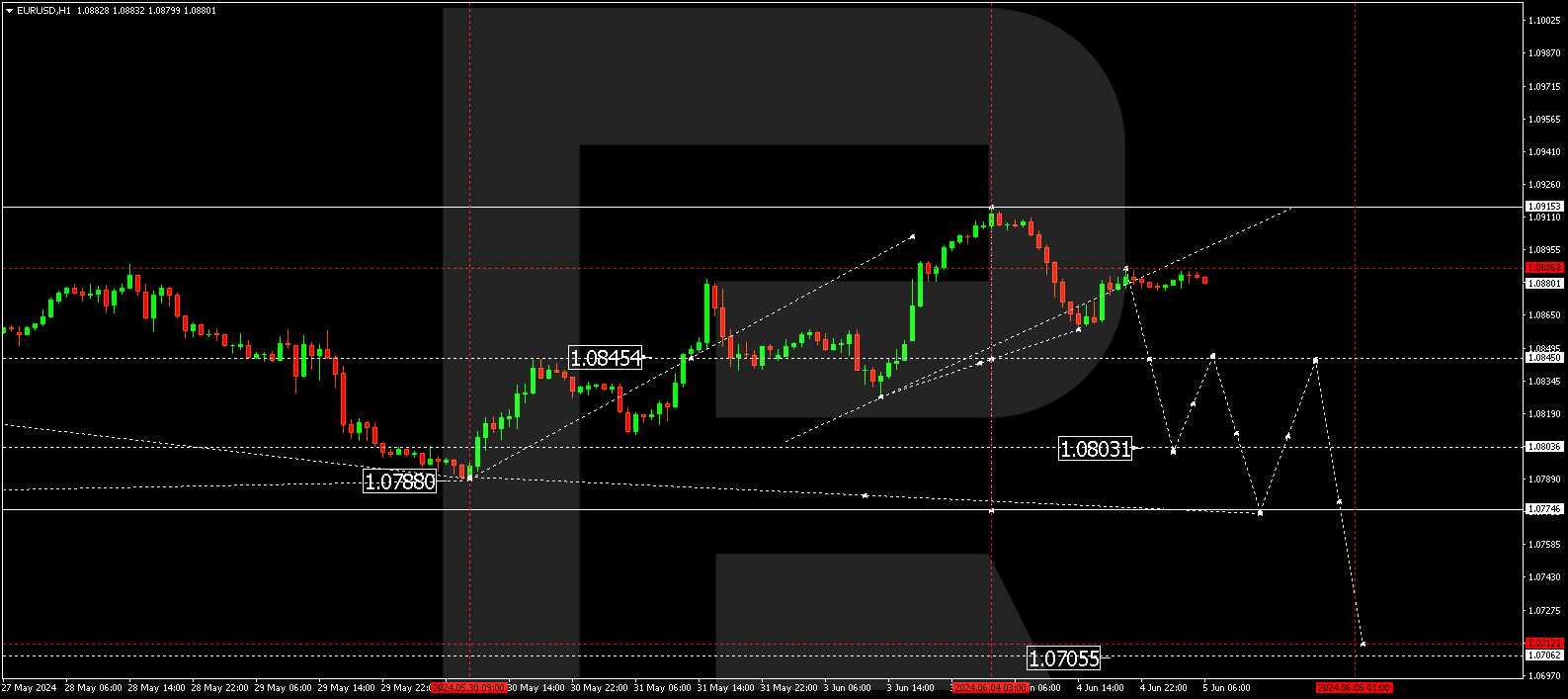

EURUSD, “Euro vs US Dollar”

The EURUSD pair has completed a downward impulse to 1.0858 and corrected towards 1.0886, with a consolidation range forming below this level today. A downward breakout and a decline towards 1.0845 are expected. If this level also breaks, it will open the potential for a wave towards 1.0803, the downward wave’s local target.

