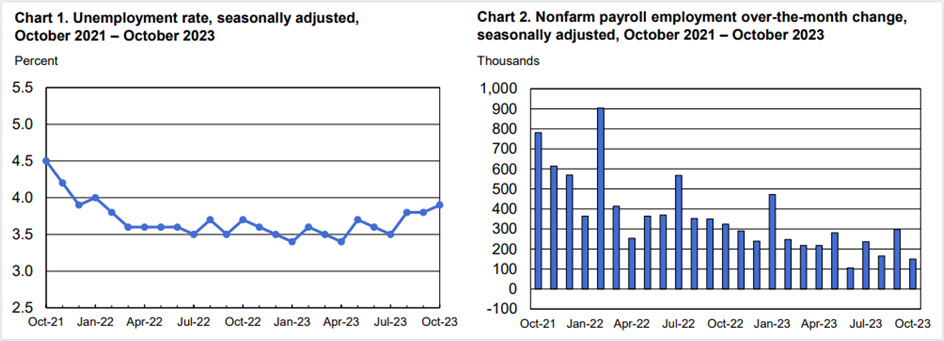

Unemployment rate climbs to 3.9% in October, the highest since January 2022

The US economy added 150,000 jobs in October, around half the jobs created from the downwardly revised 197,000 the previous month, data released by the Bureau of Labor Statistics on Friday showed. A poll of economists by the Wall Street Journal had forecast 170,000 people to join the labor force in October. Meanwhile, the unemployment rate slipped from 3.8% in the last two months to 3.9% in October, the highest since January 2022.

Source: US Bureau of Labor Statistics

The sharp drop in the labor force comes as high interest rates pinch corporate America and partly from a drop in manufacturing payrolls triggered by the Union Auto Workers (UAW) strikes on the big three car manufacturers. Manufacturing jobs dropped by 33,000, largely from the UAW strike against Ford, GM, and Stellantis.

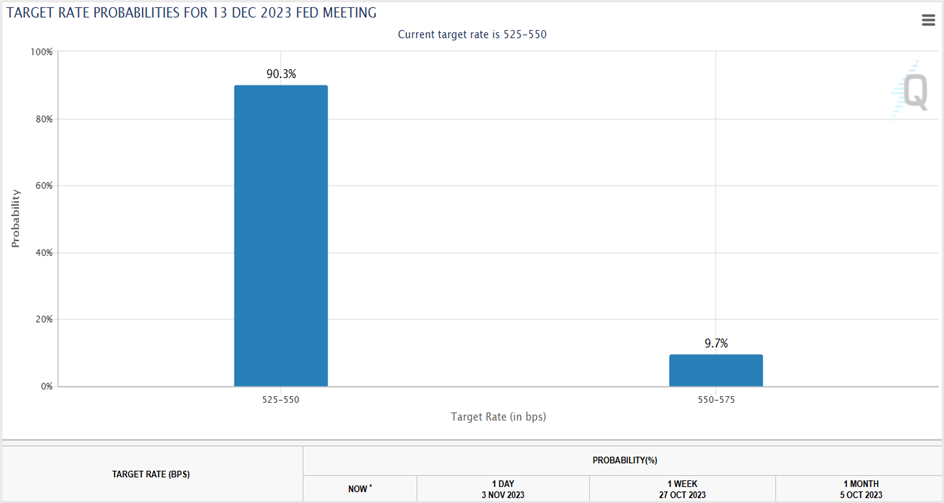

Fed officials employ wage data as one of the components to gauge inflation, and while policymakers have left the door open for additional rate hikes depending on how the incoming data pans out, most analysts believe its tightening cycle ended in July regardless of what they say. Friday’s labor statistics report has further reduced the probability of a December rate hike to just 10%, the CME FedWatch Tool showed.

Key highlights of the labor force report by the Bureau of Labor Statistics

The data presented by the BLS comprises labor statistics from two monthly surveys. First, the household survey, which measures the status of the labor force, such as unemployment. The second is the establishment survey, which gauges nonfarm employment, hours, and industry-wise earnings.

According to the October household survey, the unemployment rate, at 3.9%, and the unemployed people, at 6.5 million, were little changed month-on-month. In addition, the labor force participation rate, at 62.7%, and the employment-population ratio, at 60.2 percent, were also mostly unchanged on the month. 1.3 million people were unemployed over the long term (jobless for 27 weeks or more), accounting for 19.8 percent of the total unemployed, while there were 4.3 million part-time employees. On the other hand, 5.4 million people not in the labor force were looking for a job. These individuals were not counted as unemployed since they were not actively looking for a job in the four weeks before the survey.

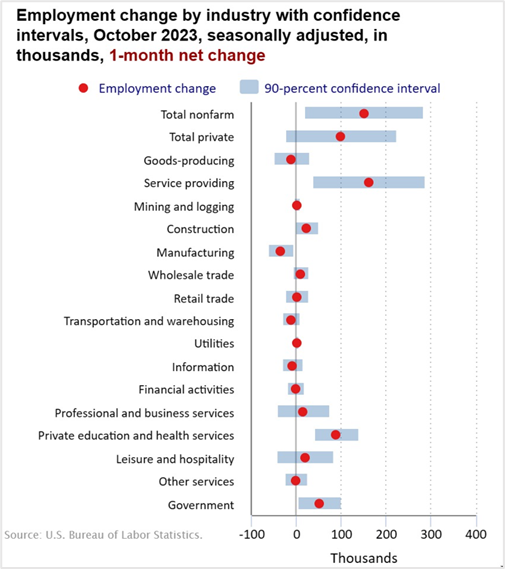

According to the establishment survey, the total nonfarm payrolls in October were below the average monthly gain of 258,000 over the previous 12 months. Nonfarm employment increased in the healthcare sector, with 58,000 jobs added, in line with the average monthly gain of 53,000, while government jobs rose by 51,000, payrolls in social assistance grew by 19,000, and construction sector jobs expanded by 23,000. On the contrary, job growth in the manufacturing sector fell by 35,000 due to a decline of 33,000 in motor vehicles and parts, primarily from the UAW strike.

