The world of Forex trading is vast, dynamic and constantly evolving. With the movements and changes of the global economy, traders are always looking for trading strategies that can help them navigate the turbulent waters of the forex market.

As we enter 2024, it is essential to arm ourselves with the best forex strategies, backed by expert opinions from expert analysts, investors and professional traders, to ensure profitability and sustainability in our efforts to obtain benefits in forex trading.

According to Richard Dennis, one of the best and most famous trader trainers, the appeal of Forex trading lies in its potential profitability. However, he emphasizes that this potential can only be unlocked with specialized knowledge and unwavering discipline. Echoing this sentiment, Jitanchandra Solanki underlines the importance of discipline in trading. It suggests that traders can maintain their discipline by adhering to well-reasoned and proven Forex trading strategies.

In addition, Bear Bull Traders experts advocate direct learning from professionals, emphasizing that it provides traders with profitable strategies and risk management techniques.

With these expert insights in mind, let’s delve into the top Forex strategies that are set to make waves in 2024.

1. Day Trading: The Short-Term Game

Intraday or intraday trading remains a favorite among traders who prefer quick, short-term trades. The essence of day trading is to capitalize on small price movements by opening and closing positions within the same trading day. Key intraday trading strategies include:

-

Trend Following: This strategy involves following the market trend: Buying during an uptrend and selling during a downtrend.

-

Reversal Trading: Also known as countertrend trading, this strategy takes advantage of predicting trend changes.

-

Momentum Trading: This strategy focuses on strong price movements combined with high trading volumes, with the aim of capitalizing on momentum before it dissipates.

In the dynamic world of Forex, day trading offers the thrill of making quick decisions and reaping potential rewards. However, it is not without its challenges. The key to day trading success lies in the day trader’s ability to stay informed, make quick decisions and maintain discipline. As market volatility can change in a matter of minutes, a day trader must be vigilant and use real-time data and tools to keep an eye out for opportunities and manage their trades well.

With the right mindset and strategy, day trading can offer lucrative opportunities for those willing to navigate its fast-paced nature.

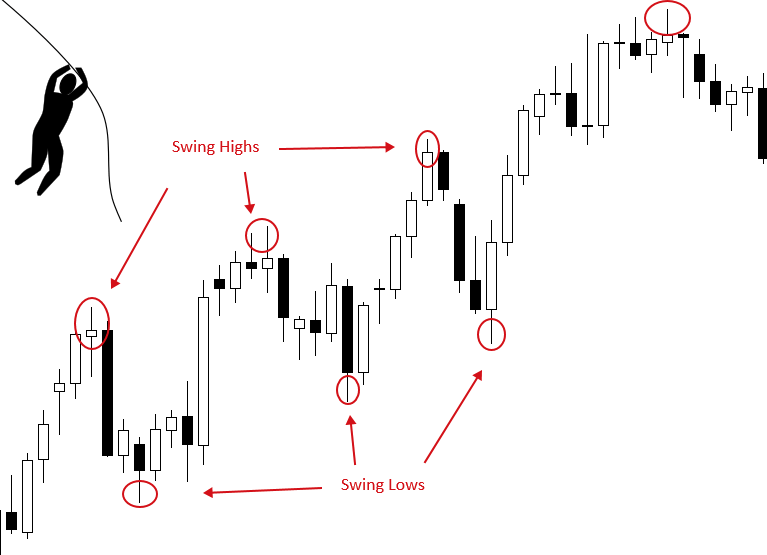

2. Swing Trading: Capture market swings

swing trading is for those who have a keen eye for capturing significant market movements over a period of days or weeks. The main objective is to identify and profit from the “highs” and “lows” of a trend. The most notable swing trading strategies are:

-

Trading based on supports and resistances: These fundamental elements of technical analysis help forex traders identify possible entry and exit points.

-

Channel Trading: This strategy involves identifying currency pairs that move within a defined channel and trading based on its limits.

Swing trading, while offering the potential for significant profits, requires a combination of patience and in-depth knowledge of the market. It’s about understanding the pace of the market and taking action at the right times. Traders must be adept at analyzing market trends, using a combination of technical analysis and fundamental analysis to predict future price movements.

With the right approach, swing traders can capitalize on market fluctuations and make profits in both bullish and bearish scenarios. It’s a strategy that requires both skill and intuition, but for those who master it, the rewards can be substantial.

3. Position Trading: The Long Game

Position trading is the marathon of Forex strategies. Traders hold their positions for weeks, months or even longer, aiming to profit from significant price movements. Key strategies in this category include:

-

Breakout Trading: This strategy focuses on identifying and trading the early stages of a trend, especially when a price breaks through a defined support or resistance level.

