Market Overview

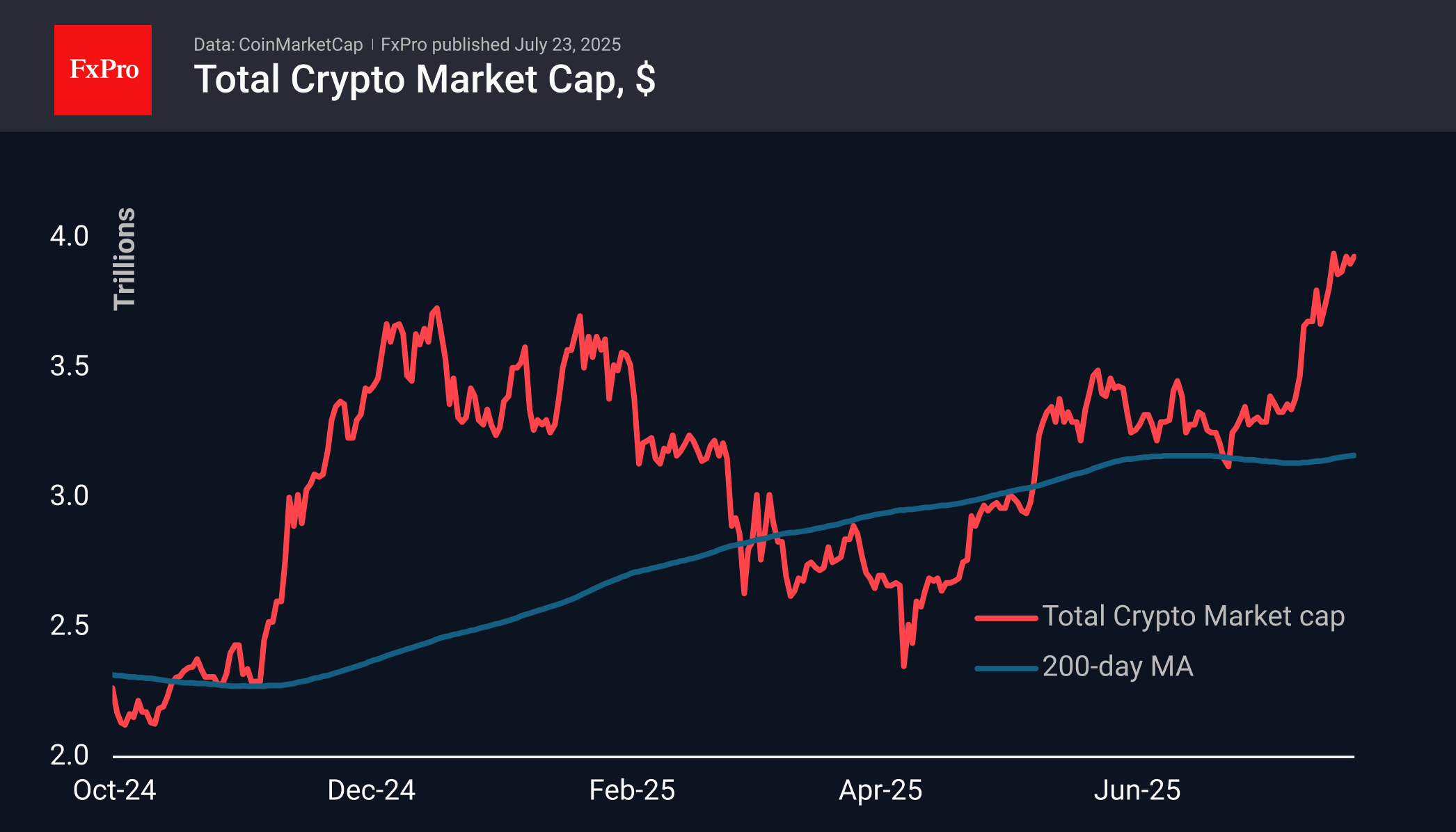

The crypto market cap continues to hover around $4 trillion, hesitant to cross this threshold. It is currently standing at $3.93 trillion. This is reminiscent of the stagnation we also saw at the end of last month. It seems that we are seeing calendar rhythms, with increased inflows at the beginning of the month and caution at the end. Cryptocurrencies are ignoring the positive sentiment on the stock markets: technical factors are temporarily dominating the agenda.

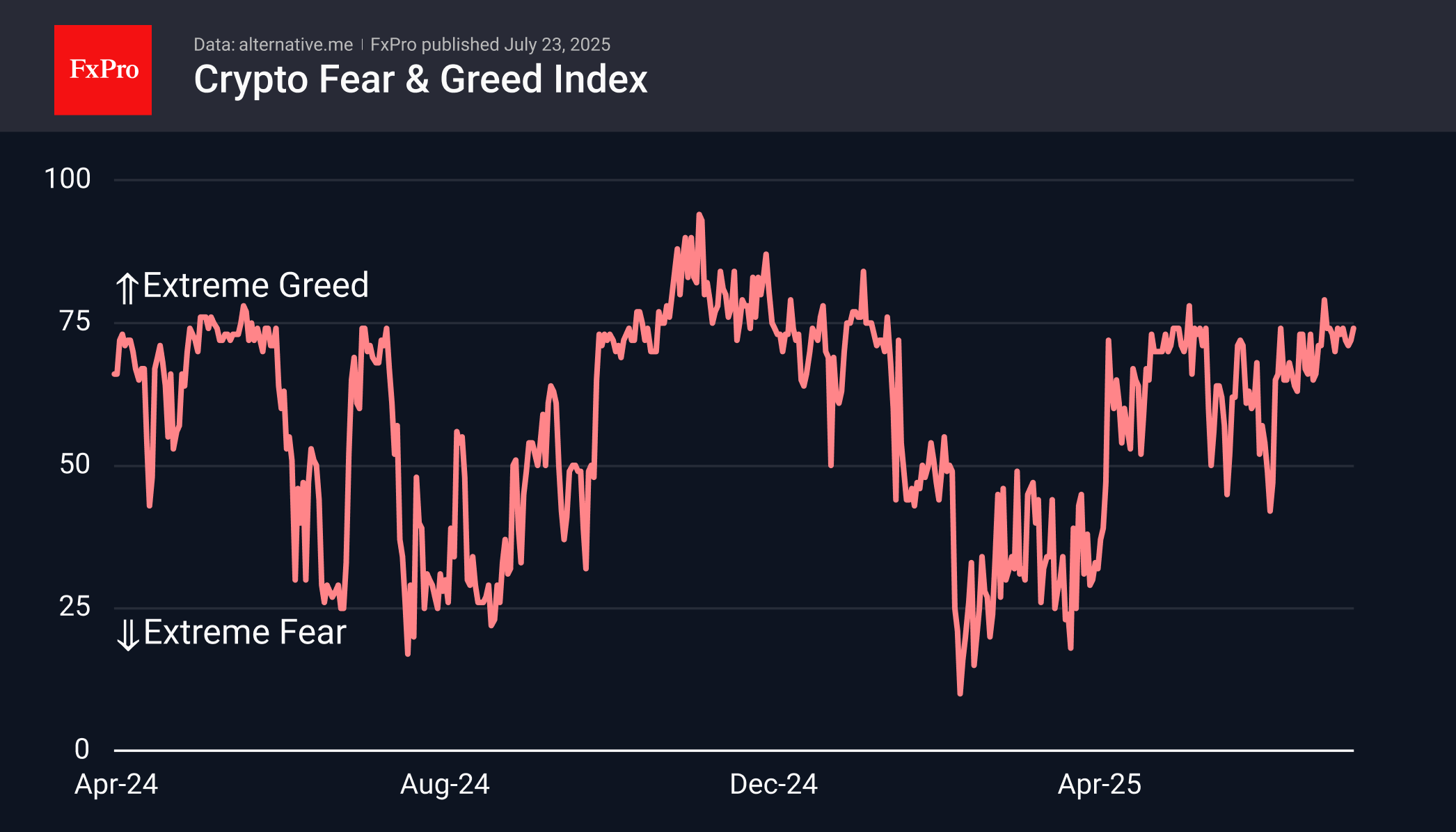

The sentiment index rose to 74, suggesting that bullish sentiment will continue and even strengthen. The lack of new significant reasons on the horizon is preventing cryptocurrencies from entering the territory of extreme greed (>75). Such a reason could be the approval of an ETF with staking or the expansion of the set of altcoins in exchange-traded funds.

