Dollar ends flat, stock benchmarks remain mixed, and treasury yields rise following the announcement

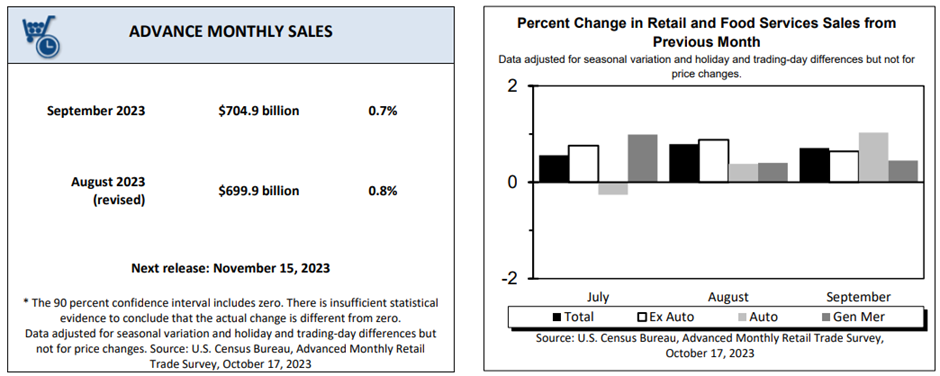

US retail sales rose by a solid 0.7% in September, slightly below the upwardly-revised 0.8% in August, as Americans continued spending at bars and restaurants while stepping up online purchases and automobiles, the Commerce Department reported on Tuesday. The sharp increase in retail sales signals strong consumer spending, one of the primary factors that kept the US economy expanding.

Over a 12-month period, retail sales rose 3.8%. On the other hand, core retail sales, which excludes automobile sales, rose 0.6%, unchanged from the previous month. The retail sales report exceeded the 0.3% month-on-month increase forecast by economists polled by Reuters, who defended their estimates from softening consumer confidence.

The retail sales (mom) figures come on the heels of a tight labor market report, which showed that the US economy added 336,000 jobs in September. However, despite all the resilience, consumers face strong headwinds since most rely on debt to fund purchases, and the high borrowing costs have driven credit card delinquencies to 11-year peaks.

The monthly retail trade survey is crucial for Federal Reserve officials as they decide on the monetary policy going forward. While markets more or less believe the Fed is done raising interest rates, a strong consumer spending report like this one obscures the math.

Key highlights of the Commerce Department's retail sales report

The advance estimates of US retail and food services sales, adjusted for seasonal variation and holiday and trading-day differences, excluding price changes, were at $704.9 billion in September. Sales at nonstore retailers or online purchases surged 1.1% on the month and 8.4% from last year, while receipts at food services and drinking places jumped 0.9% in September and 9.2% over 12 months.

Meanwhile, sales at auto dealerships surged 1.0% on the month from 0.4% in August and 6.4% from the previous year. In addition, receipts from health and personal care, food and beverage, and general merchandise stores rose in September.

On the contrary, sales at electronics and appliances stores, building materials and garden equipment, and clothing and accessories stores dropped as consumers cut back on fresh purchases. Meanwhile, receipts at department stores, sporting goods, hobby, musical instruments, & book stores were unchanged month-on-month.

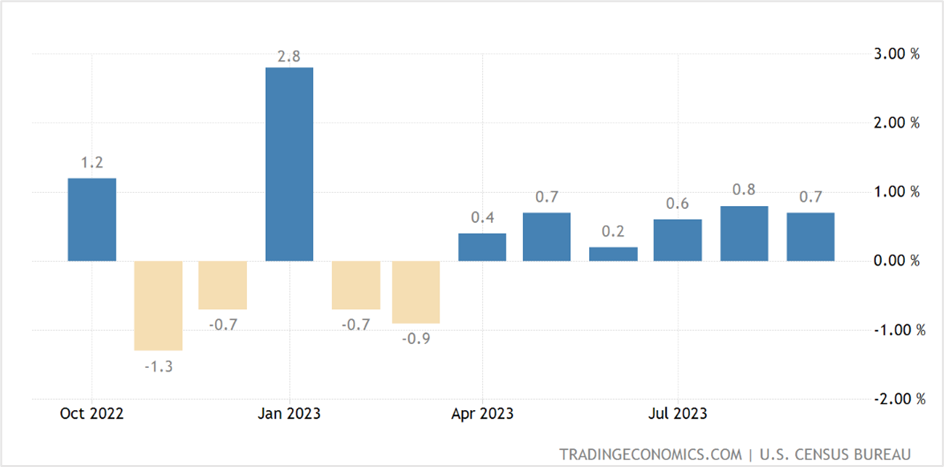

Retail Sales (MOM)-October 2022- September 2023

Analysts assessment of the monthly retail trade survey

David Russell, the global head of market strategy at TradeStation, said all three sales figures were higher over the last three months, which would lead to solid GDP growth numbers in the third quarter. He believes the robust consumer spending report will prevent the Fed from loosening policy rates anytime soon.

Robert Frick, the corporate economist at Navy FederalCredit Union, said consumer spending was broad-based, with purchases rising on everything from durable goods to food and drink at restaurants and bars. He believes that consumers will keep spending as long as the job market remains healthy.

Despite the robust retail sales numbers, Jeffrey Roach, the chief economist at LPL Financial, believes US consumers face headwinds, and investors should look at the underlying factors in the sales report to get a better feel about consumers' health. He thinks the surge in credit card usage and early signs of delinquency will dampen the eagerness to spend.

