Octa FX tinjauan

Ringkasan

Proses verifikasi dan evaluasi 5 langkah kami-bagaimana kami mendapatkan informasi?

Inspeksi Umum – 30%

Pengalaman Perdagangan – 30%

Audit Teknis – 20%

Pengalaman kolektif dari kolaborasi dengan broker – 10%

Wawancara dengan pedagang sungguhan – 10%

Lihat seluruh proses di sini .

Kelebihan

-

spread kompetitif dan tidak ada komisi

-

Opsi Leverage Tinggi

-

pemrosesan penarikan cepat

-

deposit minimum rendah

Kontra

-

Rentang Terbatas Instrumen yang Dapat Dipimpin

-

tidak diatur dalam yurisdiksi tingkat atas

-

Sumber Daya Pendidikan Terbatas

Detail umum

Ulasan pelanggan

skor

Kami selalu teliti dalam ulasan broker kami. Namun, kami merasa perlu untuk mempertimbangkan apa yang dikatakan oleh komunitas OCTA dan ahli lainnya. Lagi pula, kami adalah satu ulasan di lautan banyak. Mempertimbangkan apa yang dikatakan orang lain memberikan perspektif yang lebih baik tentang layanan OCTA.

Kami ingin memulai dengan mengatakan bahwa OCTA memiliki banyak ulasan komunitas yang positif, terutama di situs -situs seperti TrustPilot.

Berikut adalah contoh dari apa yang kami temukan.

“ Saya telah menggunakan octafx setidaknya selama dua tahun terakhir. Ini adalah perjalanan yang hebat) dengan volume yang sama sekali dengan octa tawaran secara rutin. Jumlah bonus yang saya dapatkan untuk setiap deposito adalah pengecualian yang dikumpulkan! diperdagangkan di platform. – Tinjauan TrustPilot

Berikut adalah contoh ulasan dengan hanya tiga bintang.

“Secara keseluruhan saya suka platform tetapi akhir -akhir ini saya mendapat akun dua kali dilikuidasi ketika posisi telah dilindung nilai. Akun berhenti tepat sebelum BTC berbalik untuk naik lebih baik. Kondisi ” – Tinjauan TrustPilot . WQWW4. WQWW4. WQWW4.

Kami juga memperhatikan pada Trustpilot bahwa banyak ulasan yang lebih baru, terlepas dari peringkat mereka, diberi label sebagai “diundang”. Ini berarti bahwa OCTA mengundang atau mendorong ulasan yang mungkin tidak dibuat.

Sejauh yang dikatakan para profesional, ulasannya sedikit lebih beragam. Sebagian besar berbagi sentimen keseluruhan bahwa OCTA adalah broker yang andal dan terkemuka. Namun, beberapa kehati-hatian terhadap opsi leverage tinggi, dan mencatat instrumen perdagangan yang agak terbatas. Baca ulasan nyata dari pedagang di seluruh dunia:

Belum ada ulasan.

Share Your Experience

Help others by sharing your review

Pertanyaan yang sering diajukan

pertanyaan yang sering diajukan

Dalam penelitian kami, kami telah menemukan octa menjadi broker forex yang andal. Diatur oleh CYSEC, FSCA dan MISA memberikan kredibilitas. Jika mereka diatur oleh pihak berwenang seperti ASIC atau FCA, ini akan semakin meningkatkan keandalannya. Penting juga untuk melihat umur panjang dan rekam jejak. OCTA telah berada dalam permainan perdagangan forex selama lebih dari satu dekade dan telah membangun reputasi yang kuat untuk keandalan. Kami telah memperhatikan beberapa masalah sesekali dengan penarikan dan masalah teknis. Tapi, ini adalah sesuatu yang sesekali berjuang.

