We all know that Forex trading can be immensely profitable, and I guess if you’re reading this article, you already know that. Now, you’re probably wondering if the broker you have been trading under all this time may be earning more than you are, and maybe you’re a little jealous about that. So, you’re thinking of starting your own Forex brokerage, but don’t quite know how to go about it.

Well, the good news is that it’s possible, and not that difficult as a matter of fact. All you need now are a few guidelines to help you get your Forex brokerage company up and running. Let’s start with the basics:

7 Tips What you need to start your Forex Brokerage

Every business has its own set of requirements, and the Forex business does too. These are the essentials you need if you want to have a chance at running a Forex brokerage firm:

1. Approval by the local Forex regulator

Wherever you choose to set up your company’s headquarters, you won’t even start running until the regulators give you the thumbs up. This is the company that will oversee any complaints against your brokerage. Some of the most recognized Forex regulators are:

- Australia - Australian Securities and Investments Commission (ASIC)

- Cyprus - Cyprus Securities and Exchange Commission (CySEC)

- Russia – Federal Commission of Securities Market of Russia (FFMS)

- South Africa - Financial Services Board (FSB)

- Switzerland - Swiss Financial Market Supervisory Authority (FINMA)

- UK - Financial Conduct Authority (FCA)

- US – US Securities and Exchange Commission (SEC)

First, you will need to have your brokerage company registered as a Forex broker, which means getting a license and legal registration. Afterward, you can then start your Forex company under the regulatory body which will demand that you adhere to their rules. The regulator determines:

- The kind of identification that clients must provide. Most regulators require 1 form of identification and 1 form of address verification, for example, a passport and utility bill. Stricter regulators may require 2 of each. It may not be a problem for you, but it might restrict some clients from certain parts of the world

- The amount of capital required. A specific amount of capital should be deposited with your liquidity provider or bank to cover any losses by your clients. The FFMS, for example, requires 5 million Rubles in the capital, but this amount will vary from one region to another

There are still other ways of getting around these requirements, such as franchising. If you don’t want to start your own company from scratch, you can ‘borrow’ an already established broker’s name. Of course, this would mean that a portion of your profits will have to be deducted, but it also saves you from the registration and advertisement costs. (Find out: Comprehensive Review of ActivTrades Trading Tools)

2. Office space and staff

After your company is registered and you have all the legal fronts covered, you need to get some office space. Even though having a Forex brokerage is primarily an online business, you still need to have a physical presence. This may be part of the requirements for your business registration by the regulators.

And just because it’s an online business, it doesn’t mean that the office won’t require some touching up. Now and then, you might get a client who elects to pop into your offices just to have a look, and you need to create a good impression. This means that the office needs to be good enough to impress any clients who walk in.

In addition, you can’t run this business on your own – you need people to help with office operations, IT, and other technical needs, and also traders. Clients who visit your website will probably need to speak to someone from your company about any questions they have, which means a customer care desk.

As a Forex broker, your job isn’t to just oversee your clients’ trades but to trade on your own as well. This keeps your company’s capital growth to sustain the business through hedging. There is also an added advantage to trading as a brokerage firm, all your clients serve as information boxes. You can simply watch how your clients are trading and identify any shifts in the market.

3. Trading platform (s)

The most common Forex trading platform is MetaTrader 4, and you pretty much have to offer this given that most clients will want to keep using it. MetaTrader isn’t free software, though, so you will have to get the license from MetaQuotes, the parent company that designed MetaTrader. This platform costs $200,000 and is a necessary investment.

They also have an updated MetaTrader 5 which has added features, and that might also be useful for your company. However, most users are not accustomed to using it, and it is not very necessary, you can do without it.

Other trading platforms are also available, such as cTrader which is also quite popular. Even though it may not be as popular as MetaTrader, you might want to get it for your company. There are other peculiarities when dealing with some of these newer trading platforms like cTrader, Quik, etc. so you might have to consider those too.

4. Marketing and campaigns

Now that your business is ready, you need to attract clients, which means creating a strong online presence. Fortunately, there are numerous ways to do this – search engine optimization (SEO), YouTube Ads, Google Ads, etc. I may not cover all the ways to do this, but you’re going to need an experienced internet marketer to put your company on the map.

Being an online business, for the most part, this is a crucial step, and it’s best to go all out without sparing any expense. Forex broker comparison websites and Forex trading brokers review websites are essential in winning the hearts and minds of potential clients.

5. Stable and fast internet connection

The Forex market is an online business, so having a stable internet connection is essential. We are not talking about the regular internet connection you get at home, though, it needs to be a high-capacity connection. Your clients will demand instant transactions and processing, so this is a must if you want to keep your clients happy.