Market reaction to the retail sales data

The US stock markets were mixed on Tuesday, with the Dow Jones Industrial Average and the S&P 500 rebounding from early losses to end flat, while the Nasdaq 100 closed in the negative, reversing some of the previous session gains. The 30-share Dow Jones Industrial Average settled at 33,997.65, up 0.04% for the day, while the S&P 500 ended flat at 4,373.20 and the Nasdaq 100 closed at 15,122.01, down 0.33%.

As traders contemplate the market direction following a host of positive economic data, Michael Wilson, the chief US equity strategist at Morgan Stanley, forecasts the S&P 500 to end the year at 3,900, that's a drop of about 11% from Tuesday's close.

According to Wison, the market breadth is appalling, the consumer confidence survey by the University of Michigan is waning, while Wall Street analysts have tempered the corporate earnings growth expectations for the next few quarters and the year ahead.

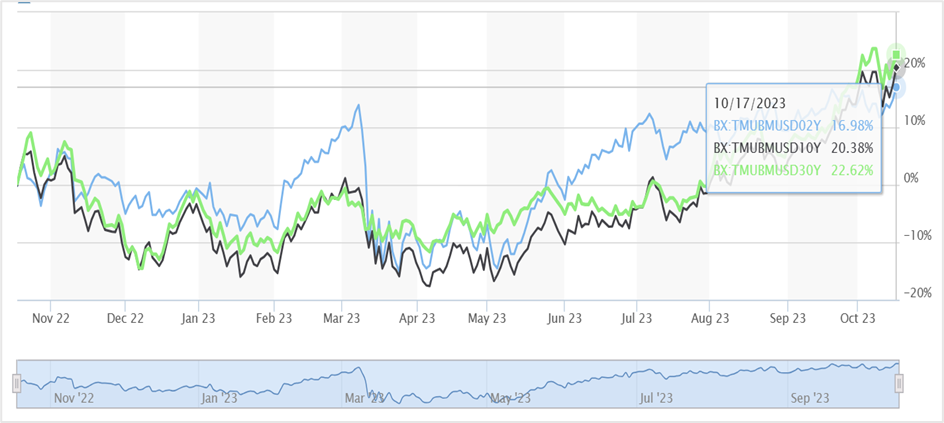

In the US Treasury markets, government debt sold off after the solid retail sales data renewed confidence that the US economy might avoid a recession. The yield on the benchmark 10-year Note jumped 13.7 basis points to 4.846%, the highest at 3.00 pm ET since July 25th, 2007. Meanwhile, the 2-year Note settled at 5.208, up 9.9 basis points, the highest in 17 years, while the 30-year bond closed at 4.931%, higher by 7.8 basis points.

Gennadiy Goldberg, the head of US rates strategy at TD Securities, believes we are in an air pocket between 4.5% and 5.3% on the 10-year rate, with the high end of the range prevailing before the 2007-2009 financial crisis. He, however, thinks the 10-year might not get close to 5% in the next couple of weeks due to the lack of resistance between the current level and 5%, which could block any further upside moves.

In the currency markets, the US dollar rallied against its counterparts in the currency index (DXY) immediately after the retail sales data was announced but pulled back during the session to end flat at 106.25 on Tuesday. The US currency slid 0.16% versus the euro, while it rose 0.19% against the Japanese yen and 0.24% to the pound sterling.

The yen closed a tad below ¥150.00 to the greenback as traders remained wary of the possibility of a currency intervention by the Bank of Japan. Meanwhile, the pound sterling slipped on news from the UK labor market, which showed a drop in job vacancies and a slowdown in employee salaries.

Technical View

EUR-USD

The EUR-USD pair closed 0.16% higher at 1.0577 on Tuesday, registering the second successive positive close. The single currency has been trading in a narrow band between 1.0450 and 1.0640 for the last three weeks. While the pair is in a primary downtrend versus the US dollar, if the near-term support at 1.0450 is taken out, the decline could extend to 1.0300-1.0350 (lower red trendline) max. However, if the pair closes on the higher side of the range at 1.0640, the gains could extend to 1.0760 in the near term. Click the link to view the chart TradingView — Track All Markets

Strategy: Go short at 1.0640 with a stop and reverse at 1.0680 for a profit target of 1.0460. If the stop loss hits, continue holding long positions with fresh sell stops at 1.0640 and exit as prices approach 1.0760 (Fibonacci line).

EUR-USD daily chart

Nasdaq 100 E-mini December futures

The Nasdaq December futures closed 0.32% lower at 15240.75 on Tuesday, reversing a part of the 1.12% run in the previous session. The index futures are in a long-term downtrend, with key resistance at 15522.00, and although there were a couple of attempts to break into the primary bullish trend last week, they failed. The immediate support is at the bottom of the recent range of 15050-15100, with the next support at 15590-15610, with a break below it likely to push the index futures toward 14240. Click the link to view the chart TradingView — Track All Markets

Strategy:

Short the index futures at 15520, with a stop loss at 15580 for a profit target of 15150. If the stop loss is triggered, enter long trades on the pullback at 15540 with a stop at 15480 for a target of 15700. Click the link to view the chart TradingView — Track All Markets

Nasdaq December futures daily chart

SingaporeUS

SingaporeUS