-

Range Trading: Ideal for markets without a clear directional trend, traders buy at the support level and sell at the resistance within a defined range.

Position trading is not for the most fearful traders or investors. It demands a deep understanding of the market, a solid understanding of global economic factors and the patience to wait for the right moment to close a position. Unlike day trading or swing trading, where quick decisions are paramount, position trading is a long-term game. It’s about analyzing long-term trends, understanding geopolitical developments, and having the confidence to hold a position even when the market fluctuates.

This strategy is best suited for traders who have a broader perspective of the market and are willing to weather short-term storms in anticipation of long-term gains.

4. Algorithmic Trading: The Technology-Driven Approach

In the ever-evolving landscape of forex market trading, algorithmic trading has become a game-changer. By harnessing the power of computer algorithms, traders can now analyze large amounts of data and execute trades with unparalleled accuracy and speed. This technology-driven approach is not just about automation; It is about optimizing trading strategies to maximize profits and minimize risks.

In essence, algorithmic trading consists of automating the decision-making process based on a set of predefined rules. These rules are derived from quantitative methods, such as technical analysis, and are programmed into trading systems to execute trades when certain conditions are met. The beauty of this approach is its objectivity; Trades are executed based on data, not emotions.

One of the most recognized strategies in this area is arbitration. This technique takes advantage of the price discrepancies of a currency pair in different markets. The idea is simple: buy low in one market and sell high in another. However, execution requires sophisticated algorithms that can detect these price differences in real time and place trades in a fraction of a second before the market adjusts.

But algorithmic trading is not limited to arbitrage. There are numerous strategies that forex traders employ, including:

-

Scalping in Forex: A strategy in which traders (called scalpers or speculators) aim to profit from small price changes over short periods.

-

Trend strategy: It consists of trading in the direction of the market trend, buying during uptrends and selling during downtrends.

-

Impulse trading: Pursue the momentum of price movements, buy high and sell higher.

-

News Trading: Take advantage of the volatility caused by major press releases.

-

Statistical Trading: Using statistical models to predict future price movements.

-

High-frequency Trading (HFT): Executing large volumes of trades in milliseconds to capture minimal price differences.

-

Price Action Strategy: Trading based on the analysis of raw price data without the use of indicators.

The rise of trading platforms such as MetaTrader 4 (MT4) has helped the retail trader expand access to algorithmic trading. With MT4, traders can not only develop their own algorithms but also leverage pre-built solutions and expert advisors to automate their strategies. This has opened up a world of possibilities, allowing even those without coding experience to benefit from algorithmic trading.

However, like all trading strategies, algorithmic trading is not without risks. While algorithms can process information faster than any human, they are also susceptible to glitches and errors. Additionally, market conditions can change quickly, and an algorithm that worked well under one set of conditions may not work as well when market dynamics change.

5. Seasonal Trading: The Rhythm of the Market

Each market has its rhythms and the forex market dances to the rhythm of its own seasonal rhythms. Seasonal trading strategies are based on the principle that historical price movements repeat at specific times, allowing traders to anticipate and capitalize on these patterns. These strategies are not just limited to daily fluctuations; They span various time frames, from intraday cycles to annual cycles.

For example, day traders might notice that the currency pair EUR USD often sees a rise in the European morning but falls during the North American trading session. This could be attributed to the opening of major financial centers in Europe and the United States and the volume of transactions that occur during these periods.

On a monthly scale, some traders may notice the Australian Dollar (AUD) strengthening against the US Dollar (USD) during the summer months. This could be related to Australia’s fiscal year closing in June, which would trigger capital flows and corporate transactions that would impact the value of the currency.

Annual patterns also influence. For example, the Japanese yen (JPY) has historically shown strength in the month of January. This phenomenon, often called the “January effect,” can be attributed to factors such as the repatriation of funds by Japanese companies and the dynamics of the country’s fiscal year.

Another seasonal strategy revolves around major global events. For example, during the Olympic Games, countries hosting the event could see an influx of foreign investment, which could lead to a temporary increase in the value of their currency.

At its core, seasonal trading is about understanding these recurring patterns and taking advantage of them for potential profits. However, it is essential for traders to remember that while history often rhymes, it does not always repeat itself. External factors, such as geopolitical events or unexpected economic data releases, can alter these patterns. As with all trading strategies, due diligence, continuous monitoring and risk management are key to success in seasonal trading or investing.

Forex Indicators: Improving the effectiveness of the trading strategy

In the complex world of forex trading, having the right tools can make the difference between a successful trade and a missed opportunity. Forex indicators, based on technical analysis, serve as invaluable aids to traders, offering information on possible future price movements and improving the effectiveness of chosen strategies.

As we move into the new year, several indicators have gained importance, each with its unique utility and application. Let’s dive into some of the most sought-after tools this year:

-

Moving Average (MA): The moving average is a fundamental tool in a trader’s arsenal. Calculates the average price of a currency pair over a specified number of periods, smoothing out price fluctuations and providing a clearer view of the general direction of the trend. There are different types of MAs, such as the Simple Moving Average (SMA) and the Weighted Moving Average (WMA), each with their own nuances. Traders often use MAs to identify possible support and resistance levels or to confirm the strength of a trend.

-

Exponential Moving Average (EMA): A more responsive variant of the moving average, the EMA gives more weight to recent price data. This means that it reacts more quickly to recent price changes than the SMA. Traders often use the EMA in conjunction with other indicators, looking for crossovers as possible buy or sell signals. For example, when a short-term EMA crosses above a long-term EMA, it could indicate a possible uptrend.

-

Stochastic Oscillator: This momentum indicator compares a particular closing price with a range of its prices over a given period. The stochastic oscillator generates values between 0 and 100 and is typically used with two lines: %K (the actual value) and %D (a moving average of %K). When the %K line crosses above the %D line, it can be a buy signal, and when it crosses below it, it can be a sell signal. The stochastic oscillator is especially useful for identifying overbought or oversold conditions in the market.

While these indicators are powerful tools, it is essential to remember that no single indicator can provide all the answers. Successful traders often combine multiple indicators, along with fundamental analysis, to gain a holistic view of the market.

Additionally, continuous learning, practice and adaptation to the ever-changing Forex market landscape are crucial to leverage these tools effectively. As the market evolves, so should a trader’s toolset, ensuring they remain at the forefront of innovation in the world of trading.