//

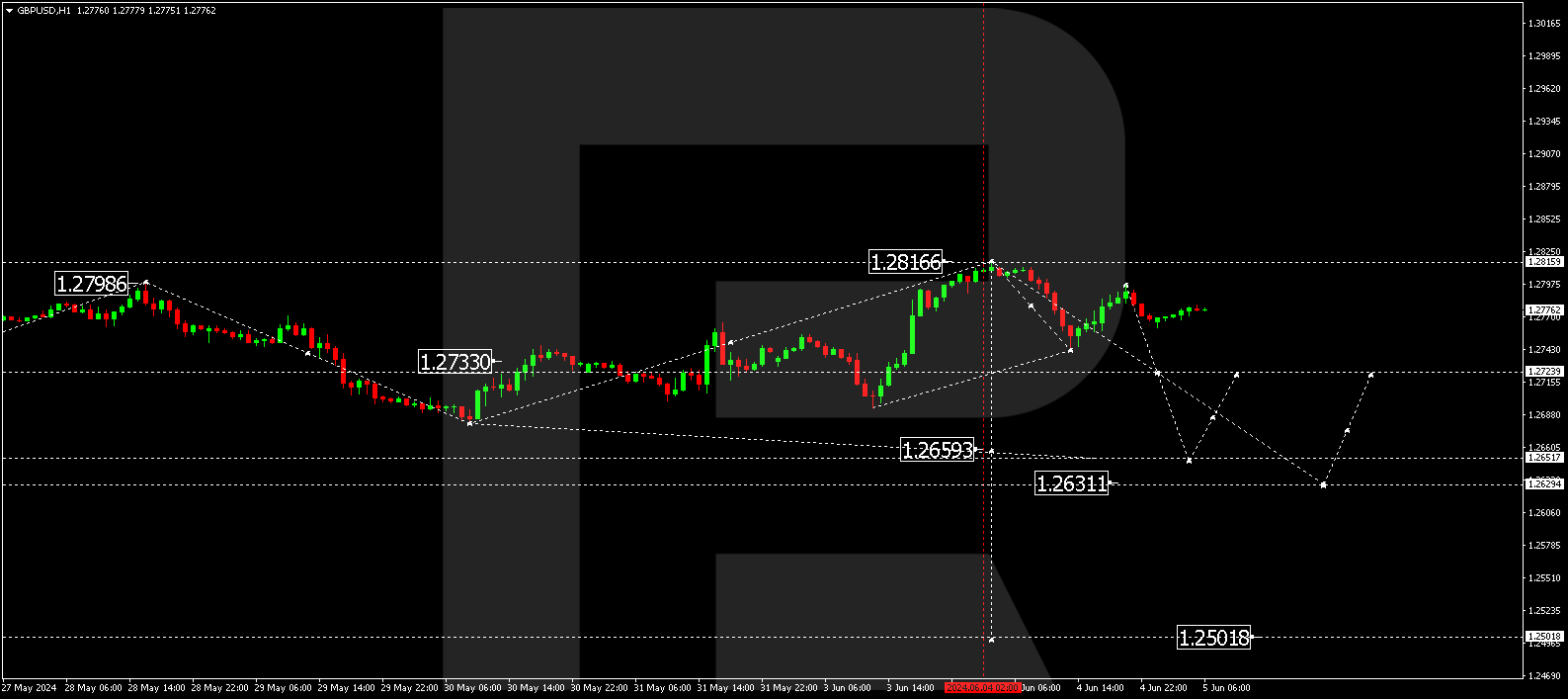

GBPUSD, “Great Britain Pound vs US Dollar”

The GBPUSD pair has declined to 1.2742 and corrected towards 1.2796, with a fall to 1.2733 expected today. A breakout of this level will open the potential for a wave towards 1.2673, potentially reaching 1.2631, representing the downward wave’s first target.

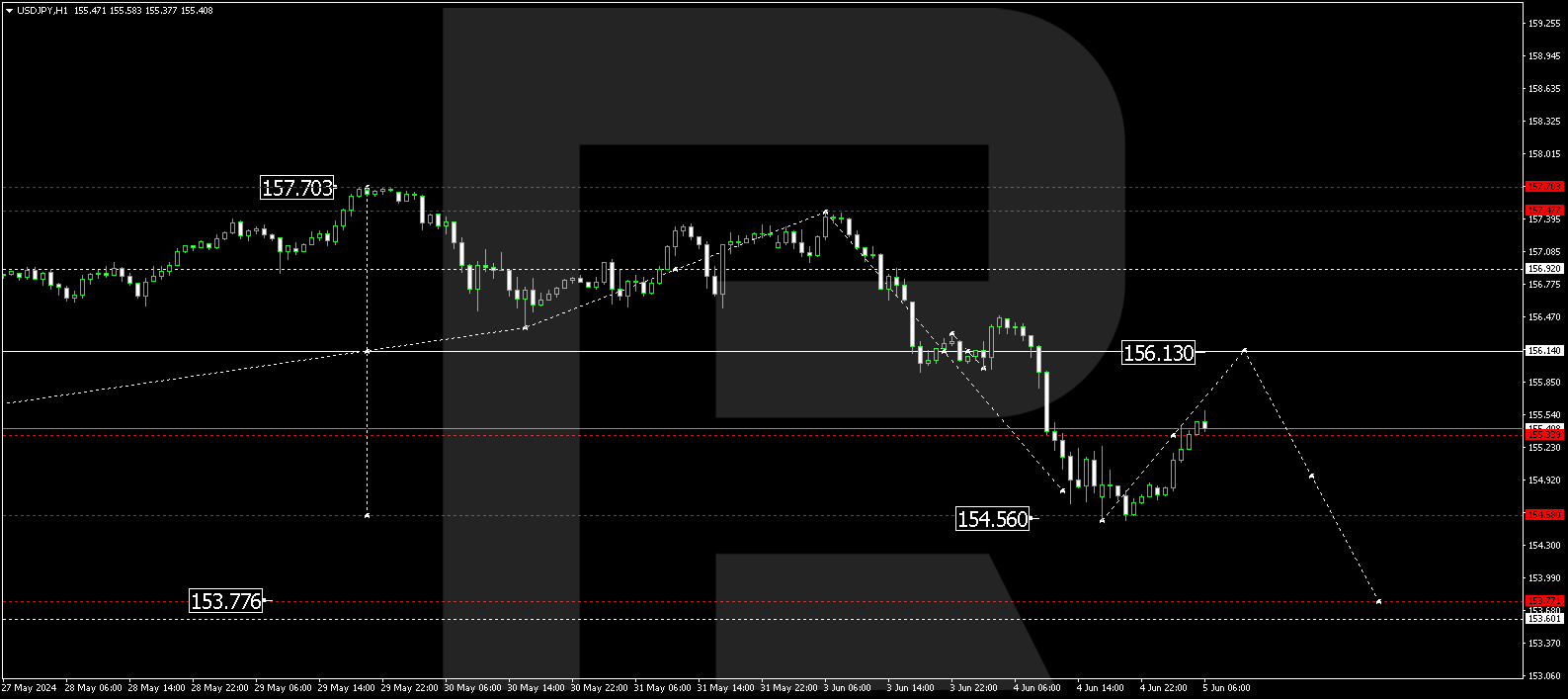

USDJPY, “US Dollar vs Japanese Yen”

The USDJPY pair has declined towards 154.56. Today, a correction might develop, targeting 156.13. Once the correction is complete, a new decline wave might start, aiming for 153.77 as the local target of the downtrend.

