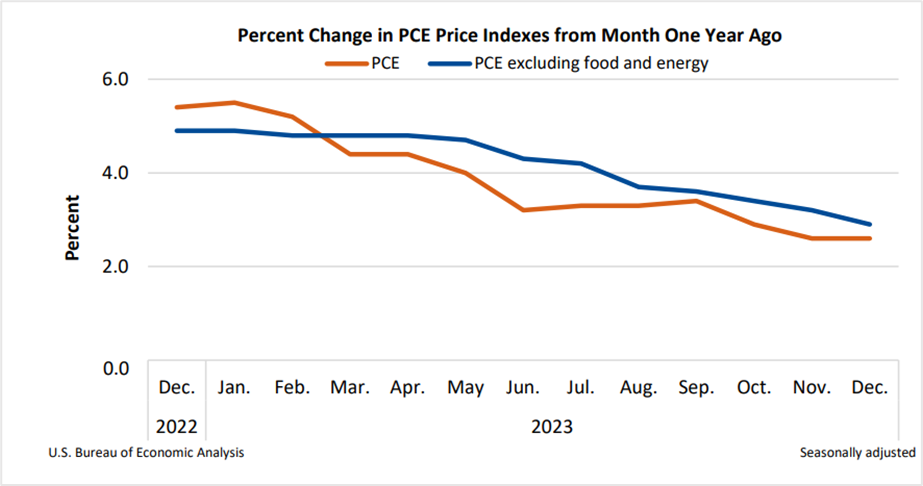

Personal consumption expenditures (PCE) rose 0.2% in December from -0.1% the previous month, while they were unchanged at 2.6% annually. Food prices increased by 0.1% and energy by 0.3%, the Commerce Department's Bureau of Economic Analysis (BEA) said on Friday. An average poll of economists by Reuters was spot on with their monthly and annual headline inflation forecast. Meanwhile, core PCE, which excludes food and energy prices, increased by 0.2% from 0.1% on the month, while it advanced at an annual pace of 2.9% from 3.2% in November, the smallest increase since March 2021.

The worst period of inflation in the last four decades is behind us, but market experts believe that prices could take a few years to return to the pre-pandemic levels. Meanwhile, the Federal Reserve spiked up interest rates to multi-decade highs of 5.25%-5.50% to tame inflation, and although it has not impacted the economy from advancing, analysts believe it won't be long before high borrowing costs depress growth.

According to Wall Street experts, the uptick in inflation will not impede Federal Reserve officials' decision to leave interest rates unchanged at current levels even as they chart the future monetary policy path. Policymakers will gather on January 30th-31st for the first FOMC meeting in 2024, with markets overwhelmingly anticipating a no-change policy.

Key highlights of the PCE index report

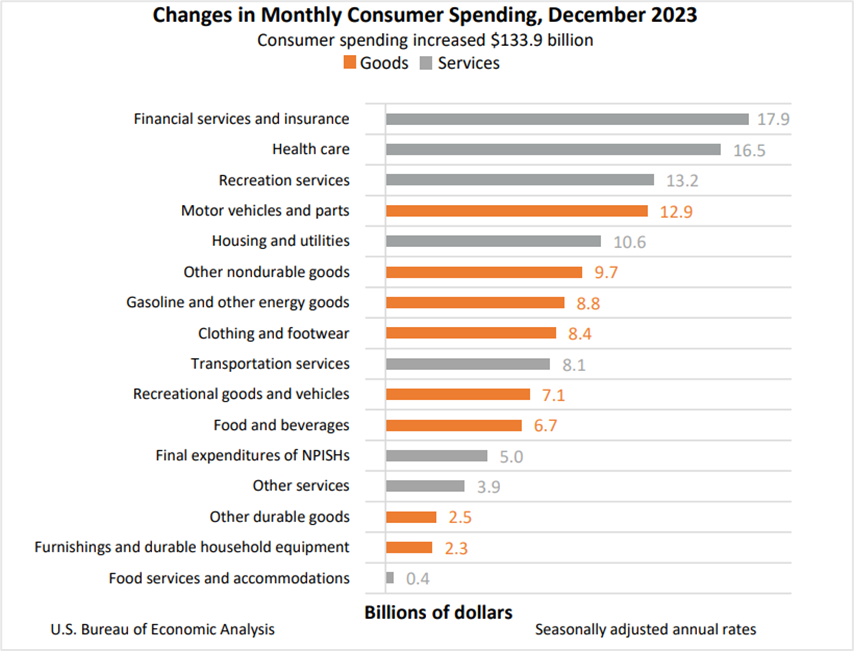

Personal income surged by 0.3% or $60.0 billion month-on-month in December, while disposable personal income (DPI), which subtracts taxes from personal income, increased by 0.3% or $51.8 billion. Personal outlays, comprising the sum of personal consumption expenditures (PCE), personal interest payments, and personal current transfer payments, advanced by 0.7% or $134.7 billion, while consumer spending rose by 0.7% or $133.9 billion. Meanwhile, personal savings came in at $766.7 billion in December, with the personal saving rate at 3.7%.

Consumers spent on both services and goods. Within services, the most significant contributors to the increase were financial services, insurance, health care, and recreation services. Within goods, the biggest contributors were motor vehicles and parts, other nondurable goods, gasoline, and other energy goods.

Economists' review of the PCE index Dec report

Jeff Klingelhofer from Thornburg Investment Management believes rising inflation shouldn't concern the markets significantly at this point since Fed officials have pointed out that even if inflation falls and interest rates don't change, the tightness of the monetary policy increases.

