Sales weighed by cold weather and seasonal adjustments; expected to rebound next month

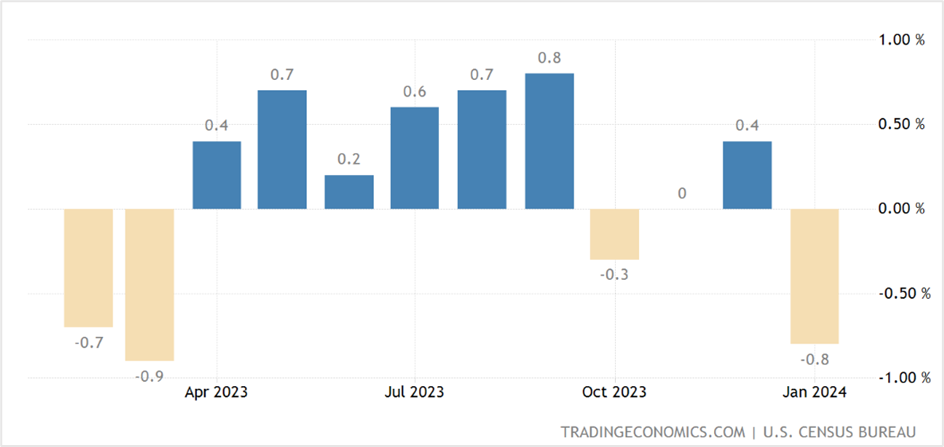

Sales at US retailers shrank 0.8% month-on-month in January, marking the lowest reading in 10 months, primarily weighed down by a drop in receipts at gasoline stations and auto dealerships, data compiled by the Commerce Department’s Census Bureau showed on Thursday. Meanwhile, the retail sales figures for December were revised lower from 0.6% to 0.4%. A poll of economists by the Wall Street Journal projected a 0.2% drop, primarily due to a decline in auto sales in January. Excluding autos, sales fell by 0.6% from +0.4% in December.

Retail sales contribute to a third of all consumer spending, offering cues to the strength of the US economy. The lower-than-expected receipts were weighted down by winter storms, which kept shoppers at home after a solid holiday spending season. In addition, seasonal adjustments in January also contribute to the decline. However, as we’ve seen in the past months, retail sales have typically rebounded after contracting. Despite this, the impact will likely be felt when the Bureau of Economic Analysis announces the first quarter GDP data in April.

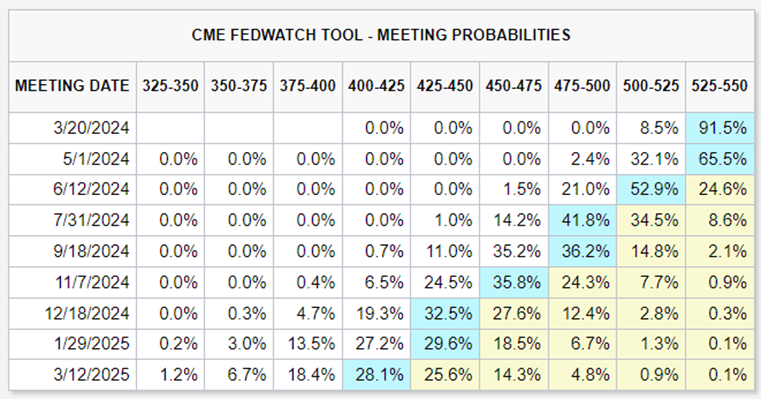

However, despite the weaker-than-expected retail sales report, the bets of a May rate cut stood at 32%, with the odds of the Fed pivoting to lower rates in June at 53%, the CME FedWatch Tool showed.

Source:cmegroup website

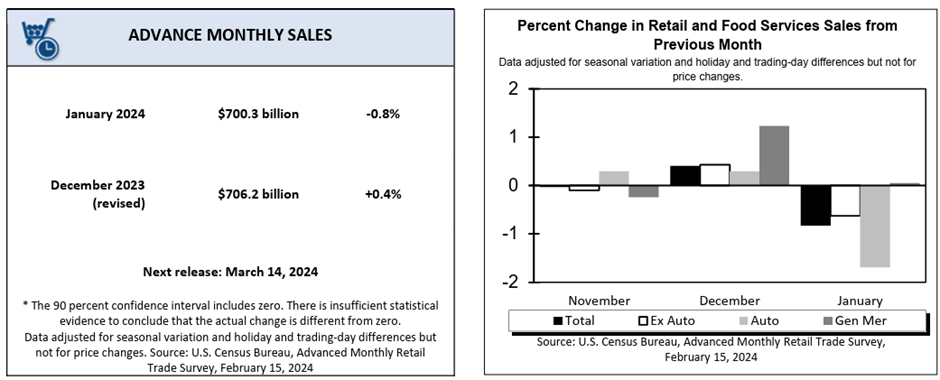

Key highlights of the advance monthly sales for retail and food services

The advance estimates of US retail and food services sales, adjusted for seasonal variation and holiday and trading-day differences, excluding price changes, came in at $700.3 billion month-on-month in January, shrinking by 0.8% from the previous month and up 0.6% from January 2023.

Receipts at nonstore retailers rose 6.4% from last year, while those at food services and drinking places surged 6.3% during the corresponding period. Higher sales were also reported at food services and drinking places, departments, and grocery stores.

On the other hand, sales fell by 1.7% month-on-month at motor vehicles and parts dealers, 1.7% at gasoline stations, 1.1% at health and personal care stores, and 3.0% at miscellaneous store retailers.

