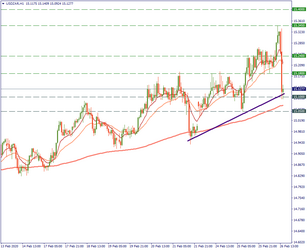

What happened? Societe Generale, a leading European investment bank, expressed optimism over the South African rand’s growth. Why? Firstly, the bank believes the ongoing global recovery will underpin the emerging market currency in the upcoming months. Secondly, the rand is usually influenced by cre...

23.03.2021

99