The focus returns to inflation in the new week.

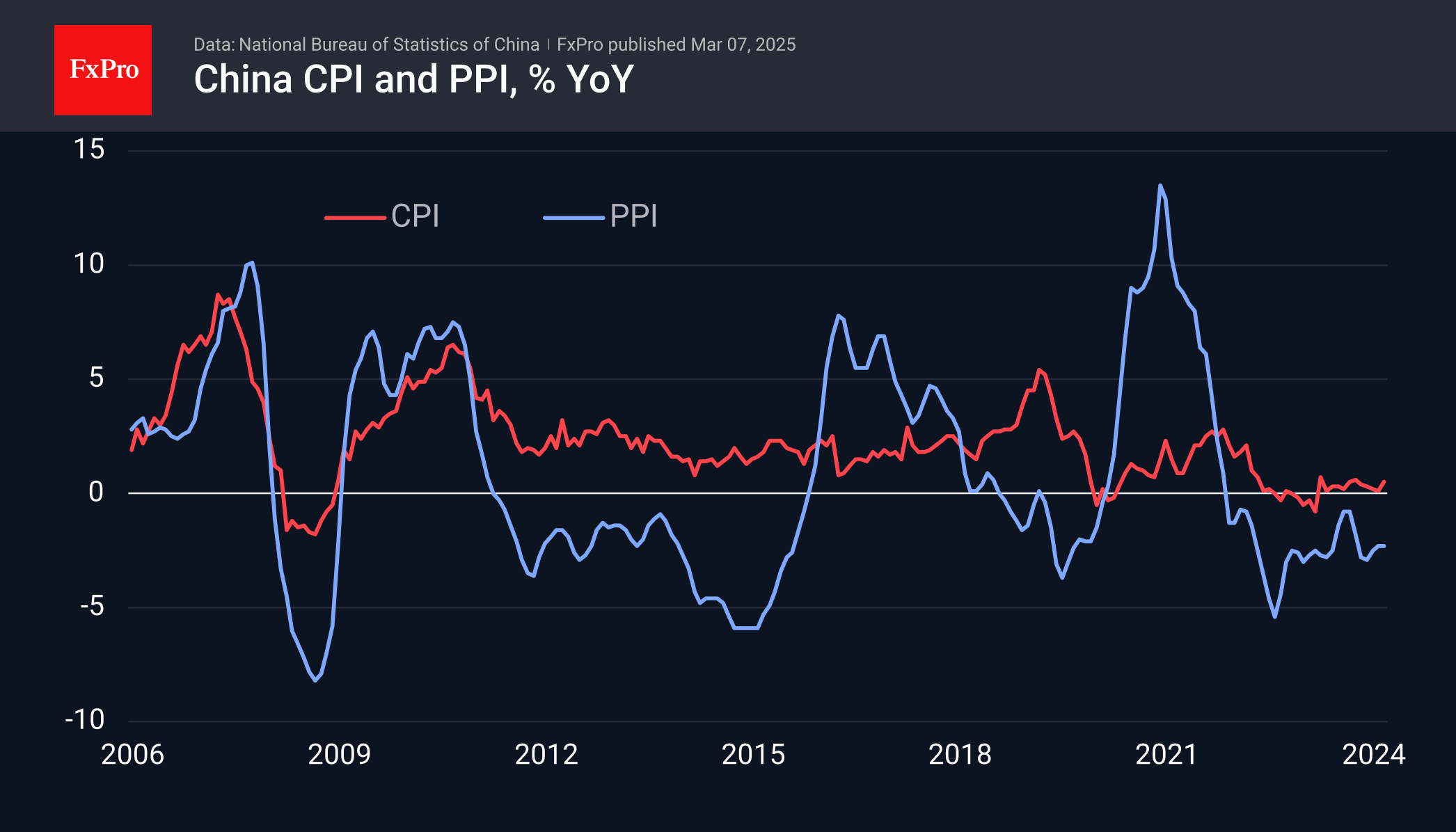

On Sunday, China is expected to report negative year-on-year inflation in consumer and producer prices. This may trigger a new wave of deflation talks in China, which will affect market sentiment at the start of the week.

The US will release its consumer inflation data on Wednesday and producer price change on Thursday. The main concern of the markets is whether the US is already facing a new wave of inflation, which the new tariffs promise to spur further.

On Wednesday, the Bank of Canada will announce its decision on the key rate. It is currently at 3.0%, but because of the tariffs, some economists say a big cut is now possible. For now, we expect a quarter-point cut and a willingness to cut it further.

Source: https://fxpro.news

RoboForex

RoboForex Exness

Exness FxPro

FxPro Alfa-Forex

Alfa-Forex Libertex

Libertex FxGlory

FxGlory XM

XM IC Markets

IC Markets