An IT expert may call this kind of connection business-grade or carrier-grade, but it just means that it is far superior to the consumer-grade connection at home. Several reasons make this necessary:

- It has guaranteed bandwidth – the consumer-grade connection would share the bandwidth across users, so the speed drops when several people are connected. With a business-grade connection, you have a guaranteed bandwidth that is reserved specifically for you, whether you’re using it or not

- No downtime – consumer internet connections are often disconnected for upgrades and whatnot, but you can’t have this. Every second your Forex website is inaccessible may lose your clients

Whether you’re targeting a local market or the international market, you have to be available, and having a reliable internet connection helps you do that.

On the other hand, it makes the choice of a location to set up your offices a lot more difficult. Despite most of the world being connected to the internet, this business-grade connection is only available in major cities, and not in every country either. Therefore, you also need to identify the country and city with such a connection – you can’t just throw the dice.

6. The market maker

You have to be able to fill all your clients’ buy and sell orders every time without fail, and this is only possible with a market maker. In short, a market maker is an entity willing to buy or sell a currency pair, commodity, or any other financial instrument at any time. Normally, this would be a liquidity provider, like a Tier 1 bank, but you can be a market maker yourself if you have enough capital.

Very few Forex brokerages around the world can become market makers themselves, and even if you do have the capital, it’s probably best to have a liquidity provider than to use all your initial capital for trading expenses. We’ll see why in the next section below.

The choice of a market maker is also a crucial one since it is they who offer the financial instruments you are going to trade. For example, one market maker may only offer currency pairs, while another may also throw in a few stocks and commodities. These may not be your primary area of focus, but they do help to establish your company as a major player.

7. Payment service providers

This determines how your clients deposit and withdraw money into their accounts. You must offer a variety of payment services to ensure no one is locked out just because their favorite payment system is not available. Some of the most common payment systems include:

- Skrill

- Neteller

- Bank transfers

- Credit cards

Skrill, Neteller, and credit card funding are preferred by most traders because the transactions are instant. Bank transfers may take some time since the request must be processed by the individual’s bank and the processing period will vary.

You will need to set up contracts with these payment providers and agree on the charges and terms of their service. You may also have noticed that PayPal isn’t popular, despite being very popular as a money transfer service, but that’s probably because they have very strict conditions. Anyway, you can still attempt to get them as a payment provider, and that may give you an edge over other Forex brokers.

Guidelines for running a successful Forex brokerage

Besides just having a Forex brokerage company, I assume you would want it to be successful and profitable. By the way, successful and profitable don’t always mean the same thing – just think about all the Forex companies out there that are only profitable because they scam their clients. You have probably even traded with such a broker before you realized they were going to rip you off.

In light of that, we’re going to make your Forex company both successful and profitable, meaning ethical and profitable at the same time. Here are some tips:

Maintain a favorable operational-to-trading ratio

Remember when we mentioned not using up all your initial capital for trading expenses above, here’s what it meant. For the liquidity provider to act as the market maker for your Forex company, they require that you have some money deposited into the account you have with them. This amount remains with the liquidity provider, and cannot be used for trading, but it grows as you gain profits.

Besides satisfying the Forex regulator's capital requirements, it also protects you from a crisis in case of any major financial moves in the Forex markets. Take FXCM, for example, one of the biggest Forex brokers in the world which were at risk of going bankrupt. On the 16th of January 2015, FXCM was supposedly in breach of its capital requirements because it had incurred losses from its customers that left the company in a $225 million debt.

This example illustrates the point made earlier about not using up all your initial capital just so that you can act as a market maker yourself. By keeping most of your capital with your liquidity provider, you get to have a better ratio between your capital and the client’s funds. In so doing, you are better able to weather any major financial crises that come your way, and you had better be prepared.

FXCM probably had a ratio of 1:1, capital versus clients’ funds, which is why they were hit so hard. Other companies caught up in the bankruptcy of Forex brokers perhaps had even less, and they had to close shop. To avoid such a scenario, try to keep this ratio at about 2:1 or 3:1.

It’s all about location

The location of your company’s headquarters is extremely important. We have already seen how infrastructure needs may be affected by the locale, but it also determines a lot of other things, like personnel. Among the main deterrents to Forex trading in South Africa, for example, is a lack of skilled personnel to handle the requirements of a Forex brokerage firm.

In addition, the financial regulator in your location will also have unique requirements. Some may restrict your recruitment of new clients only to specific regions, while others will allow you to sign up clients from all over the world. The US is particularly strict about signing up non-US citizens as clients, and that might throw a spanner in the works. After all, as a new Forex broker, you don’t get the luxury of restricting clientele.