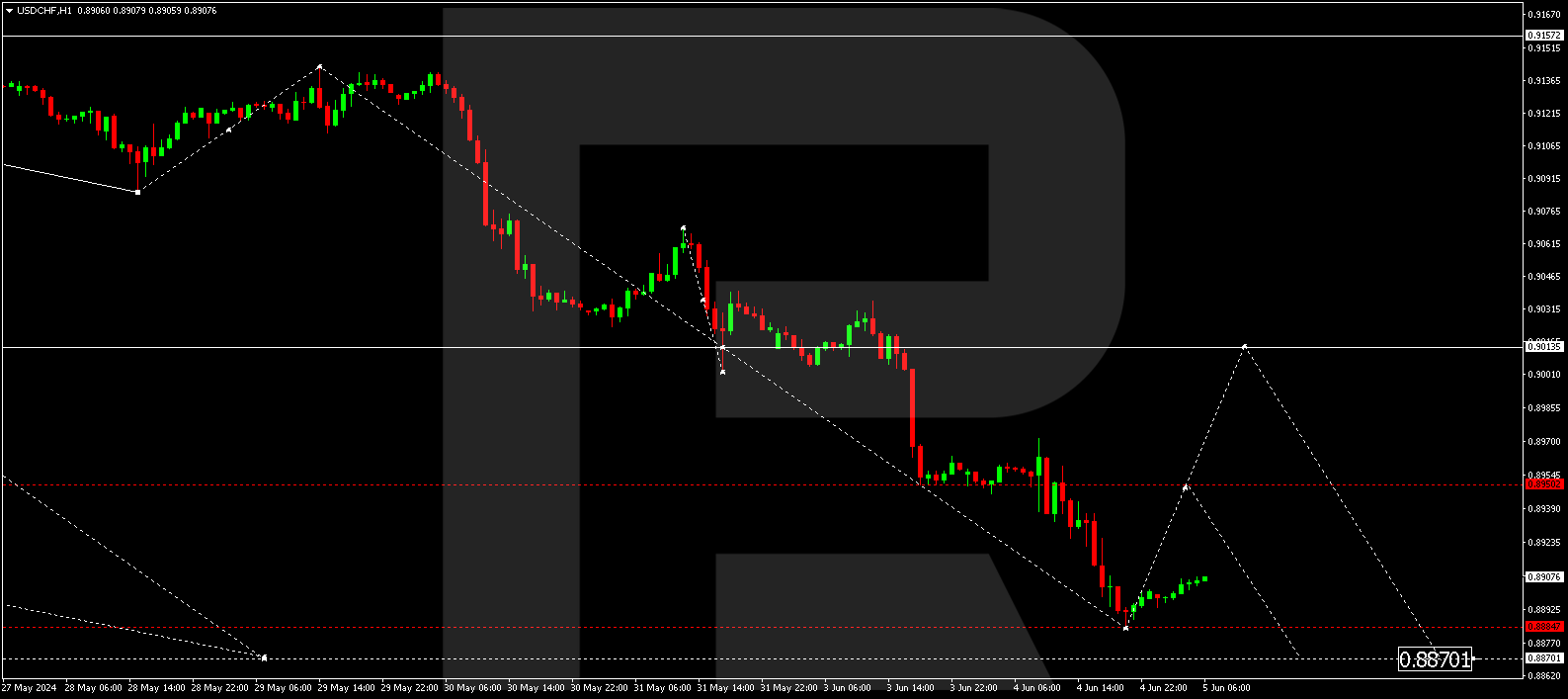

USDCHF, “US Dollar vs Swiss Franc”

The USDCHF pair has completed a decline wave, reaching 0.8885. Today, a consolidation range might develop above this level. With an upward breakout, a growth wave could continue towards 0.8950. A breakout of this level will open the potential for a wave towards 0.9013, representing the first target.

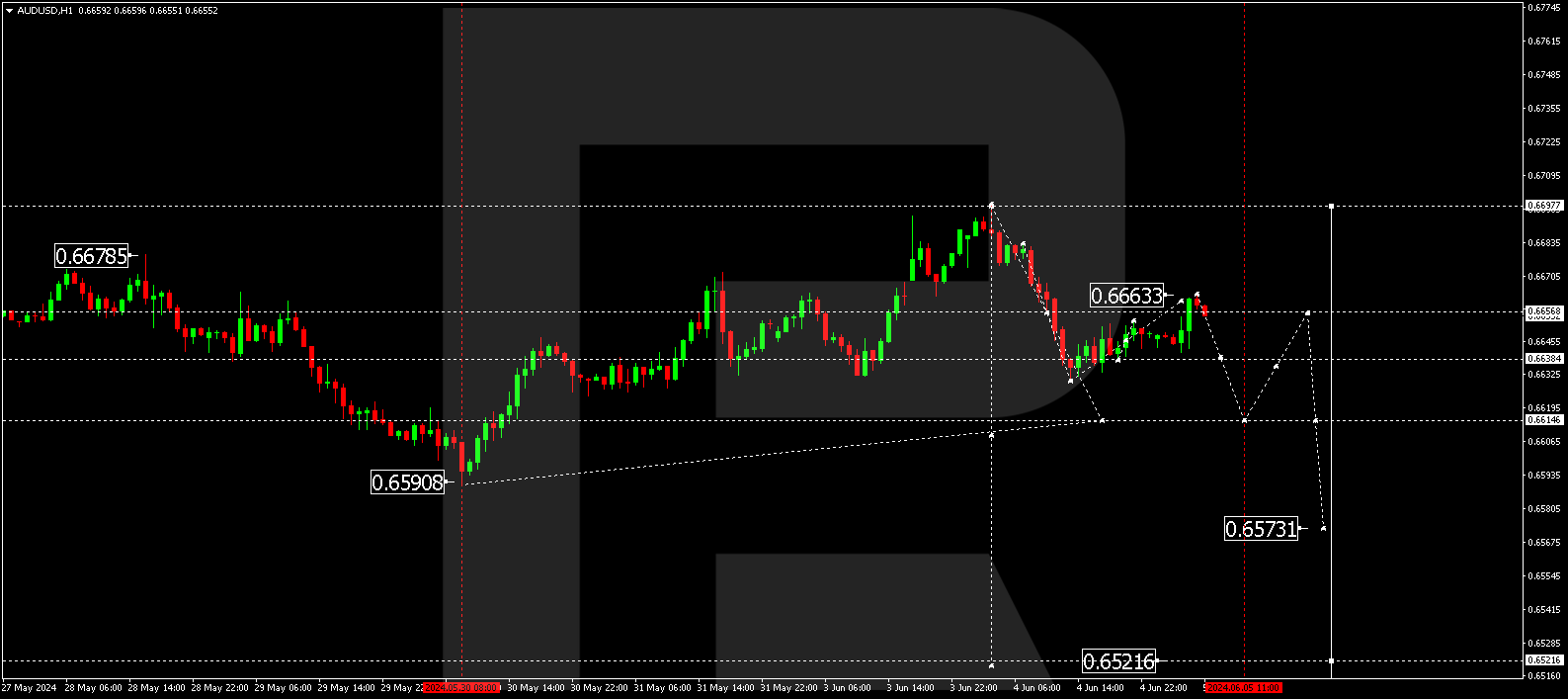

AUDUSD, “Australian Dollar vs US Dollar”

The AUDUSD pair has completed its movement to 0.6630 and corrected towards 0.6663. Today, a wave targeting 0.6630 is expected. A breakout of this level will open the potential for a wave towards 0.6614, potentially continuing towards 0.6575 as the local target of the downtrend.

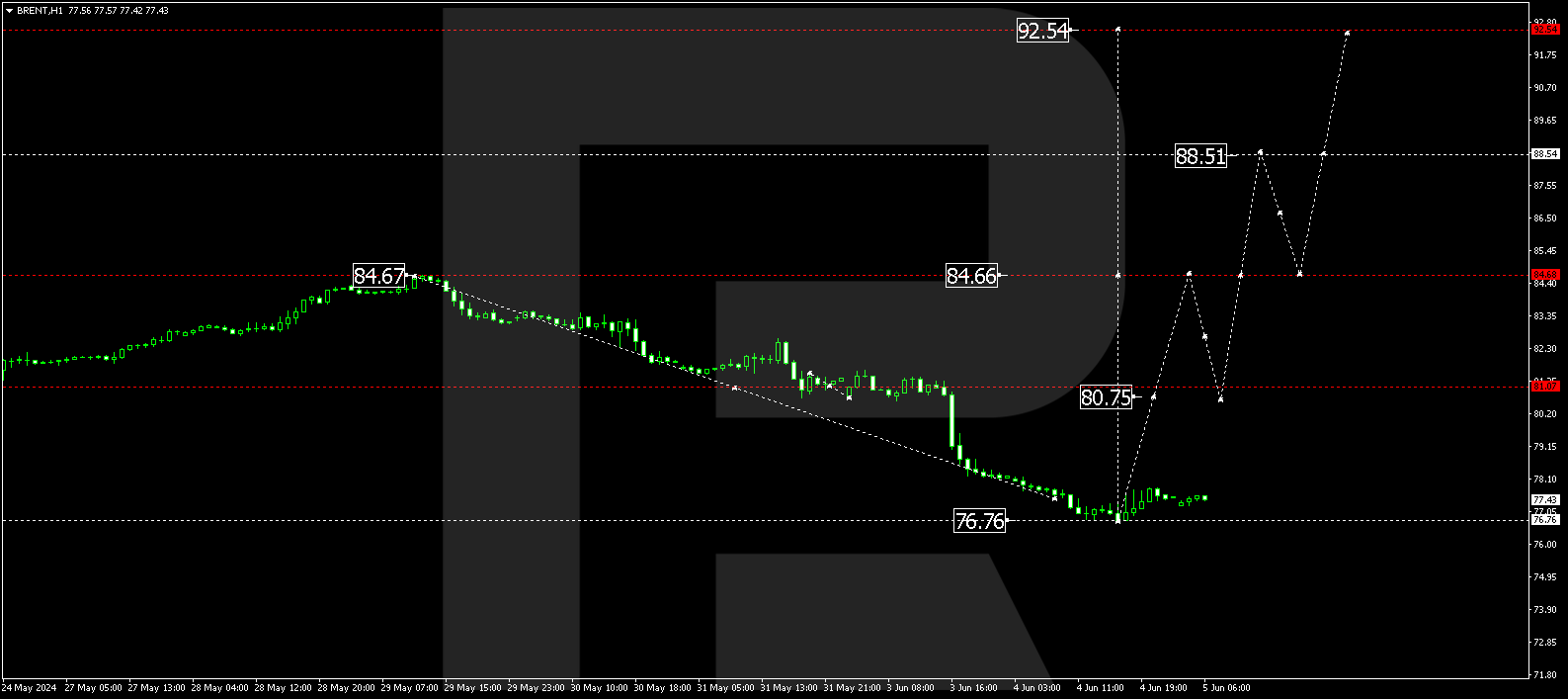

Brent

Brent has completed a decline wave towards 76.76, practically reaching the estimated target for correction. Today, a consolidation range might form at the current lows. With an upward breakout, a new growth wave might start, aiming for 80.75. A breakout of this level will open the potential for a wave towards 88.50, potentially continuing towards 92.55, representing the first target of the next upward wave.

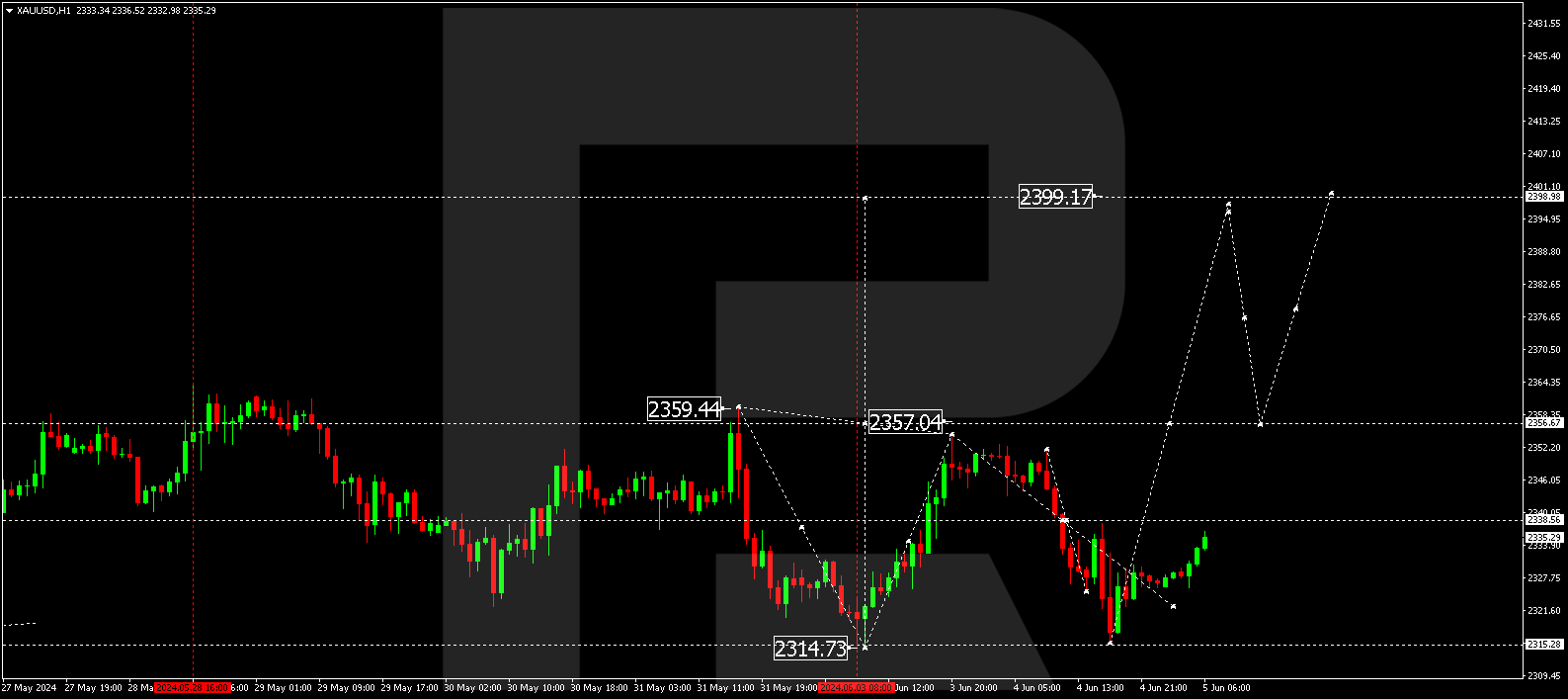

XAUUSD, “Gold vs US Dollar”

Gold is currently in a consolidation phase around 2338.55. The market has completed a decline towards 2315.55. Today, a rise towards 2338.55 is possible. If this level also breaks, it will open the potential for an increase to 2356.66. With an upward exit from this range, a correction might develop towards 2399.17. With a downward breakout, the trend could continue towards 2212.77, representing the local target.

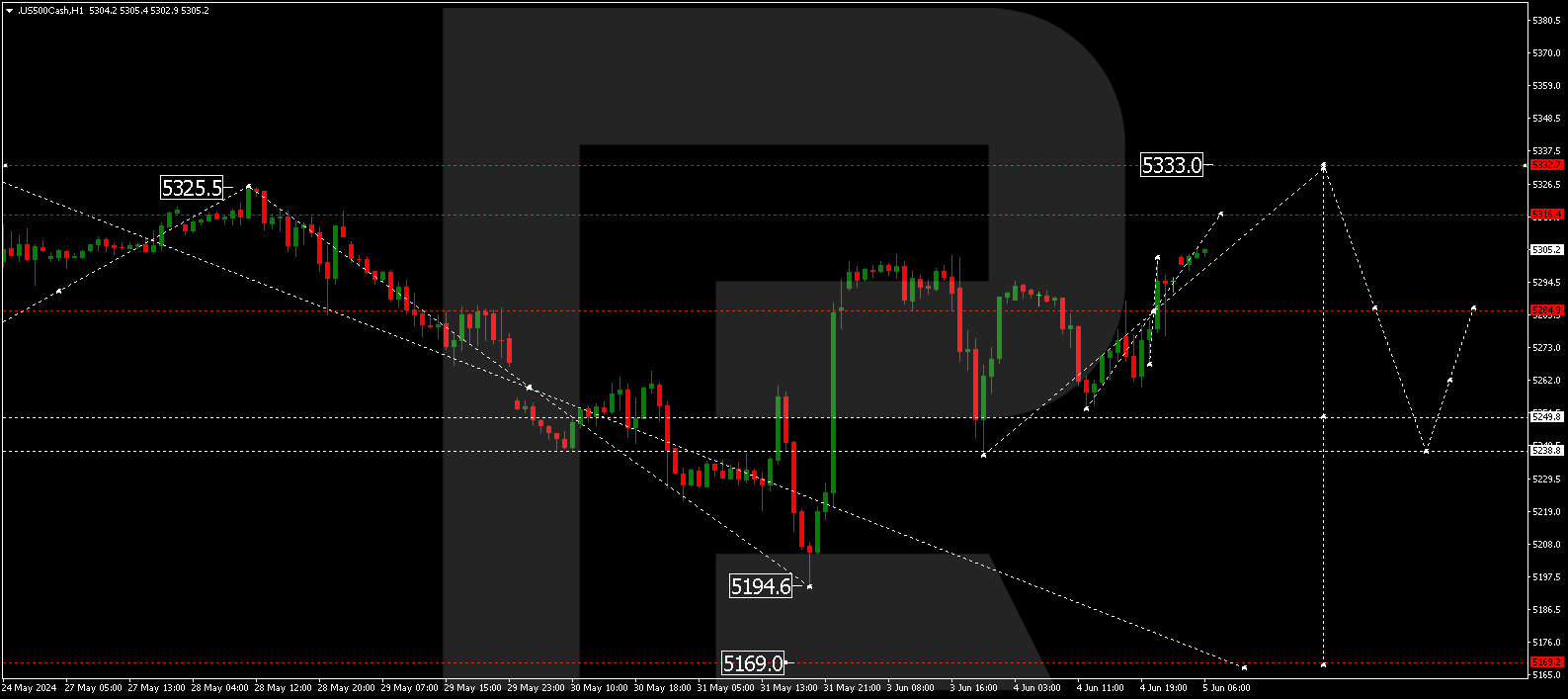

S&P 500

The stock index has formed a consolidation range around 5285.0, with the market exiting this range upwards today. Practically, the market suggests expanding the range to 5316.5, with the wave potentially continuing towards 5333.0. Subsequently, a decline towards 5238.8 is expected. A breakout of this level will open the potential for a movement by trend towards 5169.2.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Source: http://www.roboforex.com

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM Rynki układów scalonych

Rynki układów scalonych