For the past two decades, online retail FX exchange has become increasingly popular. More US brokers offer Forex. It’s not that the industry wasn’t available, but because it was very exclusive. Before the 21st century, only high-net-worth individuals and companies were able to participate. Then came the internet and suddenly anyone with a computer or smartphone could participate. Today, the FX arena is available virtually everywhere in the world as long as someone can get an internet connection. That being said, the trade is still concentrated around a few areas. In this post, we shall be looking at the main features and everything else bout exchanging the FX arena from 4 regions – CA, Australia, the US, and the UK.

FX exchanging in CA

CA has the 10th largest economy in the world when ranked by GDP at $1.76 trillion. At the same time, the country had a population of over 37 million in 2018. These two factors make the country very attractive to FX brokers because they should have a lot of people willing and able to join the industry. This is why the country grossed 1.3% of the daily transactions in the entire industry as reported by the Bank for International Settlements (BIS) in 2016. (These are the: Global Trends of FX Brokers’ Business in 2019)

Considering that the FX arena is the largest financial market in the world with $5.1 trillion in daily transactions, that means there was a lot of activity from CA. For this reason, the CA authorities had to implement laws to monitor this market, and it is worth looking at these in detail.

The primary regulatory body over the entire FX industry in CA is the IIROC (Investment Industry Regulatory Organization of CA). It is a part of the CA Securities Administrators (CSA), giving it a mandate over all provinces in CA. From the regulator’s website, IIROC is mandated to maintain integrity in CA’s financial markets, which of course includes the FX arena. In the early 1990s, financial firms chose to voluntarily become members of a self-regulatory organization like the IIROC. However, now it is mandatory for any financial company wishing to operate within CA to become a member of the regulator. (Exchanging Stocks in FX Brokers: Commissions, Swaps, Spreads Research)

This also applies to FX brokers, who are required to acquire a license from and become a member of the IIROC before they can solicit any CA citizens to trade. In addition to the license from IIROC, an FX broker must also be registered in the province where they run their operations. Although the laws used to vary a bit from one province to the next, they have now been unified across the country. For example, there was a time when Quebec province considered FX pairs as derivative instruments while Montreal, Ontario, and British Columbia considered them as security. This caused a lot of confusion between provinces, but the differences have now been straightened out.

To confirm whether a particular broker is licensed to operate in CA, the IIROC website offers to produce an Advisor Report based on the name of the advisor and the firm they work in. Alternatively, the CSA website has a National Registration Search tool for the same purpose. These two facilities help you ensure that the broker is authorized to operate in CA.

For an FX agent to be licensed by the regulator, they have to undergo a rigorous review from the top down. First, all the broker’s employees have to be trained and proficient in the industry, including the salespeople. This is good news for traders because some brokers employ untrained salespeople leading to fraud. Israel is a good case in point of how outsourcing can lead to problems. Second, the firm has to prove it has sufficient capital to protect its clients from bankruptcy. Going forward, all licensed brokers must adhere to high standards of integrity and service provision, with the IIROC hawk-eyed to catch any misconduct. (Learn: Why Professional Traders Prefer Exchanging Stocks Rather Than FX)

Indeed, the FX arena in CA is one of the most strictly governed, meaning that traders are very safe working with IIROC-regulated brokers. To prove they are worth their salt, take note of how few cases of FX scams are reported out of CA. And even when there are cases, they usually involve offshore companies that lured in unsuspecting CAs rather than regulated firms misbehaving. This is not so surprising when you consider how restrictive the CA laws are to the average trader.

As for the traders themselves, though, it is not so easy to get into the industry or stay there. To start exchanging, you must prove your net worth to be higher than a certain minimum, and surpass a set minimum income and financial assets. These standards are quite high and prevent many traders from actually entering the markets. Furthermore, there are also restrictions in leverage set at a maximum of 18:1. This is lower than the leverage cap in the US, EU, and even Japan. Plus, hedging is not allowed, just like in the US. Considering these restrictions, it’s no wonder many CA citizens choose to work with offshore brokers and sometimes end up being victims of scam brokers. (These are the: New FX Brokers Regulations in Russia in 2019)

That being said, those who are qualified to enter the markets and can handle the low leverage get the chance to trade in one of the safest environments. Moreover, it’s not too bad dealing with low leverage as long as you know what you’re doing, and we here at TopBrokers help you make the best investment choices.

FX exchanging in the UK

Ever since the UK residents voted to leave the EU, a lot has occurred. One Prime Minister resigned for failing to keep the UK within the EU, only to be succeeded by another who resigned for failing to pull the UK out of the EU. With things in this state of limbo, the UK could still be considered a part of the EU as no specific border controls have been implemented yet. For the intent and purpose of this article, therefore, we shall treat laws governing the UK as the same as those governing the industry for the rest of the EU and EEA members. Besides, you will come to realize that the regulations so far are the same anyway.

In the UK, the FCA (Financial Conduct Authority) plays the role of watchdog over the entire financial market. It was formed in 2013 to replace the Financial Services Authority (FSA) that had been in charge since 2001 and was preceded by the Securities and Investments Board (SIB). While the UK is still a member of the EU, it takes its cues regarding legislation from the European Securities and Markets Authority (ESMA). It is the latest changes to FX laws proposed by ESMA that we shall focus on because these changes have also affected FX laws in the UK. Those firms on the FCA-regulated FX brokers list have had to apply these new regulations ever since they were implemented in August 2018.

What are the FX laws as proposed by ESMA?

After the 2008 financial crisis, financial regulators were forced to re-evaluate their guidelines. Many regulators made changes in the years following the crisis, including ESMA. From as early as 2011, ESMA began discussing a revision to the MiFID laws to address some of the problems, and by 2014 the first draft of MiFID II was published. In this new legislation, the regulator proposed various changes in the way financial service providers reported their activities and guarded their clients’ interests. (Do you wonder: Will Institutional Investors and Sharks Invest Massively in Bitcoin in 2019?)

The MiFID II laws first became active in January 2018, but further revisions were made addressing the retail FX arena and CFD exchanging brokers in particular later. These revised FX laws were first implemented in August 2018, effectively changing the entire landscape of the industry. The new laws that were implemented in August 2018 made several key changes in various aspects such as:

Leverage

One of the main concerns ESMA had about the retail FX arena was how high leverage could go. Many brokers were offering leverage as high as 1,000:1! This means you could have bought one lot (100,000 units) of, say, US dollars on the USD/CHF live chart for just a $100 margin. In the regulator’s opinion, such high amounts of leverage were posing a risk to traders because many did not understand the risks involved. In the above example, perhaps the person who initiated the trade didn’t know that they would lose their entire $100 if the value of the US dollar declined by just 10 pips. If the trader had $1,000 in the capital, then the entire capital would have been wiped out after the USD declined by 100 pips, which is very probable especially when volatility is high. (When Choosing A FX Agent, Pick The One With Winning Clients)

Many retail traders were attracted by these high-leverage offerings because the brokers did not state clearly that using leverage was very risky. And so many traders were losing money as a result, and ESMA sought to help reduce such cases. Although there were no exact statistics on the win/loss back then, it was known that a majority of traders lost money through the FX exchange. (Here are the: Top 5 FX Traders Who Became Millionaires)

The regulator, therefore, placed a cap on leverage at 30:1. The idea behind the cap was to limit the amounts of losses traders could make when trades went south. For example, at a 30:1 leverage and $100 margin, the USD would have to drop by over 300 pips for the whole margin to be lost. This is much safer than the previous 10-pip decline, which is what ESMA was hoping to achieve. As for the other financial instruments, their leverage levels were also capped at a sliding scale down to 2:1 for cryptocurrencies as these were considered the most volatile of the asset classes. (This is: Everything You Need To Know About Exchanging In Gold Markets)

When these laws first came out, many traders and brokers thought they were draconian. Smaller brokerage firms felt they were going to lose clients to larger firms that didn’t provide such high leverage even before MiFID II. Meanwhile, traders also thought that the cap was too low. After all, even the cap in the US, where FX trading is considered restrictive, is placed at 50:1 for major currency pairs. On the bright side, though, brokers can still offer high leverage up to 200:1 as long as a trader proves they understand the risks. Your broker could evaluate your trading skills based on the length of time you have been trading and your expertise to qualify you for higher leverage.