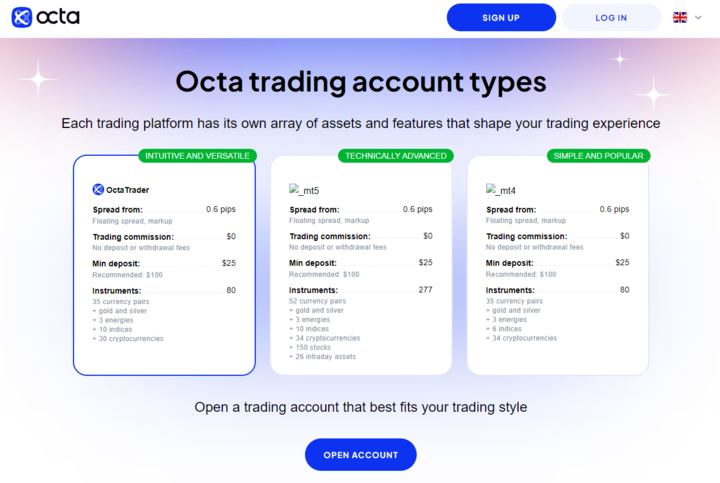

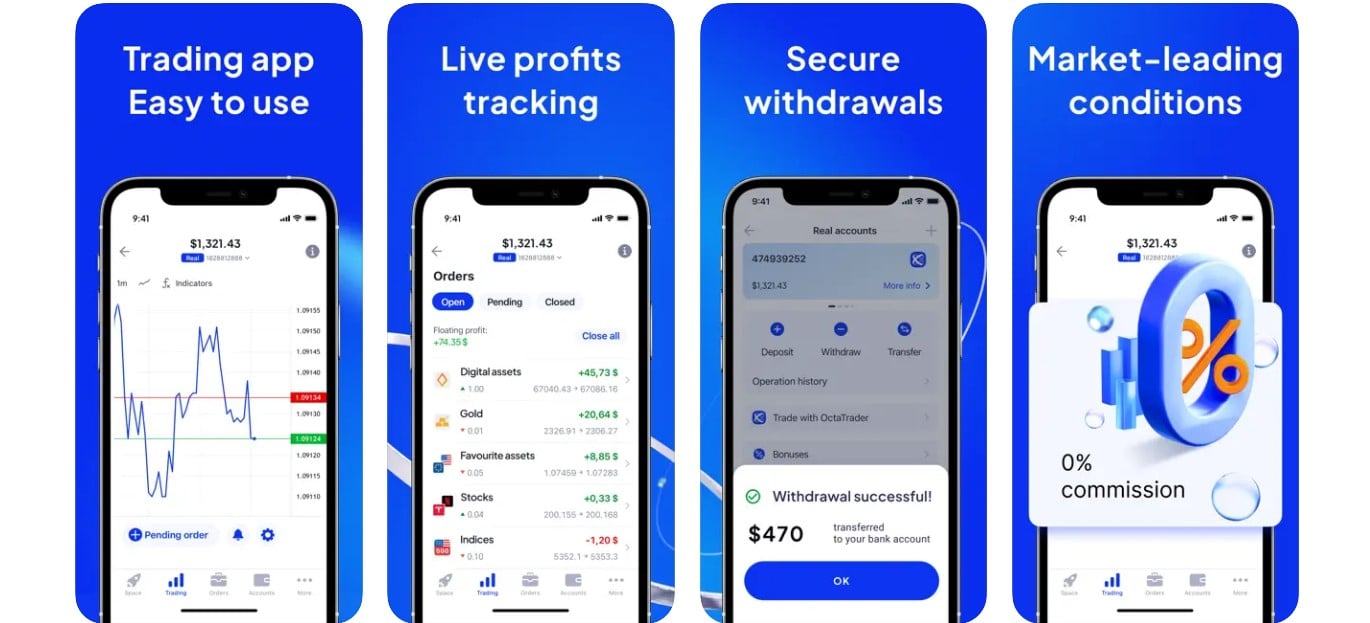

Lineup platform OCTA menampilkan metatrader standar emas. Ini termasuk Metatrader4 dan Metatrader5. Platform Metatrader menawarkan fitur yang kuat dan kegunaan yang menarik bagi pasar yang luas.

Selain platform Metatrader, ada juga platform hak milik OCTA yang disebut octatrader . Dari semua opsi platform, ini adalah yang paling ramah pengguna dan intuitif untuk digunakan. Pedagang yang lebih maju mungkin bukan penggemar terbesar, tetapi investor pemula atau sesekali akan merasa mudah dinavigasi.

Semua platform ini tersedia di aplikasi web dan seluler, termasuk Android dan iOS.

Bagi mereka yang ingin mempelajari lebih lanjut tentang platform Metatrader, kami sarankan membaca .

dengan broker forex, deposit minimum dapat di seluruh papan. Beberapa tidak memiliki persyaratan minimum atau menetapkan batas yang sangat rendah, seperti $ 1. Yang lain menetapkan batasan yang jauh lebih tinggi. Octa jatuh di suatu tempat di tengah spektrum, lebih condong ke ujung bawah.

