BCS, too, declines as ESI and EEI fall by over 1.0 points amid waning confidence

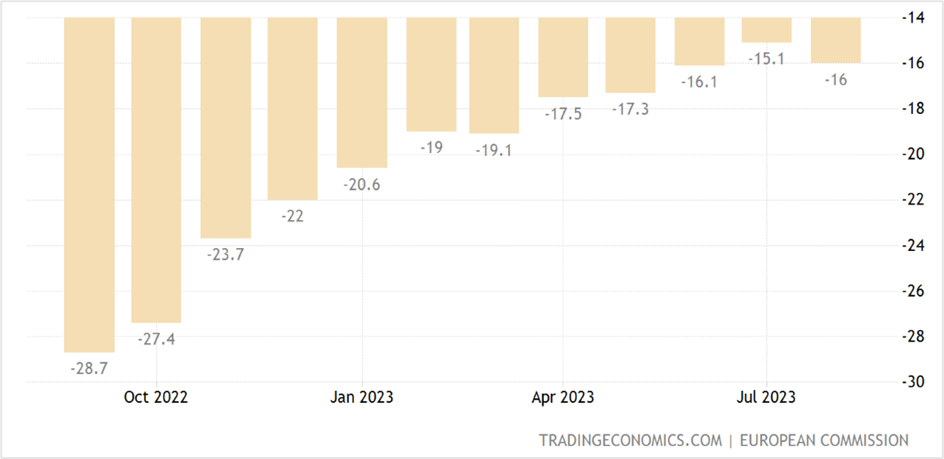

The Flash Consumer Confidence Index in the euro area fell by 0.9 percentage points to minus 16 in August 2023 from minus 15.1 the previous month as surging inflation worsened economic activity and slowed economic development, data released by the Directorate-General for Economic and Financial Affairs (DG ECFIN) showed. A poll of economists by the Wall Street Journal expected the consumer confidence index to improve in the 20-member bloc.

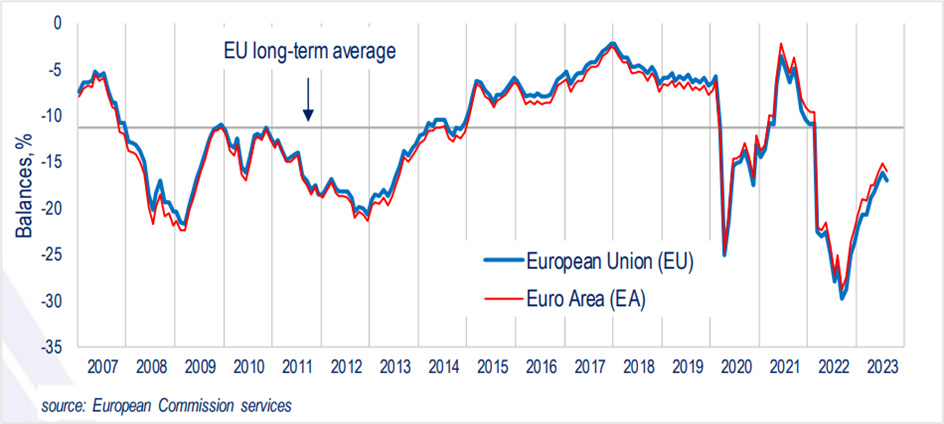

The decline in the August sentiment, the first since March this year, reversed the uptick in consumer confidence from the previous month, with the index continuing to remain well below its long-term average as high inflation and rising interest rates squeeze consumers' income.

The consumer price index in the eurozone was at 5.3% year-on-year in July 2023, the least since January last year, amid a drop in energy prices, and although inflation has eased quite a bit since then, it's still way above the Central Bank's target of 2%. The worsening consumer expectations align with declining private-sector output, impacting the business climate in the region and increasing the woes of the ECB as it attempts to cap inflation by raising interest rates incessantly, even as it dodges pushing the eurozone into a recession.

Euro Area consumer confidence- August 2023

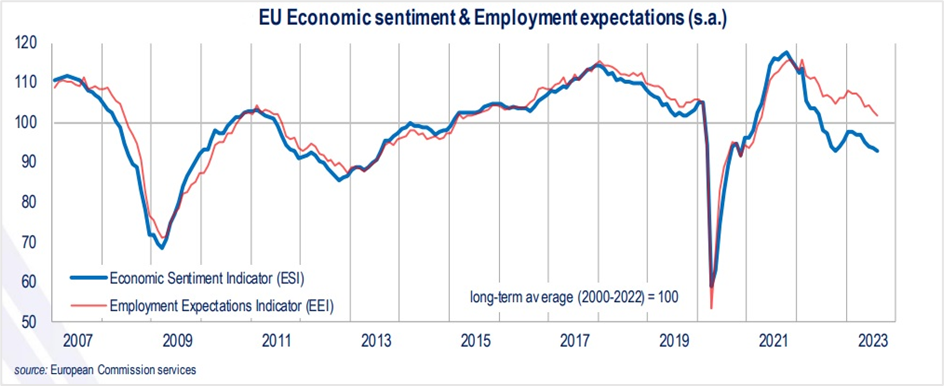

Euro Area Business and Consumer Survey (BCS) – August 2023

In other economic data announced by the Directorate-General for Economic and Financial Affairs (DG ECFIN) on 30th August 2023, the Business and Consumer Survey (BCS) in the eurozone slid again in August, with the Economic Sentiment Indicator (ESI) down 1.2 points to 93.3, while the Employment Expectations Indicator (EEI) dropped 1.3 points to 102.1.

