Risk Warning: Your capital is at risk. Statistically, only 11-25% of traders gain profit when trading Forex and CFDs. The remaining 74-89% of customers lose their investment. Invest in capital that is willing to expose such risks.

AVATrade review

Overview

Our 5-step process of verification and evaluation – How do we obtain information?

General inspection – 30%

Trading experience – 30%

Technical audit – 20%

Collective experience from collaborations with the broker – 10%

Interviews with real traders – 10%

See the entire process here.

Pros

Highly Regulated and Trustworthy

Excellent Educational Resources

User-Friendly Platforms

A Range of Different Account Types

Competitive Spreads on Some Instruments

Excellent Customer Service

Cons

High Inactivity Fees

High Pricing for Retail Accounts

Does Not Allow US & Canadian Clients

General details

Customer reviews

score

Read real reviews from traders all over the world:

Accounts

Type of Trading Accounts on AVATrade

AVATrade offers various trading accounts to cater to the needs of different types of traders, from beginners to experienced professionals.

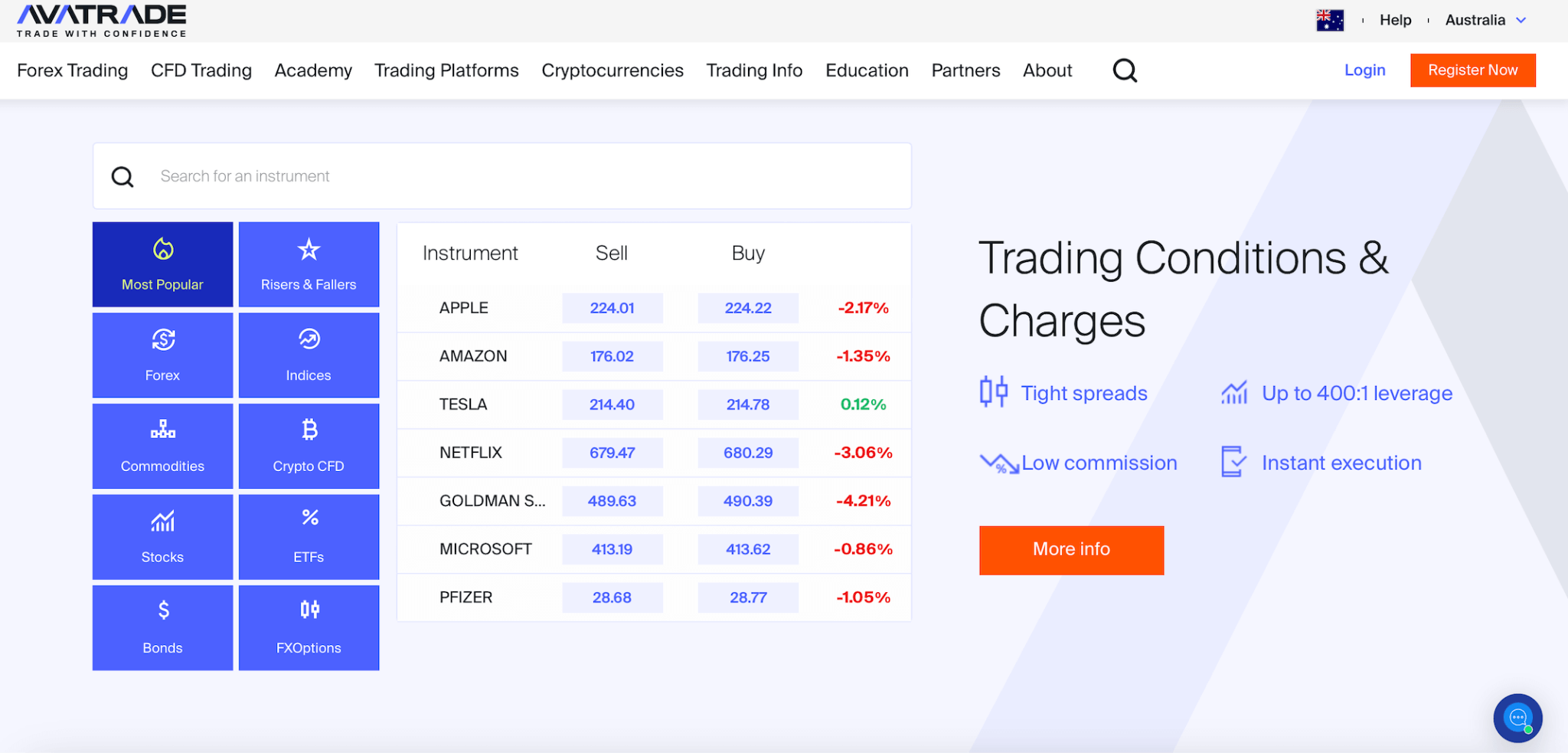

- Standard Account: The Standard account is designed for beginner traders in the Forex and CFD markets. The minimum deposit requirement for a Standard account is $100. It offers variable spreads and leverages up to 1:400. The account also provides access to various trading instruments, including Forex, stocks, indices, commodities, cryptocurrencies, bonds, and ETFs.

- Retail Account: The Retail account is designed for traders with more Forex and CFD market experience. The minimum deposit requirement for a Retail account is $1,000, which offers variable spreads and leverages up to 1:30. The account also provides access to a wider range of trading instruments, including Forex, stocks, indices, commodities, cryptocurrencies, bonds, and ETFs.

- Professional Account: The Professional account is designed for experienced traders who meet specific criteria, such as having a certain level of trading experience, financial knowledge, and trading volume. The account provides access to various trading instruments, including Forex, stocks, indices, commodities, cryptocurrencies, bonds, and ETFs. The account also offers lower spreads and higher leverage, up to 1:400, depending on the instrument traded.

- Demo Account: AVATrade also offers a demo account for beginners who want to practice their trading strategies and test the trading platforms without risking their capital. The demo account provides access to various trading instruments and allows traders to trade with virtual funds.

Trading Denominations on AVATrade

AVATrade allows traders to deposit and trade in currencies, including USD, EUR, GBP, and AUD.

Company Structure

AVATrade was founded in 2006 to provide a reliable and user-friendly trading environment for Forex traders. Since its inception, the company has experienced exponential growth and expanded its services to cater to traders of all levels. Today, AVATrade has thousands of registered customers globally and executes over two million monthly trades, with total trading volumes surpassing $70 billion.

The AVATrade Forex Broker is a multinational company with regional offices and sales centers in Paris, Dublin, Milan, Tokyo, and Sydney. AVATrade’s global presence enables it to provide localized support to its clients, making it easier for traders to get assistance in their preferred language and time zone. The company’s administrative headquarters are located in Dublin, Ireland.

The company has won over 30 reputable industry awards since 2009, including Best Forex Broker, Best Trading Experience, and Best Customer Service awards. These awards are a testament to AVATrade’s commitment to providing its clients with high-quality services and a positive trading experience.

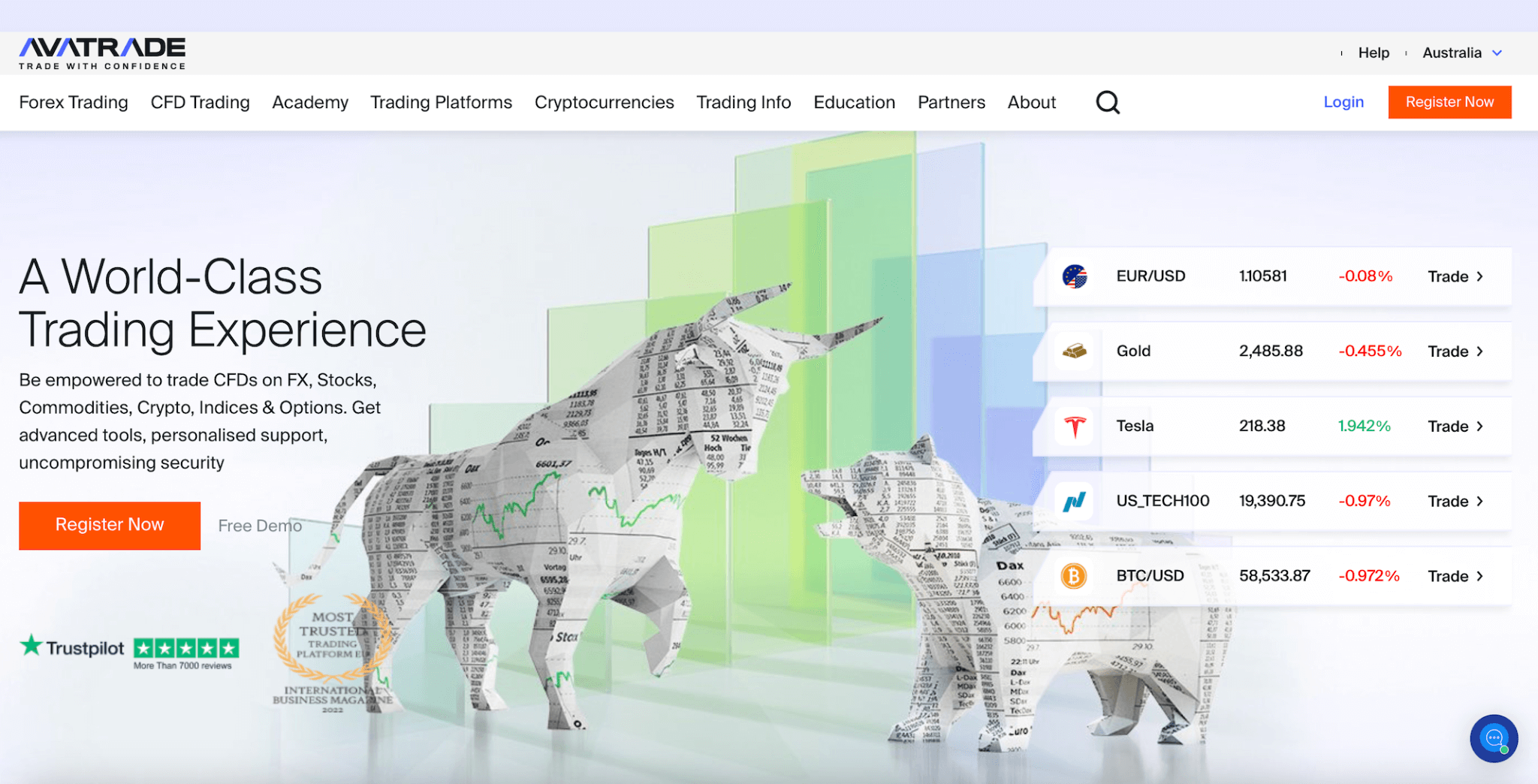

Tradable instruments

Tradable instruments on AVATrade trading platforms include:

Frequently asked questions

Find the right answer to your question below.

AvaTrade is a highly regulated broker providing extensive customer support. This includes negative account balance, segregated funds, and encryption. Having been founded in 2006, AvaTrader has a long history with great reviews and comments from industry experts.

AvaTrade offers several trading platforms. It offers MetaTrader 4 & 5. These are industry-standard platforms which come with a range of charting tools and features. This broker also offers a Web Trader platform, which doesn’t require any downloads or installation. For trading on-the-go, AvaTradeGO is the proprietary app which is available on iOS and Android.

AvaTrade has different minimum deposits depending on the type of account chosen. The Standard Account requires a $100 minimum deposit. However, the Retail Account requires a higher minimum of $1000, which is a considerable amount compared to many other brokers.

One of the main negative comments about AvaTrade concerns the lack of diverse accounts for experienced traders. The Retail Account is the prime choice for these types of traders and with a high minimum amount, it can be alienating for some.

AvaTrade offers a Demo Account which is ideal for beginners. This allows new users to practice their trading skills and strategies without the risk of using real money.

AvaTrade offers excellent customer support which is available through email, telephone, and live chat. Support is available 24/5 through several languages. Many users rate AvaTrade’s customer support responsiveness and quality very highly.

AVATrade compared with alternative brokers

To see the full broker review click “See review”, to see the complete table and compare more brokers visit our Comparison page.

- Overall verdict

- Trading

- Minimum deposit

- Maximum leverage

- Fees

- Withdrawal fee

- Deposit fee

- Safety

- Top-tier regulators

- Investor protection

-

3.7/ 5

-

3.8/ 5

- $100

- 1:400

-

3.2/ 5

- $0

- $0

-

4.2/ 5

- ASIC, CBI

-

See review

-

Free VPS hosting

-

24/7 instant money withdrawal

-

Specialized trading accounts

-

4.9/ 5

-

5/ 5

- $10

- 1:2000

-

4.8/ 5

- 1%

- $0

-

4.9/ 5

- No

-

See review

-

Specialized trading accounts

-

Free VPS hosting

-

24/7 instant money withdrawal

-

4.5/ 5

-

4.6/ 5

- $5

- 1:888

-

4.3/ 5

- $0

- $0

-

4.7/ 5

- ASIC, FSC, CYSEC

-

See review

-

Specialized trading accounts

-

24/7 instant money withdrawal

-

Free VPS hosting

-

4.9/ 5

-

4.9/ 5

- $10

- 1:2000

-

4.8/ 5

- $0

- $0

-

4.6/ 5

- FCA, CYSEC

-

No

No

-

See review

-

4.1/ 5

-

4.2/ 5

- 0$

- 1:400 (1:30 for EU)

-

3.9/ 5

- 0$

- 0$

-

3.9/ 5

- FCA

-

See review

SingaporeSG

SingaporeSG

United StatesUS

United StatesUS