Fundamental analysis of Brent/

Filter:

Brent

Clear

Popular

EUR/USD

GBP/USD

USD/CHF

USD/JPY

AUD/USD

Brent

XAU/USD

All instruments:

Forex

USD/CAD

EUR/JPY

EUR/GBP

NZD/USD

EUR/AUD

GBP/JPY

CAD/JPY

EUR/CAD

NZD/JPY

GBP/CHF

CHF/JPY

EUR/NZD

GBP/AUD

CAD/CHF

AUD/NZD

NZD/CAD

GBP/CAD

AUD/CHF

Energy

WTI

Brent

Indexes

S&P500

DOW30

DXY

Select

AUD/CAD

AUD/JPY

AUD/SGD

AUD/USD

BTC/USD

CHF/BGN

CHF/RON

CHF/SGD

CHF/TRY

EUR/CHF

EUR/CZK

EUR/DKK

EUR/HKD

EUR/HUF

EUR/ILS

EUR/MXN

EUR/NOK

EUR/PLN

EUR/RON

EUR/RUB

EUR/SEK

EUR/SGD

EUR/TRY

EUR/USD

EUR/ZAR

GBP/BGN

GBP/CZK

GBP/DKK

GBP/HKD

GBP/HUF

GBP/NOK

GBP/NZD

GBP/PLN

GBP/RON

GBP/SEK

GBP/SGD

GBP/TRY

GBP/USD

GBP/USD

GBP/ZAR

HKD/JPY

NZD/CAD

NZD/CHF

SGD/HKD

SGD/JPY

TRY/JPY

USD/BGN

USD/CHF

USD/CNH

USD/CNY

USD/CZK

USD/DKK

USD/EUR

USD/HKD

USD/HUF

USD/ILS

USD/JPY

USD/MXN

USD/NOK

USD/NOK

USD/PLN

USD/RON

USD/RUB

USD/SEK

USD/SGD

USD/TRY

USD/ZAR

All Forex brokers

All Forex brokers

Alpari

EXNESS

FBS

FIBO Group

HYCM

IG

Instaforex

NordFX

RoboForex

What happened? OPEC+ shocked investors last week with its decision to prolong output cuts by 500 000 barrels a day. Besides, Saudi Arabia announced it would keep voluntary cuts of 1 million barrels a day throughout April. That actions sent oil prices soaring. Goldman Sachs and JPMorgan upgraded thei...

12.03.2021

101

What happened? Financial giants such as JPMorgan and Goldman Sachs anticipate crude oil to skyrocket as high as $100 as the global economy rebounds. Oil prices haven’t been at such a high level since 2014. What are the reasons behind banks’ optimism? The banks believe that Biden’s fiscal stimulus of...

17.02.2021

106

The year-end is getting closer. What will 2021 bring us? Let’s find out what major banks expect! USD: down and down and down Most analysts predict the further falling of the US dollar during the next year. The consensus is the decline by 5-10% against most currencies. There are two main reasons for ...

16.12.2020

159

What happened? Oil has surged to March highs amid optimistic vaccine news and the peaceful presidential transition. Actually, it doesn’t matter when widespread vaccinations will start. What matters is that investors see the light at the end of the tunnel, and they are ready to invest in the most dam...

25.11.2020

103

Oil keeps rallying for the fourth day in a row after Goldman Sachs claimed that the oil market is in deficit and also because of the recent storm in the Gulf of Mexico, which led to the sharp decline of oil production. It is the best week for oil since June! Analysts from Goldman Sachs anticipate th...

18.09.2020

133

Main / For Traders / Forex Analysis / Fundamental analysis 08.09.202014:36 Brent oil faces headwinds Long-term review Similar to the rally in US stock market indices, the rapid rise in oil prices from April lows, which continued through the end of summer, looked quite exaggerated. T...

08.09.2020

123

Relevance up to 09:00 2020-06-18 UTC+2 Energy Minister Suhail Al Mazroui of the United Arab Emirates said that the production cuts administered by OPEC members will soon bring oil prices back to normal.When the markets collapsed, Mazrui initially claimed during a conference call that $ 40 a barrel....

17.06.2020

82

Investors await the OPEC+ decision on output cuts. It will define where the oil price will go. Brief background The oil market was completely destroyed this year. The coronavirus outbreak forced all the people to stop travelling, driving their cars and factories to shut down. As a result, the oil de...

05.06.2020

79

Long-term review Dear colleagues. The fall of oil quotes into the negative zone caused a serious commotion not only on world exchanges and the information space, but also in the minds of investors. What until recently was unbelievable has become a reality. However, negative prices cannot be the n....

22.05.2020

81

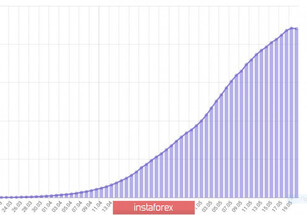

Relevance up to 11:00 2020-05-21 UTC+2 This chart shows the number of active coronavirus cases in Russia, that is, the total number of infected people, excluding recovered and dead. Yesterday, on May 19, the figure seemed to have hit the highest point. This chart shows the number of new coronavir....

20.05.2020

78

Relevance up to 19:00 UTC+2 The pound significantly fell against the US dollar - for the first time since the beginning of April, the sterling fell into the framework of the 22nd figure, demonstrating a bearish mood. The GBP/USD pair reached its local high on April 14, peaking at 1.2647. But buye....

22.04.2020

98

Relevance up to 13:00 2020-04-22 UTC+2 Oil costs $ 17 in the US. Brent oil costs $ 20. US oil's June contract fell to $ 12.Obvious problem: large oversupply of oil in the market - all storage tanks are full.Production cuts promised by the OPEC + deal should work out gradually - but what about dema....

21.04.2020

91

Relevance up to 09:00 2020-04-22 UTC+2 U.S oil price plunges to less than $0 per barrel on April 20.This oil situation in the USA gives very negative prospects for the oil market. The oil contract for May delivery stopped trading on Monday. As for June contracts, Brent oil so far is held at levels....

21.04.2020

110

Relevance up to 15:00 2020-04-21 UTC+2 Two good news:1. Western countries have passed the "peak" of the pandemic. Countries in Western Europe, such as Italy and Spain, showed a significant decrease in the number of deaths per day - below 450. Death toll in Britain and France is below 600 and 500 d....

20.04.2020

90

Relevance up to 08:00 2020-04-21 UTC+2 On Friday, US oil prices fell another 8%, reaching a new 18-year low of $ 18.27 per barrel. At some point, the price even fell to $ 17.33 per barrel - the lowest price since November 2001.The accelerating collapse of the oil market reflects the realization th....

20.04.2020

80

Relevance up to 03:00 2020-04-07 UTC+2 4-hour timeframe Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - downward. CCI: -128.8756 A new trading week begins with a continuing downward m....

06.04.2020

72

Relevance up to 20:00 UTC+1 The financial world has experienced another day of increased turbulence. The battle of traders for the US currency led to the fact that the dollar index rose to 103 points, reflecting the huge demand throughout the market. The euro-dollar pair again updated the low, re....

20.03.2020

80

Relevance up to 18:00 UTC+1 "The dollar is back": a similar thesis can often be found in the analytical reports of many currency strategists today. The US currency is behaving quite abnormally today – amid all disadvantageous and extremely negative factors, the greenback is rapidly regaining lost....

13.03.2020

47

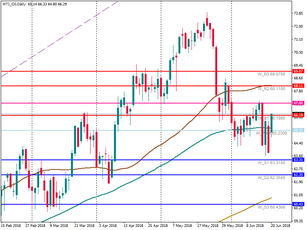

Relevance up to 08:00 2020-01-18 UTC+1 The dollar/yen pair reached semi-annual highs, gaining a foothold in the 110th figure. The upward trend for the pair has been actively developing since the beginning of 2020 - the price has stepped over three hundred points for a week and a half. Against the....

17.01.2020

56

Long-term review Oil increased earlier this month as tensions between Iran and the United States flared after a US military strike that killed Iran's top military commander in Iraq. However, crude oil prices bounced back last week as tensions appeared to ease after a retaliatory strike from Iran a....

15.01.2020

49

Crude oil had a rough time during the past few weeks. What let the commodity down and what should we expect in the future? Staggering demand Fears about the global economic growth slowdown represent a major hurdle for oil. When economies experience problems, their demand for the commodity slides to...

10.06.2019

137

Company does not offer investment advice and the analysis performed does not guarantee results Global macro overview for 14/01/2019:Crude oil bounces across the boardThe prices of the WTI and Brent oil have rebounded above the key levels of USD 50 and USD 60. Above-average volatility and extremely....

14.01.2019

189

Company does not offer investment advice and the analysis performed does not guarantee results The Canadian dollar paired with the American currency is rapidly becoming cheaper. On the eve of the Catholic Christmas, the USD/CAD pair still entered the 36th figure - for the first time since April la....

26.12.2018

153

Yesterday's session was extremely cruel to bulls in crude oil as the price of WTI Crude Oil dived from $58.83 per barrel to the level of $55.64. The decrease was 6.10%. From the top of the beginning of October, there were drops of 27.50% despite the declarations of OPEC members to reduce production ...

14.11.2018

138

The ECB head Mario Draghi provided a short-term rally to the European currency yesterday: the EUR/USD pair initially updated its monthly high, impulsively reaching 1.1815, and just a few hours later returned to its positions – in the middle of the 17th figure. The failed rise of the euro is explaine...

27.09.2018

140

Don’t you know what to trade? Trade oil! This week is full of events for the oil market. It started with a new US-China dispute. Last week the US imposed additional tariffs on Chinese goods. As a result, China declared a possibility of retaliation. The country threatens to impose duties on US commod...

24.07.2018

120

Global macro overview for 03/08/2017:The recent Crude Oil inventories data recorded another draw in stockpiles. According to Energy Information Administration (EIA) data an inventory draw of -1.5M barrels for the week ending July 28th following a draw of -7.2M barrels the previous week. The market p...

03.08.2017

25