Meanwhile, the average hourly earnings for all employees in the private sector rose by 7 cents, or 0.2%, to $34.00. Year-on-year, average hourly earnings have increased by 4.1 percent.

Source: US Bureau of Labor Statistics

Economists review of the nonfarm payrolls report

Sean Snaith, the director at the Institute of Economic Forecasting, believes the labor market is strong despite October’s weak nonfarm payrolls. He says we are in a protracted inflation, and the Federal Reserve’s work is unfinished.

Seema Shah, the chief global strategist at Principle Asset Management, said the nonfarm payrolls report indicates a slowing labor market. She trusts the September data, which showed the US economy added 336,000 jobs before being revised to 297,000 this month, was only a momentary blip, even as she forecasts a no-rate-hike move by the Federal Reserve in December.

David Russell, the global head of market strategy at TradeStation, said the labor market could finally be cooling after years of solid growth. According to him, a miss in the top line, in addition to lower revisions and a higher unemployment rate, is a clear message to the Fed policymakers. He believes further rate hikes will be off the table, and rate cut talks will dominate discussions next year.

Market reaction to the US nonfarm payrolls-unemployment rate report

The US stock markets closed higher for the fifth successive day on Friday as a string of positive macroeconomic data from the US led to renewed equities buying. The S&P 500 closed at 4358.34 on Friday, up 0.94% on the day to jump right back into the primary bullish trend and within range of a solid rally, which could see it targeting 5000.

Meanwhile, the Nasdaq 100 rallied 6.48% during the week to end at 15099.49, registering the highest daily settlement in almost three weeks, and the Dow Jones Industrial Average climbed 0.66% to settle at 34061.32, the most since mid-September.

Most investors have been pessimistic about US stocks, but the outcome of last week’s Federal Reserve meeting and the jobs report has infused fresh buying on hopes that interest rates have peaked. According to the chief investment officer at Raymond James private client group, Larry Adam, the stock market benchmark S&P 500 has fallen sharply and quickly, signaling a market rally toward the year-end. He believes the S&P 500 could rise by 6%-12% from current levels to hit the firm’s year-end target of 4400 and 12-month target of 4650

US Treasury yields retreated for the second successive week, with the yield on the 30-year note registering the sharpest weekly drop since March 2020. The decline in yields comes from the Fed signaling an interest rate pause in November, an increase in the most recent weekly jobless claims, and the unemployment rate rising to 22-month highs in October.

At 3.00 pm Eastern time on Friday, the yield on the rate-sensitive 2-year note fell 14 basis points to 4.828%, while the benchmark 10-year note quoted 4.668%, a drop of 11.1 basis points, and the 30-year bond slid 7 basis points to a 3-week low of 4.750%.

The greenback fell more than a percent against its counterparts in the six-currency index on Friday, registering the biggest one-day loss since July 12th, as the nonfarm payrolls report and other economic data raised expectations that interest rates won’t go any higher this cycle. The US dollar index futures slid 1.44% for the week, settling at a three-week low of 105.02 on Friday. The world’s most liquid currency fell 1.0% against the euro to close at 1.0727, while against the pound sterling and the Japanese yen, it slid 1.43% and 0.71% to end the week at 1.2377 and 149.32, respectively.

Technical View

US dollar index futures

The dollar index futures fell 1.04% to settle at 105.02 on Friday, registering the lowest close since September 13th, amid market expectations that the Federal Reserve might be done raising interest rates this cycle. The six-currency DXY broke out of a triple-top formation at 105.60, and the target for the bearish reversal is at 103.80, the range between the highest peak and the trough in the reversal pattern, with intermediate support at 104.50.

Short the dollar index from current levels to 105.50, with a stop loss at 106.20 for a profit target of 104.00-104.50. Place trailing stops to protect profits.

US dollar index futures- Daily chart

Click the link to view the chart- TradingView — Track All Markets

Gold December futures

Gold December futures closed 0.29% higher for the day at $1999.20 a troy ounce on Friday. The precious metal has been oscillating in a $40 band between $1975-$2015 a troy ounce for the last couple of weeks as it attempts to settle above crucial resistance at $2011.00. A close above this level is highly bullish for gold, with the rally likely to extend to the August 2020 highs of $2089.00 and beyond. On the downside, near-term support is at $1989.00, followed by $1970.00, a close below which prices could plunge to $1925.00- $1930.00.

Go long on December gold if prices close above $2011.00 or at the break of $2021.00. Place a stop loss at $2001.00 and exit as prices approach $2085.00. Long positions can also be initiated at $1970.00, with a stop loss at $1960.00 for a profit target of $2005.00- $2010.00.

Gold December futures- Daily chart

Click the link to view the chart- TradingView — Track All Markets

RussiaUS

RussiaUS