Analysis & Forecast

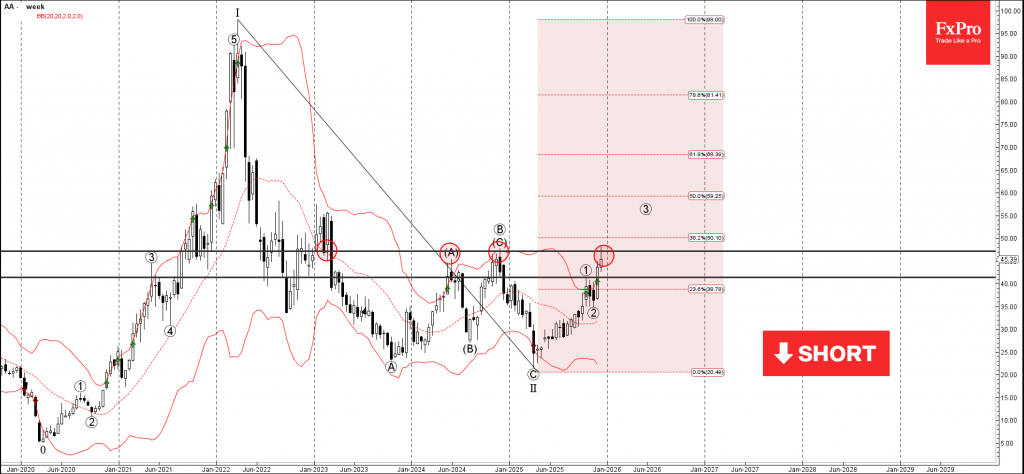

Alcoa: ⬇️ Sell– Alcoa reversed from strong resistance level 47.00– Likely to fall to support level 41.40Alcoa recently reversed down from the resistance area between the strong resistance level 47.00 (former yearly high from...

Exxon Mobil: ⬇️ Sell– Exxon Mobil reversed from resistance area– Likely to fall to support level 115.00Exxon Mobil recently reversed down from the resistance area between the key resistance level 120.00 (which has been reversing the p...

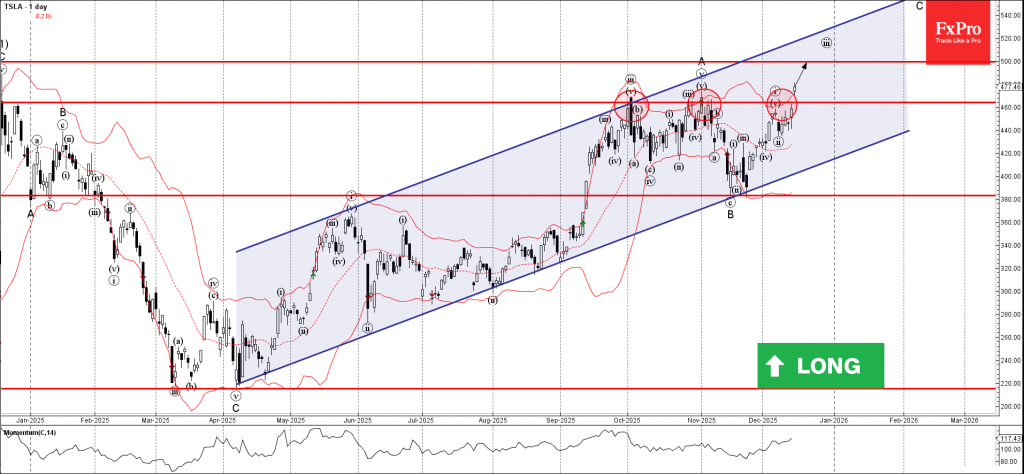

Tesla: ⬆️ Buy– Tesla broke key resistance level 460.00– Likely to rise to resistance level 500.00Tesla today opened with the sharp upward gap breaking above the key resistance level 460.00 (which has been reversing the price from...

