CAD/JPY Trade Ideas

Filter:

CAD/JPY

Clear

Popular

EUR/USD

GBP/USD

USD/CHF

USD/JPY

AUD/USD

Brent

XAU/USD

All instruments:

Forex

USD/CAD

EUR/JPY

EUR/GBP

NZD/USD

EUR/AUD

GBP/JPY

CAD/JPY

EUR/CAD

NZD/JPY

GBP/CHF

CHF/JPY

EUR/NZD

GBP/AUD

CAD/CHF

AUD/NZD

NZD/CAD

GBP/CAD

AUD/CHF

Energy

WTI

Brent

Indexes

S&P500

DOW30

DXY

Select

AUD/CAD

AUD/JPY

AUD/SGD

AUD/USD

BTC/USD

CHF/BGN

CHF/RON

CHF/SGD

CHF/TRY

EUR/CHF

EUR/CZK

EUR/DKK

EUR/HKD

EUR/HUF

EUR/ILS

EUR/MXN

EUR/NOK

EUR/PLN

EUR/RON

EUR/RUB

EUR/SEK

EUR/SGD

EUR/TRY

EUR/USD

EUR/ZAR

GBP/BGN

GBP/CZK

GBP/DKK

GBP/HKD

GBP/HUF

GBP/NOK

GBP/NZD

GBP/PLN

GBP/RON

GBP/SEK

GBP/SGD

GBP/TRY

GBP/USD

GBP/USD

GBP/ZAR

HKD/JPY

NZD/CAD

NZD/CHF

SGD/HKD

SGD/JPY

TRY/JPY

USD/BGN

USD/CHF

USD/CNH

USD/CNY

USD/CZK

USD/DKK

USD/EUR

USD/HKD

USD/HUF

USD/ILS

USD/JPY

USD/MXN

USD/NOK

USD/NOK

USD/PLN

USD/RON

USD/RUB

USD/SEK

USD/SGD

USD/TRY

USD/ZAR

All Forex brokers

All Forex brokers

Alpari

EXNESS

FBS

FIBO Group

HYCM

IG

Instaforex

NordFX

RoboForex

Ichimoku Kinko Hyo CAD/JPY: The pair is trading above the cloud. An upward pressure would lead the pair to exit further the cloud, confirming a bullish outlook. Fibonacci Levels XAG/USD: Silver continuous to stand above 61.8% retracement area. Bears seems that losing control of the trend. EU M...

05.02.2021

15

Ichimoku Kinko Hyo CAD/JPY: The pair is trading below the cloud. A downward pressure would lead the pair to exit further the cloud, confirming a bearish outlook. Fibonacci Levels XAU/USD: Gold after a remarkable selloff is trading above the 38.2% retracement area. US Market View US stock marke...

25.01.2021

27

Ichimoku Kinko Hyo CAD/JPY: The pair is trading below the cloud. A downward pressure would lead the pair to exit further the cloud, confirming a bearish outlook. Fibonacci Levels XAG/USD: Silver is consolidating below 38.2% retracement area but price action remains weak. EU Market View Asian e...

13.01.2021

10

Ichimoku Kinko Hyo CAD/JPY: The pair is trading in a bullish sentiment above the cloud. The currency pair has just surpassed the Kijun-sen and the Tenkan-sen, confirming a bullish momentum. Fibonacci Levels XAU/USD: Gold gains and moves above 50% level. Sooner or later it seems that bulls will...

20.10.2020

7

CAD/JPY recovered last week to the 78.00 area (38.2% Fibonacci of the February-March decline), but then turned down again getting back below the 50-period MA on the H4. On the H1, the pair formed a lower high. The resulting pattern resembles a bearish “Head and Shoulders”. This allows expecting a sh...

16.03.2020

7

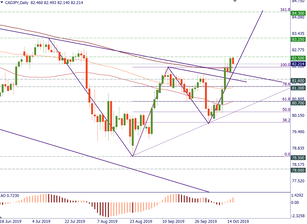

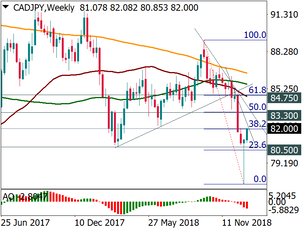

Trade idea BUY 82.60; TP1 83.20; TP2 84.00; SL 82.40 CAD/JPY has risen to 82.50 but met the resistance of the 50-day MA. The price action seen on the daily and weekly chart since the middle of July is so far corresponding to a bearish harmonic “Butterfly” pattern. The completion of the pattern impli...

16.10.2019

6

Trade idea SELL 80.80; TP 80.00; S: 81.00 Japanese yen has broadly strengthened as the demand for it as a safe haven increased. CAD/JPY fell and it looks like it has the potential for further declines: the pair isn’t oversold yet and didn’t reach any major support. Fibonacci tool locates a minor sup...

02.08.2019

10

Trade idea SELL 81.20; TP 80.85; SL 81.35 CAD/JPY formed a “shooting star” candlestick on D1. This means that the pair will likely move down in line with the overall downtrend. On H1 and H4, there’s a lower high. As a result, the decline below 81.20 (50% Fibo of the June 18 - June 20 advance) will ...

21.06.2019

23

Trade idea SELL 80.64; TP1 80.40; TP2 80.00; SL 80.80 The Japanese yen keeps strengthening versus other currencies as the market remains in the risk-averse mode. CAD/JPY is in the long-term downtrend and is now making another leg down. Yesterday the pair failed to close above the 50% Fibo level in t...

18.06.2019

6

Trade idea SELL 80.20; TP 79.25; SL 80.45 Risk aversion persists and so far there are no signs that the situation will improve. CAD/JPY is a natural pick for trading in this kind of environment. The pair is testing levels below 80.50 - the area that limited the decline in 2017 and 2018. The downtren...

31.05.2019

5

Trade ideas BUY 83.90; TP 84.50; SL 83.70 SELL 83.15; TP 82.70; SL 83.25 As a rule, when the price consolidates in a horizontal corridor, it’s possible to trade on the potential break of this range. CAD/JPY is sensitive to the market sentiment: if risk appetite improves, the pair will rise, while i...

10.04.2019

6

Trade idea SELL 82.20; TP 1 81.40; TP2 8.50; SL 80.50 It looks like CAD/JPY formed a “Head and shoulders” pattern. The pattern may not look very pretty but it has all the required elements. The pair broke below the neckline in the 82.40 area on Friday. On Monday, the price attempted to get higher bu...

26.03.2019

4

Trade idea SELL 84.10; TP 83.40; SL 84.40 CAD/JPY failed to close last week around the high of 85.20 and, as a result, remained capped by the 50-week MA in the 84.53 area. On Monday, the pair closed away from the daily lows but still below the 100-day MA at 84.00 and February support line. The weekl...

05.03.2019

4

Trade idea BUY 83.60; TP1 84.30; TP2 84.70; SL 83.30 If you want to make a bet on the positive risk sentiment, you can consider buying CAD/JPY. This pair has recently risen above the 50-day MA and 50% Fibonacci of the October-January decline (83.35). Upside targets lie at 50-week MA at 84.35 and 61....

05.02.2019

4

Trade idea BUY 82.20; TP 83.30; SL 81.80 There are various ways to trade the CAD this week. There is the Bank of Canada’s meeting on Wednesday and a rate hike is expected. One of the ways is to bet on the advance of CAD/JPY. The pair formed a “hammer” on W1 and is now likely to retrace to higher lev...

08.01.2019

4