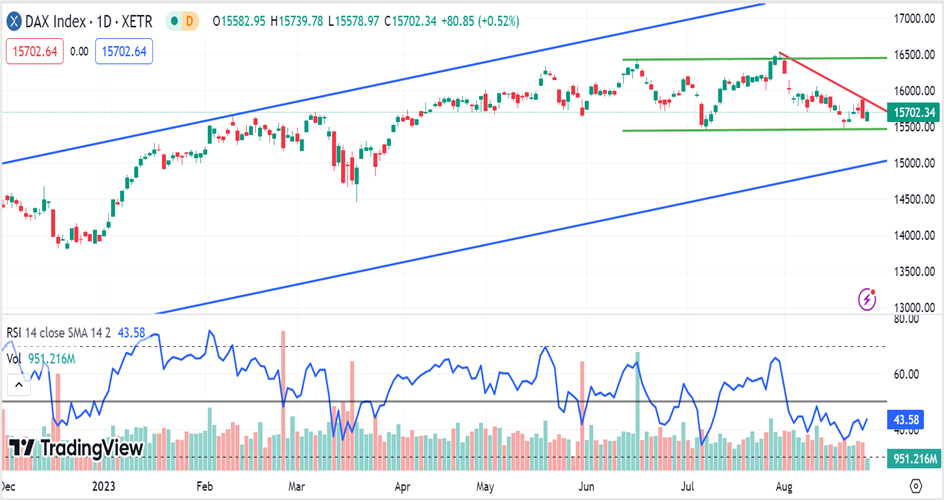

Technical View

The DAX is in a primary uptrend but has mostly been oscillating in the 15460-16460 range since mid-June. The index looks to have found near-term support at 15480, a good entry to go long on DAX futures. However, the index has to settle above the resistance at 15840 for gains to extend to the top end of the band at 16460 and beyond.

Buy DAX futures if the spot index hits the support at 15480, with a stop loss at 15430 and a profit target of 15800-15830. Long positions can also be initiated if the index settles above 15840, with stop losses at 15830 and a profit target of 16450.

DAX- Daily chart

The EURUSD pair is in a primary downtrend after settling below long-term support at 1.0965 on August 18, 2023. The pair also closed below the previous lows of 1.0833 set on July 6th after it settled at 1.0810 on Thursday, August 24th.

The pair will likely extend the drop toward supports at 1.0640-1.0690 in the near term, represented by the downward-sloping red and blue horizontal trendlines. However, if the pair settles above the resistance at 1.0835 (green horizontal line), it could push toward the nest resistance at 1.0940.

Short the euro between 1.0810-1.0830 with a stop loss at 1.0865 and exit as the exchange rate approaches 1.0700.

Spot EURUSD- Daily chart