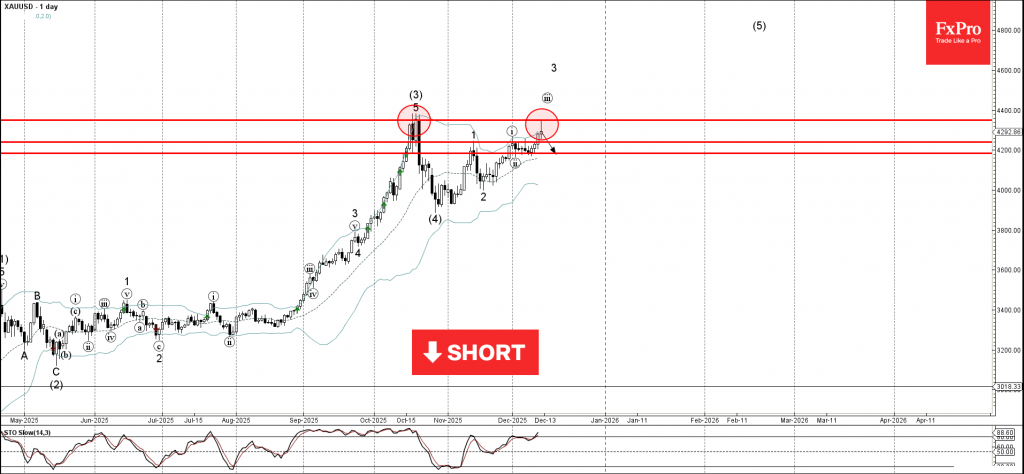

Gold: ⬇️ Sell– Gold reversed from strong resistance level 4350.00– Likely to fall to support level 4200.00Gold recently reversed from the resistance area between the strong resistance level 4350.00 (which stopped sharp wave ...

EURGBP: ⬆️ Buy– EURGBP reversed from support zone– Likely to rise to resistance level 0.8850EURGBP currency pair recently reversed up from the support zone between the strong support level 0.8745 (former resistance from Apri...

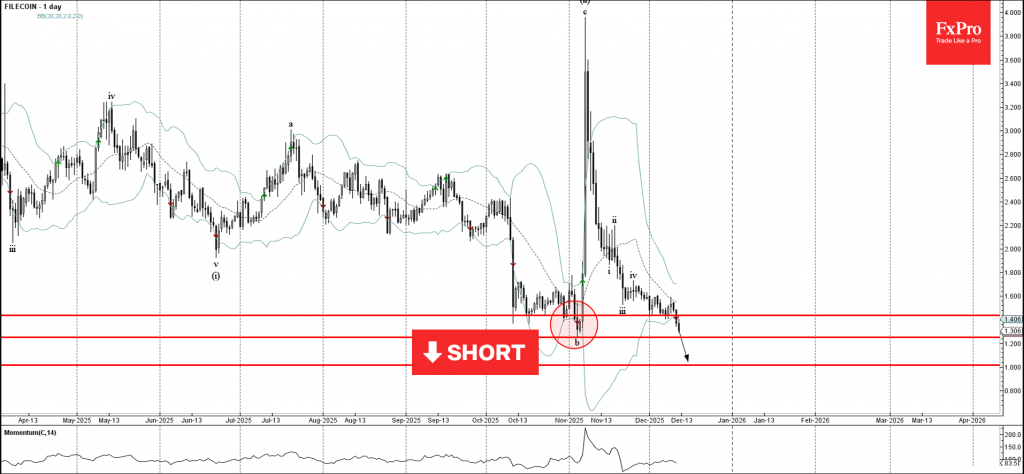

Filecoin: ⬇️ Sell– Filecoin broke key support level 1.435– Likely to fall to support level 1.000Filecoin cryptocurrency recently broke below the key support level 1.435, which reversed the price twice from the start of Decem...

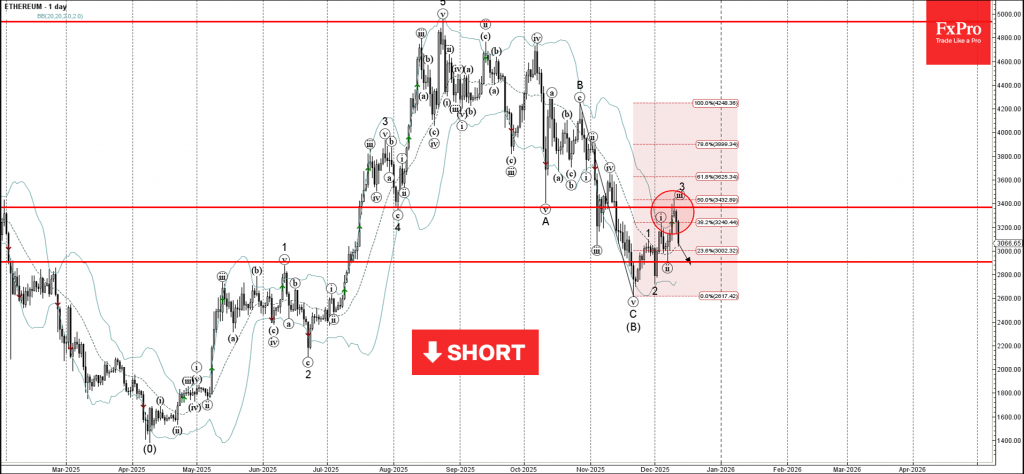

Ethereum: ⬇️ Sell– Ethereum reversed from resistance level 3400.00– Likely to fall to support level 2907.00Ethereum cryptocurrency recently reversed down with the daily Shooting Star from the resistance area between the key ...

