We’re used to hearing stories about hedge fund managers, private equity managers, and investment bankers who are millionaires and even billionaires, but what about Forex? You might be surprised by the fact that there are a lot of Forex traders who are making lots and lots of money from their own homes, but you won’t hear about them because the Forex market is decentralized and it’s impossible to know how much an individual trader makes.

A fund manager must have a registered company to operate and advertise their profits to attract investors. With Forex, you don’t always need investors because you can trade with even the little money you have in your savings account. As for these huge firms, they need a lot of capital to be plugged directly into the exchanges like NYSE. You don’t need that much capital as a Forex trader because your broker offers you leverage and the connection to the exchanges.

The only question is, just how much money can you make, and is it enough to allow you to quit your current job? We all know that the Forex market is the largest in the world, with a daily trading volume of $5.3 trillion, but we also know that only about 20% of traders are profitable; probably less. The winners in the Forex market are making a lot of money, perhaps more than you’re making in your current job, and if you don’t like your current job, you might consider trading on a full-time basis.

Before you do, though, there are certain things you have to consider.

What to consider before quitting

Now that we’ve established that people do and can provide for themselves through Forex trading, there are a few issues to consider before making the move:

Time

As with all other skills, Forex trading also has a learning curve, and there is no successful trader who started making money from their first trade and kept going without a stumble. However, the time it takes to learn how to trade is not definite like a college semester, instead, it’s all about personality and understanding. Do you understand exactly how the markets work and the factors that influence the strength of a currency, and can you avoid the common mistakes traders make by mastering your emotions?

The former is easy to learn through practice and research, but the latter, the emotions part, takes dedication, experience, and time. It is only with time that a trader learns discipline to handle the hurdles of Forex trading and become successful. So, before you hand in your resignation, make sure you have had enough time to master these skills and ensure you can become successful in your trading career.

I would advise everyone to practice for at least 6 months on a demo account, and another 6 months on a live account before even considering leaving their job. If, after this time, you feel confident in your profitability, then you can move to the next step.

Capital requirements and personal needs

There are different types of accounts you can open with the best Forex brokers, some of them need only $1 for an account, but these accounts don’t have much of a return. If you’re going to be a full-time trader, you will need an account that can bring in enough profits to pay the bills and other expenses. Everyone has different needs – some might find a $500 profit a month enough while others require more, depending on their needs.

Now, a standard account of $500 can bring in some profits, but probably not enough because you will be limited in the size of lots you can trade, the number of trades, and the margin requirements. In short, a $500 account may be great to train with or as a part-time trader, but you need at least $5,000, in my opinion, to ensure you can provide for yourself.

Trading costs

Here, I’m not talking about the spreads or commissions you pay your broker, I’m sure you’ve already taken that into account. Instead, these trading costs are the costs you will incur to pay for technical indicators, robots, tutorials, etc., basically, all the resources you need to stay up-to-date. You see, to become successful, you can’t rely on the Forex calendar and Forex charts alone, even though they are useful, you need more information which you will have to pay for. These sources will ensure you stay ahead of the curve and push you towards 20% of the winners.

How to make your full-time career work

At this point, you have to start picturing yourself as a full-time trader with no other job or employment. If you want to stay that way, there are a few tips that will make your life more comfortable, probably more than in your previous job, and how not to fall back into a situation where you have to start looking for a job:

How to pay yourself

The frequency at which you’re going to be making withdrawals and the amount of money you withdraw should also be very well thought out. Remember, the more capital you have in your trading account, the better positioned you will be. But since you’re trading for a livelihood, you have to withdraw some money at some point. You will have to choose between how much money you need to spend and how much to leave in your account to ensure you still trade profitably.

Unfortunately, I really can’t tell you how much is enough because I don’t know your needs, but you should strive to keep the account balance growing in case of a rainy day in the future when you don’t make enough profits. I know of people whose accounts have remained the same for months because they withdraw all the profits at the end of the month, but their profits have never grown. A larger account balance will ensure that next month’s profits will be higher because you will be able to make more trades with higher volume.

For example, imagine you open a $5,000 account and make a 20% profit every month, that account will have a balance of $44,580 at the end of the year! There isn’t a savings account in the world offered by a bank with such annual returns. If you can keep making that kind of profit for the next year, you could be withdrawing almost $10,000 a month, and keep that income growing. Therefore, you should be very careful about how you pay yourself, because withdrawing all your profits will only keep you stagnant. If possible, you should try and avoid making any withdrawals for a few months while living on your savings, until you feel your account can generate enough profits.

Setting up a VPS

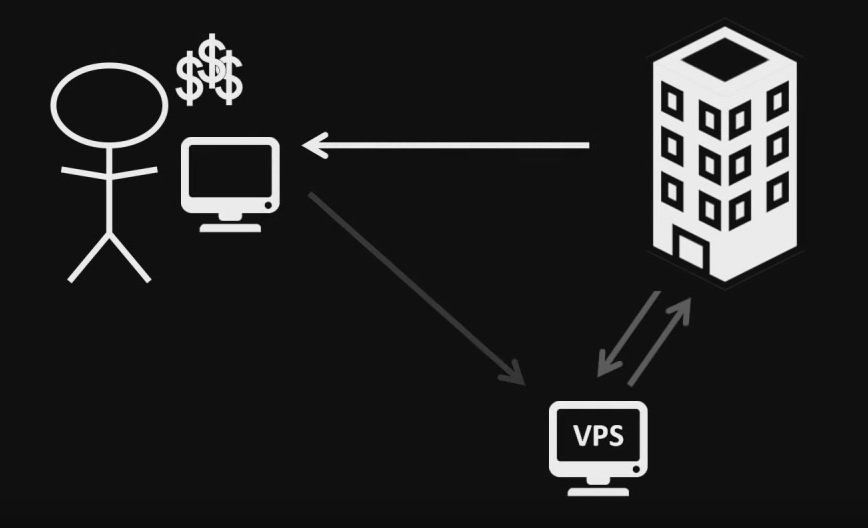

A virtual private server (VPS) is like having your server, except it is virtual, meaning that you don’t need to have the physical components of a server. There are various providers of these VPS services you can use, and you will be executing all your trades through the VPS. All your indicators, robots, and Forex trading platforms will be installed on the VPS, and you only access it through your computer’s browser. The advantages of having a VPS are plenty, the main ones being that you can place trades from any device with an internet connection without having to install any additional software, it runs 24/7 and the speed of execution is faster. We’ll talk more about VPS in a later article, but for now, this image should show you the basics of a VPS connection:

Keep learning and be open-minded

It’s a shame, but also true that money can go to someone’s head. After trading profitably for months, and making lots of money, some traders start to become overconfident in their skills as traders and ignore any outside advice. This can be a recipe for disaster because there should never be a limit to knowledge and you should always be open to new ideas. This means staying up-to-date with the technological advancements that aid in trading and listening to ideas from experts like myself.

The other day I was reading about Warren Buffet and Bill Gates’ favorite book, Business Adventures by John Brooks, a former writer for the New Yorker magazine. Here are these billionaires running some of the largest companies in the world and still they take time to learn from a simple writer – tells you something, doesn’t it? Never ignore good advice despite how highly you think of yourself.

As a trader, keep yourself informed about everything Forex-related, and it shouldn’t matter if you think the person is beneath you. Read all economics-related books to learn more about the mechanics of the economy, too, so that you have a deeper understanding of the economy of countries whose currencies you trade.

To see how other Forex traders are making a living solely on Forex traders, the video below is a documentary on the life of a successful trader: