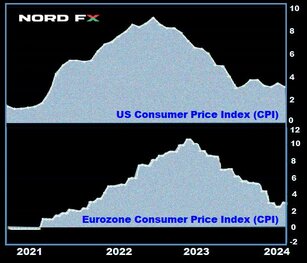

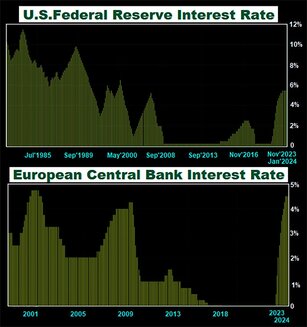

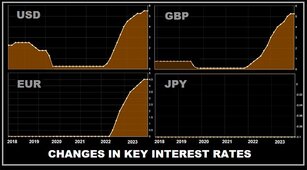

EUR/USD: The Dollar Soars ● Last week saw two significant events: the first shocked market participants, while the second passed without surprises. Let's examine the details in order. Since mid-2022, consumer prices in the US have been declining. In July 2022, the Consumer Price Index (CPI) was a.....

13.04.2024

73