Joseph Brusuelas, the chief economist at RSM, said the Fed's preferred inflation gauge implies it could hit the central bank's 2.0% target shortly and will create an environment for policymakers to begin a multi-year policy pivot that will interest rates toward a 2.5%-3.0% range. The Fed's benchmark interest rate is currently at 5.25%-5.50%.

Gus Faucher, an economist at PNC Financial Services, believes the pace at which inflation slows will determine a recession. If inflation falls to 2% by the same time next year, it would be due to a downturn. But if economic growth slows without faltering, it could drop to the Fed's target by the year's end or early 2025.

Market reaction to the personal consumption expenditures news

The US stock markets ended mixed on Friday, with the key stock indices scaling fresh all-time highs multiple times during the week. The S&P 500 and the Nasdaq 100 slid from record highs, while the Dow Jones Industrial Average closed with small gains as investors booked profits ahead of the FOMC meeting and the unemployment report this week. But despite the pullback, the three major indices settled higher for the third week in a row, marking twelve weekly gains out of thirteen.

The S&P 500 hit record closes in the last five out of six sessions, primarily led by the tech sector, with stocks like Nvidia (NVDA), Broadcom (AVGO), Advanced Micro Devices (AMD), Microsoft (MSFT), and Apple (AAPL) registering solid gains as the Artificial Intelligence (AI) craze boosted the broader market to record highs. However, the other ten sectors in the benchmark stock index are trading around 15% below their all-time peaks, perturbing investors since a few heavyweights driving the broader market could be vulnerable to a downturn if they stumble.

Yields on US Treasurys mostly ended higher on Friday, reversing the morning session lows as the December personal consumption expenditures report reinforced investor expectations that the US economy will pull off a soft landing. However, the fall in yields was shortlived amid worries about more government debt hitting the markets and the need for the Federal Reserve to reduce its balance sheet.

The yield on the 2-year Treasury Note gained 5.6 basis points to end at 4.355%, the yield on the 10-year TNote rose 2.1 basis points to 4.141%, and the 30-year Tbond yield slipped one basis point to 4.271%. Meanwhile, the yield curve between the inflation predictor 2-year and 10-year TNotes remained inverted by 21.4 basis points.

This week, the US Treasury Department will auction another round of debt securities as the government prepares to meet its spending requirements for the coming quarter amid high social security and interest payments.

According to Kim Rupert from Action Economics, Treasury securities are already at a record in terms of issuance size, with a couple of coupons at record levels. With supply outstripping demand,five-year notes sold at 4.055% or higher last Wednesday as investors demanded higher premiums to take on additional debt.

The US currency slipped against its counterparts in the dollar index (DXY) on Friday after the PCE price index data rose modestly in December, raising hopes of a rate cut later this year. The index, which tracks the performance of the US dollar against a basket of six currencies from developed nations, slid 0.14% to 103.433 amid low volumes as investors awaited the outcome of the FOMC meeting on Wednesday and the nonfarm payrolls data toward the end of the week.

Spot EURUSD and the GBPUSD pairs closed nearly unchanged at 1.0853 and 1.2703, respectively, while the greenback gained 0.33% to settle at 148.14 versus the Japanese yen.

According to Jonathan Peterson, an economist at Capital Economics, despite the solid economic data from the US, disinflationary pressures have capped the surge in the US dollar, and against this backdrop, the outlook for a stronger greenback remains grim over the next few quarters.

Technical View

WTI crudeoil March futures (CLH24)

Crudeoil futures rose for the third successive day on Friday to close at $78.01 a barrel, marking the highest settlement since November 14th. The sharp increase in oil prices comes from several factors ranging from positive economic sentiment in the US and Chinese stimulus- both expected to boost demand while mounting tensions in the Middle East are expected to disrupt supply.

WTI crude is in a primary downtrend, but last week, prices broke through crucial resistance and December highs of $76.18, indicating an extension of the bull run over the near term. Prices could now surge to the next resistance level at $79.50-$80.00 and further toward the $86.00-$90.00 zone. On the downside, the immediate support is at $76.00, followed by $72.00.

Trading Strategy:

You can initiate long positions in crudeoil at three levels.

First– Enter long trades if prices close above $80.00 or break $81.50. Have a stop loss at $79.00 and exit as prices approach $86.00.

Second- Open long positions if prices dip to $76.00 a barrel, with a stop loss at $75.00 for a profit target of $79.00.

Third- Long positions can also be set up if oil prices drop to $72.00. Place a stop loss at $71.00 and exit in the $76.00-$79.00 zone.

Ensure that trailing stop orders are placed on your trades.

WTI crudeoil March futures (CLH24)- Daily chart

Click the link to view the chart- TradingView — Track All Markets

Spot EURUSD

The euro closed almost unchanged at 1.0853 against its US counterpart on Friday, pausing the previous day's fall after the European Central Bank left interest rates unchanged at their first policy meeting in 2024, and the US economy expanded by 3.3% in the last quarter of 2023.

The pair has been trading in a tight band with a downward bias over the past few weeks, and this will likely continue in the near term, with prices likely to swing between the support zone at 1.0750- 1.0760 and resistance at 1.0950. A breakout of either of these levels could drive the pair by 150-200 points in that direction.

Trading Strategy:

Open long EURUSD positions at 1.0750/60 with a stop loss at 1.0700 for a profit target of 1.0870-1.0950. On the other hand, if the euro surges from the current levels, short the pair at 1.0950 with a stop and reverse at 1.0990 for a profit target of 1.0770-1.0800. If the stops are hit, hold on to the long trades with a stop loss at 1.0920 for a profit target of 1.1110.

Ensure that trailing stops are placed on your trades.

Spot EURUSD- Daily chart

Click the link to view the chart- TradingView — Track All Markets

SpainUS

SpainUS