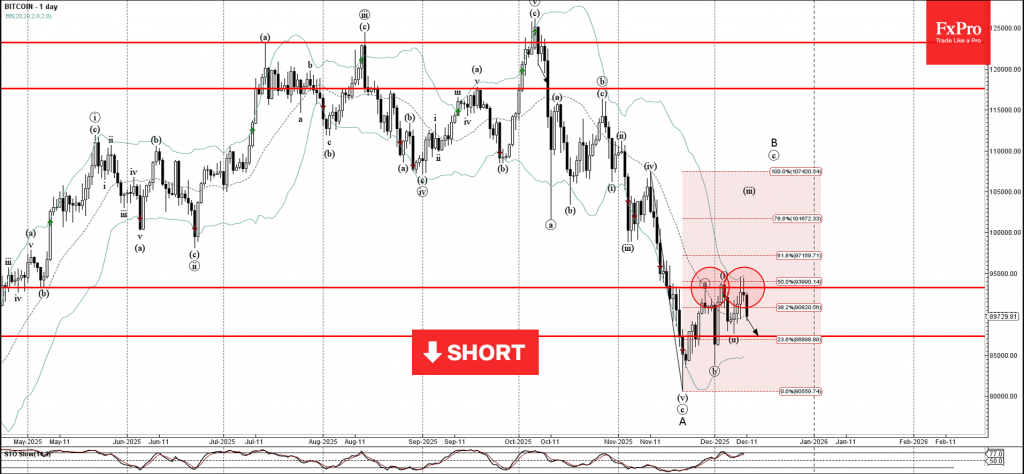

Bitcoin: ⬇️ Sell– Bitcoin reversed from resistance area– Likely to fall to support level 87330.00Bitcoin cryptocurrency recently reversed down from the resistance area between the pivotal resistance level 93285.00 (which has...

USDJPY: ⬇️ Sell– USDJPY reversed from resistance area– Likely to fall to support level 154.50USDJPY currency pair recently reversed down from the resistance area between the strong resistance level 157.20 (former monthly high fro...

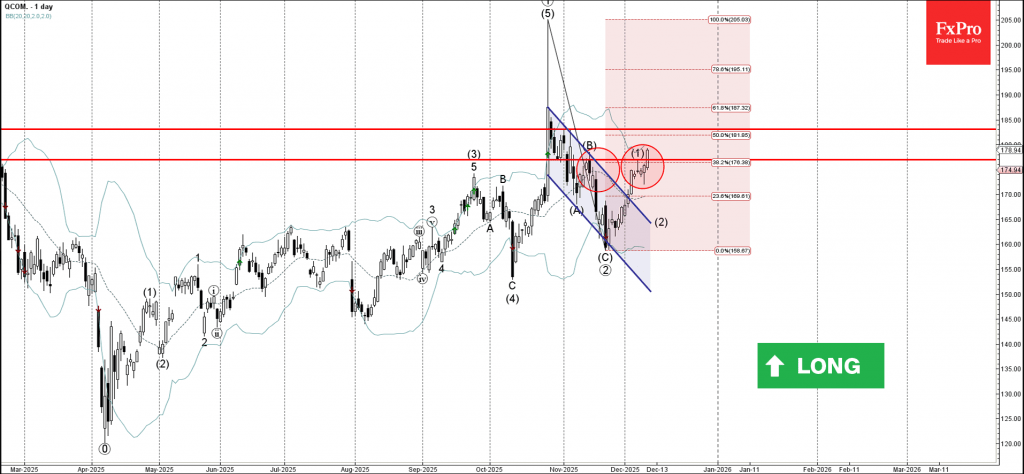

Qualcomm: ⬆️ Buy– Qualcomm broke strong resistance level 177.00– Likely to rise to resistance level 183.00Qualcomm recently broke the resistance area between the strong resistance level 177.00 (top of the previous wave (B)) ...

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM IC Markets

IC Markets