Indicating risk

The FX arena is completely decentralized, which makes it almost impossible to know how many traders lose money and by how much. Such a loophole allowed brokers to state whatever statistics they wanted and to lure in unsuspecting traders. Many of them would advertise how easy it was to make money in the FX arena, and of course, got a lot of new clients this way who would eventually lose money. For the brokers, this wasn’t a problem because even the best FX ECN brokers make money through spreads whether the client wins or loses. Many other brokers were market makers who made money when the client lost, which meant higher profits when clients lost money. (FX in the USA: Myth or Reality?)

Now, all brokers who operate in the EU and UK are required to indicate the risks involved in FX exchanging. First, they have to indicate their win/loss ratio so that clients know just what proportion of traders make money with a particular broker. Through these statistics, we now know that an average of 76.3% of all FX traders lose money. Some brokers such as AETOS, eToro, XM Markets, Darwinex, and GBE Brokers have over 30% winning clients, but the rest can’t claim such high win/loss ratios.

Elimination of trading incentives

Where brokers used to provide bonuses to their traders, now they have been asked to refrain from doing so completely. Previously, a trader could generally expect to receive various forms of bonuses from a broker. These started from the no-deposit bonus and welcome bonuses to the deposit bonuses and loyalty bonuses. ESMA also considers these as a tool for luring amateur traders with the promise of quick profits, and they have banned them completely. (find out: Why ESMA Regulator Bans FX Bonuses)

How have these laws affected the UK FX industry?

As you would expect, there have been mixed reactions to the implementation of the new laws by ESMA. On one hand, many traders and brokers have either exited the EU and UK markets or set up subsidiaries in other countries with more favorable FX laws. It is thus not uncommon for a trader to be advised by a broker to transfer their capital to a different subsidiary of their brokerage if they wish to enjoy higher leverage. The worst effect of the law has been the reduction of profits by EU and UK-based brokerages. Offshore brokers with flexible FX laws have been actively targeting EU and UK residents, meaning fewer profits for brokers located there. Even IG Group with overwhelming positive IG Reviews has suffered losses lately.

On the other hand, there have been significant reductions in the losses experienced by traders. ESMA reported that they have noted this change and that their laws seem to be working. According to data received from individual local and national regulators, there aren’t as many traders losing money as before. Now, whether the laws themselves have been effective or traders have moved away is hard to tell, but we can say that the number of losing clients has been slashed.

Due to this perceived reduction in losing clients, ESMA recently renewed their new laws for the third time. You see, when ESMA proposed these restrictions to the FX arena, the changes were not made permanent, but rather more on a trial basis. ESMA cannot dictate the financial laws of every individual EU nation, but the countries usually do. Since the first implementation in August, ESMA has made 3 renewals to the restrictions, and the fourth is expected at the beginning of May, at which point the new regulations would have been active for a whole year. (How and When Do You Know You’re Ready for The Big Live Account Leagues?)

At the same time, ESMA has been pushing local regulators to make the laws permanent and some already have. The first ones to do so were the FCA, BaFIN of Germany, and AFM of the Netherlands. Of the three, the FCA’s implementation has been close to what ESMA proposed and even includes the addition of turbo contracts. This year, France’s AMF and Austria’s FMA are also planning to do the same with many more EU countries expected to follow suit. However, Austria is going to make some minor changes to the ESMA regulations such as:

- including some minor changes in the way risk warnings are displayed

- defining digital currencies

- not completely prohibiting the participation in circumvention activities

We can expect to see more EU countries falling in line and applying these ESMA rules, at which point the laws will become permanent.

Elsewhere in Europe

Since UK and EU residents want to look for greener pastures, many aren’t interested in looking too far away. This is why many of them have turned to other European brokers, especially those regulated by CySEC. In Europe, CySEC was the regulator with the least amount of restrictions on the FX arena, and they also probably have the highest number of licensed brokers. Nevertheless, now the Cypriot regulator is also seeking to place restrictions on the industry, perhaps even harsher than those by ESMA. (FX Trading in Singapore: Laws and popular FX brokers)

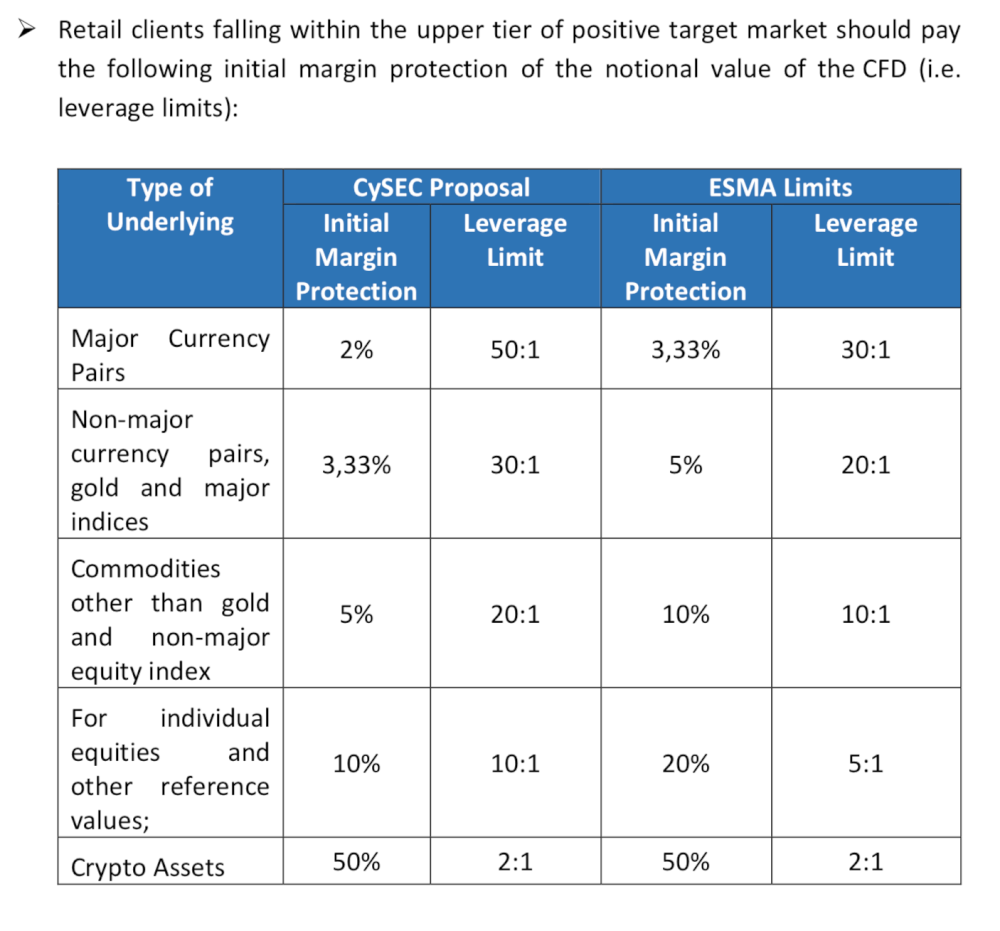

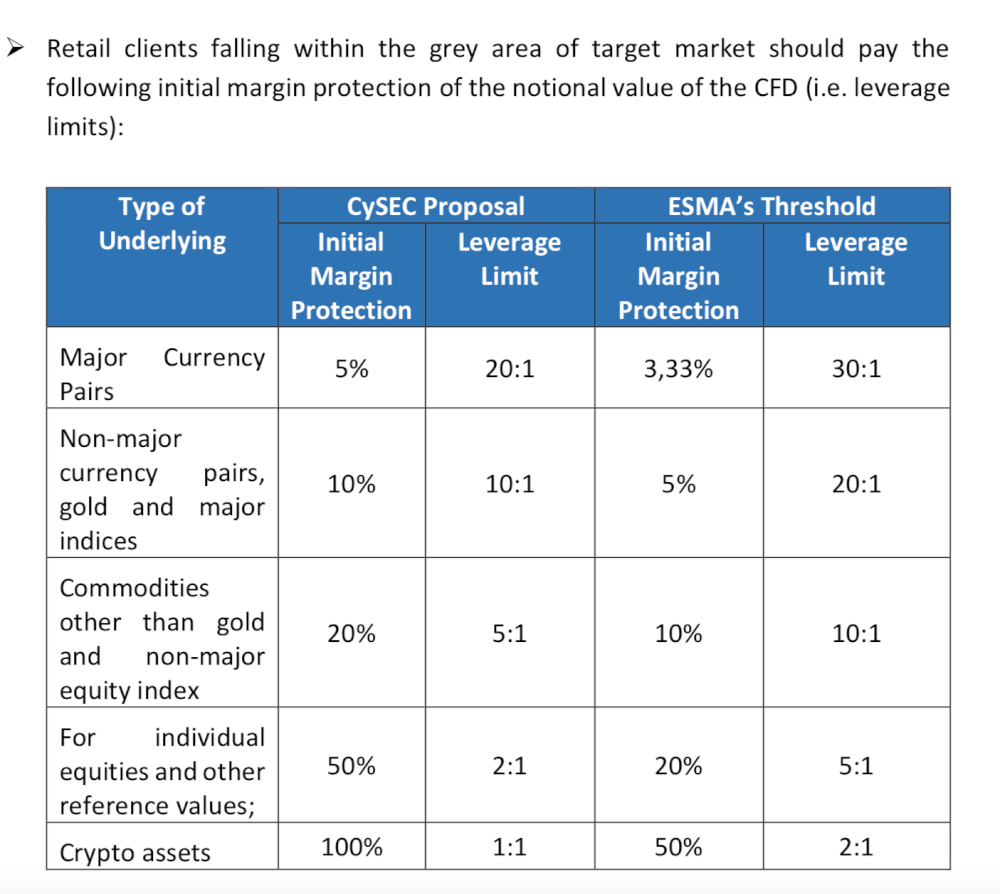

In a statement by CySEC, ESMA did not distinguish between the different categories of traders when they implemented their new regulations. They were going to do so by creating 3 categories of retail clients.

The positive area target market includes traders with prior knowledge and expertise in FX trading and they would receive higher leverage. The leverage cap for this category would be 50:1, higher than ESMA’s 30:1. Negative area target markets probably consist of traders with no prior knowledge of the FX arena whatsoever. FX trading for beginners needed to be limited to protect them from losses.

Grey area target markets will involve those traders who can’t be classified either as negative or positive. These traders will experience very restrictive caps on leverage, tougher even than those by ESMA. FX brokers will be able to categorize their clients during the initial due diligence process required by law. Given this change by CySEC, it will be interesting to note how traders react in the coming months.

FX trading in Australia

Over in Australia, you will find the Australian Securities and Investments Commission (ASIC) as the financial watchdog. ASIC was formed in 1998 to replace the Australian Securities Commission (ASC) founded in 1991. Today, ASIC is one of the most trusted FX regulators in the world. Even ASIC-licensed brokers are some of the most trusted brokers around the world – just look at, say, the Pepperstone review as an example. To confirm whether a particular broker is truly licensed by ASIC, the ASIC website provides a search register for all Australian-based companies and the state of their license.

Thus, it is no surprise that these brokers noted an influx of European clients ever since ESMA implemented the new restrictive laws. This is because while Australian residents can only trade with ASIC-licensed brokers, these brokers are free to sign up clients from elsewhere in the world; until recently. (Investor Tips 2019: What To Include In Your Portfolio)

On the 5th of April 2019, the Australian parliament passed the Treasury Laws Amendment bill that will probably come into effect in 2021. The bill gives ASIC the right to intervene when it deems the distribution of certain financial products harmful to consumers. Many experts believe that ASIC will classify FX trading as such and implement tough restrictions on the industry. A spokesperson for CFD Trading and Compliance Forum told Finance Magnates that the change was brought about by an increase in complaints to ASIC. According to him, the products are often misrepresented considering their high risk and minimal entry requirements. This is the same as what ESMA stated, indicating that the Australian regulator may also follow the way of ESMA.

In response to the new legislation, IFGM brokers have already started refunding overseas customer funds and finding new ways to accommodate these clients. Many believe that IFGM has jumped the gun as there is still a lot of debate over what this new legislation means for the industry. Many brokers are still accepting new overseas clients and offering their services as usual claiming that the services are regulated locally in Australia by ASIC. There is still some confusion over this new regulation, but there is time for the various parties to agree on the way forward. However, if ASIC decides not to allow its licensees to accept overseas brokers, then it will be a huge blow for the industry that has been facing a lot of pressure of late from different countries. (Can You Get Your Money Back From A Fraudulent Broker?)

FX trading in the US

Ever since the Dodd-Frank Act was passed in the US in 2011, the US FX arena has never been the same again. Where the industry was thriving before the law, it is now significantly less popular, although it still exists. The Dodd-Frank legislation placed caps on the amount of leverage that could be offered to clients down to 50:1 on major currency pairs and 20:1 on all other pairs. Add to this, hedging was completely banned forcing brokers to implement a first-in-first-out (FIFO) policy. For anyone who loves to make position trades, hedging can be a very important tool when markets are volatile to minimize risk. Naturally, many retail traders in the US fled the local brokers and signed on with offshore brokers who had more favorable terms. (You can: Learn How To Use Position Trading In The FX arena For Profit)

As for the US Forex brokers, they no longer had a huge incentive to stick around. Huge FX trading companies with plenty of capital started around for sure, but that’s because they relied on institutional investors anyway – the kind who don’t need anything above 50:1 leverage. As for the smaller brokerages, things got too tough. First, because their primary customer base was fleeing offshore and because of the high standards. Brokers in the US had to be licensed by the CFTC and become members of the NFA, and this meant huge capital requirements. A lot of the smaller brokerages could not handle this and the potential crippling bankrupting fines imposed on companies that were even slightly in the wrong. An example is FXCM with general positive FXCM reviews and yet they were fined $7 million in 2017.

That being said, there are still several NFA-regulated brokers who tend to the US FX arena, and the industry might even see a rise soon. Now that ESMA has imposed tough regulations (tougher than in the US) and CySEC and ASIC considering the same, the US FX arena doesn’t seem too bad now. Some might even prefer it. The NFA has been known to be a very competent regulator and has managed to keep FX scams at a minimum. Combining the security of funds with the now favorable trading terms makes the US a ripe market for traders around the world. In addition, as there are a limited number of new binary options brokers, the US provides an opportunity as the industry is still legal there.

Many US residents were hoping that with the new administration, the Dodd-Frank Act could probably be repealed and more favorable conditions restored. Unfortunately, this now seems more unlikely than ever. First, the amendment of the legislation has been very slow as we have only seen minor changes over the past almost 3 years. And second, it is now unlikely leverage will be lifted above the current level considering that so many other countries are lowering their leverage.

For US residents, there are now no greener pastures unless you consider offshore brokers. Just remember that working with such brokers is very risky to your capital as the brokers are known to run elaborate scams. To find out more about FX exchanging in the US, check out our previous post on the topic. (Legalization of FX Trading in the US: Facts and Trends)

For more Top Brokers, make sure you check out our Best Forex Broker for Trading Gold list and our NordFX Forex Trading Performance and Reliability Report.