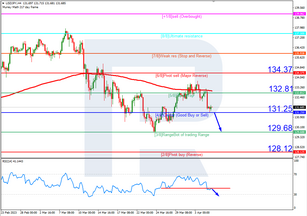

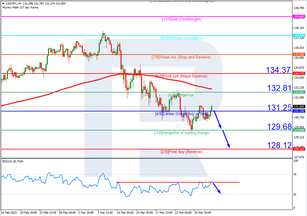

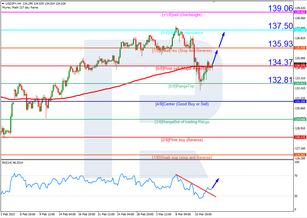

17.04.2023USDCAD, “US Dollar vs Canadian Dollar”On H4, the currency pair has formed a Hammer reversal pattern. The instrument is now going by the reversal signal in an ascending wave. The target for the correction might be 1.3395. Next, the price could rebound from this level and continue the downtr...

17.04.2023

195