Deposit minimum OCTA mulai serendah $ 25. Ini adalah tingkat yang baik untuk pedagang baru yang ingin memulai dari yang kecil dan bereksperimen dengan sedikit investasi keuangan. Pedagang Forex yang sudah basah kaki mereka kemungkinan besar ingin melebihi tingkat deposit minimum. Minimumnya pasti ramah anggaran, tetapi hanya ada begitu banyak yang dapat dilakukan dengan $ 25.

Ada broker online yang tidak memerlukan setoran minimum sama sekali. Kami merekomendasikan ulasan kami pada Tidak ada pialang Forex Deposit .

Leverage adalah alat yang memungkinkan investor meminjam dana untuk meningkatkan potensi pengembalian yang lebih tinggi. Dengan kata lain, seorang pedagang dapat mengendalikan posisi yang lebih besar dengan jumlah investasi yang jauh lebih kecil. Opsi leverage tinggi pasti dapat memaksimalkan potensi laba. Octa memainkan ini dengan menawarkan pengaruh 1: 1000, yang tinggi ketika mempertimbangkan industri secara keseluruhan. Tidak jarang melihat leverage dibatasi pada level 1:30 atau 1:50.

Meskipun ada keuntungan yang pasti untuk opsi leverage tinggi OCTA, ada juga beberapa kelemahan. Sama seperti keuntungan dapat diperkuat, demikian juga kerugian. Untuk alasan ini, yang terbaik adalah melanjutkan dengan hati -hati dengan leverage, bahkan jika level yang diizinkan tinggi. Selalu pintar untuk bereksperimen dengan leverage dengan menggunakan jumlah yang lebih kecil sampai pengalaman diperoleh. Menurut pendapat kami, leverage juga paling aman saat berdagang dengan salah satu broker forex terbaik .

OCTA menawarkan dukungan pelanggan 24/7 tetapi tidak memberikan opsi untuk dukungan telepon. Tim dukungan pelanggannya dapat dihubungi menggunakan opsi obrolan langsung, email, atau media sosial platform. Dukungan pelanggan ditawarkan dalam berbagai bahasa.

Kualitas keseluruhan dukungan pelanggan OCTA baik. Kami berharap mereka menawarkan dukungan telepon, tetapi mereka cepat merespons melalui saluran yang ditawarkan.

Octa FX dibandingkan dengan broker alternatif

- Putusan keseluruhan

- Jual beli

- Setoran minimal

- Leverage maksimum

- Biaya

- Biaya penarikan

- Biaya setoran

- Keamanan

- Regulator tingkat atas

- Perlindungan investor

-

Perdagangan sosial

-

Perdagangan Otomatis

-

Akun bebas swap

-

3.8/ 5

-

3.7/ 5

- $10

- 1:1000

-

3.7/ 5

- $0

- $0

-

4.5/ 5

- CySEC

-

Tidak

Tidak

-

Lihat ulasan

-

Akun perdagangan khusus

-

24/7 penarikan uang instan

-

Free VPS hosting in Indonesian is: Hosting VPS Gratis

-

4.9/ 5

-

4.8/ 5

- $10

- 1:2000

-

4.8/ 5

- $0

- $0

-

5/ 5

- FCA, CYSEC

-

Tidak

Tidak

-

Lihat ulasan

-

Penarikan uang instan 24/7

-

Akun perdagangan khusus

-

Hosting VPS gratis

-

Leverage tinggi

-

4.7/ 5

-

4.7/ 5

- $100

- 1:10000

-

4.7/ 5

- $0

- $0

-

4.7/ 5

- FCA

-

Lihat ulasan

-

Akun perdagangan khusus

-

Spread Ketat

-

Komisi rendah

-

4.6/ 5

-

4.6/ 5

- $200

- 1:500

-

4.5/ 5

- $0

- $0

-

4.2/ 5

- ASIC, CySEC

-

Lihat ulasan

-

Free VPS hosting

-

24/7 instant money withdrawal

-

Specialized trading accounts

-

4.9/ 5

-

4.9/ 5

- $10

- 1:2000

-

4.8/ 5

- 1%

- $0

-

4.8/ 5

- Tidak

-

Lihat ulasan

RoboForex

RoboForex Kehebatan

Kehebatan FxPro

FxPro Alfa-Forex

Alfa-Forex kebebasan

kebebasan Kemuliaan Fx

Kemuliaan Fx XM

XM Pasar IC

Pasar IC