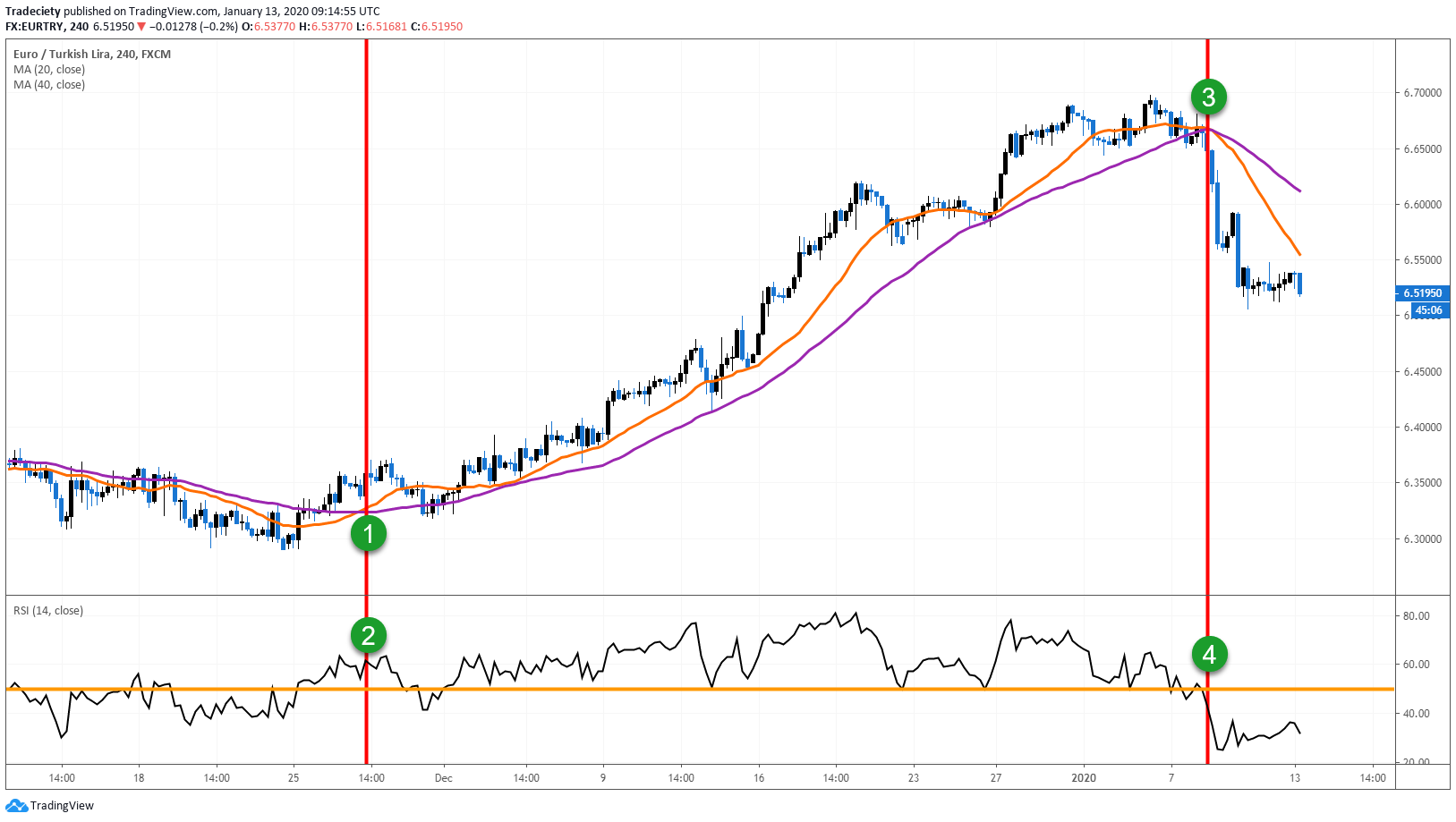

Example of how professional traders operate the forex market using moving averages

This trading strategy consists of a moving average cross system in addition to adding a type of indicator called RSI (Relative Strength Index) to reduce the risk per transaction as much as we can.

A 20 and 40 period SMA is used, but it is possible to use any combination depending on the time period used in our candlestick charts. The cases that give the best results when opening a position are:

Moving averages and trading styles of the trader/investor

-

Short-term trading ——————— ————–> SMA of 10 and 20 periods

-

Medium term trading (best for 1H and 4H) —–> 20 and 40 period SMA

-

Long-term trading (best for 4H and Daily) –> 50 and 100 period SMA

-

Swing trading (Daily and Weekly) ——————-> SMA of 100 and 200 periods

In addition, to carry out our operation, we will add the 14-period RSI indicator to see more clearly the strength of the trend and better manage risk in order to make better decisions on our financial assets.

When the RSI is above the 50 level (orange line), we only look for bullish signals. And when the price is below the 50 level, we only look for bearish crossovers.

Let’s take a look at the situation below and take into account the following four points or rules of this trading method.

-

The short-term moving average crosses above the long-term moving average. This is a bullish signal because it means that the short-term price movement is increasing relative to the long-term price. Signals bullish momentum.

-

The RSI is trading above the 50 level, which means it would have been nice to follow the bullish crossover signal. The RSI is, therefore, a filtering tool. If the moving averages cross towards a bullish signal but the RSI is below the 50 level, the trader would not open any long trades (buy).

-

The next moving average crossover to the bearish side occurred here. Although the moving averages were close to crossing before, we must wait for a crossover to be confirmed.

-

The RSI fell below 50 with the crossover, confirming the bearish signal.

Of course, you can layer more criteria on top of those two. For example, a trader can add trend lines or horizontal breakouts to the strategy. Or even add a longer-term moving average as an additional trend direction filter.

It would be interesting to take a closer look at the placement of orders in this trading strategy according to our trading style.

At point (1), the moving averages crossed bullishly. The price was already trading above the moving averages previously, but we have to wait for the moving averages to be crossed. When the moving averages were crossed, the RSI was already above level 50, which confirms the bullish trend signal and we can enter directly or place a buy order on the candle that confirms the entry rules.

You can probably already follow the system and understand how the bearish setup in points 3 and 4 was created.

I do not recommend starting trading with this approach blindly. Instead, try it out on a demo account and get a feel for how all the components of this trading strategy work together. You may want to make modifications or need to add more or different tools to this way of trading for better personal results.

Conclusion: Adapt to the current landscape of the Forex market

The foreign exchange market is dynamic and strategies that work today may be obsolete tomorrow. As 2024 progresses, it is critical that traders stay informed, adapt, and choose strategies that align with their goals and the pulse of the market.

Whether you are an experienced trader or just starting out, understanding and employing the right strategies can make the difference between success and stagnation or failure in the world of Forex.

Your Turn

Leave opinions, or even any questions or ideas, in the comments below, we will be happy to read and answer them.

And of course, don’t forget to subscribe to receive more tips and resources on trading and Forex.

ChinaUS

ChinaUS