The fall in the Economic Sentiment Indicator (ESI) was primarily due to waning confidence by managers representing the consumer, services, retail trade, and construction sectors. On the contrary, industry confidence recorded a 0.3-point dip, a solid recovery after six months of sharp declines, a sign that the business climate in the manufacturing sector could improve going forward. Among some prominent economies in the EU where ESI declined was France, with a 2.5-point drop, Germany minus 2.4, and Italy minus 1.1. Contrarily, ESI improved in Spain by +1.5 points and Poland by +1.2 points, while sentiment was almost unchanged in the Netherlands at +0.2 points.

On the other hand, the Employment Expectations Indicator (EEI) slid as managers from services, construction, and retail trade lowered their hiring expectations, while those from the manufacturing industry raised expectations. The key highlight of the August EEI indicator was the marginal improvement in consumers' unemployment expectations from July, although they are not included in the headline indicator.

Meanwhile, the European Commission's Economic Uncertainty Indicator (EUI) eased by 1.0 point to 19.7 in August as managers in the manufacturing industry, services, and retail trade were uncertain about future business conditions while consumers were unsure about their future financial position. The exception was a rebound in the uncertainty among managers in the construction industry.

The composite index measures consumer confidence in the eurozone by compiling data from five monthly surveys comprising the manufacturing industry, services, consumer, construction, and retail trade. The confidence indicators thus produced reflect consumers' broad insights and expectations at the individual sector level and are used to determine potential consumer and business spending in the eurozone.

Market Reaction

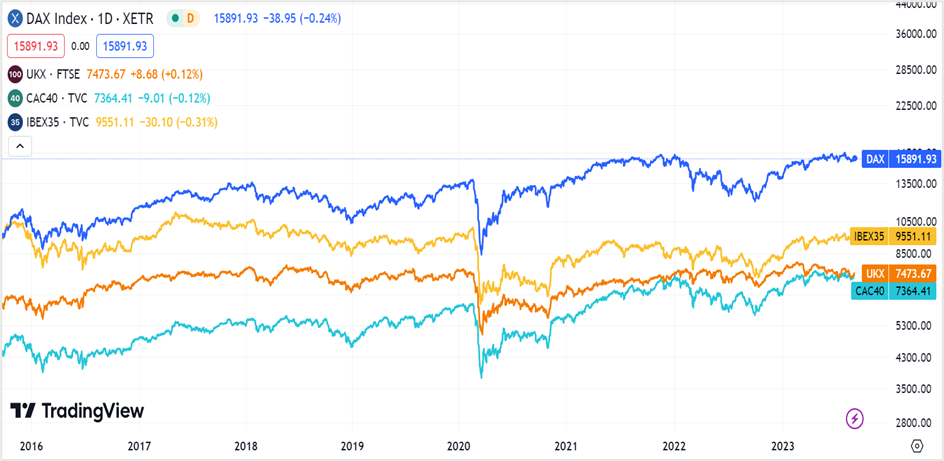

Weak consumer sentiment weighed on European equities, with the key stock indices in the region reversing the morning session gains to end mixed on Wednesday. Also, a separate report by Eurostat on Wednesday showed inflation expectations of consumers in the euro area surged to 9.0 in August from 4.9 the previous month, beating Street expectations of 8.6, reinforcing the view that rising prices would drive interest rates higher, leading to deteriorating labor market conditions, and slowing economic development.

The German DAX, France's CAC 40, and Spain's IBEX 35 closed with losses, while the UK's FTSE 100 ended with small gains.

Meanwhile, US equities extended gains on Wednesday, with the primary stock benchmarks ending the fourth successive session in the green. The S&P 500 rose 0.38% to settle at three-week highs of 4514.87, the 30-stock Dow Jones Industrial Average closed at 34890.24, higher by 0.11%, and the Nasdaq 100 climbed by 0.56% to end the day at 15462.

Traders await a slew of economic data from the US this week, with the July PCE index due to be announced on Thursday, 31st August, and the nonfarm payrolls and the unemployment data out on Friday, 1st September.

Technical View

Overnight, the EURJPY settled at 159.73, the highest since 28th August 2008, as traders await the eurozone inflation data on Thursday for signs on whether the ECB will pause or continue its rate hiking cycle.

On charts, the EURJPY is in a primary uptrend, with the gains likely to extend after the pair took out key resistances to close above 159.30 (horizontal red line). If the support holds for the next 3-4 trading sessions, it could push the pair toward the top end of the long-term bullish channel at 164.00-164.50. On the contrary, a close below 159.30 will lead to the euro pulling back toward the near-term support at 155.00-155.50, indicated by the green trendline.

The short-term trading call would be to go long on the EURJPY at 159.30, with a stop loss at 158.80 for a profit target of 164.00. However, if the pair settles below 159.30, reverse your trades with a stop at 159.70 for a target of 155.50.

Gold futures are in a primary downtrend, with prices making lower highs and lower lows (indicated by the downward-sloping red channel). However, prices are approaching key breakout levels at $1983 a troy ounce (the top end of the bearish channel), and a close above this resistance should drive the precious metal toward $2020 in the near term (the blue trendline plotted from the 31st July highs of $2010.90). Also, if gold futures close above $1983, it signals the breakout of the medium-term symmetrical triangle in an uptrend, with a 3-6 months target of $2180-2190. So, watch out for this level, as it could eventually lead to a trend reversal.

The short-term trading strategy would be to go long on gold futures if prices close above $1983 or break $1990. Place your stops at $1975 for a profit target of $2020.