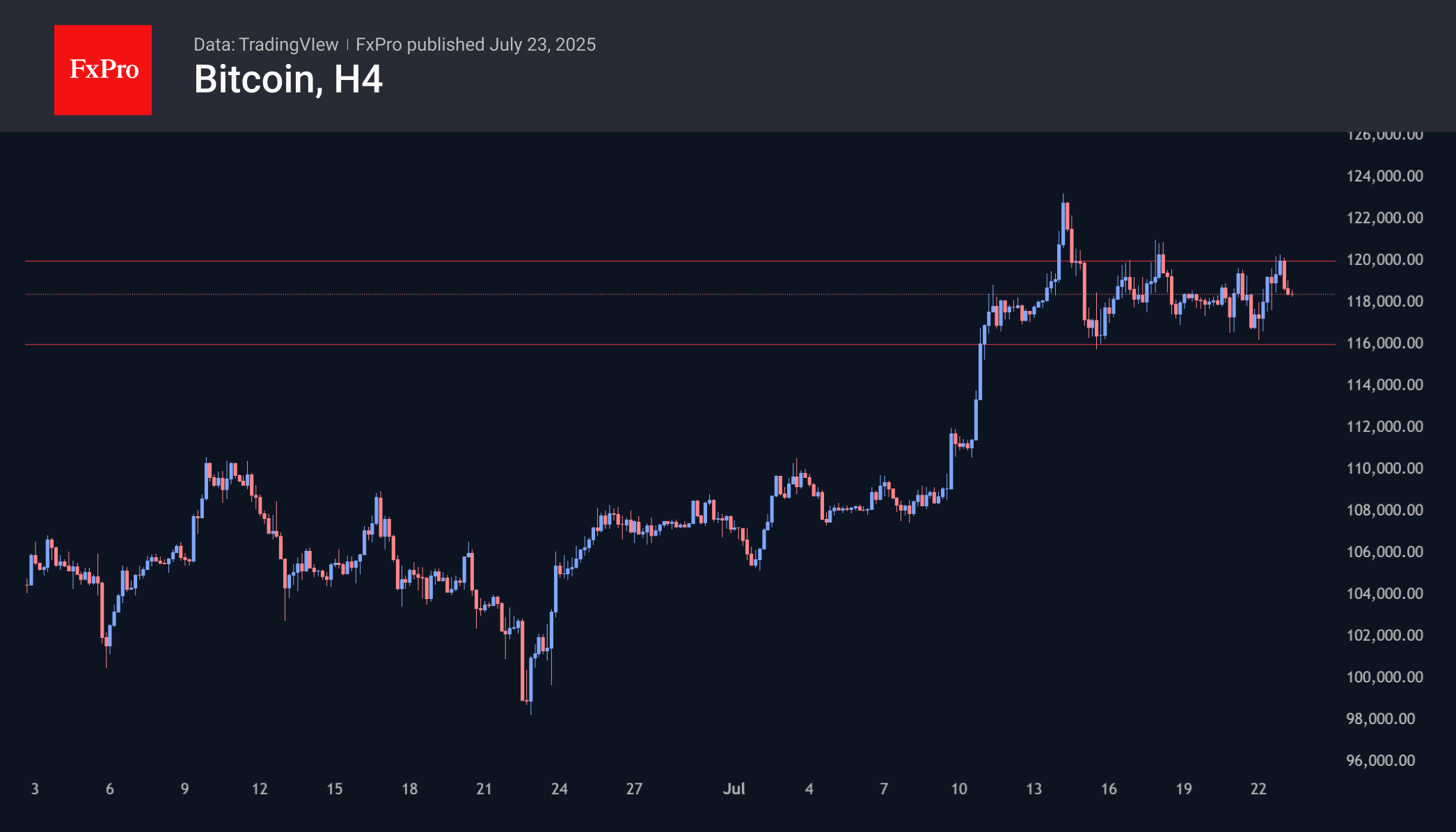

Over the past 24 hours, Bitcoin has moved from the lower to the upper limit of the $116-120K trading range and has again rolled back to its centre. This dynamic confirms the market consolidation pattern. However, this inability to grow further is now affecting altcoins, where upward movement has similarly stalled.

News Background

Dogecoin jumped 40% in a week amid growing chances of the launch of spot Dogecoin ETFs. In addition, mining company Bit Origin announced a strategy to replenish its DOGE reserves by $500 million. The firm has already made its first purchase of $40.5 million.

Strategy additionally purchased 6,222 BTC last week at an average price of $118,940, according to Michael Saylor. The company now owns 607,770 BTC at an average price of $71,755 and a total value of over $43 billion.

SharpLink Gaming, led by Ethereum co-founder Joseph Lubin, purchased 79,949 ETH for $258 million last week. The average purchase price was $3,238 per coin.

The largest US crypto exchange, Coinbase, has launched trading in perpetual futures on Bitcoin and Ethereum for US users. US traders previously did not have access to perpetual futures due to a complex regulatory framework.

The non-custodial TON Wallet is now available to US residents. Wallet options include cryptocurrency transfers in Telegram chats, built-in trading and analytical tools, staking, transaction signing, direct deposit, and withdrawal of funds to bank cards.

The FxPro Analyst Team

Source: https://fxpro.news

РобоФорекс

РобоФорекс Экснесс

Экснесс ФхПро

ФхПро Альфа-Форекс

Альфа-Форекс Либертекс

Либертекс FxGlory

FxGlory XM

XM IC Рынки

IC Рынки