You can view all the details about the Advance Estimates of US Retail and Food Services HERE

Economists review of the Commerce Department report

Bill Adams, the chief economist at Comerica Bank, believes the drop in the sales figures in January will quickly reverse once the weather clears as households catch up on their spending plans, which were delayed by the cold weather. He thinks the Federal Reserve will overlook this report since it is a temporary problem.

Robert Frick, a corporate economist at Navy Federal Credit Union, said the January retail sales report is weak but does not signal a fundamental shift in household spending. He doesn’t expect consumer spending to be robust this year, but he believes the economy will keep expanding amid surging employment and wage growth.

Neville Javeri, a portfolio manager at Allspring Global Investments, thinks markets are cheering the weak retail sales figures and negating the impact of the higher-than-expected consumer inflation in January.

Market reaction to the US retail sales report

The US stock markets rose for the second consecutive day on Thursday after the weaker-than-expected retail sales figures reignited rate-cut hopes amid expectations that the US economy might be slowing down. The 30-share Dow Jones Industrial Average (DJIA) surged 0.91% to 38,773.12, the benchmark S&P 500 climbed 0.58% to 5,029.73, registering its eleventh-record close this year, while the Nasdaq 100 rose 0.21% to 17,845.72.

While investors remained optimistic, some economists believed bad news on the economic front was great for the markets since it elevated a potential Fed rate cut. Earlier this week, the hotter-than-anticipated CPI data rolled back expectations of a Fed rate cut to June, driving stocks lower.

The top-performing sectors on Thursday included utilities, materials, and energy, which up until recently were floundering. On the other hand, Apple (AAPL) was under pressure after Warren Buffett’s Berkshire Hathaway (BRK) trimmed its stake, while George Soros Fund Management exited totally. The other losers included Alphabet, the parent of Google (GOOG), which fell more than 2% after ThirdPoint dissolved its stake.

US government debt securities rose on Thursday, with the yields declining for the second successive day after a mixed batch of economic data from the US. While retail sales fell 0.8% in January, soothing fears of inflation rebounding, the lower-than-expected weekly jobless claims report damped hopes of the labor market cooling anytime soon.

The yield on the rate-sensitive 2-year Note slipped 0.6 basis points to 4.576%, while the yields on the benchmark 10-year Note and the 30-year Bond fell by 2.3 basis points to 4.236% and 2.5 basis points to 4.412%, respectively.

According to Andrew Hunter, the deputy chief US economist for Capital Economics, the slowdown in retail sales might partly be due to weather-related problems seen in the past, although it tempers suggestions of robust economic activity. He expects US economic growth to moderate in the first quarter.

In the forex markets, the greenback weakened against its six rivals in the US dollar index (DXY) after the weaker-than-expected retail sales data showed some signs of the economy weakening, although the weekly unemployment benefits data pointed to a tight labor market. The six-currency dollar index slid 0.41% to end Thursday’s session at 104.296 but is on track to register its fifth consecutive weekly gain. The pullback in the dollar is attributed mainly to the weak retail sales report, although a separate reading of the unemployment claims for the week to February 10th showed job losses at 212,000, far lower than the 220,000 expected by economists.

According to Christopher Wong, the currency strategist at OCBC-Singapore, US economic activity is showing signs of slowing down, which is playing on the US dollar, and believes that a softer reading on the January PPI data will lead to further USD weakness.

Technical View

Tesla Inc (TSLA)

Tesla shares jumped 6.2% to $200.45 on Thursday to register the highest close in three weeks, breaking out of a key bullish reversal pattern in the process. The stock has rebounded more than 16% after plunging to multi-month lows earlier in February after the company reported weak fourth-quarter earnings for 2023 and delivered a dim outlook for this year.

Over the past few weeks, the EV maker’s shares have formed an inverted head and shoulders pattern, with the breakout finally occurring on Thursday. The breakout of the bullish reversal pattern at $195.00 could drive prices to $216.00 over the next few days, and if the momentum continues, the gains could extend further toward key long-term resistance at $229.00-$231.00.

On the downside, the immediate support is at the breakout level of $195.00, followed by $180.00.

Strategy:

Buy Tesla shares if prices dip to $195.00, with a stop loss at $189.00 for a profit target of $216.00- $230.00. However, if the shares continue to surge from Thursday’s rally, initiate long positions at the break of $211.00, with a stop loss at $202.00, and exit as prices approach $230.00.

Ensure to trail your profits.

Tesla Inc- Daily chart

Click the link to view the chart- TradingView — Track All Markets

Spot USDJPY

The USD pulled back against the Japanese yen on Thursday to close 0.42% lower at ¥149.89 after the sharp drop in the US retail sales figures in January drove the US currency lower against all its major counterparts, more than offsetting the gloomy economic data from the Asian country.

However, the decline will be tested by the near-term support at ¥149.20/25, with successive closes below it pushing the USDJPY pair toward the ¥142.00-¥145.00 zone. On the upside, the greenback could extend gains toward the next resistance zone at ¥151.75-¥152.00- the 2022/2023 highs.

Strategy:

Go long on the USDJPY pair at ¥149.25/30 with a stop and reverse (SAR) at ¥148.75 for a profit target of ¥151.50-¥152.00. If the SAR is triggered, hold on to the short positions, with a stop loss at ¥149.75, and exit as the pair approaches ¥145.00.

On the other hand, if the US dollar extends gains from the current level, short the pair at ¥151.75-¥152.00 with a stop loss at ¥152.50 and exit at ¥149.50-150.00.

Ensure to trail your profits.

Spot USDJPY- Daily chart

Click the link to view the chart- TradingView — Track All Markets

CanadaUS

CanadaUS