There is also the aspect of taxes, which will vary from one location to the next. You want the right balance between affordable taxes and proper infrastructure. This is why you will find so many brokers in Cyprus which have very favorable tax requirements.

The point is, that there is a lot that your location affects, and you need to think about every angle.

Commission or spreads

There are only 2 ways of making money as a Forex broker – charging a commission per trade or widening the spreads a little bit. Earning from commissions is straightforward, a percentage of the client’s profits is deducted. Spreads are a little more complicated.

Your liquidity provider is going to act as a market maker for you, in exchange for a wider spread. The spread is the difference between the buying and selling prices, and you can always see this difference whenever you’re watching the business section of the news. With online Forex, the spread is much tighter, or lower, because of competition between the many Forex brokers, but there will always be a spread. The liquidity provider earns from the spread they offer you, and you as the broker in turn widen the spread a little more to make some profit.

For example, the LP may offer you the EUR/USD pair at 1.11400/1.11395 buy/sell, which is a 5-pip spread, and you offer the same pair at 1.11405/1.11390, which is a 10-pip spread.

These may seem like small measures, but they are critical for the broker. The choice between the two comes down to your preferred target client. High-volume traders who place long-term trades may prefer to be charged by commission because it ensures they have the tightest spreads, but scalpers may prefer the spreads. We recommend you check the FXPro Broker Leverage and Spreads Analysis.

Determine your target clientele

Every business needs to have a niche in the market that sets them apart. Given the large number of Forex brokers available, the only way to set yourself apart is to offer a unique service. This unique service, of course, needs to be targeted at a certain kind of customer.

For example, if you intend to attract high-volume traders, you need to offer services that appeal to such a trader, like an account manager, and a favorable payment service like quick bank transfers. On the other hand, scalpers and beginners may be attracted by bonuses and tight spreads. The idea is to cater to create a unique market niche, at least in the beginning, and expand your services as you begin to grow your Forex brokerage company.

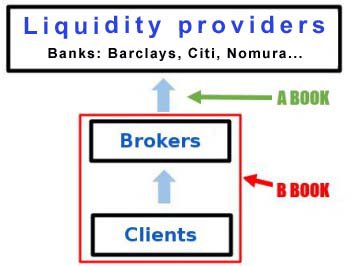

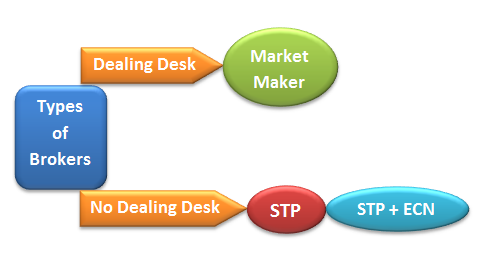

Determine your mode of processing trades

There are 2 main ways you can process your clients’ orders, straight-through processing (STP) or electronic communications network (ECN). The STP system is also known as a dealing desk because the client’s trades are first received by the broker before being handed over to the liquidity provider. In cases where the broker acts as the market maker, then the client essentially trades with the broker.

This system creates a conflict of interest between the broker and client because every time the client makes a profit, it is the broker who loses money. Usually, the profit paid out to the winning client may be covered by the spread, but with spreads becoming tighter due to competition, the broker loses from every winning trade.

However, it is still the most common system because it allows the broker to offer huge leverage, ideal for the scalper. Nevertheless, the best STP Forex brokers hardly lose money due to this system because so many traders lose. So much so that the CEO of FXCM said that he would be surprised if 15% of day traders were profitable. It might seem sadistic, but the truth is that most traders lose money, and the broker is rarely at risk of losing money from the clients’ winning trades.

With ECN, the trades are routed directly to the liquidity provider, but this system requires that the client trade at least 1 lot which can be up to $100,000. High-volume traders prefer the most popular Forex ECN brokers because this system provides the tightest spreads enjoyed in the interbank market.

There is also the option to offer binary options and become among the top binary options brokers. Again, choosing which mode of processing you shall offer will depend on your target clientele. However, you can offer both of these services to capture a wider market.

Observe the competition

Every business owner knows to keep an ear on the ground to catch any news from their competitors, and you need to do so too. Since you will all be competing for the same clients, it’s important to know what the competition is offering, and then try to become better. Also learn from their mistakes, so that you can avoid the same traps.

Also: Make sure to always offer the best Forex Broker options!

Feeling psyched about starting your own Forex brokerage firm? Watch how your life is going to be in the video below: